Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Afrimat has more good news for the market (JSE: AFT)

Alongside the Lafarge deal opportunities, the rest of the group is producing great results

Afrimat has released a trading statement for the year ended February 2024. HEPS is expected to increase by between 21% and 26%, coming in at between 553.6 cents and 576.5 cents. This is excellent news for shareholders, particularly after the other recent good news of the Lafarge deal closing.

On a share price of R63, Afrimat is trading on a Price/Earnings multiple of roughly 11.2x at the midpoint.

Detailed results are due on 15 May, so you’ll have to wait about a month to learn more about the drivers of these numbers.

Lighthouse is looking at selling more Hammerson shares (JSE: LTE | JSE: HMN)

Lighthouse would prefer to be prepared for direct property investment opportunities

Lighthouse Properties has already sold down quite a chunk of Hammerson shares, with Hammerson having won few friends among its strategic holders for the decisions it made around its dividend. Based on previous Category 2 announcements, Lighthouse has sold Hammerson shares representing 26.21% of Lighthouse’s market capitalisation. If they moved through the 30% mark over a 12 month period, it would trigger a Category 1 process.

Such a process is time-consuming, so Lighthouse is pre-empting this by going through the motions now and asking shareholders for approval for such a disposal. The shares in Hammerson wouldn’t be sold at a price lower than a 10% discount to the 5-day VWAP before the disposal.

Assuming the approval is obtained, this would give Lighthouse the flexibility to sell the Hammerson shares as required in response to opportunities to make yield-accretive direct property investments.

Ninety One’s AUM is trending sideways (JSE: N91 | JSE: NY1)

It’s more difficult to increase AUM without a significant distribution angle to the business

Whilst I’m the first to acknowledge that I’m no expert in this space, it does seem to me as though the PSG Konsults and Quilters of this world are finding it easier to increase AUM than the more pure-play asset managers like Coronation and Ninety One. It makes sense to me intuitively, as having a large sales force out there can only be positive for assets under management. Of course, that sales force comes at a substantial cost, so the distribution side of the business needs to be successful for there to be a net positive impact on the group.

Without a particularly strong distribution model, Ninety One’s AUM seems to be limping sideways. A year ago at the end of March 2023, it was £129.3 billion. At the end of December 2023, it was £124.2 billion. The latest number is for March 2024, coming in at £126 billion.

Key metrics head the right way at Purple Group (JSE: PPE)

The swing into profitability is for all the right reasons

When the trading statement came out that reflected a move into the green, the market didn’t really give much of an initial reaction. This changed with the release of detailed interim results, with the share price up nearly 17% for the day. This is because there’s a great story to tell, with Purple revenue up 29.3% and group expenses down 0.4%, leading to a positive earnings result.

Notably, the net asset value is 41.6 cents per share and interim HEPS was 0.78 cents, so the closing share price of 90 cents reflects a lofty valuation. If Purple can maintain this momentum and push through the inflection point for profitability (i.e. with most of the additional revenue dropping to the bottom line), the earnings multiple can unwind quite quickly.

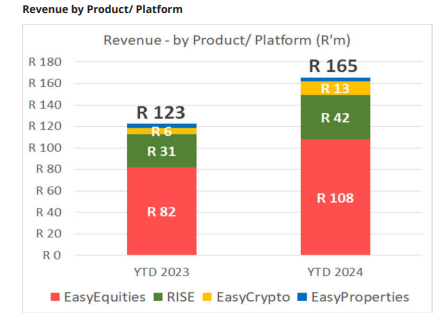

There are numerous metrics in the full report, including Easy Group (EasyEquities and associated businesses) growing revenue by 34.9% and active clients by 12.5%. This means they are making more per client, achieved through non-activity based revenue increasing by 62% to R95 million. The monthly account fees have made all the difference here. Compare this to activity-based revenue increasing by 10% to R71 million. For all the naysaying and complaining on social media at the time, the account fees have absolutely been the right decision. Easy’s bottom line swung from a loss of R16.5 million to profit of R11.8 million.

Perhaps most impressively, they achieved net retail inflows despite the operating environment.

This certainly isn’t the most beautiful chart I’ve ever seen, but it does show how the Easy Group actually makes money:

It’s also good to see that the earnings from GT247.com have become a lot more dependable, with profit for the period of R4.2 million for this period vs. R3.2 million in the comparable period.

Riskovitz Value Fund could invest up to $100 million in Trustco (JSE: TTO)

At this stage, the arrangement is light on details

Trustco has entered into an agreement with Riskowitz Value Fund that provides for a six-month window period for the latter to invest up to $100 million in hybrid capital (or other capital to be agreed on) in Trustco. Essentially, it sounds like Riskowitz is agreeing to keep the capital available for Trustco, with no fee payable by either party.

Riskowitz is already a shareholder in Trustco with a 23% stake. It has been a shareholder for over 10 years.

I found this line in the press release on the Trustco website, which wasn’t in the SENS announcement:

“The transactions allow Trustco and RVF to capitalise on the unreasonably low market valuation of Trustco, to create long-term value for all Trustco shareholders.”

To me, this makes it sound like Riskowitz may well be investing in a hybrid instrument so that Trustco can then execute share buybacks of ordinary shares at the depressed market price. I’m purely speculating on this.

Little Bites:

- Director dealings:

- As one would hope, a few directors and the company secretary of Fortress Real Estate Investments (JSE: FFB) elected to receive capitalisation shares in lieu of the cash dividend.