Steve Porter gets out of bed every day to make sure that the clients of Metrofile Cloud can keep their businesses running when disaster strikes. In a world of public cloud offerings with all the bells and whistles, Metrofile Cloud’s private cloud business takes a no-nonsense approach to delivering cloud services to South African businesses of all sizes – and with a real person on the other end of the phone when you need help.

In this episode of Ghost Stories, Steve’s candid approach comes through strongly in these discussion points:

- The layers of risks faced by South African businesses

- The danger of “sticker shock” in public cloud pricing models and why these models are often overkill for the needs of local businesses

- The critical importance of having a public cloud exit plan

- Whether data stored on a public cloud is truly safe and impossible to lose (spoiler alert: it isn’t)

- The pros and cons of private cloud and where such a solution may be more suitable than public cloud

Steve isn’t for everyone. Metrofile Cloud isn’t for everyone. But if it resonates with you, then this might be the most important podcast you listen to for your business this year. Find out more about Metrofile Cloud here and connect with Steve on LinkedIn here.

Listen to the podcast here:

Transcript:

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast. I come to you in a year where the word “cloud” is basically everywhere. AI is all over the place; there’s a lot going on in this space.

And who better to speak to about the world of cloud and what they do at Metrofile Cloud than the Managing Director of that business? That is Steve Porter – Steve, I’m pretty excited to tap into a proper understanding of not just what you do, but also learning something about cloud along the way. Thank you so much for doing this podcast with me. It must be an exciting time in the world for you and your business. So thank you for doing this.

Steve Porter: Thanks for having us, Ghost. Yeah, it’s great to be here. I certainly hope I can help elucidate cloud. But yeah, let’s give it a crack.

The Finance Ghost: Yeah, no pressure. No, I’m just kidding. So I think let’s start with understanding a little bit more about Metrofile Cloud. This is the business that was previously called IronTree, now called Metrofile Cloud. Give us not quite the elevator pitch – maybe a little bit longer than that – just so we get a proper understanding about what you guys do there?

What is the backstory of this business, what does it look like today and what does it actually do?

Steve Porter: So we’ve been part of the Metrofile group for about four-and-a-half years now. Part of the reason why we were purchased and we moved across was we were seriously keen about the mid-tier market.

Historically, what was IronTree was pretty much only SME or SME-based – and certainly not knocking the SME base, it’s an amazing market, but we wanted to see if we could have a crack at bigger types of customers. We’ve learned some interesting lessons along the way. Obviously we come from a small company background, so this is our first sort of corporate or enterprise-level experience – not without its challenges, but I think we’ve made good progress.

The goal was that Metrofile has what they call grandfather accounts, solid historical accounts, and we wanted to see if we could penetrate that with our services. So if I just step back slightly, we were specifically or predominantly based in the SME space and we started with good old online backups in the days of ADSL. The business has morphed quite radically. Backup is still a great part of our business, but we’ve definitely moved up the value chain.

Let me take a step back again. Everything we do is cloud. We don’t put servers down at client’s sites. We only do cloud based services. And there are various reasons for that, but that’s what our business model is.

From a cloud perspective, our specialty is enterprise hosting, SME hosting, disaster recovery, backups and everything around that. At a very high level, elevated pitch, that’s pretty much what we do.

If I give you a summary of why I think we get out of bed, I think in this country we all know we’re two steps away from financial disaster at a personal and business level, I think why we get out of bed is there is joy in making sure the businesses stay up and running. Personally, that’s why I get out of bed.

The Finance Ghost: I think it really talks to the layers of risks that these clients are facing, right? Like you say, it’s the financial risks that seem to be ever present, not just in South Africa, I think it’s everywhere in the world really. But South Africa definitely has its own cocktail of this stuff. And if you can take away some of the technology risks, some of the cybersecurity risks, some of the data integrity risks, then I guess that certainly helps.

Cloud does a lot of those things, right? As opposed to on-prem data storage, etc.

Steve Porter: Maybe if we just start with what cloud really is and there’s that wonderful meme and you’ll see on coffee cups – cloud is just someone else’s computers in a data centre. And if we have to be brutally honest, that’s what it is.

So why do we think we can offer a cloud service, is maybe where we should start? If I use one of our oldest customers who runs a distributed – their IT manager spent every day unplugging, re-plugging, rebooting, fixing. They fix one problem every two, three weeks, a specific problem. We fix that problem a thousand times a day for multiple customers. So what we allow organisations to do is to actually do their job. They should be thinking of strategic problems, business problems, and let us worry about the grunt work.

If I summarise, that is what cloud really is – it’s a scalable solution for business, operational and strategic problems. And I think that’s what we’re good at.

The Finance Ghost: That word gets thrown around a lot these days. I laugh sometimes because when I was in school, “cloud” was very much the thing that rain comes from out of the sky. Good luck to anyone trying to do a school project on that now because if you type cloud into Google, you’re going to find a lot of stuff that has nothing to do with the different types of clouds!

I think for people who are non-techies like me – as an important piece of disclosure, I’m very much a financial guy, I’ve just had to learn a lot about tech along the way – I suppose like tech executives, you have to learn a lot about finance along the way! Cloud really has almost two elements to it as I’ve understood it from you when we were talking about doing this podcast. So the one is the crunching of numbers and a place for that to happen and the other one is the storing of data. And obviously you can’t crunch the numbers if you don’t have the data.

To help listeners understand how Metrofile Cloud fits into this broader landscape, where it feels like there are so many players in this cloud space, how exactly do you fit in, other than just the size of the customers, for example? And how do you compete with these global giants in tech?

Steve Porter: I think there are two critical elements around – okay, so let’s step back. There’s private cloud and there’s public cloud. So public cloud, for all of us out there, we know it’s Google, it’s Amazon, it’s Azure, and there are other small players like DigitalOcean. But principally there’s three. Right? And there’s Huawei. Sure.

What do they offer you? They offer you everything in the kitchen sink and they bill you like your cell phone usage. It’s per-second billing. So for every second that a service is up, you are being billed. That’s got multiple knock-on side effects. If I think back to the early days of cloud, developers would tick multiple boxes and then get what’s called in our world, “sticker shock” – they find out at the end of the month their bill has raced away.

It’s dangerous. And it’s dollar-based and if you don’t pay your bill at the end of the month, your service is cancelled. It’s that simple. You get two emails: hi you haven’t paid, hi you haven’t paid, it’s cancelled.

I think there’s a financial element and then there’s the technical element.

The technical element is they provide services for the type of business in my mind like an Uber or an Airbnb. Let’s use Yuppiechef as an example. You know that Yuppiechef is going to have spikes in Easter, Mother’s Day, Father’s Day, Black Friday, Christmas, and I’ve probably missed one or two. And it’s hard to plan for that scale. But for the balance of the year, I would say almost every business in South Africa specifically can tell you what percentage they’re going to scale by. That is not what cloud is designed for, it’s designed for massive spikes.

So yes, they do offer you the ability to scale phenomenally, but there are handcuffs. There are multiple handcuffs. There’s a cost handcuff and there’s an exit handcuff. And one of my pieces of advice to any CTO / CFO / CEO / MD is ensure before you make the leap, you have an exit strategy. That is the most critical.

That then brings us to what we do, which is private cloud. Private cloud is – it’s different, it’s by invite only. Do we want to work with you? Do you want to work with us? Does our billing model work for you? It’s not a sign up, tick the boxes and payable at the end of the month. It’s a different experience.

Before I get down to our technicalities, what is it that we try to do differently to the public cloud providers? Okay, one, we don’t have this scale. We’ll probably never have this scale and I’m completely comfortable with that. But what we do is hold your hand. So in this country, again if I come back to strategic focus that both your technical and your business needs, our goal is to remove that manual, to your point, crunching data and storage data – we take that burden away from you and hopefully will allow you to focus on what your job really should be.

Then if I break down the technicalities, if you look at the basics of any public cloud provider, it’s compute, as in like your laptop or your Mac or your desktop. It’s a means of crunching numbers. So you need a place to store the numbers. We provide that with, in technical terms, S3 storage and obviously server storage. But S3 is where you want to store the large volume data and then we have multiple services around that, that either keep you safe, allow expansion and ensure that if something goes wrong, there’s a second site you can fall over to.

We’re providing the core services of any public provider at a rand-based amount with humans at the other end of the telephone, or WhatsApp these days, I suppose.

The Finance Ghost: So that’s where that term hyperscaler comes from, right? These international cloud giants – and I think you’ve explained it really well there in terms of it allows you to have the big spikes in use. I can understand if you’re a big international ecommerce business or social media or whatever the case may be, I mean that makes a world of sense.

Steve Porter: Uber.

The Finance Ghost: Uber. There we go. Exactly, as you said. That makes sense. But I totally take your point. For the majority of businesses, they’ve got a pretty good idea of how much they’re going to grow by. And so your offering does allow for the retailers to have a crazy month, but it also allows for them to then also have a decent idea of what they’re going to grow at and to then have a more cost-effective offering that addresses both of those things. Right?

Steve Porter: Yeah, I mean I think that’s what it boils down to, right? You’ve got three options. You can go back – okay, so let’s assume your CTO or your MD, when everyone was excited during COVID, you cashed in your on-prem or your on-premises servers and you had two choices at that point: go into the cloud, some private version, or public cloud. I’m guessing 99% went public.

The cost reduction with working people like us is we’re buying hardware at scale. So even your on-prem, even if you went back to on-prem, we’re still going to be cheaper. And what they are not factoring in, is the human element, the reason why they thought – okay, so obviously there was the remote working Covid influx which makes total sense. I think it’s a bit like having a baby – and I’ve never had a baby, so my wife tells me it’s like this – is that you quickly forget how painful it was and you want another one. So now organisations are going to realise that maybe a public client provider wasn’t the right move, so they’re going to go back to on-prem but they forgot the pain. Our job is to take away the pain.

The Finance Ghost: Steve, I think the one point that we really do just need to maybe circle back to there and just absolutely land is that “sticker shock” point. I think that’s an important one. It’s like prepaid electricity versus waiting for your bill at the end of the month when they read your meter. But in this case the meter can really start going – it’s like running everything in your house at the same time x10 and then waiting to see what the exchange rate does to your electricity cost while your meter is running. That’s effectively what it is. The rand has had a nice year in the last 12 months, but that hasn’t been the norm and I wouldn’t assume that that’s going to continue into perpetuity.

So I guess it’s all, it’s again – it’s about just reducing risk. That was something you raised right at the start. Businesses face a lot of risk. This is about taking away exchange rate risk, cost risk and then on top of that addressing a lot of the IT risks. That’s really what the offering boils down to. It’s essentially a homegrown solution for South African clients.

Out of interest, do you have clients elsewhere in the world or is it very much SA- focused?

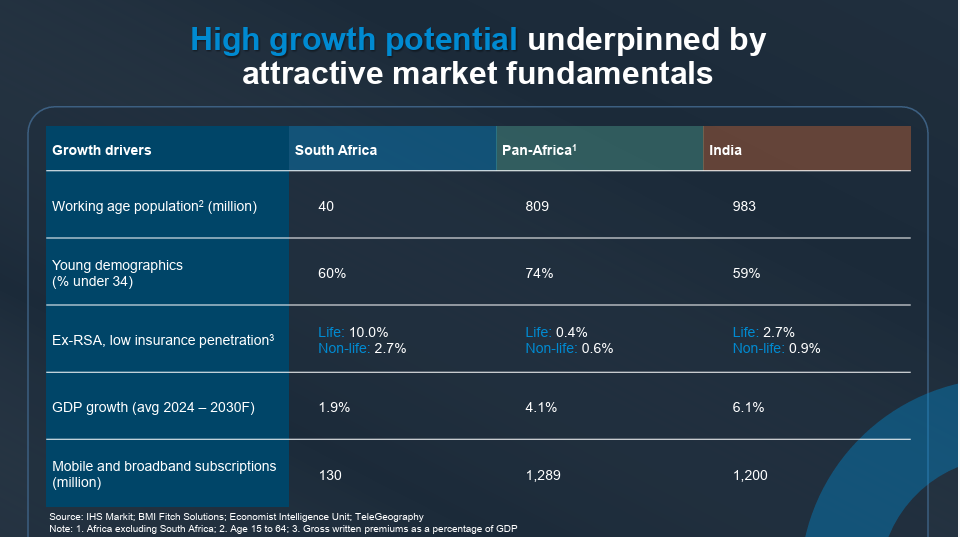

Steve Porter: So we’ve got, obviously through the Metrofile Group, we have other territories, so Kenya, Botswana, Dubai, we’ve got a smattering of clients in Kenya. But in terms of the rest of the world, no, it’s not our focus.

One of the founders, an amazing guy, David Lees, he said: fish where the fish are. And I think so many South African businesses, I know we’re off topic, so many South African businesses think, how can we expand our wallet? Let’s go either into Africa or international.

There’s enough fish in the pond here and it’s a beautiful pond.

So I just want to go back to a point you said a few seconds ago, the metric – you’re spot on – the metric is 10x. Your cost of data storage, data compute, going to a public provider is 10x what our cost is or what on-prem would be. And on their marketing, I remember when Amazon first came into this country, we were sitting in some dev conference and they’re like, we are the cheapest in the world! I remember Dirk putting up his hand saying, but how is that possible? And he just flat out: we’re the cheapest.

What public providers are, cloud providers are, is marketing engines. They can push a message into the market at a scale that none of us can replicate. And whether the messaging is correct or not, it’s pervasive. If I think about how they cost – and I think this is so interesting, we cost all-in, so when you take a product from us, we want you to be as safe as possible. As an example, you would have your hosting application, you would have cybersecurity, you would have four hourly backups, you would have disaster recovery, because there’s no point not having it.

Then our partners would come to us as an example and say, but Amazon’s cheaper. And you look at their costing, it’s like, well, all they’re giving you is the base. You’ve still got to do all the rest and you don’t know what those prices are yet. So it’s clever, obviously, I have other words for it, but it is certainly clever. And it’s forced us to adjust how we approach our customers, which is maybe not a bad thing, but it’s not being true to the business.

Their job and our job, and I suppose maybe their job is different, again is to ensure that your data is absolutely 100% rock solid safe. I want your MDs, your CEOs, your CTOs, I want you to sleep well at night and not have to stress around any chance of your business being down on a Monday morning. That should be the last thing on your mind.

The Finance Ghost: Thanks, Steve. We’ve definitely landed the point there around just the risk of defaulting to the really big names and why Metrofile Cloud is at least an alternative that people should be considering. I guess that’s the overarching point.

And there’s some other stuff here that is well worth landing and I was quite surprised to learn this when you mentioned it to me. I distinctly recall thinking about everything I have saved on my OneDrive – and the fact that I don’t really have it saved anywhere else – and that is whether or not cloud is actually always safe. Because especially for tech noobs like me, I kind of think, well, I’m just going to save this to the cloud and that’s it, all is well, when I need it, that cloud will rain my data down upon me and nothing will go wrong.

But that’s not necessarily a guarantee, right? There have been some real world data losses. So I think let’s just unpack that a little bit, particularly on public cloud obviously. What have been some of these examples where things have actually gone wrong and then what kind of recourse do the customers of these cloud providers actually have?

Steve Porter: It’s a great – yeah, I don’t read terms and conditions, I don’t read manuals. I’m stupid. I should have learned at this age by now to read the manual. If you look at financial cloud providers and public cloud providers, they stipulate in their terms and conditions that you’re liable for your data, they’re not. And I think it’s something we take for granted.

If you look at the cloud model, what are they selling you? They’re selling you redundancy by putting out three points of presence in a country – POPs. So they’ll have one in Cape Town, one in Joburg and one wherever else. And in theory, what that’s meant to do is provide you redundancy. And I think even in South Africa we’ve all seen what happens when an internet cable is damaged or there’s a latency increase.

But then the final and the scariest part is, well, what happens if the data actually is gone? There’s a wonderful case study from Google, I think – when was this? – in May 2024. It was a company called UniSuper. They’re a R135 billion business and their data was wiped out by basic admin error at Google. Gone, absolutely gone!

UniSuper had done backups, but they’re old. They recovered some of their data. They were down from May 2nd to May 15th. Think of that from a $135 billion business in terms of downtime and cost. I suppose what they will have learned in the process is what we know, is that just because you’re in the cloud doesn’t mean you don’t need to take care of data governance and data security. It’s on you! It’s absolutely on you!

And you will only find out – it’s a bit like that when someone leaves their laptop in the car in South Africa and you think, I’m just going to nip out quickly to the shops and I’m sure it’ll be fine. And that’s the same mentality. It’s not – it will be fine, for 99.9% of the time it’s probably going to be okay – but do I want to be or do you want to be that business that makes that mistake? And I think, if you take the South African context again, there are no safety nets in this country. If your business goes down for days or weeks or months, which we’ve seen, what’s the effect on you? What’s the effect on the business? What’s the effect on your employees?

There are no safety nets.

So I think part of the problem with being in South Africa, in the tech space, or most spaces, is we are slightly behind the rest of the world and we always have been and we probably always will be. And there’s strengths and weaknesses to both of those.

From a data governance perspective and a business risk perspective, it is on you as the business owner to ensure that your data – which second to people, is the lifeblood of your organisation. And there are multiple strategies for that. But it’s time for us to realise that we are the ones that are responsible. The American providers, the cloud providers, it is not their responsibility.

The Finance Ghost: You can imagine if it was a huge Australian financial services business, in the case of UniSuper, that went through that – and I was reading now the joint statement between them and Google at the time it happened, which of course is full of the usual PR gumpff, “inadvertent misconfiguration during provisioning”, AKA fat fingers – this does happen. But the point is that if that can happen to such a big client, then little old me has got zero chance. There’s absolutely no chance. And little old South African SME, frankly, never mind little old me, has also pretty much got zero chance.

I can imagine a world in which that can get pretty nasty and I guess the lesson here is you’ve got to think about backups alongside cloud. It is not the silver bullet that basically solves everything, but I guess private cloud has some advantages in that regard, in terms of obviously what you offer. And I guess what you’re always up against is people going the public cloud route by default. It’s the “nobody gets fired for hiring IBM” issue. Anyone who has ever been, for want of a better description, a challenger brand in any kind of advisory business, tech business, take your pick, understands the frustration of even where your product is, in some regards better and in some regards worse – it’s definitely not suitable for everyone. But even where you are better for someone, it’s so hard to get them to just walk away from the big default brand.

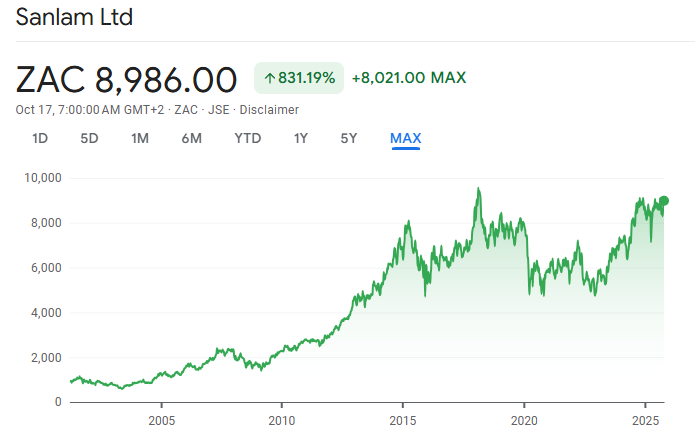

This is why I’m an investor in the big default brands. On the other side of all of this, as a Microsoft shareholder, I’m listening to this and going, yeah, I’m feeling good about my cloud investment there, doesn’t necessarily mean it’s great for the – the best choice for clients all the time, but it certainly sounds like a good choice for my investment.

I guess in terms of your private cloud offering, to what extent do you mitigate these data security risks and what sort of support do clients get where something does potentially go wrong? You mentioned earlier, there’s a human on the other side of the phone or WhatsApp, that’s quite different to being in chatbot hell.

I think just talk us through the level of comfort that you can give to South African businesses who might be listening to this, thinking hmmm I need to maybe have more of a think around my cloud offering or where my stuff is.

Steve Porter: Yeah, I think so. If I separate our services out into – I don’t want to say endpoint security because it’s the wrong word, but human security and then cloud or infrastructure security. So from a business perspective, we all know this, but I’m not sure we all take it seriously enough, your greatest – so let me just talk about the sort of user security for a second.

Your greatest footprint or likelihood of a breach or problems – I’ve got another lovely example for you – is humans. What is the tool that they use the most? It’s email! So your very first step is for us to ensure – not us, any provider, this is not about selling us, it’s about broad awareness, right? You’ve got to take care of everything that that user uses. Email, OneDrive, 365, Google Workspace, whatever it may be. It’s got to be locked on and safe and secure. And then you’ve got also got to make sure that it’s backed up. So what happens in the event of a catastrophe?

And I’m guessing that a whole bunch of people are going to go, oh, great, so Steve’s just pushing the FUD principle. I’m not pushing the FUD principle. I’m telling you, it’s your responsibility. It’s really simple.

The Finance Ghost: What is the FUD principle, Steve, by the way? I’m not actually sure what that is.

Steve Porter: Fear, uncertainty and death.

The Finance Ghost: Ah, ok. Alright, there you go!

Steve Porter: So, yeah, fear. Am I peddling fear? And I think it’s actually the opposite. But how it’s received, well that’s up to the listener.

The Finance Ghost: What is the worst thing that can happen? I completely understand that. Yeah.

Steve Porter: Yes. And then the analogy I used, I think it was a week ago or two weeks ago, in South Africa we all know that someone’s going to burgle your house. We know this. So what do you do post-burglary? You beef up your security.

The analogy is not that dissimilar for businesses – (a) why would you ever want to be burgled in the first place? And (b), if something has happened, make sure you plug the holes. The way we look at it from a tech perspective is layers of an onion. Start at the centre, your most critical thing being humans, and work your way out and just make sure you’re safe.

And then the second part is the infrastructure side. So where you would put your ERP application as an example or whatever it may be – your business-critical services that have to run 24/7, we would always ensure it’s protected from a cybersecurity perspective. So your data – we know your data is as safe as it possibly can be. We all know that there is no 100% guarantee. But from a mitigation perspective, we’ll get you as close to 100% as the industry can get you.

Then the second element, and this is a critical element, is – it’s a boring topic, backups and DR, it’s helluva boring! But not from a business perspective. So let me just clarify the difference here.

A backup is – I have a laptop, I stupidly leave it in my car, I thankfully have backups, the IT department buys me a new laptop tomorrow and I’m restored and up and running. So sure, I can use iCloud as an example or whatever it is, but that’s for my personal stuff, not work. So what’s the business backup strategy for my employees?

And then the second part is DR, right? And it’s a layer on top of backup. So I have an ERP application or let’s use, what was our, the Google one?

The Finance Ghost: UniSuper.

Steve Porter: UniSuper! So what happens when my data does go down? What is my DR strategy? And DR is – it’s in the name. What happens when I hit a disaster? In our world, you flick a switch, you switch over to a cloud-based replica of your ERP application. You’re probably down for three minutes, maximum eight, and you carry on working. When Google have restored your business data, you switch back to Google or whatever it may be. I don’t think we take disaster recovery seriously enough in this country, let alone backups, let alone cybersecurity. But I almost want to say at the infrastructure level, whatever is business critical, the tick box for DR has to be ticked.

So I just want to go back to the cybersecurity thing for a second and I’ll come back to DR again if you don’t mind.

So earlier this year, July, there was a company in the UK, KNP. I think they’d been in business for 158 years. One employee got exposed or hacked. It took their business down completely – as in they are no longer in business! And one of the stats we have from our DR vendor, there’s I think it’s about 55%, maybe even 60% of businesses that when they have a disaster that’s not recoverable, their business collapses. And I don’t think we understand the consequences of that sort of action.

I just want to go back to the infrastructure section again, if you don’t mind. I think what separates us again from your public cloud providers, is all of that is baked into our solution. Sure, from a costing perspective we have to take it out because those are the quotes the public providers are doing. But from a responsibility and integrity perspective, I’d rather you know the full costs and how it’s going to benefit your business rather than surprise you down the line with additional costs.

We do flat billing. There are no surprises in the month. The second place where you are going to get caught out from a public cloud perspective is, let’s assume you did think about an exit strategy and if you did, fantastic! For the rest of you that haven’t, I suggest on Monday morning, that is the first thing you do – is what is my exit strategy when I can’t handle a 10x bill anymore? And then you’re going to find out – what’s that wonderful Hotel California song? “You can check in, but you can never leave”. That’s public cloud. You will have put your data in and now you’re going to find out the cost of getting it out. I’m not crazy about the concept, I think it’s a terrible concept and I get it, every business has got to build moats. But we’ve designed our business right from the start, it’s an all-you-can-eat buffet. You want to take your data out when it’s time to leave, here it is. If we have failed you as a provider, if we have upset you and you want to leave, by all means leave. Then we have failed you, here’s your data.

I’m not crazy about that. In the technical world they call it ingress, which is inbound data and egress, which is outbound. And you get absolutely hammered on outbound costs. It’s not cool.

The Finance Ghost: No, that does sound like a FUD up of note, actually. We don’t want to be getting anyone involved in that. And I’ll say it again, when you’re a little old South African business, you get on the wrong side of this very fast let’s be honest.

A lot of people listening to this will probably have a financial background, just given the Ghost Mail audience. They’re probably “cloud curious” or they’ve got cloud and they are wondering about why the bill is so high. And I think it’s important – I definitely want to understand a broader point around how do they actually begin to access you – but we’ll get to that just now, because what I do want to also do is just – there must be reasons, there must be things the public cloud providers can do obviously that you might be a little bit short on?

Because what it sounds like to me is Metrofile Cloud is a very good example of hitting the most important things that most of the businesses need. So, is the data safe? Is it accessible? Is it backed up? Just the basics. I mean, that KNP example you gave is shocking. I went and Googled it now – that is horrific! When cybersecurity goes wrong, it’s insane how that can literally just sink an entire business. It is very scary stuff. No one likes to think about this stuff or talk about it. It’s like doing your will. You don’t want to think about what happens, but you kind of need one. This is very much the will of IT.

But where, for example, are the public clouds going to just be more suitable? So the one example that maybe jumps to mind is I read Oracle’s earnings transcript last week, which was an absolute love letter to Cloud and Larry Ellison talking about how we’re going to get to this world where a company exec can kind of sit back on the beach and ask a question to an LLM like: “who should we sell to next?” And this LLM will search every imaginable document in the entire organisation and everything in the whole world before coming back with this mystical answer of: “That person, that’s who you should phone.”

Now, obviously I’m being slightly facetious because you can tell that I’m quite skeptical of us getting to this world, because at the moment I don’t even exist in a world where I can actually get a transcript of this podcast done by AI that doesn’t require me to spend an hour and a half fixing it. So forgive me for wondering when we might get to that world.

But big dreamers do build the world and often they – it’s the old story, aim for the stars, miss, and you’ll hit the moon. Very nice. Looks good on a motivational poster. And fair enough, there’s some very exciting stuff getting built out there.

Is that somewhere where for the large enterprise level clients who now desperately need to tell an LLM story – because otherwise how do they get their bonus this year – does that sound like something that maybe isn’t super suitable for your environment? Where do you run out of road in terms of competing against the big public cloud providers?

Steve Porter: So let me start with the LLM topic. That is something certainly we are absolutely focusing on now. There is no – look, there are multiple providers starting to do it in South Africa, but there’s no one that’s doing it yet. And I think it’s a key service that is missing in this country.

And again, why should I pay US dollar-based rates? I don’t want to say it should be free and cheap, but it should be as cheap as possible, or as cost effective as possible like all other services. Absolutely, we are heading down that path and I think any business that hasn’t figured out how to use – and I won’t call it AI because it’s not AI – automation, next level automation in their business, should be thinking about it. So let’s wrap that one.

From a full-service suite public provider perspective, can we compete? Absolutely not. And I have absolutely zero desire to. There is not a service – let’s just use Amazon as an example – that they do not provide. Whether it’s Elasticsearch as an example, or queuing, or you name it, they’ve got it. They have got everything. I mean, as an example, one of the things we’re looking at is how do you extract tabular data from PDF documents? There are only three ways that are production ready – it’s Google, Amazon and Azure. So use them! As a breadth of suite, no one can compete.

I mean, the investment for a start, mindboggling. We could discuss how they snaffled open-source tools, products, rebranded them, took them in house and now they’re making money out of it – questionable. But from a breadth perspective, can’t compete. No desire to compete. Again, I come back to, and the reason why we wouldn’t want to compete, again, is that 99.9% of businesses in this country don’t need that breadth of tooling.

So if we go back to our offering versus a public cloud offering and I come back to, what it is we take away from you, what we give to you – so, yes, sure, we’ve only got storage, we only got compute and we’ve got a whole bunch of other services around that. But let’s just say we’ve got three primary services. Will that tick off 99% of business’ needs? Yeah, probably. Absolutely!

So what do we give you? We give you time. We give you time to think and we give you time to be strategic, not worry about OS updates and all the boring stuff. That is not what the public providers give you. They’re going to give you an absolute smorgasbord of products and then they’re going to take away time. Then you’re going to have to figure out, how in heaven’s name you use this? How do I use it in production? What happens when it goes wrong? You are asking for a world of pain unless you are a massive business, you have deep pockets and you’ve got budgets for massive teams.

It’s a totally different model, but again – and you may think I hate public providers by the way I speak – I don’t. I’m an absolute fan of DigitalOcean. I think it is probably one of the most beautiful models out there. They’ve done what we’re talking about at a much higher level, UK, Europe, US, but they’ve done it so cleverly in that it’s, let’s say, 12 services and it’s just at the right level for developers. It’s not everything in the kitchen sink. So I suppose you as a business need to figure out which is the correct path. But even if I look at the DigitalOcean model versus our model, DigitalOcean is designed for developers, not business people. You’re still not getting the time back. So again, I suppose it comes back to what you as a business value? Do you want your IT guys to be spending your time fixing servers or do you want your IT guys to actually be thinking about how we build this business?

That’s my humble take on where public and private really sits.

The Finance Ghost: Yeah, it makes sense. It’s like what Capitec has done in banking, it’s like what Chinese cars have done around the world actually, is that at the end of the day, for 99.9% of applications, it’s enough – and it’s therefore very cost effective because a lot of other competitors are trying to layer on bells and whistles and then charge everyone for it, even the people who didn’t need it, to try – it’s almost like a subsidy! That’s a problem.

And the other thing – you’ve touched on it there – is the team, because it’s all good and well to say, well, I can go this route of doing the very fancy international stuff, especially if you don’t need it. You’re locking yourself into not just the cost of the hyperscaler itself, but also, I would imagine, a huge amount of advisory costs, teams, developers, it all sounds very complicated. And again, I realise this is definitely not my area of expertise, so it probably sounds infinitely more complicated to me than perhaps it is, but it sounds pretty complicated.

And I guess that was one of the things I wanted to make sure we cover off as we start to bring this to a close, is for a CFO who’s sitting and listening to this and maybe isn’t in a large organisation where there’s a dedicated CTO, for example, how do they access Metrofile Cloud? Do you have that sort of advisory piece in house where you help clients understand their needs, etc. Or is it almost like the investment product provider: “speak to your financial advisor” and the advisor will contact us. Is it that kind of environment? Or can you also do the advice piece and actually help businesses figure out what they should be doing?

Steve Porter: Our business is built on a partner network. We are very happy to advise, but we would always get the partner involved from the outset and it’s their responsibility as one of our partners to implement.

But absolutely from an implementation, from a strategic perspective, from a “how would I go about eating this elephant?” we are absolutely there to help. From an implementation perspective, we have an amazing, amazing group of partners and we work really closely and I think, well, with our partners. We’ve got some positive reviews – I don’t want to sound like a Verimark salesman.

But I think you’re right. I think it starts with auditing where you are, just understanding, not applying FUD principles and figuring out how we can get you to a place that is safe, secure, your auditors are happy, your CFO is happy, and you can sleep soundly at night.

The Finance Ghost: So, Steve, if I can really summarise everything that I’ve heard from you, it almost sounds a little bit like when I set out to build The Finance Ghost and I took a look at this ecosystem of all these social media platforms, and then I looked at the magic of email and I thought to myself, well – time has proven me slightly wrong in that it turns out that Gmail, for example, has more control over deliverability than I would ever have imagined possible, but be that as it may – the point is that with email, there isn’t a specific algorithm that decides whether you live or die. Whereas on any of these social media platforms, if you upset the algo or something changes or whatever, you can have spent years upon years upon years building something that can literally get turned off essentially overnight because you are nothing more than a tenant in the big house that tech built. That is the reality.

So I went the email route because I thought there’s no ways I’m doing that, I’m not spending my life building something on one platform, that makes no sense, people’s preferences change. And I’m so glad I did because it gives me so much control over what I’ve built and how I continue to grow it and where I focus and which social media platform I use, etc.

I don’t think it’s super different when companies are looking at cloud. That’s what I’m hearing, is if you go and lock yourself into one of the public cloud providers and you build this incredible layer of AI models and you retrench all your staff and you believe that every single day you’re just going to flick a button and you’ll get a little email in the morning telling you exactly what you should sell to who – well, maybe I just don’t want to live in a world that looks like that, I’m not sure – but I’m not sure we’re going to get to a world that looks like that. There’s just too much that goes wrong with tech, etc.

How do you then value a business? Because actually all the value then sits in the technology house. What is your business actually worth? It’s just a model, just a button, it’s just something that gets flicked. So I think where you are telling a really helpful story actually, and that I think is something people need to hear, just be careful about the extent to which you hand over the keys to your entire business to a large technology house where you really are just a number. That is something to keep in mind.

It’s not to say that public cloud doesn’t work for everyone or doesn’t work for you or doesn’t work for whoever. Just be cautious and at least take the time and effort to actually consider the risks and you’ve mentioned a few of them which are really valuable – lock-ins, exit strategy, data integrity, etc. etc. All of that is incredibly valid.

And Metrofile Cloud is an interesting private cloud alternative where, if you’re looking for a South African solution with pricing that’s not going to give you a huge fright at the end of the month – it really is prepaid electricity plays Eskom – and on top of that can just do the basics and probably enough for most businesses, then that is where Metrofile Cloud plays.

Is that a pretty good summary of where you guys are at?

Steve Porter: I think it’s spot on. Absolutely spot on.

The Finance Ghost: So I guess the last point then is for those who have listened to this and gone “hmmm,” which is that classic “hmmm” of, “hmmm, I need to think about this a bit more,” where shall they direct that in a way that lets them speak to the right person? Is it contacting you directly? Is it finding one of your partners?

Steve Porter: Contact me. Contact us metrofilecloud.com all our numbers on there. I’m very happy to dish out my number. That is the point. Start a discussion and it’s not even around – sure, we’re all in business, we want to make money, but it’s about awareness. And if I come back to why I wake up in the morning, it’s about ensuring that businesses can carry on doing business. That’s all this is about. Absolutely. Website, WhatsApp, phone calls. We are available.

The Finance Ghost: Yeah, I think that’s maybe one final point from my side and something I’ve personally enjoyed just getting to know the Metrofile Cloud team – and all of you are Ghost Mail readers, that’s how this all came about – but it’s just very cool to meet a team that is genuinely so candid and also just so entrepreneurial. It’s quite clearly a business by entrepreneurs for entrepreneurs. And I think as an entrepreneur myself, you can tell – you can immediately tell when you are dealing with a business that has that kind of DNA versus that sort of big corporate call centre kind of vibe: don’t talk to me, talk to the machine.

So, well done to you, Steve, and to the team. To listeners that have made it this far in the podcast or read the transcript, I hope you’ve taken something from this. I hope you’ve taken something actionable. Worst you can do is have a conversation and just see if you are using the right services at the right price and that it’s doing everything you need. I mean, it certainly doesn’t hurt.

And much as FUD is frustrating at times and it’s ugly to think about, you’ve given a couple of quite scary case studies there about where things can go wrong and that’s what risk is at the end of the day. That’s why we have insurance. We don’t want these things to happen to us, but sometimes they do, and that’s why people take out insurance. That’s why they should think about their data. You’ve given me a lot to think about as well, so thank you, Steve. I really wish you guys all the best heading into the back-end of the year and hopefully we get to do another one of these again at some point and keep us appraised of what’s happening in cloud.

Steve Porter: Fantastic. Can’t wait. Yeah. Enjoyed every second. Likewise, meeting you has been 10 out of 10.

The Finance Ghost: Thanks, Steve. Ciao.

Steve Porter: Take care.