As we hurtle toward the end of the year, the familiar rush is on to get deals over the line. It’s never an easy task, and 2025 has been no exception — with geopolitical and economic headwinds, both at home and abroad, weighing heavily on investors’ confidence and sentiment.

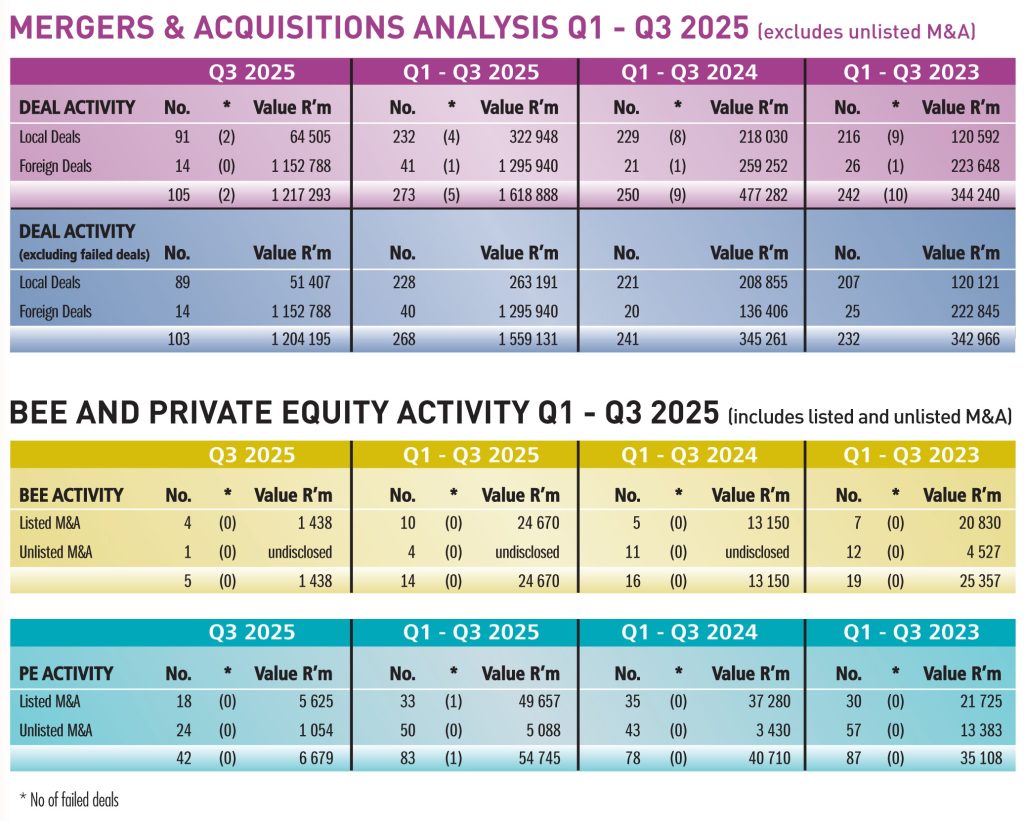

Looking back at the period Q1 – Q3 2025, deal activity has remained relatively consistent, showing a gradual improvement year on year, when compared with the same period in 2023 and 2024. This year’s aggregate deal value of R1,62 trillion is, however, heavily skewed by the Anglo American | Teck Resources merger, valued at R1,05 trillion (US$60 billion). Excluding this outlier, total deal value comes to R571,89 billion, up from R477,28 billion in 2024 and R344,24 billion in 2023.

Conversely, BEE deal activity continues to decline, with many of the latest announcements representing extensions of existing, often underwater, structures – symptomatic of the framework’s ongoing struggle to deliver its intended economic outcomes. It will be interesting to see whether, under the current GNU dispensation, ongoing conversations about alternative empowerment mechanisms gain meaningful traction.

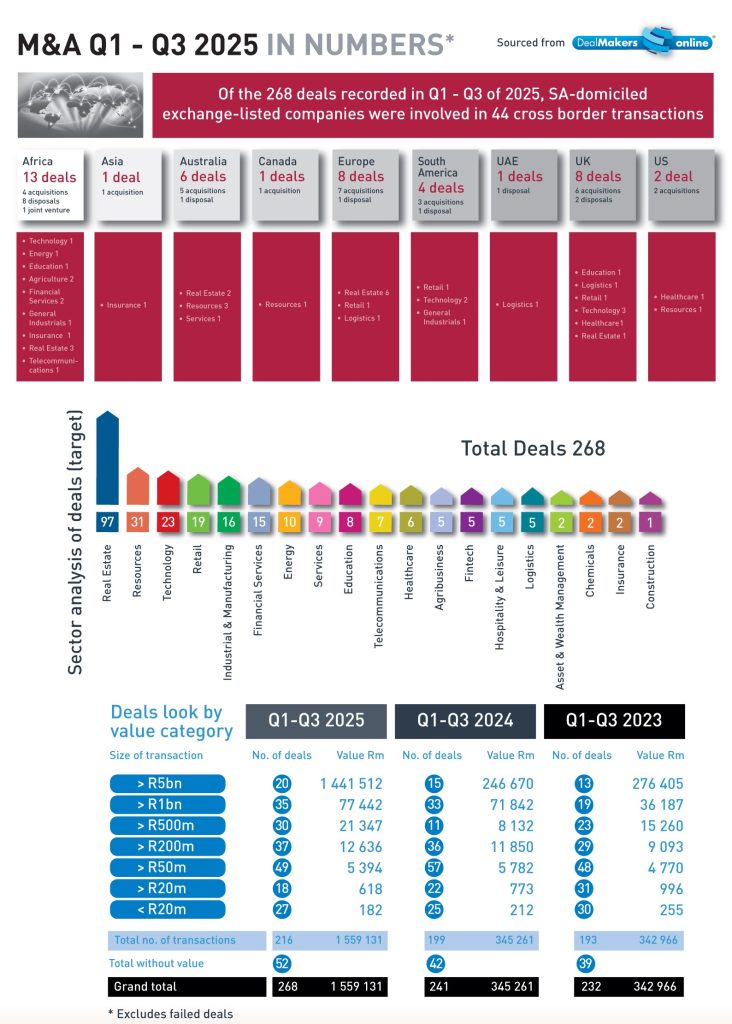

Excluding the five failed transactions, 268 deals were recorded during the period, of which 40 were announced by companies with secondary inward listings on one of South Africa’s exchanges. The R50 million – R200 million value bracket once again accounted for the most deals. Sectorally, real estate continues to dominate deal flow, followed by resources and technology. South African-domiciled, exchange-listed companies were involved in 44 cross-border transactions, with Africa (13 deals), Europe and the UK (8) the most active destinations – again led by real estate and resources activity.

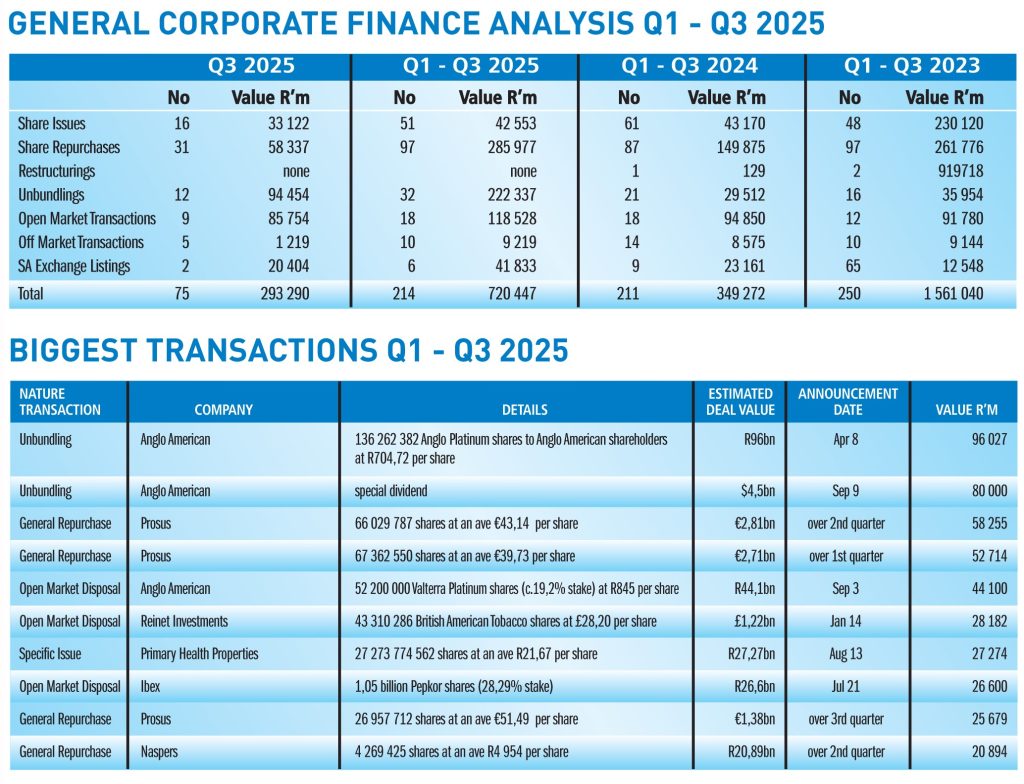

Companies also continued to return value to shareholders through repurchase programmes. During the first three quarters of 2025, companies repurchased R285,88 billion in shares – nearly double the comparable 2024 period – with Prosus leading the charge. The largest General Corporate Finance transaction during this time was the unbundling by Anglo American of its stake in Anglo American Platinum, valued at R96 billion.

Private equity continues to consolidate its presence in the dealmaking landscape. Over the past few years, the industry has had to adapt to higher capital costs, more challenging exits, and the growing influence of AI. This has prompted a strategic pivot toward private credit, as firms diversify their offerings to provide flexible financing solutions in a high-interest environment.

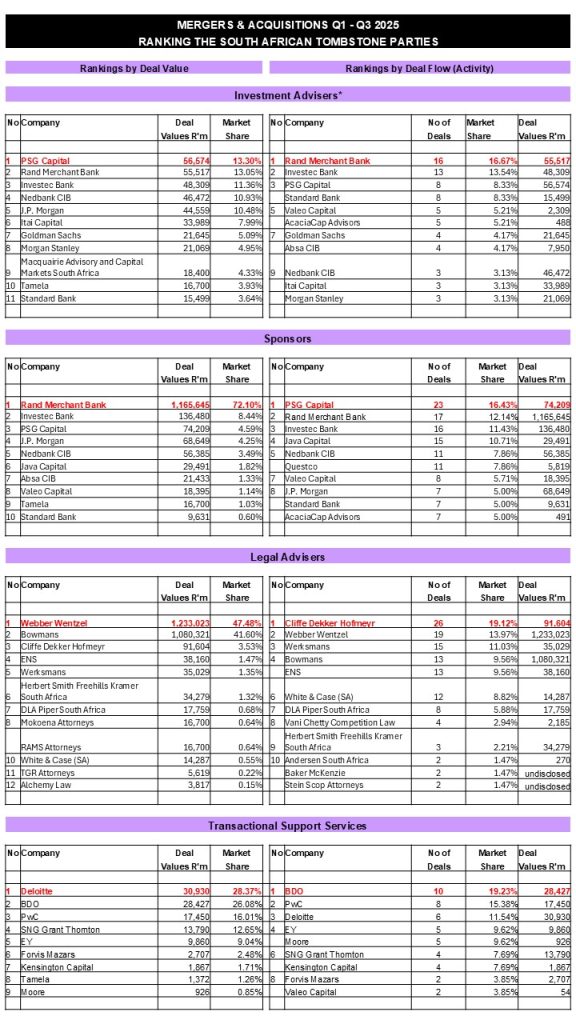

DealMakers Q1 – Q3 2025 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

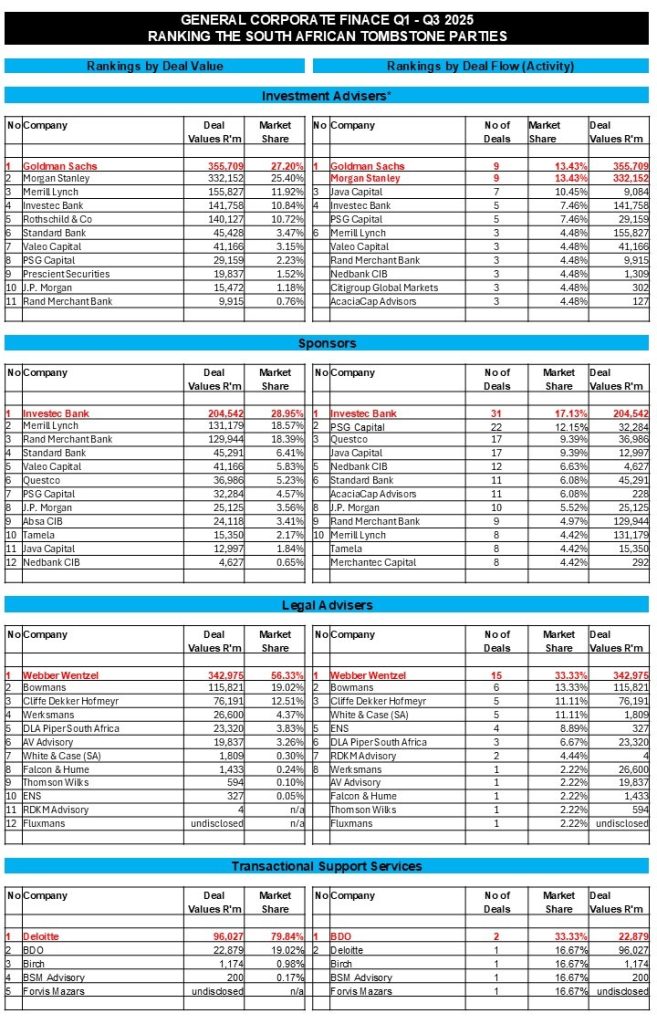

DealMakers Q1 – Q3 2025 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

DealMakers is SA’s M&A publication

The latest magazine can be accessed as a free-to-read publication on the DealMakers’ website www.dealmakerssouthafrica.com