DRDGOLD inks a wage deal with NUM and AMCU (JSE: DRD)

This brings certainty, but also above-inflation increases for five years

DRDGOLD had a tricky end to 2025. Despite gold prices doing wonderful things for the share price, the company received notice of a protected strike action from NUM and AMCU. The strike was suspended to allow the parties to sit around the negotiating table.

It looks like the unions came out with a strong deal here. They’ve secured increases of between 6% and 7.5% per year for the next five years. There’s a new 2% performance-based incentive based on key metrics, as well as various other improvements to allowances and support schemes. Backpay is payable from 1 July 2025. And as the cherry on top, there’s a payment of R5k to each employee!

DRDGOLD better hope that the gold price keeps doing well.

MC Mining takes drastic action with Uitkomst Colliery (JSE: MCZ)

This comes after the quarterly update that revealed the difficulties

MC Mining has attracted international investment based on the exciting Makhado hard coking and thermal coal project. The problem is that the group also owns Uitkomst Colliery, where the financial performance is going from bad to worse. In business as in life, you cannot allow a tumour to go untreated.

This is why MC Mining has taken the decision to temporarily suspend mining and processing operations at Uitkomst with an intended effective date of 1 March 2026. They have a lot of hoops to jump through to achieve this, not least of all from a labour and retrenchment perspective.

It’s always very sad to see stuff like this, but businesses are run for a profit and sometimes need to make tough decisions. Uitkomst is suffering cash losses at the moment, something that a mining company with an important development project just cannot (and shouldn’t) stomach.

The reference to this being a temporary closure is just an effort to retain long-term optionality. I can’t see them magically reopening in a couple of months.

Pepkor had a solid finish to 2025 despite the tough base (JSE: PPH)

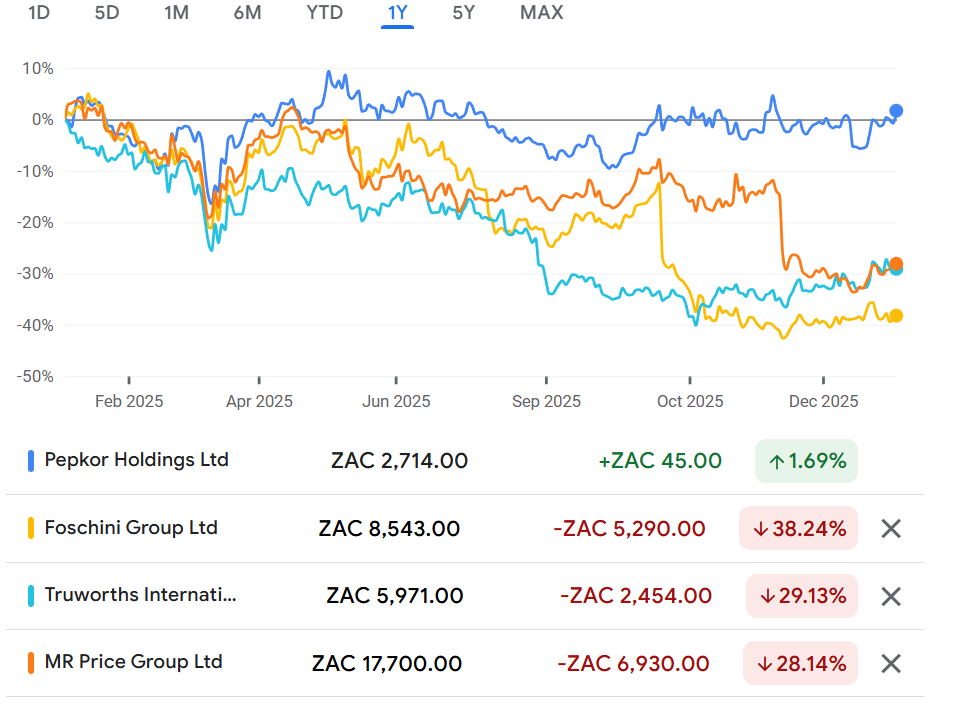

This is why the share price suffered much less than clothing peers over the past year

We know that the clothing sector has been a hideous place to invest in the past year. Even Pepkor, by far the best of a bad bunch, is only flat over 12 months. That’s considerable outperformance in this context though:

Yikes!

Pepkor’s defensive share price performance has been well earned. For the three months to December 2025, a really tough period vs. the two-pot withdrawal base period at the end of 2024, revenue was up by 8.3% if you split out the acquisitions. If you include them, then revenue was up 12.9%. Impressively, the two-year CAGR without acquisitions is 10.3%. Double-digit revenue growth in this market is excellent.

Sales in Southern Africa were up 2.0% on a like-for-like basis. In PEP Africa and Avenida, like-for-like sales were up 12.7% in constant currency, as those businesses didn’t have the two-pot withdrawal distortion that we had in South Africa. In rand terms, they were up 16.7%.

In case you’re wondering, PEP Africa and Avenida contributed 4% and 5% of group sales respectively.

Another important lens is to compare cash sales (up 7.4%) to credit sales (up 26.9%). Credit sales contributed 18% of total sales.

Group online sales increased by 27.9%, an exceptional performance that shows how important digital adoption is across the LSM curve. Mr Price (JSE: MRP) should pay attention here, as their online sales are only growing in line with in-store sales.

Looking at the retail segments, the Clothing and General Merchandise (CGM) segment grew 5.8% excluding acquisitions and 7.5% on a two-year CAGR basis. Furniture, Appliances and Electronics (FAE) grew 4.6% excluding acquisitions and 6.5% on a two-year CAGR basis. I must note that CGM is over 5x the size of FAE, so these segments are far from being of equal importance.

Speaking of importance, PEP and Ackermans contributed a combined 63% of group sales. It’s therefore critical that these parts of the business perform well. Ackermans struggled with a 0.6% decline in like-for-like sales, but PEP managed a strong 2.8%. Back-to-school is a critical period for Ackermans, so the current quarter likely matters even more than the festive quarter.

Retailers often have to make tough decisions in their footprints. For example, Pepkor has closed Shoe City – that’s a significant closure of 113 stores. Making these tough decisions is key in driving the group forwards.

You might be wondering how those segmental performances reconcile with the much stronger group revenue performance. The answer lies in the Fintech segment, where revenue was up by a wonderful 25.4%. This includes financial services, insurance, cellular and other revenue opportunities.

In the first three weeks of January 2026, they’ve carried on where they left off. Group sales were up 8.3% excluding acquisitions.

Shoprite piles the pressure on competitors (JSE: SHP)

They achieved above-inflation earnings growth despite being very aggressive on price

Shoprite isn’t trying to win a competition based on who can release the best quarterly results. They are playing a long game, acting as the python that is continuously squeezing the impala until it devours the whole thing. Retail is a game of tiny incremental changes and improvements, particularly in grocery retail where consumers are so price sensitive.

The recent trend at Shoprite has been one of decelerating growth in the Supermarkets RSA segment, although they are still posting strong growth rates that reflect ongoing increases in volumes.

The trend continued in the quarter ended 28 December (Q2), Supermarkets RSA grew sales by 6.5% vs. 7.9% in the quarter ended 28 September (Q1). The trend was visible elsewhere as well: 11.3% in Supermarkets non-RSA in Q2 vs. 12.9% in Q1, and 2.3% in Other Operating Segments in Q2 vs. 4.8% in Q1.

This means that group sales from continuing operations increased 6.5% in Q2 vs. 8.0% in Q1. For the first half of the year, that comes out at 7.2% growth. It’s easy to forget the sheer scale here: to achieve that growth, Shoprite needed to find an additional R9.2 billion in sales!

But the real story here is around inflation, which is where we can see how Shoprite is punishing inefficient competitors. In a period in which official food inflation was 4.7% for the six months, Shoprite’s internal selling price inflation was just 0.7%. Competing against Shoprite is no joke, with price deflation in November to December!

Like-for-like sales increased 1.9% for the six months, so this implies volume growth of roughly 1.2%.

Digging into the segments, we find Shoprite and Usave with sales growth of 5.1%. Both banners experienced price deflation, including -0.7% at Usave.

Tell me again how capitalism is evil and that it doesn’t benefit the poor to allow businesses to run efficiently? I would love to see any government in the world do a better job than this with the capital they would raise through more taxes.

Further up the LSM curve, Checkers and Checkers Hyper achieved sales growth of 8.9%, with selling price inflation for Checkers of 1.9% and Checkers Hyper of 1.1%. This is another reminder of how difficult they are making things for competitors like Woolworths (JSE: WHL).

As for the scooters all over our roads, Sixty60 sales increased by 34.6%. It’s a remarkable story of disruption and the importance of distribution.

The growth in the footprint is rapid, not least of all as Shoprite is stepping into the void left by a shrinking Pick n Pay (JSE: PIK) across the country. They opened 262 stores over the past 12 months (note the different time period here), including 50 Shoprite, 42 Usave and 32 Checkers.

Shoprite is also incubating a number of other banners like Petshop Science, Uniq Clothing, Checkers Outdoor and Little Me. These form part of the “adjacent businesses” and these names were good for 71.2% growth. Petshop Science is being rolled out the fastest, with 45 new stores in the past year. They actually closed two Little Me stores, so there are clearly more little tails and fluffy ears out there than humans who need prams. The birth rate is becoming a very scary story.

In Supermarkets Non-RSA, constant currency sales growth was 9.5%. In rand, sales were up by 12.1%. They opened a net 15 stores over 12 months, taking them to 272 stores across seven countries.

In the Other Operating Segments area, OK Franchise suffered a decline of nine stores and sales growth of only 1.7%. In much happier news, Medirite increased sales by 13.5% and pharmaceutical distributor Transpharm was up 5.5%. Pharmacy (with the associated health and beauty knock-on benefit) is an important retail category in South Africa.

Once you bring it all together, HEPS from continuing operations increased by between 5.2% and 10.2% for the six months. That may not sound exciting (especially for a company on a P/E close to 20x), but that’s still an inflation-beating return in a period where Shoprite delivered lower prices to the poorest South Africans. That’s hard to fault and certainly looks like a strong, defensive performance.

As an aside, the sale of the furniture business to Pepkor (JSE: PPH) is ongoing. Lewis (JSE: LEW) is fighting hard to get that deal blocked by the Competition Commission.

Vukile buys a new property in Spain (JSE: VKE)

They haven’t taken long to recycle some capital

Vukile recently announced that they were selling some properties in Spain. This is because those properties had reached a level of maturity that made them more suitable for ownership by an institutional investor rather than a dedicated REIT. The hands-off approach of the new owners is evidenced by Spanish subsidiary Castellana locking in a management agreement for the properties.

Naturally, this means that Castellana has been looking for new opportunities to deploy capital. It didn’t take them very long, with a property in Spain having been identified.

Castellana has agreed to buy Berceo Shopping Centre in Logrono from Barings Core Spain, a company listed on the Euronext Paris. The price is €108 million, payable in cash.

Castellana will acquire the majority of the gross lettable area, with the portion occupied by Carrefour owned by an institutional investor in Spain. We aren’t used to seeing these structures in South Africa, but it makes sense if you think about it – the opportunity to really add value lies in the part of the property that isn’t occupied by the anchor grocery tenant.

The broader region has around 324,000 inhabitants and has grown 3% since 2018. The GDP per capita is ahead of the Spanish average, with expected GDP growth of 2.4% being in line with the national average.

We easily forget how developed South Africa actually is. Vukile notes that this centre is the only major retail destination within a 100km radius!

The acquisition price is a net operating income yield of 7%. Buying a European property at that yield does seem interesting, especially as Castellana believes that there are good opportunities to improve the underlying income. Thanks to the lower cost of debt in Europe, the cash-on-cash yield is actually leveraged up to 8.6% through the use of €50 million in debt (a loan-to-value ratio of 46%).

Nibbles:

- Director dealings:

- The brothers who founded WeBuyCars (JSE: WBC) sold a whopping R866 million worth of shares. The entity through which they both hold their shares now has only 5.65% in the company. I can certainly understand the desire to diversify, but obviously the optics aren’t great when the company has been through a difficult time recently. The selling pressure was clear in the share price, which is down 11% over 7 days. I remain invested in this story for numerous reasons.

- The CEO and founder of Acsion (JSE: ACS) bought shares in the company worth R2.4 million.

- The CFO of Sephaku Holdings (JSE: SEP) bought shares worth R646k.

- A director of Visual International (JSE: VIS) sold shares worth R45k. And no, the website still doesn’t work.

- In December, Sappi (JSE: SAP) announced a possible joint venture for graphic paper in Europe with UPM-Kymmene Corporation. This would be a Category 1 transaction, so a circular and shareholder vote is required. The JSE has granted an extension to the company for the distribution of the circular, with the new date expected to be around 30 April 2026.

- ASP Isotopes (JSE: ISO) never seems to sit still. The company is highly active in growing its existing business and bringing in new opportunities, evidenced by the latest deal to acquire preferred stock in a company called Opeongo. This is a biotech company working in therapeutics for fibrosis, inflammation and cancer. The preferred stock is convertible and comes with various investor protections. This is a casual $10 million bet on this biotech firm.

- KAL Group (JSE: KAL) announced the disposal of Agriplas back in September 2025. There’s just one condition outstanding, namely approval by the Eswatini Competition Commission. It’s amazing how it is almost always a non-South African competition regulator that takes the most time to grant approval in these deals. The parties have extended the fulfilment date to 16 February 2026.

- Hulamin (JSE: HLM) has renewed the cautionary announcement related to the disposal of Hulamin Extrusions. There is still no guarantee of a firm deal being announced here.

- Sanlam (JSE: SLM) has now received the shares in Ninety One (JSE: N91 | JSE: NY1) as payment for the asset management deal. This makes Sanlam a 12.5% shareholder in Ninety One. If you adjust for the minorities in Sanlam Investment Holdings, Sanlam Group has an effective 9.1% holding.

- Orion Minerals (JSE: ORN) announced that some of its South African project companies have been selected for the BHP Xplor accelerator program – basically an incubator for mining projects. This delivers $500k in equity-free funding for the projects, as well as access to technical expertise and experienced mentors. Before you panic, the Prieska Copper Zinc Mine and New Okiep Mining Company are not part of this award as they are far further down the road in their respective development journeys.

- Oando (JSE: OAO) released results for the quarter and year ended December 2025. There’s close to zero liquidity in the stock, so I’ll just mention it down here. Revenue fell 21% year-on-year and gross profit was down 82%. Profit after tax increased 10%, but there are lots of non-operating adjustments in there.