Araxi might be expanding in the payments space (JSE: AXX)

This is certainly the part of the business that they should be focusing on

Earlier this week, we saw results from Araxi (previously Capital Appreciation) that highlighted the huge gap in performance between the Payments segment and the Software segment. My view is that they should be getting out of Software and just focusing on what they are really good at – Payments!

We don’t seem to be at that point yet, but the company has released a cautionary announcement based on negotiations for a potential acquisition of a “meaningful payment services business” – and that sounds like the right sort of thing for them to be focusing on.

With an unencumbered balance sheet and over R300 million in cash as an acquisition war chest, they are in a strong position to be able to do a smart deal. Now we have to wait and see exactly what that deal is, assuming something actually materialises after this cautionary. Remember, there’s no guarantee of a deal being announced.

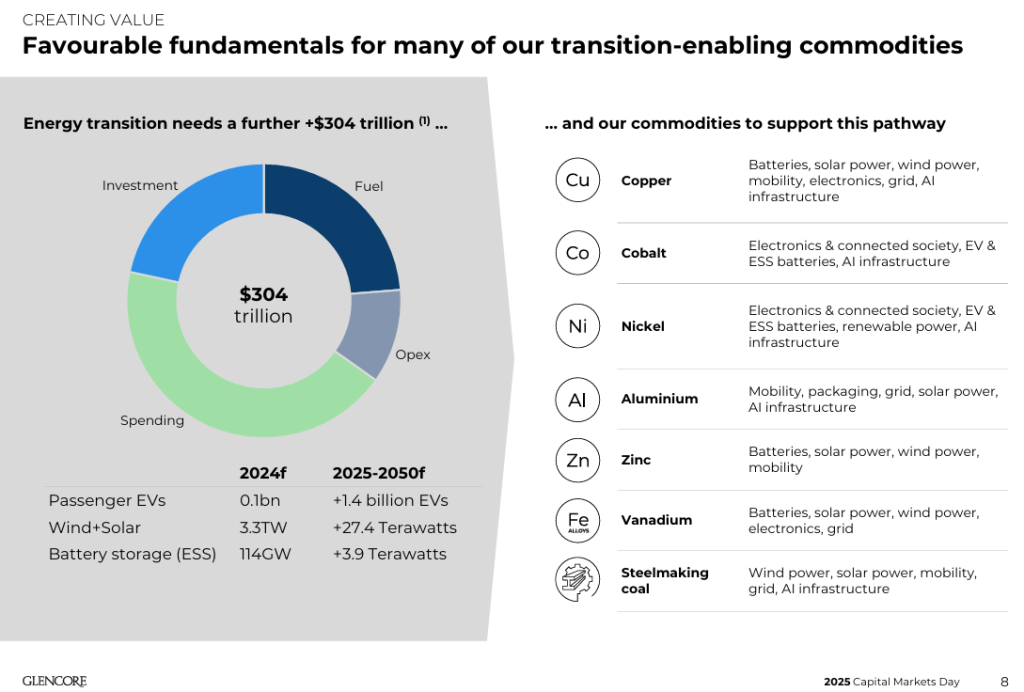

Copper was the focus at Glencore’s Capital Markets Day (JSE: GLN)

The goal is to become one of the largest copper producers in the world

Here’s some festive 2025 relationship advice: find someone who looks at you the way the mining sector looks at copper. The bunfight over this commodity has been quite something to watch, with the biggest balance sheets in the game being positioned for copper expansion strategies. If there’s any disappointment in demand vs. current expectations, it’s going to get nasty.

At Glencore’s Capital Markets Day, the headline story was a plan to significantly increase copper production and become one of the largest copper producers in the world over the next decade. Here’s a useful slide on why copper is the belle of the ball at the moment:

Interestingly, Argentina is where the action is happening for them, with other South American territories like Peru and Chile featuring as well. They expect copper volumes to achieve a compound annual growth rate (CAGR) of 9.4% from 2026 to 2029, while total group production measured on a copper equivalent production basis will have a CAGR of 4.0%. In other words, copper itself will increase a lot faster than the other metals.

Although they expect copper to self-fund its growth pipeline, it doesn’t hurt to have the cash-generative coal and other assets to support the group. They’ve also achieved a more efficient group thanks to identified cost-saving opportunities worth $1 billion a year across 300 initiatives. They expect to fully deliver these savings by 2026, with half already locked in for 2025.

Glencore has also been on a drive to simplify the portfolio, with approximately 35 assets either sold or shut since 2021 and $6.3 billion raised from key disposals. They talk about having eliminated around 1,000 roles through a new operating structure. This is clearly where a big chunk of cost savings have come from.

The full presentation is obviously filled with fascinating details about Glencore and the broader sector. If you’re keen to take a look, you’ll find it here.

Hyprop taps the market for R300 million (JSE: HYP)

The capital raises are picking up in the REIT sector

Hot on the heels of a raise at sector peer Equites Property Fund (JSE: EQU), we now have Hyprop with an accelerated bookbuild. At least they are telling us how much they actually want, in this case R300 million to add to the R808 million raised earlier this year. That’s more than a billion rand of fresh equity this year!

In terms of the planned use of funds, Hyprop has found a balance between vague explanations and some specifics. There’s the usual “growth pipeline and potential acquisitions” comment that basically lets them do anything, accompanied by references to some specific capex projects like the Somerset Mall extension and a food court upgrade in Canal Walk, along with solar projects in the local portfolio.

In short, they are tapping a hot market for more equity capital. The timing is good and we are going to see more of this in the REIT sector.

Importantly, the guidance for growth in distributable income per share of 10% to 12% for the year ended June 2026 is unchanged by the raise.

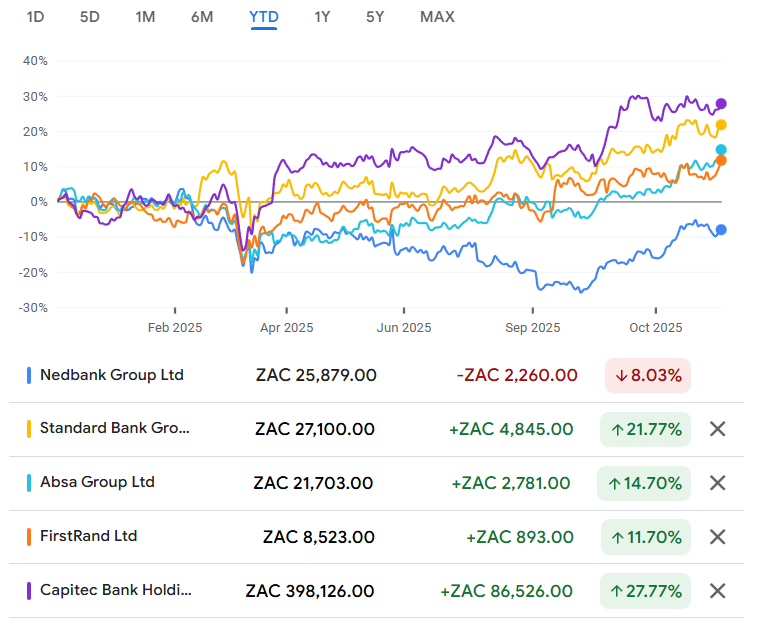

It’s been a rough year for Nedbank investors (JSE: NED)

There wasn’t much growth even before the Transnet settlement

Sometimes, underperformance is so stark that a share price heads in a completely different direction to the peer group. In this year-to-date chart, it’s unfortunately the bank with the green logo, Nedbank, that is the only one in the red:

This isn’t entirely due to the settlement with Transnet for R600 million. The market is smarter than that, as Nedbank’s market cap is currently over R120 billion. The settlement is therefore just 0.5% of the market cap.

No, this underperformance is thanks to Nedbank posting weak growth numbers despite this being a strong year for the South African economy. If they can’t achieve meaningful growth in this period, then what chances do they have when the cycle gets tough again?

A pre-close update that deals with the 10 months to October shows the disappointment that shareholders have had to stomach. Net interest income (NII) grew by low-to-mid single digits, which is better than the tepid 2% growth in the six months to June 2025. Interest rate decreases obviously put pressure on this number, but Nedbank also has weak margins vs. some of its peers. At least the credit loss ratio is in a decent place, below the midpoint of the through-the-cycle target range of 60 basis points to 100 basis points.

Non-interest revenue (NIR) growth is the really poor story, sitting below mid-single digits. You cannot boost return on equity as a bank if you can’t grow your NIR at a meaningful rate above inflation.

To add to the problems, expenses grew by mid-to-upper single digits for the period, which means it increased faster than NII and certainly NIR. This is negative jaws territory (as they call it in banking), with margins going the wrong way.

These numbers exclude the Transnet settlement, as does the guidance for the full year of diluted HEPS growth being in a range of flat to low-single digits. Return on equity is expected to be 15% or higher.

Probably the only highlight here is the share repurchases of R2.4 billion year-to-date. But this is taken into account in the HEPS guidance, so things are still far from exciting.

Nedbank desperately needs to inject some life into its story. Their acquisition of fintech iKhokha was approved by the Competition Commission and closed on 1 December. Their sale of Ecobank to Bosquet is awaiting regulatory approvals across various divisions. They’ve also made some divisional management changes.

In the absence of any meaningful progress though, Nedbank has proven to be a value trap this year i.e. “cheap” for a reason.

Raubex has made it explicit: they are looking to sell Bauba Resources (JSE: RBX)

Here is yet another example of M&A being reversed down the line

Back in 2022, Raubex went through a mandatory offer process (i.e. they deliberately triggered the 35% ownership threshold) to acquire Bauba Resources. This was a dicey strategic fit from the start, as it brought mining risks into a group that already faces plenty of cyclical risks from construction, infrastructure and other key exposures – including other mining clients!

Just three years later, the usual fate for poorly conceived deals is about to play out: Raubex is now looking for a buyer for Bauba Resources. It’s the right call, as being stubborn about not sorting out the problem doesn’t help anyone. If anything, it’s just example number five zillion of why M&A should always be treated with caution.

This move was well telegraphed in the latest set of results, with Raubex making it clear that they were “evaluating the long-term strategic direction” of the business. That’s just fancy corporate speak for “we probably need to sell this thing” – and quickly.

At this stage, all they’ve done is appoint an advisor to help them assess strategic options and find a potential buyer. There’s no guarantee of a transaction going ahead, even if there’s a “for sale” sign hanging over the door. If they do find a buyer, it’s going to be very interesting to compare the selling price to the 2022 acquisition price.

Lovely growth numbers at Sabvest (JSE: SBP)

This is one of the best local investment holding companies

Sabvest has a strong reputation for capital allocation skills and returns generated for shareholders. They’ve been around for a long time and the track record speaks for itself.

There will be good years and bad years of course, but the year ending December 2025 will go down as a great year. In a trading statement for the period, they highlighted NAV per share growth of between 18% and 25%, along with an expected jump in the dividend per share of between 19% and 24%.

The share price reflects this momentum, up 36% year-to-date.

Nibbles:

- Director dealings:

- The current CFO of Growthpoint (JSE: GRT), who is retiring early next year, has sold shares worth nearly R1.3 million.

- The CEO of Spear REIT (JSE: SEA) bought shares for direct family members worth R92k.

- An associate of the CEO of Grand Parade Investments (JSE: GPI) bought shares worth R29.6k.

- An associate of a director of South Ocean Holdings (JSE: SOH) bought shares worth R20.7k.

- Omnia (JSE: OMN) participated at the Absa Corporate Summit and has made the presentation available here. It’s a goodie to work through if you want to get to grips with the company.

- Here’s some encouraging news for the Altvest Credit Opportunities Fund (JSE: BACC), by far the best part of Africa Bitcoin Corporation (JSE: BAC). The fund has placed notes worth R50 million under the R5 billion Domestic Medium Term Note Programme. They need to keep scaling that thing and scale requires capital.

- Will PSV Holdings (JSE: PSV) come back from the dead? There’s been a lot of effort to try and make this happen, with DNG Energy working to get the company out of liquidation and suitable for status as a listed company once more. The latest update is that the liquidator has requested a motivated Section 155 Scheme of Arrangement (essentially a compromise with creditors). This is expected to be received in December.