Glencore is proof that perseverance can work (JSE: GLN)

To the dismay of Teck’s board, its shareholders are taking notice of Glencore

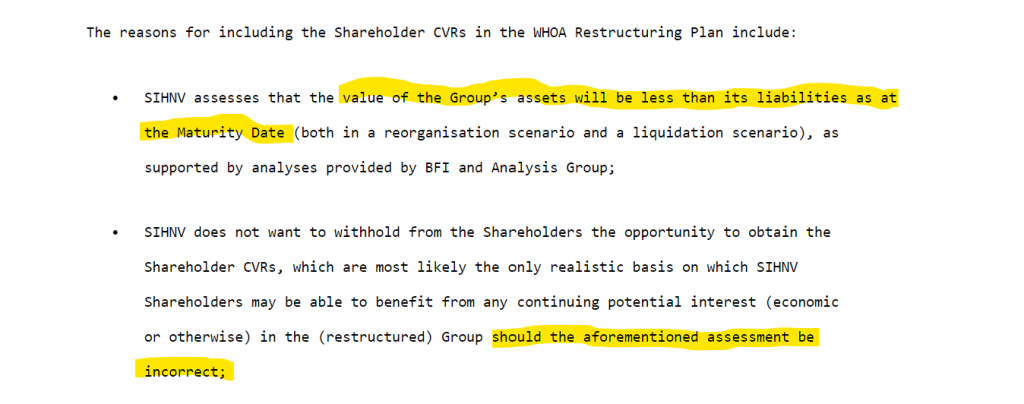

I suspect that “Glencore” is a swearword in the average household of a Teck Resources board member in Canada. After initially approaching the board and then improving its proposal, Glencore suffered a double rejection that led to a letter being released to Teck Resources shareholders.

It seems to have landed, because Teck decided to withdraw its separation proposal. In other words, the Teck board has realised that the Glencore proposal isn’t going to just disappear and that shareholders deserve a chance to consider it. Even if the board won’t take the offer to shareholders with its blessing, Glencore has said more than once that it is willing to make the offer directly to shareholders. This would be a textbook example of an attempted hostile takeover.

Even with all of this going on with Teck, Glencore isn’t sitting on its hands. On the aluminium side of the business, Glencore is agreed to acquire a 30% stake in Alunorte S.A. and a 45% stake in Mineracão Rio do Norte S.A. (MRN) with the counterparty to both deals being Norsk Hydro ASA.

The combined value of those deals is $775 million and the effective date is 30 June 2023. Due to various adjustments that are expected to be made to the price, the expected payment is $700 million.

Alunorte is the world’s largest alumina refinery outside of China, located in Brazil. MRN is an open case bauxite mine located in Brazil. Bauxite is the main ore of aluminium and Alunorte is one of the biggest customers for MRN’s bauxite.

This is another reminder of what a force of nature Glencore actually is. With a market cap of around R1.35 trillion, this is a huge commodity platform business that can pull a few levers and make huge steps in exposure to so-called “transition metals” – with the Teck deal as a particularly large attempt in that space.

Industrials REIT remains defensive (JSE: MLI)

The update for the fourth quarter reflects a healthy business

If you’ve been regularly reading your Ghost Bites, you’ll know that Industrials REIT is currently under offer from Blackstone. This will need to go through a shareholder approval process, along with an extensive regulatory process for a deal of this size.

In the meantime, the company has to stay up to date with reporting requirements. This also helps investors make an informed decision about the offer.

In the fourth quarter of the 2023 financial year (covering the three months to March 2023), the company gave a mix of quarterly and annual numbers for investors to chew on. For example, Industrials REIT achieved 4.8% like-for-like growth in passing rents and 10.6% growth in estimated rental values over the full financial year.

And in this quarter specifically, there was an average uplift in rent of 27% on all lettings signed during the quarter. The supply-demand dynamics remain favourable in this property sector, allowing the company to achieve substantial increases in rent when leases come up for renewal. Through its Industrials Hive platform, the company is focused on having relationships directly with tenants by showcasing its available properties through an in-house web platform.

The sale of the care homes joint venture in Germany was completed in April, so the portfolio is now purely focused on multi-let industrial units. This is part of why it fits so neatly into a portfolio run by the likes of Blackstone.

The loan-to-value (LTV) ratio was 29% on 31 March 2023. The average cost of debt is 2.8% and average maturity is 3.2 years, with loan extensions that could take that to 4.4 years.

MC Mining had a mixed quarter (JSE: MCZ)

Production at Uitkomst was sharply down year-on-year, but exports are here

With “challenging geological conditions” in addition to localised flooding and of course load shedding, MC Mining suffered an 18% drop in production at Uitkomst Colliery, measured on a year-on-year basis. Sales were higher though, with the particularly good news being that a big portion of domestic sales has now been rerouted to export sales after management initiatives in that space.

The company is also busy with the Makhado hard coking coal project, with a detailed implementation plan having been formulated and put into action for the first five years of mining and processing operations.

At the outsourced Vele Aluwani Colliery which was recommissioned in December 2022, mining and processing of coal ramped up and 48,518 tonnes of thermal coal was delivered during the quarter. For context, Uitkomst produced 101,616 tonnes this quarter.

The company had cash of $14.1 million at the end of the quarter vs. $20.2 million at the end of December.

MTN Nigeria and Ghana release results (JSE: MTN)

If you are invested in MTN, you need to follow the subsidiaries in Africa

I always enjoy the release of results by MTN’s African subsidiaries. They tell us so much about business in Africa in general – a high growth region that is fraught with currency risk. Companies that can grow in-country with internally generated cash flows (like MTN) can make it work. Those that are trying to bring the cash home to deal with South African debt are in trouble (like Nampak).

Starting with Nigeria, the data story continues with active data users up by 14.7% vs. mobile subscribers up by 9.4%. Active mobile money wallets grew from 2 million to 3.2 million!

Some margin pressure is coming through, with service revenue up by 20.5% and EBITDA up by 17.7%. EBITDA margin fell by 130 basis points to 53.3% – still a huge number.

The story deteriorates thereafter, with profit before tax up by just 8.5% and earnings per share by 3.8%. Why is this the case? The clue lies in the EBITDA acronym – Earnings Before Interest, Taxes, Depreciation and Amortisation.

Depreciation and amortisation increased by 23.4%, a function of MTN’s significant capex investments in the country. Net finance costs are a bigger issue, up by a whopping 42.2% with inflation in Nigeria at a 17-year high and the Monetary Policy Rate in the country up to 18%.

At first blush, it seems as though MTN is cutting back on investment, with capex down by 25.8%, or down by 47.8% excluding right-of-use assets. Accounting weirdness aside, the insight here is that capex has slowed down considerably. If you read through the details of the announcement, you’ll find commentary around a high base for capex and supply chain challenges in this quarter that impacted the capex growth rate. They expect a “ramp-up” in capex during the rest of the year, so it wouldn’t be correct to say that MTN is slowing down on investment in Nigeria. With net debt to EBITDA of 0.2x, there’s still plenty of financial headroom even if finance costs are showing a worrying trajectory.

I would love to give you the details on Ghana but the MTN Ghana investor relations website was down when I tried to access it. I’ll check back in this week to see what I can find.

Reinet gives us a clue about its NAV move (JSE: RNI)

Reinet Fund’s NAV move is a precursor to Reinet Investments

Reinet is an investment holding company that primarily holds shares in Pension Insurance Corporation and British American Tobacco. That’s a defensive portfolio of note.

Like all investment holding companies, the key metric is Net Asset Value (NAV) per share. Before the listed company releases its NAV update, Reinet announces the quarterly NAV of the Reinet Fund, the vehicle through which the investments are held.

These NAVs aren’t exactly the same, as there are balance sheet items at Reinet Investments level that you won’t find in Reinet Fund. It does give a very strong clue as to the percentage movement in the NAV though.

At Reinet Fund level, the NAV has decreased by around 1.3% from December 2022 to March 2023.

Sasol raises more US dollar funding (JSE: SOL)

Sasol is attractive to global lenders and fixed income investors

One should never assume that a successful debt raise is an indication of returns coming the way of equity investors. The metrics involved are completely different, as fixed income is all about debt affordability and equity is all about growth. Still, it’s never a bad thing when a company is appealing to debt providers.

Sasol has raised $1 billion through the issuance of notes (debt instruments) that mature in 2029. The rate is 8.75% per annum, so that gives you an idea of where the dollar yield curve is and the kind of risk premium that Sasol needs to offer.

The orderbook reached over $2.3 billion, so this raise was 2.3x oversubscribed.

Together with the recent extension of its dollar loan maturity, Sasol has full pre-funded the March 2024 bond maturity.

Southern Palladium signs off on a busy quarter (JSE: SDL)

Drilling, drilling and more drilling

Southern Palladium is firmly in drilling and exploration mode. You need to be a geologist to really understand the updates on SENS, so I usually just look for commentary from management around whether the drilling results are in line with expectations or not.

Having done wider drilling in this quarter to figure out which of the four potential development scenarios is the most favourable, the next quarter will be about narrower infill drilling to increase confidence levels from Inferred to Indicated.

As at the end of March, the company held $12.93 million in cash vs. $14.20 million at the end of December 2022.

Little Bites:

- Director dealings:

- A non-executive director of Hammerson (JSE: HMN) has acquired shares worth £8.9k.

- An associate of a director of Ascendis Health (JSE: ASC) has bought shares worth nearly R92k.

- African Rainbow Minerals (JSE: ARI) has announced that CEO Mike Schmidt has stepped down after 11 years in the job. He will stay on as Executive of Growth and Strategic Development. The current COO, Phillip Tobias, has been appointed as CEO with effect from 1 May 2023. It’s always good to see internal appointments like this.

- The AB InBev (JSE: ANH) dividend has been approved by shareholders. A dividend of €0.75 will be paid to holders on the JSE register on 5th May.

- If you are a shareholder in Kibo Energy (JSE: KBO), you’ll be interested to know that subsidiary Mast Energy Developments has released its annual report. Recent activities have focused on the Pyebridge project site, the construction and development of the Bordesley project and the acquisition of two reserve power projects.