We all need somewhere to live, but that doesn’t mean that buying property should be the default decision. Most of all, it doesn’t mean that buying any property at any price is sensible. Data-led decision making is crucial when buying a home, especially in South Africa where house prices don’t automatically go up.

Hayley Ivins-Downes and the team at Lightstone Property are passionate about helping South Africans apply more science to the emotiv decision of buying a home. With incredible data on property across the country, Lightstone makes it easier to avoid turning a dream home into a nightmare.

On this podcast, Hayley unpacked topics like:

- Relative property values across provinces and the trend over the years

- Development activity and the types of properties being built

- The effect of the interest rate cycle

- Semigration trends and the impact they have on values

- How the average age of buyers has increased vs. ten years ago

- The question on everyone’s lips in Cape Town: has the property trend reached a relative peak?

Property is one of the most important financial decisions you can make. If you do the research before you buy stocks, you should certainly do it before you buy property. You can learn more about Lightstone here.

Listen to the podcast here:

Transcript:

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast. Thank you for being here with us. You’ve probably clicked on this because you have an interest in the property sector, and I think you will be well rewarded for that by getting some fantastic insights into the South African property market because today I have the great joy of speaking with Hayley Ivins-Downes. She is the Managing Executive of real estate at Lightstone Property.

Lightstone is fascinating because they have all the data, just all of it, basically – it’s brilliant! I’ve seen the reports, I’ve seen some of the stuff that you’re able to put out there, Hayley. I actually asked an agent for a Lightstone report, quite literally this week because I’m doing some planning around real estate for myself personally over the next few years. Data-led decision making hey – that’s something I’m passionate about, it’s something that you’re clearly passionate about.

So, Hayley, welcome to the show. Thank you for doing this. I’m very excited to dig in and get some fantastic insights from you.

Hayley Ivins-Downes: Great. Thanks, Ghost. It’s really great to be here and to be able to share some of our insights and knowledge and data from Lightstone. I think it’s really important for any homeowner / buyer / seller to make sure that they’ve got all the right information and making these decisions.

The Finance Ghost: Yeah, absolutely. And you’ve been with Lightstone for quite some time, so plenty of experience on this podcast, which I’m excited about.

So let’s maybe get a lay of the land, quite literally, actually, when it comes to Lightstone. I think people know the name, but I’m not sure that enough people know that they can ask for these reports from their agent. They can even go and buy the reports themselves. So let’s just get an understanding of what Lightstone actually is. What is the data set, how has it been built and why is it important?

Hayley Ivins-Downes: Lightstone is actually part of the Halls Group, coming out of Nelspruit and Mpumalanga area. We started in 2005, really just focused around offering information and valuations. We started by developing a residential property valuation model that the banks currently use in terms of granting of bonds. And so we use a lot of the deeds data. We’ve got all the history, all the transactions, and we obviously get a lot of insight out of that information.

We have over the years built up reports and specifically focusing on certain segments of the market – your banking, your insurance and your real estate. And for the man on the street, the home buyer, the homeowner, the home seller, we also have valuation reports which you can purchase with a credit card, pay as you go, which really makes it a lot easier than having to sign up.

Just as a matter of interest, when I was looking for a property, it was actually really quite important to ensure that you have all of this information. So sometimes it is not a bad thing to sign up for subscriptions because you have a month, because it does give you a lot of information on the area that you’re possibly going into and what is actually happening in that area on the property side.

So we’ve built up obviously a wealth of information over the years, and that just keeps us going and providing more information for really anybody in the property industry or sector.

The Finance Ghost: You’ve raised a really interesting point there, which is that the banks use this for valuations and a lot of people get caught out by this when they go and buy a house. So sometimes you have a buyer who just gets too hot for the deal and the seller and the agent manage to make it work. I mean, this is a negotiated transaction so if you don’t have your wits about you, then you will overpay for property.

And then you put in your offer to purchase and it’s subject to bond finance. And you’re assuming you’re going to get a 100% bond, and you might get a 100% bond – on the value that the bank thinks it’s worth! And if the bank thinks it’s worth R1.5 million and you’ve offered R1.7 million, you’re going to get a R1.5 million bond because the bank thinks you’re overpaying and so they don’t have enough asset cover on the bond. Is that accurate?

Hayley Ivins-Downes: Absolutely. I think that’s one of the benefits of having a Lightstone valuation report. This is really the valuation that the banks see as part of the process of granting the bond. They obviously assess their own credit information on the back-end, essentially on the buyer, but they use our valuation model and what our estimate is to help guide them as to whether they should be granting the bond and the amount that should be granted. So it’s really quite important to also have that knowledge before you buy the property, to understand what the bank may be seeing in terms of the process, in terms of the valuation estimate on the property you’re looking to purchase.

The Finance Ghost: A lot of people listening to this will be investors in shares on the market. This is just doing the valuation work, but for the property. You wouldn’t go and buy a share at any price – or you shouldn’t go and buy a share at any price – but people behave this way with property because I think it becomes such an emotive decision. You fall in love with a house or sometimes you live in a market where you end up in a situation where you’re squeezed on where you’re going to be next because rental stock is not always available. You can tell I live in Cape Town, it’s a very much a lived experience there – rental properties are not always available where you want them!

Or you want to try and lock in a specific house because your kids are starting school – there are a lot of reasons why people overpay for property and a lot of them are well-meaning reasons. These are not irrational reasons, but it can become a real issue down the line, not only from a bond perspective, but also just in terms of – you might really regret it in years to come. If you significantly overpay for a property, you can end up effectively underwater in that thing. At some point the shine comes off and you look at this and say, wow, how much financial damage have I done myself here? As opposed to just renting or even better, buying at the right price. So I guess that is where Lightstone is just so important.

Hayley Ivins-Downes: So important. I think it’s really – once you purchase a property and at the end of the day we do need to live somewhere – but also once you make that decision in terms of purchasing the property, just understand also in terms of the growth of the area, in terms of where the properties around you are actually growing in value, are you investing in the property in the right way? So if you’re going to be spending money, is it the right investment that you’re doing? Because at the end of the day, five years down the line, 10 years down the line, will you get some level of return on your property?

And I think we’ll discuss further down in the podcast, but you’ll see that in many areas, property is not the greatest investment from a short-term to medium-term at the moment. We really need to be astute and understand where we’re actually investing and what property we’re purchasing.

The Finance Ghost: Yeah, I will beat this drum all day. I absolutely agree with you. You’ve got to buy a property for the right reasons. The property you live in – there are a lot of good reasons to buy the place you’re going to live in for a long time, I’ve run a lot of the numbers myself, what annual growth you need to see in properties to make it make sense over a 7-to-10-year holding period.

Because that’s the other thing people say: “This is my forever home.” Forever is a really, really long time – people’s jobs change, their careers change, their spouses sometimes change, their kids move school, things happen and so if you overpay – and I think a big part of the problem is obviously just the costs on the way in and on the way out, transfer duty, etc. is so onerous that you can’t just – it’s almost like having a kid, you can’t put it back, you can’t go and buy a property and then 12 months later say, oh dear, I can’t own this thing anymore, let me get out of it. You’re going to take a massive, massive bath.

And the problem is it’s going to happen on an asset that is worth millions because it’s a very over-leveraged position. It’s like going and buying shares in a company, borrowing money from the bank and then not caring about the valuation. You would never do that. So why do people do it with property?

Hayley Ivins-Downes: No, exactly. Exactly! Anecdotally, just to share with everybody. We used to live in a suburb in Johannesburg and we purchased the property 10 years ago or 12 years ago and we paid a price…

The Finance Ghost: …oh, my condolences. I know where this story ends. It can’t be good.

Hayley Ivins-Downes: No, we sold it two years ago to move. We made a loss on that property.

The Finance Ghost: Yeah.

Hayley Ivins-Downes: We got less for that property than what we had paid!

The Finance Ghost: Sho, never mind inflation.

Hayley Ivins-Downes: No, never mind inflation. So I think it becomes really important just to keep your head up when you’re buying a property and not let the emotions run too much. Be aware of the area that you’re buying into because areas can decay and that also obviously affects your investment. So yes, all of these factors play a really important part.

The Finance Ghost: No, they really do. I mean, the last maybe anecdotal piece and then we can dig into some of the data that you’ve got at Lightstone about property – I think we’ve really landed the point around how important this is.

So I did my articles in a banking environment, which means I had access to staff rates on a home loan. And conventional wisdom, certainly from my parents’ generation, was always: don’t pay someone else’s bond! I mean, how many times have you heard that? Every time you pay rent, you’re paying off someone else’s bond? Pay off, just every payment is one more brick. You have heard all this before.

I naively in my articles was like, well, I have got access to this incredible bank rate, let me buy this little apartment in Joburg, and I came out okayish but definitely down versus if I had just rented. Without a doubt, I absolutely should have just rented. There is no reason on earth why I should have bought that property at the age I bought it when there was so much uncertainty over where my career would take me. There were no kids that needed a stable environment. It was an absolutely nonsensical decision with the benefit of hindsight.

I always encourage people: property can be the best decision you ever make and also the worst decision you ever make. It’s not like pressing the “buy” button because you feel like some shares in Sasol, you can get out of those pretty easily. It’s not the same in property.

Hayley Ivins-Downes: No, no. Do the numbers, before you make a decision.

The Finance Ghost: So let’s do some numbers because I think this is what we’re really here for is to understand what you’ve got in the data. I think one of the big South African talking points obviously of the past decade, has been the shift of wealth. You’ve talked about it now from Gauteng to effectively the Western Cape. I think that’s where most of it has gone. Another big talking point has been something like how vulnerable the Eastern Cape economy has actually been. And of course the beauty of property data is this is one of the ways you can just see it unemotively. Take out all the politics, take out people shouting at each other, property prices, willing buyers, willing sellers en masse dealing with having to take a view on somewhere in the ground. There’s no better measure than that.

Hayley Ivins-Downes: Yeah.

The Finance Ghost: So based on that, I’m very keen to see what stats and what trends you might have around that whole shifting-of-wealth-around-the-provinces point.

Hayley Ivins-Downes: Great. I think let’s start – probably good just to understand the total value that we’re talking around. If we had to look at the full property industry in South Africa, we’ve obviously divided that into residential and non-res, and your residential component basically makes up 85% of that. Total number of property stock: 8.55 million, just to give a view in terms of the legally owned property. And looking then at the value, total value of R13.5 trillion and of that, 54% in residential.

If we start now trying to understand what’s actually been happening in terms of the market and how it’s been shifting. So it’s been really interesting just to see specifically after Covid – but if I just do a little bit of a dig in terms of where the property market value has shifted, I actually managed to find an older version – 2015 – in terms of where we kind of showed the shift. In 2015, Gauteng was basically sitting with 38.4% of the value. Western Cape was sitting with 26.8% of the value. Third one, always coming in third is your KZN, and that was sitting at 12.3% of the value. And then I’ll get into Eastern Cape a little bit further on.

But if we just bear in mind the differences specifically between Gauteng and Western Cape. Up until now, what we’re saying now, 2025, basically Gauteng is now sitting at 36.9% of the value, so basically a drop of 2%. Western Cape has jumped up to 30% of the value so climbed 3.5% / 4% of value. And if you think about the value, that percentage of the R13 trillion, it’s a big number.

If we start looking at where the big difference started to happen, it was really post-Covid. So 2020, what we saw was interest rates dropped, an all-time low in 50 years, so it was really a big drive towards buying your property. It was certainly a buyer’s market – owning your own property as opposed to renting. And we saw this shift starting to happen and we saw 2020, I mean Gauteng was sitting at 38%, Western Cape had already started jumping up to 28% and then it just started increasing. We started to obviously see that shift – and we’ll get into more detail around semigration further on – but we’ve definitely seen the shift of value move definitely more down to the Western Cape.

Gauteng is still sitting at the top in terms of value, but Western Cape has certainly started catching up. Gauteng dropping.

The interesting component of KZN is it really is flat. There’s been hardly any movement. If we look 10 years ago it was 12.3%, it’s now 12.15%. So really tiny in terms of the shift.

The Finance Ghost: It really is Gauteng to Western Cape. I mean that’s what it’s done, right? It’s incredible.

Hayley Ivins-Downes: It is, definitely the biggest shift. And I think just linking into that, we obviously saw the shift of the ability to be able to work anywhere. So you didn’t need to go into the office. There was definitely a phase where that was happening. And so people used the opportunity to really move where they felt they wanted a better lifestyle or the fact that they could have better experiences. And obviously, the biggest view is Western Cape is running better from a municipal / provincial angle, so that’s also an interesting conversation on its own.

And then if we drop into the Eastern Cape, so the Eastern Cape economy has really been struggling. And I mean, if we go back 10 years, the value of Eastern Cape was sitting at 6.4% of the value. It really is now 6.29%. So it’s actually been declining in terms of what’s happening in the Eastern Cape. And it’s almost like a bit of the forgotten province and yet the potential there is huge.

Anecdotally, I was just on a hike on the Wild Coast, and I just think the potential for that area is so big, specifically from a tourism point of view to lift up that area. But we’ve definitely seen on the property side, that there’s been a bit of a slide on the value side of it. Even on the volume in terms of activity and transactions, also a bit of a drop. So, yeah, it’s definitely been the one that’s stood out as the drop that we’re seeing. It’s been interesting just to see the differences in the provinces.

The Finance Ghost: I mean, there’s a lot of interesting stuff to unpack there. In some ways, it’s actually not as big a shift as maybe some people might have expected to hear, because everything you get fed is obviously cost of living, cost of living, but of course, the cost of living comes through in a slightly tweaked metric, which is to compare the value proportion in a province to the volume of properties, because you get so much less for your money in the Western Cape.

Obviously I still have friends in Joburg and we’ll sometimes just laugh about – not laugh, but you just say, like, what is this house actually worth? And it’s this fantastic home in Joburg for a couple of million rand. And in Cape Town you are getting, if you are lucky, a complex – you know, you’re sharing walls with people for that sort of price. Joburg, you’re leaving behind a whole standalone story with a garden and a pool and a braai and three garages and the whole shebang. So it’s incredible.

I remember when I was in high school and I would get my parents to sometimes take a detour because I used to love going through the old areas of Joburg, certainly never grew up in them, like Westcliff, Houghton – just absolutely stunning. I looked the other day for fun at houses in Westcliff and what they’re worth now and I remember what they were changing hands for 15, 20 years ago. And it is just horrific! Look, people who owned Westcliff houses at that time, I don’t think that they care too much to be super honest about where the value went, they’ll be okay, but still no one wants to see their houses go down in value. That’s the reality. And it’s when you look at that top-tier property band that I think the Joburg / Western Cape difference becomes so stark. It’s amazing actually because I mean the stat is Western Cape is 30% of the value of South African property. But what percentage is it in terms of volumes?

Hayley Ivins-Downes: So volume wise, also quite interesting, it is 18% of the volumes compared to Johannesburg of 34%.

The Finance Ghost: Yeah. So that shows.

Hayley Ivins-Downes: It’s a big jump in volume compared to value.

The Finance Ghost: Massively. And that makes sense.

Hayley Ivins-Downes: That leads to it, it leans into what you’re saying. Yeah, we’ve seen the super luxury areas of Johannesburg take quite a knock in terms of property and what sellers are actually getting for their properties.

The Finance Ghost: Yeah, absolutely. And the other interesting thing in everything you were talking about there was, I think you made a comment that during the pandemic it was quite a buyer’s market because obviously you could get access to finance. So of course, the contrarian investor in me flicks it around and goes, well, that makes it a seller’s market! And the buyer’s market is when I can walk in because there’s no one else who can buy it. But because I bided my time and I can therefore get the debt and I’ve got the deposit – and that’s the way to think, you’ve got to almost think countercyclically if you want to make money in property. It’s just like buying stocks. Almost exactly like buying stocks. You’ve really got to think that stuff through, in a big way, actually!

Speaking of stocks, of course the other thing that happens on the market is you end up with growth stocks that are very hyped up and nothing can ever go wrong. And actually I’ve used this anecdote on another podcast before, but I’ll use it again. So one of the best deal makers I worked for in my career sold this absolutely magnificent home in Cape Town 10 years ago now for an eye-watering amount of money. It had been on Top Billing. It was just, it was absolute perfection! And I just distinctly recall, he hosted a braai there, this amazing house. And I remember saying to him, why on earth would you sell this? And he said to me: exactly! And that was his answer. Because there’s nothing wrong. Because everything’s perfect. Because the sun is shining down on this right now and anyone who comes to visit it is going to think exactly like you think, except maybe they have the big number to get it out the door.

And he was right. He sold it at the absolute – probably the peak. We saw Cape Town properties kind of hit that bubble period and then there was a little bit of flatlining, etc. And the problem is if property prices are flat, you are losing money versus renting. That’s the maths. Because of rates, because of the costs of maintenance, because of all of the money you incurred on the way in and what you could’ve done with the transfer duty that you had to hand over to the government, etc. People forget the opportunity cost in a big way.

And anecdotally, it feels to me like the Western Cape has run out of puff a little bit, just because I can’t understand how people are affording these homes given the jobs available in Cape Town. Are you seeing that in the data?

Hayley Ivins-Downes: We’re getting a hunch of the fact that it’s slowing down. And I think for various reasons. I think there’s a reality check in the fact that potential buyers or renters are questioning what prices are being priced at and what sellers are wanting for properties. And then the other part of it is there’s also a limited stock issue coming in. We’re finding that you speak to the estate agents on the ground in Cape Town and some of the areas where there’s a big, obvious, focus around buying properties and there’s a great demand and those properties don’t even make it to the portals, they don’t even get listed because those estate agents are sitting with such a list of buyers, that they just let the buyers know that this property is coming on the market and it’s literally sold, some of them within hours.

We’re starting to see questions around some of the prices that are being asked. And then linked to that is obviously the fact that actually because there’s no availability of stock, the demand is there, but then people are going, oof, but you know, am I willing to actually pay that for the property? It’s quite interesting – I’ll touch on that when we start looking at indices, because I think the index gives us quite a good view in terms of what’s happening with the Western Cape property market versus the national. But we’re kind of starting to see that it’s not as rosy as it was.

The Finance Ghost: Yeah. Because it just can’t be – realistically, there are just only so many jobs that actually support houses that are R5 million / R6 million. I mean, let’s say you do have a bigger family, maybe I don’t know, in your 40s and I’m really stereotyping, whatever, late 30s, early 40s, earning well and you’re looking for a big family home. Joburg, R3 million – you’re styling! You really are! Cape Town, it’s R5 million+ to get the same thing or anything close – not the same thing, just to get something of a similar relative standard. That is a very big difference.

And then on top of that, I do think that a lot of the salary gap has closed, but the number of jobs is still completely outweighed by Joburg. And there’s been this big call back to office. People have been severely caught out. They went and bought a house in Hermanus, thinking that they could work on Zoom for the rest of time. Unfortunately, this hasn’t been real life, so semigration feels like it is slowing down.

Hayley Ivins-Downes: Absolutely. And we’re starting to see that as well.

The Finance Ghost: So, bullish the Gauteng property market, potentially.

Hayley Ivins-Downes: Yes!

The Finance Ghost: Because to your point, people need to live somewhere, you know.

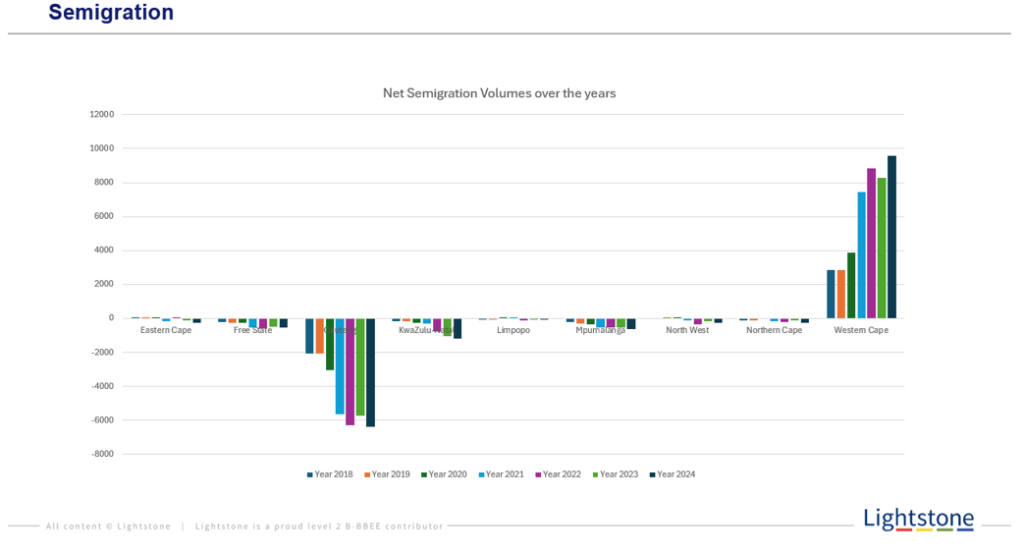

Hayley Ivins-Downes: Have to live. Yeah. And then also just looking – and you mentioned semigration, I think that’s quite a good topic just to jump into because I think that also then aligns with kind of what we’re seeing with the Western Cape / Gauteng.

I also just want to just say, there’s a lot of talk around semigration, but the percentage of people moving – and what we define as semigration is obviously moving from one province to the next – let’s be really mindful that it’s like 4% to 6% of the actual number of transfers that happen over a year. So it’s really a small number. We’re just aware of it a lot more because we’re just hearing of it a lot more and it’s had a jump up since COVID.

If we had to look at what was happening – semigration happens all the time, but what we did see was after COVID, so 2021, 2022 and also 2024 actually interestingly enough, big jump up, spikes of semigration of people moving to Western Cape. 2024, we’ve had nearly 10,000 homes over 2024 and a little bit of 2025 and the majority of that coming from Gauteng.

Then just also looking at the interprovincial movement, once again, the biggest jump is up into the Western Cape. And interestingly enough, also a lot of people from KZN also moving to Western Cape. So it’s definitely your Gauteng and your KZN that are feeding into your Western Cape. But Western Cape is definitely the province where people are semigrating to, that we’re seeing.

And then Ghost, you mentioned earlier that this semigration – we spoke about the value of property and whether people are moving for a property value upgrade or to a bigger property. What’s really clear in the graph that we’ve provided is that semigrators who move to a bigger property, the percentage is really small in Western Cape. So they’re not moving to a bigger property when they semigrate to the Western Cape.

The Finance Ghost: No, definitely not. I can definitely confirm that.

Hayley Ivins-Downes: But what they are doing, is they’re getting a value upgrade.

The Finance Ghost: So this is what I’ve actually realised because people always talk about how cliquey Cape Town is and no one invites you to their home – and look, Capetonians are as flaky as can be. When you move down here, the majority of people you make friends with are ex-Joburg, ex-KZN, ex-wherever, basically, who have all moved here. That seems to be easier.

But I also think there’s a genuine reason for this. All of the standard jokes aside, it’s because people’s homes are just not big enough to have the big braais that Gautengers are so used to. You live in Gauteng in a typical middle-class area and you’ve got space for the braais, the pools, bring the kids, bring your friends. When people invite you for a braai, they actually mean it. When people say they will come to a braai, they will in fact come. Whereas in Cape Town there’s just no space. People who live in the city, it’s a complete non-starter and the ‘burbs, even the houses are much smaller than Joburg. So people do not entertain at home nearly as much as they entertain out of home. And I think it’s the property. I genuinely do believe that.

Hayley Ivins-Downes: Definitely, definitely around the size.

The Finance Ghost: It is. And the other thing that we always assume, of course, is that everyone just lives in a complex. The stats obviously tell us not and I’m keen to get some idea of those stats. But I think that also the reason we think that is because so much of the recent development we see is complexes and estates. We’re fed that all the time. I haven’t seen a ton of activity in building big new standalone houses. A lot of it is estates, etc.

So what do the stats tell us about how people are actually living? Complexes versus freestanding houses, etc.

Hayley Ivins-Downes: So if we look at complexes and freestanding, probably once again, just to bring it back so we understand the split – when we’re looking at total volume of properties, we had basically the 8.56 million total volume, of that 85% residential. Then the residential component, 80% is freehold, 13% sectional title and then 6% your estates. So that in itself is quite important just to understand what we’re seeing.

We did some numbers recently just to try and understand any stock coming online and what people are actually looking at buying. So we looked at provincial stock added since 2020 – so that’s all new properties coming in and being bought. Just to add to that, Western Cape was highest. It was basically sitting at 6.5% of additional stock that came in since 2020 and that’s clearly being driven by demand.

If we had to then look at the split between freehold, sectional title and estate, what we’re seeing, is that estates were sitting at 16% and sectional title at 31%. So if you just bear in mind the numbers that I’ve just mentioned around the actual stock component of it, you will definitely then start getting a sense that there’s quite a few more estates coming in and sectional titles coming in, in terms of developments, new properties on the market and what people are buying. So that in itself also just then speaks to what people are looking for in terms of a lifestyle or a preference. And we’re really starting to see that in the numbers and the change of that coming through.

The Finance Ghost: You made another interesting point there, actually, which is if you look at the value shift over 10 years, as in the percentage of total value, you’ve got to be quite careful as a homeowner to pat yourself on the back and go, oh, my Western Cape property has been an absolute gem because there’s a like-for-like value move, i.e. volumes hold constant, and then there’s share of total value. So if the bulk of new development has been in the Western Cape, then the Western Cape’s share of national property value would go up even if the underlying properties did not move in value, right?

Hayley Ivins-Downes: Correct. Absolutely, yeah.

The Finance Ghost: The magic of stats.

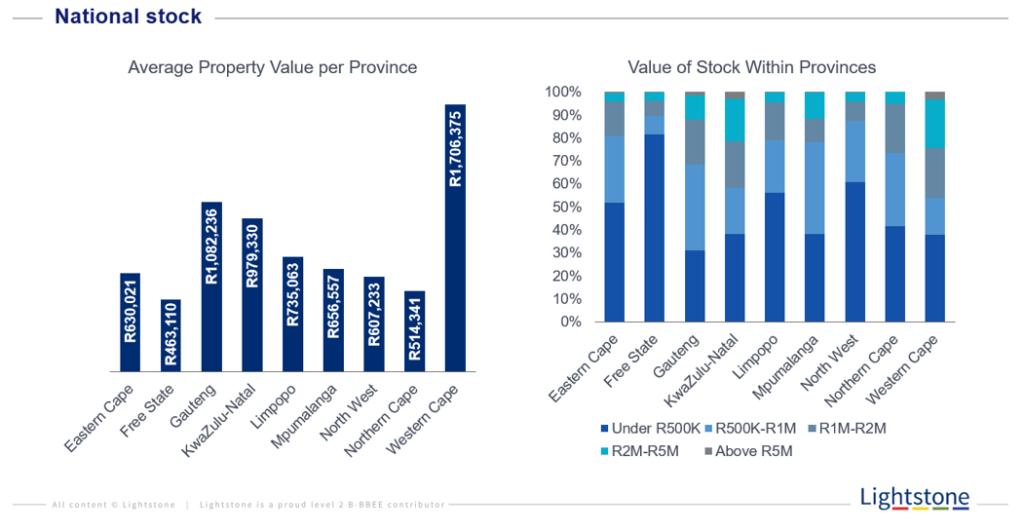

Hayley Ivins-Downes: Magic of stats. And just to be aware of that, just speaking around property values, we also looked at the average property value per province, which just speaks to everything that we’ve been saying. Where we saw the Western Cape average property value at a provincial level was R1.7 million. Compare that to Gauteng, which is just over R1 million and KZN which is just under R1 million. So it starts giving you a sense in terms of the jump up in terms of value and what we’re seeing.

And then obviously when you start breaking that further down into the different bands of property and the value bands, above your R5 million, R2.5 million to above your R5 million, the biggest portion of that is in the Western Cape, I would say probably about 25% / 28% of the properties. And the second one coming in there, interestingly enough, not Gauteng, is KZN, and KZN sitting at about 20% of their properties are sitting in those price bands. Very interesting also just to understand that as well.

The Finance Ghost: Interesting. And on a Zimbali-adjusted basis? No, I’m just kidding. But it is true though, that sometimes the specific estates do skew things. So I can tell you now in Cape Town, the number of new homes that have been built in Sunningdale is absolutely through the roof. And they are, technically speaking, freehold standalone houses, but they’re part of a bigger Garden Cities development where they all look almost exactly the same. There are strong rules, they are a complex in every way other than the boom at the start of the streets, because you don’t really need that down here like you do in Joburg. But in terms of the style of how people are living in those homes, it may as well be a complex. So that’s probably really skewing the stats actually.

That’s an important point maybe. A lot of these are macro stats and we’re talking about them because they’re interesting and they tell a story of South Africa. But when you’re doing property-level investing, and this is where the Lightstone reports are so helpful, you can buy a trend report for a suburb, you can actually just square it right down to the place you are looking.

What has this thing been doing? What are the recent average sales? What are the implied growth rates, etc? What is the value of this house in all likelihood? And that’s the true value of it. The macro stuff is very interesting, but you’ve got to be careful of stats.

My favourite quote about stats undoubtedly is about averages: “If you’re standing with one leg frozen in ice and the other leg on fire, then on average you’re fine!” But in reality, you’re not fine. So it’s always pretty important when you’re talking stats to remember that kind of stuff.

Anyway, that aside, let’s maybe go back to some of the other stuff that we can actually talk through. And I think one of the other points we definitely need to deal with is the impact of interest rates. Because while the SARB seems to basically be almost willing to sell their firstborn children before they will cut interest rates – I’m really not sure what more it takes than where we are, but be that as it may – if rates do actually come down, then it typically makes quite a difference to volumes in the industry, as any estate agent will certainly tell you, but then also the prices that can be achieved. And this is that cyclical point that I was saying, you almost need to flip around the definitions of buyers’ and sellers’ markets from an investor perspective to actually get the right deal.

But what did you see during the pandemic in terms of volumes? I mean, you mentioned it a little bit earlier. How much can you see the interest rate cycle in the numbers?

Hayley Ivins-Downes: So you can definitely see the interest rate cycle. What we saw – so, 2020, we obviously had COVID, 2021 and 2022 were really big volume years in terms of sales. So obviously speaking to your sellers, buyers, this is definitely when sellers were getting the price that they wanted and sometimes in areas that were really valued, they were getting more than they wanted, which is always a good thing.

We have obviously at that point, that was when the interest rate was at its lowest in 50 years. We then obviously started seeing the trickling back of interest rates going up. And 2023 was one of the toughest years we’ve had. The market really contracted and people then started looking at, well, if the interest rate is at this percentage and if I’m going to borrow money to buy a property, it’s going to be costing me a certain amount. And that’s when you start seeing the shift between the man on the street buying a property versus renting. Because you start doing the numbers and you start realising that when interest rates go up, it’s going to be costing me more to service my bond, my home loan, versus renting a place until the interest rate is either possibly down or I’ve saved enough money. So we’ve definitely seen the correlation. We obviously saw 2021, we saw sales of 280,000 over the year and 2024, we were down to 200,000. So quite a big drop in terms of the number of properties that had sold. And then quarter one, quarter two of 2025, we’re not even at 100,000.

I think it certainly then speaks to the fact that with interest rates not dropping fast enough, there’s always going to be questions around the affordability of actually owning a property with a bond versus renting. And it’s in these kind of instances where we see the swing in terms of sellers to buyers. Because obviously, as a seller, if you are in an area and you need to obviously move for – be it a job, be it whatever circumstance – you need to sell your property and the market is as it has been, 2023/2024, the reality is you’re not going to be getting the value that you would like to for your property.

Which means that, from a buyer’s perspective, it’s certainly in their hands that they’re going to be getting property at lower estimates in terms of market. But definitely very interesting. And it correlates very much with the interest rate. People are doing their numbers and checking out the sums.

The Finance Ghost: It’s very interesting to also see then what happens to rentals. So rates come down, bonds become more affordable. But then you have this very interesting situation where what typically happens then is the prices of properties go up because now it’s easier for you to afford, so as the seller of the property, I can now ask you for more. You don’t necessarily always just win as the buyer.

Or if I can’t find someone who’s willing to buy it at the price that I now think it’s worth, I’ll just keep ramping up the rent. And that’s where it then becomes inflationary for interest rates to come down – one of the many ways it becomes inflationary, which is what the SARB is so utterly terrified of, I think overly scared of, but I mean, it is what it is. So it’s very complex. Much as some politicians might wish it was different, we do in fact live in a free market. And that means that supply and demand does play out in property, even when it creates unsavoury outcomes and it upsets people and people get priced out of areas or into other areas.

Property is one of the very best ways to just see supply and demand in action, to see macroeconomics in action, to see the micro level stuff coming through in terms of how well a particular suburb is doing or not. This is why it fascinates me so much. I genuinely have always found residential property so interesting. Even though I personally enjoy the fact that I’m currently renting, I’m not going to rent forever. I think when you have kids and stuff, you’ve got to look through the cycle and say, financially, renting is almost certainly cheapest forever, but you also don’t want to have to move every couple of years and what happens if there isn’t a place then available near the right school, etc.

And I think that then talks directly to the age at which people become first time buyers. What have you seen in terms of – because my thesis would be that this age has moved out, I think everything is screaming that – you’ve got birth rates dropping, you’ve got lab-grown diamonds vs. mined diamonds tells you a lot about affordability of people when they’re at the age when they’re getting engaged. This all sounds so silly and anecdotal to people until you tie it all together and you ask people to just look around them, at their peer group, look at what’s happening, look at what people can afford and how they are living. It feels like a lot has changed over the last 10 years and not for the better in terms of people’s affordability.

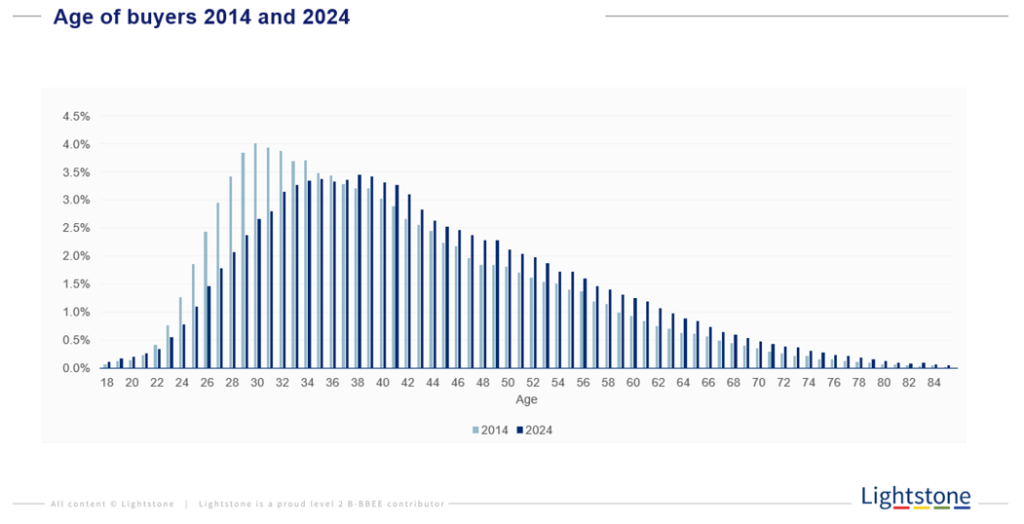

Hayley Ivins-Downes: Definitely. We obviously, from a Lightstone perspective, track first-time home buyers as well as what we call repeat buyers, obviously people buying a property for the second or more time. And it’s always interesting for us to try and understand at what age are people actually purchasing properties. We’ve recently done some research just to understand on our data and the average age of a first-time home buyer nationally is coming in at 36 / 37 years old. A person is deciding to purchase their first home at that age, which for us is really high. If we had to go back 10, 15 years ago, it was definitely in the earlier 30s that people were looking at purchasing their first property.

It has certainly changed. A lot of that has to do with affordability and the fact that you can basically work anywhere that you would like to and you don’t need to go into the office and the fact that you can rent and there’s just so many options for people these days around where they would like to live and how they would like to live. I think that has definitely been interesting.

Saying that, we obviously then looked specifically at the Western Cape, which is always an interesting stat to look at. When we look nationally it’s kind of 36, but then in the Western Cape and this obviously speaks to the price of property, 15% of the purchases between first time and repeat buyers is happening between 36 and 49, and 18% between 18 and 35, which is interesting.

Are people buying in the Western Cape at a younger age and maybe a bit further out as an investment? What is actually – it’s actually really interesting, you can start really doing a bit of a deep dive on a lot of the stuff. Western Cape just seems to be the anomaly at the moment for our stats.

The Finance Ghost: So that’s really interesting. A lot of that could just be perception – it could be people feel safe to buy in the Western Cape because they think it’s a better investment, so they’ll buy younger?

I think a lot of it – and now this is just absolutely anecdotal speculation stuff, which by the way I really love, I think it really is something that people underrate in markets as a common-sense test – I think a lot of people who have semigrated to Cape Town have consciously done that instead of emigrating. So in other words, they’ve now said, okay, I’m going to stick it through, I’m not going to be that Springbok fan overseas who tears up every time they play the anthem. I still want to be here, I just don’t want to be in Gauteng. And they then say okay, well then I’ll buy in the Western Cape. This is the closest I’m going to get to leaving. It’s exactly what happened with me – ten years ago I had to make that call. Am I staying in South Africa? If I am staying in South Africa, where am I willing to raise a family? And the answer was not Gauteng, it was the Western Cape. And hence I semigrated. And guess what? I bought at that stage. So there we have it. It could well be a lot of that.

They buy because they feel like there’s a future in that area that they are buying in. I think enough people have been burnt or they have friends who have been burnt or they have access to information where they’ve realised you cannot be buying and then selling three years later. You’re going to lose an absolute fortune! If you’re going to buy, it’s like 10 years+. You better have a proper view on where you’re planning to be.

Hayley Ivins-Downes: Absolutely.

The Finance Ghost: Speaking of holding periods, which is maybe one of the last things we have time to talk about on this, what’s really been a very fun podcast. For there to be a buyer, there needs to be a seller. So we need these sellers out there, otherwise there’s no market. What have you observed in terms of the average holding period of these sellers before they let their properties go? So how long do they hold the properties for before they actually move on to the next one?

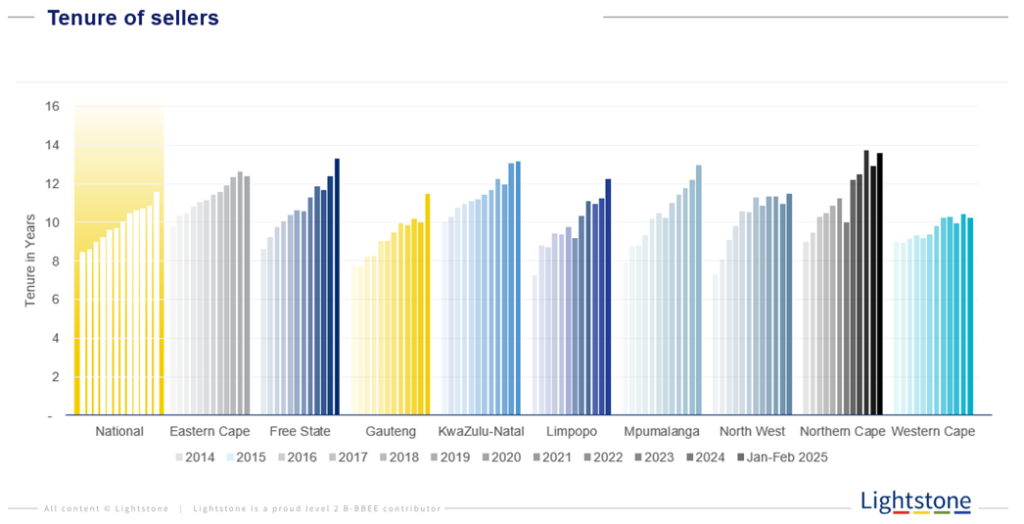

Hayley Ivins-Downes: So this we have found really interesting because I think this really speaks to the market and how tough it is actually for an estate agent or any kind of property practitioner. If we looked on a national level and we looked back to 2014, on average, people are living in their properties for eight years. When we did the stat for 2025, it’s nearly up to 12 years nationally. So people are actually hanging onto their houses for a lot longer than they were – speaks to activity in the market.

I think one of the areas that’s really the longest is Northern Cape – that goes up to 14 years. And then as I mentioned earlier, you get the Western Cape with its own numbers and the Western Cape – and this obviously speaks to the fact that maybe sellers can actually get property prices that are really worthwhile – and if we look at that, 2014, it was nine years that they were hanging onto property, and it’s really just gone up to about just over 10 years. So not a big difference in the Western Cape compared to what we’re seeing nationally, which is really interesting because there’s definitely been a shift to people hanging onto properties for longer. And that just speaks to a really tough market because basically it’s really hard to get stock for your estate agent or property practitioner stock to be sold. It really just speaks to that.

The Finance Ghost: Yeah, and it speaks directly to transfer duty. I still maintain if transfer duties were lower, I actually think the government would make more money because more houses would change hands more often. But instead we have this draconian transfer duty regime that means people have to hang onto their houses for longer. And then you end up with this situation. I had a little chuckle to myself when you gave that Northern Cape stat, because I suddenly just had this vision of someone living in this absolute middle of nowhere place in the Northern Cape, and they keep it for 14 years because that’s how long it takes until someone else drives past, wherever it is they happen to live, while looking at the beautiful stars!

We do live in a beautiful country with some very, very, very different provinces, all of which definitely have their pros and cons, that’s for sure.

Hayley Ivins-Downes: Yes, exactly.

The Finance Ghost: Maybe a good place to just end off with this, is actually to just talk about how people can then empower themselves using Lightstone. Because we’ve talked about clearly the importance of data-led decision making. Treat this as stocks you are buying on the market, but then also just remember that it is like the riskiest stock you’ve ever bought in your life because your concentration risk is enormous. You’re borrowing the money to buy it. Buying a house is a massive decision, you should never be making it lightly and the data is valuable.

So for people looking at homes, do they go through their agent? Do they buy from you directly? What is the right way to actually get the Lightstone data into your decision-making process?

Hayley Ivins-Downes: So it really works both ways. You can purchase the reports directly off Lightstone. We have two valuation reports available, actually, one for a buyer that gives a lot more detail around the area, possible costs that you need to understand that you’re going to be incurring if you’re buying a property. All of those components that the Ghost mentioned, things like your transfer fees, the bond costs, all of those elements.

Then we’ve got a seller valuation report which really just speaks to how much the seller would be able to get for their property, the value that they could anticipate getting in terms of market estimates. And I do think it’s really important to understand this information because if you’re dealing obviously with a couple of valuers or estate agents, it’s also good to empower yourself as a buyer or seller and know what your property market estimate is in the market. This is always an emotional time to be purchasing something like a property. Just make sure that you’ve got all the numbers and all the facts and all the data because it certainly then just helps the decision-making process to be a little bit more based on information as opposed to emotion.

The Finance Ghost: That’s exactly it in a nutshell. And really, I can’t stress this enough. If you get it wrong with overpaying for a home or your holding period doesn’t work out the way you thought, or something goes south for you, you can destroy generational wealth in a home. You really can. It’s quite hard in South Africa to create generational wealth in a home these days. It’s very easy to destroy it. We all need to live somewhere and renting versus buying is a classic decision and a hard one and there’s no one-size-fits-all answer. But I think the one-size-fits-all answer that is out there is use the data, empower yourself, get the piece of paper, point to the number. If you have a stubborn seller or whatever the case may be, you can bring them down with that number. And equally, to be honest, if you think you’re getting a bargain, go and check it against that and maybe you are getting a bargain as the buyer. Maybe you can pick this house up for way below what the estimated valuation is, in which case maybe that encourages you to get on with it and actually do the deal. Either way, having the data is valuable.

So, Hayley, I think we can probably leave it there. It’s been such a fun conversation. It’s been really, really cool. I would encourage people go and check out lightstoneproperty.co.za. It’s pretty easy. All of the products are there. You can either go for the subscription route or do it as a once off thing. It’s not “money” – it’s like 100-and-something rand to get the report. In the greater scheme of spending 2 or 3 million rand on a house, R126.50 I think is money well spent.

Hayley Ivins-Downes: Thank you Ghost and thank you to all the listeners who will be listening to this. And you know, we are available for any questions, if there are any questions. Happy to answer.

The Finance Ghost: Thank you, Hayley. Ciao.