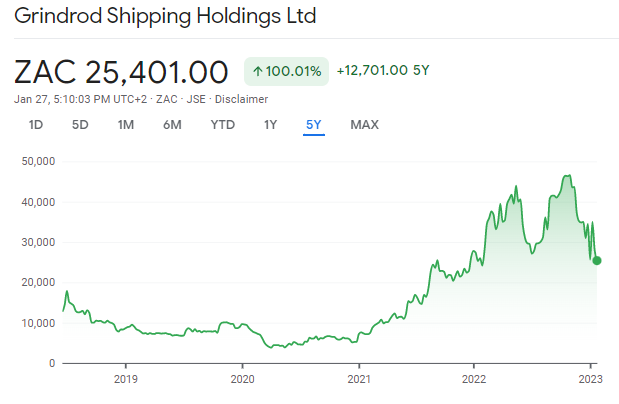

Grindrod Shipping looks for synergies

The company is working closely with Taylor Maritime Investments

After the recent corporate action, Taylor Maritime Investments is the proud owner of 83.23% of the shares in Grindrod Shipping. The company is still listed, so the shareholders who stayed behind will now participate in a journey of (hopefully) value creation as the companies explore synergies.

The companies are looking for efficiencies across insurance, commercial management, technical management and corporate activities. There is also a plan to reduce debt on Taylor’s balance sheet, which would give the company more firepower to support Grindrod Shipping.

There’s already a deal in place to sell a vessel to free up some cash, though the announcement doesn’t give an indication of the selling price.

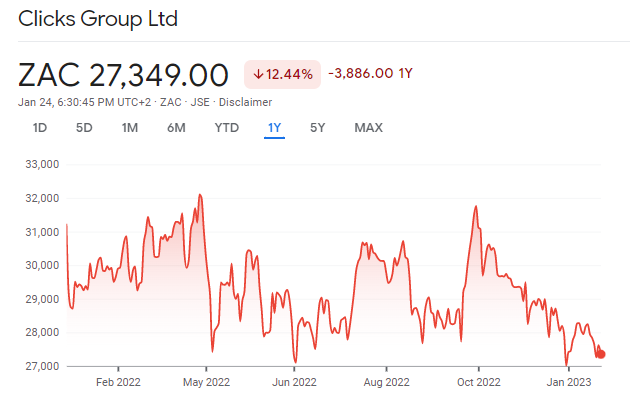

This is a highly cyclical industry, as evidenced by the share price chart:

Industrials REIT is enjoying rental uplifts, but vacancies are down

In a quarterly update, the company gives a mature view on things

Industrials REIT – a fine example of a company that “does what it says on the tin” – is still enjoying an environment that is favourable for industrial properties. High demand and limited supply means that incredible uplifts in rent can be achieved when leases are renewed.

How much? Try a 31% average uplift on for size! It’s even better for new lettings rather than renewals, with an average uplift of 36%.

Of course, these growth rates are not applied mid-lease, so the entire portfolio certainly isn’t growing at these levels. Like-for-like rents were up 5% for the portfolio over the past 12 months.

Despite the company highlighting strong demand, occupancy actually fell by 0.4% this quarter. That’s not as small a move as you think, as the percentage is measured based on the entire portfolio.

To help with occupancy, the company has its own leasing platform in the UK that has boasted a 15.4% increase in visitors year-on-year. There is obviously a dedicated sales team as well. An efficient leasing strategy helps keep costs down, with 73% of leases contracted through Industrial REIT’s short-form digital “smart leases” (as the company likes to call them).

Although the company notes that the trading environment may become more difficult this year, they also believe that attractive acquisition opportunities may become available. That makes sense, as the best deals are to be found when things get tough. At that stage, companies with strong balance sheets can pounce. The company is sitting on its cash for now, with no new deals during the quarter.

In some cases, the opportunity exists to take an active asset management approach. Simply, this means buying a fixer-upper. A recent project near Edinburgh is expected to achieve a yield on cost of 17.7%. Bearing in mind that this is measured in GBP, that’s a proper yield!

Is Lewis a good barometer for consumer health?

If so, we are going to be in trouble soon

Over the past week or so, we’ve had a flurry of updates from clothing and homeware retailers. These are semi-durable goods, which means they aren’t as necessary as the bread in your shopping basket but they are also a much easier purchasing decision than a new car or TV.

With Lewis, we take a big step into the world of durable goods. To feel confident about these major purchases, consumers need to believe that everything is going to be alright. Whether they buy on cash or credit, there’s still a significant difference in the psychology behind these decisions vs. clothing or especially food.

In the nine months to December, Lewis could only increase sales by 2.0%. Inflation, higher interest rates, growing unemployment and load shedding are all major factors here, with same-store sales barely inching upwards by 0.4%.

If you dig deeper, you’ll find the really scary statistics: credit sales over the nine-month period increased by 16.8% while cash sales declined by 13.5%. That’s a worrying outlook for South African consumers. Credit sales contributed 58.3% of total sales, well up from 50.9% in the comparable period.

If that’s not enough to concern you, the trend over the period might just do it. In the three months to December, sales fell by 1.1%. Credit sales were 17.3% higher and cash sales were whacked by 20.7%, with a net sales result that is in the red.

Once other income is taken into account, total revenue was up 2.8% over the nine-month period.

The silver lining is that collection rates are strong, so those credit sales are working out for the time being. Collection rates came in at 82.7% this quarter, up from 79.7% in the comparable quarter. The trend is going in the right direction in this metric, as the nine-month collection rate is 82.0%.

Whilst it certainly helps to see collection rates improving as credit sales increase, it’s also important to remember that the collection rate is more of a lagging indicator. What really matters is whether collection rates will stay strong this year. With consumers clearly under pressure, that’s the risk that the market didn’t like, with Lewis dropping 2.3% on a trading day that was generally poor for retailers on the JSE.

The other risk lies in what could be happening to profitability, as the announcement only dealt with sales. With rampant inflation, that sales growth number doesn’t sound high enough to avoid margin compression.

Little Bites:

- Director dealings:

- The CFO of Naspers has sold shares through an option scheme worth R92.4m. That’s not a typo.

- The CEO of Sirius Real Estate has bought shares in a self-invested pension (a structure you find in the UK) to the value of £21k.

- A prescribed officer of Alexander Forbes has sold shares worth nearly R84k.

- If you are wondering what’s going on at Steinhoff, the agenda for the AGM will be published on 2 February and a circular with full details of the balance sheet restructuring will be published on the same date.

- The meeting to approve the scheme of arrangement at Alviva was approved by a strong majority of shareholders, with around 94% voting in favour of the deal that will see Alviva taken private.

- Impala Platinum has extended the longstop date for the Royal Bafokeng Platinum transaction once more. The battles continue, with Northam Platinum as the other protagonist here.

- In a sign of the times, there were two updates on SENS regarding business rescue processes. One was Rebosis, announcing an extension to the deadline to publish a business rescue plan (now 17 February 2023. The other was Basil Read, which noted that the company is currently operating steadily despite the obvious economic challenges.