Listen to the show using this podcast player:

Ian Norden, CEO of Intengo Market, returns to Ghost Stories to talk about the sector of the market that he is passionate about: listed and private credit.

Corporate credit (or “debt” from the company perspective) is a key source of funding for companies and can drive higher returns for equity investors if used properly. For investors in these credit instruments, optimising yield and risk are key.

But as we observe a world of shrinking public issuance and growing demand for yield, will private credit be able to address this imbalance and fill the gap?

Intengo sits at the coalface of this industry, building the data and workflow systems that allow private credit markets to scale responsibly, transparently and efficiently. They are playing the crucial role of building sonar in a market where you’ll find private credit sitting below the surface.

Key themes covered:

- What private credit growth signals about economic growth

- Private credit vs listed credit — and why the distinction matters

- Why credit markets are buy-and-hold by design

- Supply–demand imbalances in South African debt markets

- The rise of hedge funds and alternative assets

- Data, complexity, and the future of private credit infrastructure

Debt arrangers, advisors, treasurers, CFOs and debt investors who want to learn more about Intengo Market can visit the website here.

Full transcript:

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast. Nice and early in 2026. It’s a new year. There’s a lot going on out there in not just equity markets, but also debt / credit markets (we’ll debate that now, Ian). It’s good to understand some of these trends.

Of course, to do that today, I get to chat to Ian Norden. He is the CEO at Intengo Market. We’ve heard from Ian before, in Ghost Mail. He’s written some really good articles and I really suggest that you go and check that out.

Ian, it’s good to have you back on. I’m looking forward to chatting to you today because we’re going to be discussing what I refer to as ‘private debt markets’, but as you quite correctly refer to as ‘private credit markets’.

I guess it’s because I have this equity/business-owner lens where I’m like, “Well, I need to borrow money – it’s debt.” And you (of course, often working with investors and institutional investors) have that lens of deploying capital into credit. That was a fun thing that came through, when we were prepping for the show.

Welcome, and I’m certainly looking forward to getting all these insights from you.

Ian Norden: Yeah, thanks, Ghost. Good to chat to you again. Is it sad that we find that fun? Or is it just that we’re in the right place?

The Finance Ghost: We’re in the right place, exactly. No one is here to listen to us talk about holidays. But we won’t be doing any of that. We’ll be talking about credit markets, and of course, a lot of the work that you do will come through in that.

This is really interesting: I think one of the first pieces that we did together (in Ghost Mail or from your side) was around debt just being the other side of the coin – because again, the average listener, etcetera, is very much coming at this from an equity lens. They understand the debts on the balance sheet (or credit from your perspective), they don’t necessarily understand how that market works.

One of the things that came through in some of the previous pieces that you’ve put forward is that your assumption – and this is again coming from equities – is that when you have listed instruments, there’s lots of liquidity. But actually, when it comes to credit markets, those listed instruments – those bonds, etcetera – are not necessarily all that liquid. These markets don’t see as much churn as you might see in equities, for example.

This is of course a really interesting thing to discuss just now, the differences of private credit versus listed credit.

But before we get to that, maybe just give us a quick recap on why the listed market doesn’t actually see the kind of churn and liquidity that we’re so used to seeing in equities?

Ian Norden: Yeah, it’s good to start there, as you say, as a quick recap.

I think what’s maybe not obvious to the South African market is that the illiquidity is actually not a symptom, it’s a feature. Institutions have almost set the credit market up to be low volatility, low churn as a counterweight to the higher liquidity and equities.

So, over time it’s almost become self-fulfilled, where you don’t want your portfolio to churn as an asset manager. Especially if you’ve got, in our market, a lot of life insurers, a lot of clients or investors, looking for long-term duration. They want to have something that just sits in their fund.

I think that’s a good place to start. We mustn’t see it as a problem. We must see it as something that actually helps our market create that diversified risk. And certainly, the lower correlation and the low volatility is a feature.

If you then say, “Well, what are the dynamics of the market?” As you said, as a bit of a recap, we’ve touched on this buy-to-hold investor base. The market is primary market-dominated. We get a lot more of our insights, especially as a provider at Intengo, trying to price and help price discovery. 95% of our stats are coming from primary market issuance. I think we’ve touched on before in previous articles how we do that in a unique way, to really squeeze all the life out of that dataset, but that’s still the primary source of data. And I think that’s where we’re seeing it stay, so we’re not seeing that change.

The Finance Ghost: And Ian, maybe just to expand on that concept, because people might not necessarily understand primary versus secondary markets.

Primary market is an issuer issuing debt instruments (dare I say it, ‘credit’ for the other people on the other side of the coin) for the first time. And the secondary market is trading amongst institutional investors who are buying up these instruments, right?

Ian Norden: 100%. So as a father of young children, you buy a car seat from Baby City – that’s the primary market. Your child outgrows that, you put that on Facebook Marketplace – that’s the secondary market.

The Finance Ghost: Good analogy.

Ian Norden: The secondary market didn’t create the baby seats, but you can still get a price for it. And you can still get liquidity.

The Finance Ghost: Yeah, that’s a really good analogy. And that buy-and-hold investor base, of course, is the problem. That’s why there isn’t as much data coming through the secondary market, right? Because there’s just less happening in the secondary market versus issuers coming to market and saying, “Hey, we want to raise debt,” and having this beautiful landing in this lovely deep capital pool.

Because that of course is a big motivation here, right? That there is actually a lot of money out there to flow into these instruments that companies then tap into to use to grow. The property sector, one of the big users, but by no means the only one.

Ian Norden: Spot on. We are seeing so much cash in the system and there’ve been a lot of systemic things that have happened. The shift at a policy level up to a surplus in our financial ecosystem, where there’s more money at the end of every day than there used to be. That’s one factor.

I think the other factor is there are just fewer and fewer listed credit instruments. So, obviously the SA government market is often referred to as ‘fixed income’ generically, and credit is more of your corporates and maybe sometimes your banks issuing.

We’ve seen 25 issuers. Now, there are hundreds of companies in the market, listed and unlisted, a couple hundred of listed companies. There are 25 issuers of listed debt. 19 regular issuers.

So, you’ve got all this cash looking for that low correlation that we touched on, looking for long duration, and you’ve got a shrinking set of assets to buy. When you have a primary market auction again, there’s just this rush for the asset.

Standard Bank has just issued the first FLAC instrument, which is a new concept in our market. It started this year. It stands for Financial Loss Absorbing Capacity and it’s really designed to be another layer in the bank’s capital stack.

By design, it should price quite a bit higher – and it was expected to price quite a bit higher – than Tier 1 bank paper. Looking at the guidance versus what cleared recently, the levels were just staggeringly low in my opinion. I think it’s just validating the over-demand of funding relative to the supply.

The Finance Ghost: Yeah, and it’s amazing because you’d think there would be more and more issuers actually running to get into this pool.

That sounds to me like a big supply-demand imbalance, where there’s lots of money and there would be great reward for more issuers to go and issue paper bonds, those domestic medium-term note programmes, all that kind of stuff.

But actually where we’re seeing so much of the growth (and what we’ll talk about just now) is in the private market. So, it’s just interesting – it seems like a bit of a mismatch.

One other thing I do want to touch on though. You mentioned Standard Bank. One of the other reasons why there isn’t as much churn out there in the secondary market is also just because of regulation.

Banks are super highly regulated and they’re not necessarily able to just churn risk like they used to on behalf of investors, on behalf of themselves. That’s kind of taken a really big participant out of the market, to some extent.

Ian Norden: Yeah, that’s a good point. Banks have always tried their best to provide churn and a lot of the banks’ credit desks are there to really help the market. We touched on before that there are only four of them (if not three very active ones).

So, you’ve still got a big mismatch in the number of players on each side of the deal. But as you correctly say, Regs have changed to the point that banks now actually have to sell more risk than they initially wanted to, and they can’t buy it back.

Previously, they could sell and replace. Now, there are a lot of strategies out there around what they call ‘asset velocity’, which is essentially the concept of increasing the speed of the assets on your balance sheet, if nothing else.

Banks can do deals but then sometimes need to sell that risk, so you’ve got even more people selling and there are people buying in certain instances, or vice versa. It also creates a funding gap after three years.

So let’s say post-three year funding, anything longer than three years, banks are becoming more and more constrained. That’s also creating a gap for things like private credit to step into.

And I think, to your comment earlier, it is happening. It’s just that we’re not seeing it historically. There are lots of private credit funds – I won’t name asset managers, but some of them have had credit funds since the early 2000s.

Now what’s happening is I think more of the market is catching up. They estimate $2.5 trillion of private credit opportunities globally, growing to $3 trillion. So, it’s out there. And I think what’s happening is there’s just more awareness than ever before.

And when you couple it with all these dynamics of less supply in the traditional spaces like the listed markets, people are saying, “Right, how do we get into this opportunity? How do we invest? How do we find the instruments?”

And those aren’t the people who’ve been doing it for 20 years. These are now almost mainstream institutional funds that have to change strategy to survive.

The Finance Ghost: Because another interesting lens on this is (and this is why private equity exists the way it does) it’s very different to investing in listed equities, because private equity professionals are really good at understanding the intricacies of that company, and then structuring a deal on top of it that is bespoke in every single way.

It has lots of different funding pieces. They usually use mezzanine instruments. For listeners who aren’t familiar with mezzanine, that basically sits on a spectrum between equity and debt, but anywhere on that spectrum – some mezz instruments are close to equity, some are close to debt.

And private equity investors use this all the time, so there’s a lot of complexity in the private market around structuring. And what’s interesting, I think, with debt and with bonds and with all of this kind of stuff (and this is something that you’ve raised before), is every instrument is essentially unique.

It’s not like equities, where if you look on the JSE and you’re looking at buying shares, yes, you’ve got to do the work on the underlying company; you’ve got to understand what you’re buying. But once you’ve done that, you understand what an ordinary share is.

You know, it gives you a right to vote, it gives you a right to dividends, etcetera, etcetera. You don’t need to try and typically dig in and understand exactly what the story is with that share.

Whereas in debt land, that’s not true. They’re all unique. And that almost lends itself quite well to private markets, because you’ve got to do the work anyway to actually understand this stuff in huge detail.

Ian Norden: Yeah, that’s a good point if you think about it that way. As you say, equities are fungible, essentially a share – even in a private equity model, once you set up the equity structure, even if it’s a convertible or mezz or anything, it then becomes pretty homogenous.

Now debt, as you say, whether it’s listed or unlisted, it’s going to be nuanced. You’ve got to say, “Well, is it FLAC? Is it subordinated? Is it securitised?” And that can happen issuance by issuance.

In the listed space, you might have a listed program that has flexibility. So, today you’re issuing a three-year or a three-month note and next week the same issuer is issuing a seven-year note secured by something that’s a fundamentally different analysis.

Whereas equity is equity, the term is always, I guess, infinity. All going well for the company, but debt is not. So if you’ve got this level of analysis already shifting to private credit, this then just becomes a question of, “Okay, can I trust the data and can I get the data?” Well, other way around, “Can I get the data and then can I trust it?”

And I think that’s where certainly we see the gap in terms of saying, “Okay, let us try and shine that light.” Because private credit isn’t a niche anymore. It’s actually where our real economy is getting funded. And that’s across the top 40s, all the way down. There are a lot of private credit deals happening.

We’ve touched before on the difference in the concept, where people might think private credit means super high yield. It just means ‘not a listed instrument’ for all intents and purposes.

So, we have to take note of this and we have to say, “Well, what can we do for that data to be credible?” So that if ultimately your pension is going into a fund that’s buying private credit, that fund is not taking excessive risk because of data opaqueness.

The Finance Ghost: What’s interesting again with an equity lens is there’s been this big uptick in just the use of private markets. Far more companies will change hands over and over again in the private space versus maybe the traditional approach, which is a founder builds a thing up, it IPOs, they exit over time, and away they go.

There’s so much regulatory burden around that stuff now. And it’s also really, really difficult for a founder to actually meaningfully exit in that way. I’ll use one example, which is Karooooo (with all the Os).

The founder, Zak Calisto, was looking to sell shares last year. It’s a big number – he wants to take money off the table. And of course the market response is, “Oh no, the company must be broken. The founder is selling.”

No, the founder actually just wants to take some money off the table. This is a very normal thing to do. It’s actually a pretty rational thing to do. And in the private market you can do that because you’re not going to have a whole bunch of people then saying, “Oh, there’s something broken with this company,” or whatever the case may be.

So, more and more founders are attracted to private markets. And I guess you’re seeing that now for different reasons in the debt space because for issuers, they would not be using private markets if they couldn’t get good pricing.

If the pricing was so much better on public markets, they would go through the pain, right? They would go through the process of actually listing bond programmes and doing all that work.

Presumably (and this is where you’ll have the data on this and you’ll have the insights), in private credit, these issuers can actually achieve pricing that is attractive enough that they look at it and say, “Well, the juice is just not worth the squeeze to go and be a listed issuer instead.”

Is that the underlying, core thing that’s really going on here? And then obviously, because there’s a lot of money floating around looking for a home, these investors are almost forced to accept private credit as an asset class because there isn’t enough public credit for the money.

Ian Norden: So I think the last point is going backwards. I wouldn’t say they have to accept anything. They have sophisticated credit teams and they really apply a strong duty of care to their clients’ funds. So, maybe they just disclaim that on behalf of all asset managers out there…

The Finance Ghost: But I guess the point is alternatives, right? The point is where else does the money go to look for yield?

Ian Norden: 100%.

The Finance Ghost: You can only do so many renewable assets and that kind of thing, so it’s difficult. It’s lots of money in a small pond, and lots of regulation, right?

Ian Norden: No, I fully agree. And the theme is right, I was just adding that layer for the listener worried that the guys are just throwing darts and hoping to hit something!

The Finance Ghost: Absolutely. Luckily we have a better system than that around here!

Ian Norden: Yeah.

The Finance Ghost: South Africa is very good with this.

Ian Norden: Let’s look at hedge funds. ‘Hedge funds’ is a new class. They want to be paid for complexity – they want to take risks but be rewarded for doing a bit of a deeper dive.

There, they want to come in and structure something bespoke. They want to invest in something that’s not vanilla. So, they’re not going to say, ever, “Buy listed credit.” It’s just not where they’re going to generate alpha.

We can talk a little bit more about hedge funds. It’s just bringing more cash to the system. But the reason I’m mentioning them is, they go where complexity lives, and private credit is complexity on steroids, most times.

They’re like, “Well, if I’m doing this work, let me get paid extra for the work. Let me get that premium for the work. Now, I don’t necessarily want to share that, so I don’t want that to be on a public exchange so others can then benefit from the structure I put in place.”

So you’ve often got demand-led investing, where the investors coming with a proposal are saying, “I’ll lend this to you.” There’s one example where the client wasn’t even necessarily looking for cash, and a proposal came to them through a reverse inquiry mechanism.

That’s probably your mid-cap, or your client, or even your smaller company, that’s going to generate real spreads and alpha for that fund.

Let’s go right to the top: listed companies. In my, let’s say ‘limited’ career starting in structured finance, often working with trusts as clients, the Regs used to talk that instruments must be listed.

Now, if you go look at CISCA (Collective Investment Schemes Control Act) Board Notice 90, or I think even Reg 28 (the Pension Funds Act Regulation 28), they talk more about instruments coming from listed issuers.

That’s because it’s actually far more onerous to be a listed issuer. Your equity due diligence and hoops and steps you’ve got to go through and reporting obligations are much more onerous in the equity space.

What the Reg said was, “Well, let’s adapt to that. Let’s say if you’re already getting the Rolls-Royce of market oversight, having a listed instrument from that same company becomes a bit superfluous.”

With that, you opened up the opportunity for investors to say, “Right. I can now reverse-inquire to Shoprite because it’s listed, so I don’t need them to go through the hoops.”

And then, the company started noticing that. Shoprite issues a lot of commercial paper, it’s unlisted and it’s got huge demand for it. And in theory, that’s an element of private credit – because it’s not public.

So I think you’ve got to look at the regulatory landscape. You’ve got to look at the investor universe. It’s all obviously a complex ecosystem, and then everything in the middle that we haven’t touched on sort of falls to one or the other.

The very large funds do have mandate to buy things that aren’t listed instruments or from listed issuers. As funds grow (and we’ve got some very large funds out there now), that 5% or 10% allocation becomes bigger and bigger.

The Finance Ghost: Feels like life just gets harder for the traditional banking models every year, essentially. They’re up against more and more pools of capital all the time.

So Shoprite – perfect example. They want to go and issue debt instruments. They want to go get private credit, they need to go and get money. Historically, they might have spoken to their primary bankers and said, “Well, we need this loan facility, etcetera.”

And they certainly still do that, because they like to spread their risk. But now, they can also go and issue paper to life insurers and institutional investors – and seemingly now hedge funds!

I’m not sure hedge funds would buy Shoprite paper because they can’t get paid for the complexity, as you say. But if hedge funds are now coming in and trying to get a piece of the action as well, presumably over time, that just drives the pricing on private credit down until there are no more new pools of capital trying to fight for it. Right?

It’s the supply and demand points. It gets to the stage where the super profits have been made and now it’s just a market in equilibrium. And that’s to the benefit (over time, I would imagine) of issuers, because pricing just feels like it’s going to get more and more competitive, which is good for the companies looking to raise.

And so more companies come and raise, and therefore there are more people trying to put money in. It’s a beautiful thing, right? I mean, this is a market. It’s a market like any other.

People just forget that. They think ‘market’ and they think ‘equity’, but actually out there, all the time, there are markets in everything. There’s a market for second-hand baby chairs, to use your analogy.

This happens to just be the market for private credit. And it’s changing, literally, all the time. It’s got a whole lot of different elements to it that go far beyond just pricing. It’s covenants, it’s that whole story. And that, of course, is a big part of where Intengo plays.

So, maybe to just help listeners understand a little bit more about your involvement in this, maybe they haven’t been exposed to it before, let’s maybe talk a little bit about how these workflow challenges in private credit, how these complexities actually translate into what you are doing, day in and day out, at Intengo Market.

Ian Norden: Thanks Ghost. I’ve got Ecos 1, so when you start talking about supply and demand intersecting, I’m trying to have big flashbacks to if I paid attention…

The Finance Ghost: Some PTSD.

Ian Norden: Yeah, PTSD mainly. But I do also think a big part of that, if I can recall some economics, is growth.

We can have all the money in the world, but if Shoprite’s not buying new stores, that also gets to the point where Shoprite will hit a ceiling for how much cash they need for operational expenditure (opex).

So, you really want to see capital expenditure (capex). You want to see long-term projects underway. And I think obviously renewable feeds that beast quite nicely, because they generally are big projects.

But I think that’s what we miss in SA. Seeing the Pick n Pays, the Shoprites, rolling out new stores. That’ll just help the whole problem because, as you said, it’s a market that relies on many factors.

So, what’s Intengo doing? Well, obviously, we don’t lend. We’re a market workflow system. I think our evolution is a quick evolution, because I think back to the first podcast we did a few months ago and it wasn’t even on our radar as something really needed by the market.

What we do now is we actually offer what we call our ‘debt concierge’ – because we sell it to corporates, so we call it debt, not credit – and we help corporates manage the complexity.

So, if you do get a complex deal, how do we help you now track those covenants? How do we give data rooms for you to use, under NDA or not, for your investor universe to access securely?

We’ve looked at it and said, “Right, what can our role be in a world that’s becoming more complex?”

If public credit is the tip of the iceberg and sits on top of the water, and private credit can be likened to everything below in the iceberg, then Intengo is essentially trying to build sonar for the market.

That’s where we see our gap. And if there’s a future where there’s no public credit at all, then you’re going to need that sonar to work accurately, to trust the information you’re getting.

And I think I’ve used that word earlier, we want to shine that light on the data. We don’t necessarily want to share the data with everyone, but if it is your data that you want to process, we will help you understand it.

We’ll put it in an easy-to-process format, for both sides, and we can do things like covenant tracking and early warning systems – for both parties. No one wants to go into business rescue or breach a covenant, so that’s where we’re taking our business.

And obviously, underpinning all of that is this massive data engine we’ve built, on the primary market data, for one. And now, as we do more private credit deals and we offer these debt services to corporates, we’re building a very powerful private credit database.

Even the largest of all data aggregates out there aren’t even accessing private credit data in that way. Sometimes, these guys are coming to us, saying, “In South Africa, what do you have? Can we buy from you?”

It’s clearly a systemic problem if these big global data aggregators don’t have access to the information. So, we think that can be our role as a neutral.

To really help the market (as far as possible, protecting confidentiality and all of that), to just help everyone benefit by sharing the knowledge we have.

The Finance Ghost: It’s why it puts you in such a cool position, to actually see these trends playing out and to actually see it coming through in the data. You’re literally right at the coalface of this stuff.

I have to do it the hard way, per se (you, of course, are really doing it the hard way), when I’m reading earnings transcripts and that kind of thing and then picking up these little nuggets to try and figure out what’s going on out there. Case in point, I recently read the results of two of the biggest names on Wall Street, both of which I have in my portfolio. There were many things that obviously came out in those transcripts that are interesting, but there are two that I think are very relevant to this conversation.

The one is that prime broking businesses seem to be doing well, which means hedge funds are very active. You’ve already spoken to how hedge funds are out there looking to get paid for risk.

They’re looking for that everywhere, and private credit seems to be one of the areas where they’re doing it (and we’ll get into that in some more detail because I’m keen to unpack more about that hedge fund point with you; I think it’s really interesting).

And then the second one, which is more just an observation, is there is immense growth in what gets, these days, formally referred to as ‘alternative assets’ – which is then this umbrella term where you can pretty much package just about anything.

It makes me laugh. It’s like the Industrials Index on the JSE. It’s like they didn’t know where else to put this stuff, so it goes in there. But private credit is often included in alternative assets, from what I’ve seen. And there’s huge growth in that space.

A lot of it then flows into, as you say, things like renewables. There’s demand for stuff like ESG layers on top of that, and sustainability linked metrics. That’s always kind of interesting to look at.

So, there’s a lot of growth here and hedge funds are very good at finding growth. This is what gets them out of bed every day.

Let’s unpack more about that hedge fund point and understand, aside from just the complexity premium that they’re looking for, what some of the other thoughts are and what you’ve seen around hedge funds that’s quite interesting.

Ian Norden: Yeah. So hedge funds, as we’ve talked about earlier in this chat, is an industry that’s, I think, traditionally equity focused. They often pride themselves on equity as a way to differentiate.

I actually finished reading The Man Who Solved The Market over the holidays. For anyone who hasn’t read that, that’s an interesting read about how you can really create a hedge fund of power using data. Very good.

Not that this is a book show, but I think, for the listener who has some spare time, read that book.

The Finance Ghost: The number of listeners to this podcast who love reading – I think you’ll find there’s a very strong overlap.

Ian Norden: [laughing] Yeah, so there’s a good light read with some analytical insights.

So, hedge funds. Now they’re coming and saying, “Right, how do I differentiate?”

The markets are becoming more efficient. Private equity is becoming… I wouldn’t say mainstream, but there are a lot of tech platforms globally that now increase the transparency in private equity. We see this gap to be the infrastructure layer for private credit and to shine the light on the datasets.

So, again, understanding risk and taking risk should still be able to rely on quality data. And I know I keep saying “data, data, data” like a broken record, but you can’t make a good decision with the wrong information.

If we look at AI as a theme, the future in AI is being a provider of credible information to the model, so that the AI can talk to credible facts.

Go and Google ‘AI hallucinations’, for example, and you’ll see how AI is making up fictitious court cases or referencing the wrong books and getting global companies in trouble.

The Finance Ghost: Yeah, we’ve all experienced some version of that, right? If AI hasn’t lied to you yet, it’s because you haven’t been trying AI.

Ian Norden: Exactly. And so our AI overlay is over our private dataset – data that we’ve collected, that we anonymise and protect information for. But if it’s your clients, we can give you the full view.

So, a hedge fund could come to us and say, “Here are my clients. Here are their financials. Put them in the machine.” We can then set all of that transparency infrastructure and process, and that hedge fund (or any investor in the hedge-fund space) can have a much clearer understanding of what they’re buying, and they can focus on the structure.

As we said, they want to get paid for complexity. So, set up the waterfalls. Set up the covenants; all the bells and whistles that create that yield. Do that, but spend your time doing that, not seeking out data and trying to figure out if it’s clean or not.

And then, before we move on from this theme, hedge funds also want the concept of liquidity. As you’ve said, that founder wants to sell some shares. Hedge funds are all about exit. You don’t make any money unless you sell.

So if you’re going to go into private equity… Okay, you’ve got some risk. But there’s probably a VC fund or something else up the chain that will buy it from you. Well, it’s more the other way around, but you could always list an IPO.

In private credits, a lot of the barrier to entry is the hedges saying, “Well, how do I ever get out of this like that?”

We’ve talked about how our market is buy-to-hold. I don’t want to do a 10-year mezz structure into some company that I don’t necessarily want to be investing in for that full duration.

What do I do?

So, Intengo’s offering a secondary market. Whether it’s liquid or not, it’s still a means to sell. And that’s important. Liquidity and tradability are different, and we create tradability. It doesn’t mean it’s automatically liquid, but you do have a way to get out.

The Finance Ghost: Yeah, absolutely. And the biggest appeal there for hedge funds is really just these things pay you a yield that is then unrelated to exactly what’s going on in equity markets.

Of course, that’s a big appeal for hedge funds. For most of them, the way they get paid is for absolute returns, to kind of say, “Above a certain percentage return, this is what we make.”

And that means that if they can lock in a strong yield on some private credit that hits that hurdle and gives them a nice underpin to their portfolio, then they’ll do it. They’ll always look for those opportunities because they’re chasing (you mentioned it earlier) alpha, which tends to be the return over and above the market return for them.

It’s even more interesting because they’re generally not benchmarking against any kind of equity index. It obviously depends on the hedge fund – some of them do; a lot of them don’t. They go with just, “This is the hurdle that we need to get above and away we go.”

Private credit can be very interesting for them, so I’m not surprised to see more and more activity in that space.

I think let’s start to bring it home, then, by just talking about what actually needs to happen in the market for this thing to just keep growing and for it to get to where you really believe it can get.

Again, you’ve got this great coalface-type view on this thing. You’re building the tools that are facilitating more investment in the space and allowing more issues to come to market and understanding pricing and that data, which is super valuable without a doubt.

As we understand some of the key challenges in this space, maybe the last few minutes on this one, let’s just understand from you: what do you think the big challenges really are, how can you respond to them at Intengo, and how can the market respond and actually just grow this area?

I think you made a really good point earlier, which is that growth in private credit means growth in the economy. It’s a retailer borrowing money to go and open stores. It’s a company borrowing money to expand.

People don’t go and raise debt unless they’re expanding. It’s not something you just wake up in the morning and do for no real reason. So, it’s very important. It really is.

Ian Norden: Yes. I think SA Inc. (or SA in general) is at an inflection point where the infrastructure needs to catch up now. We’ve had private credit happen – it’s been happening; it’s not a new concept – but now it’s becoming more in the press, in themes, on podcasts, as discussion items. So, infrastructure now needs to catch up.

And to think, 20 years ago, public markets were probably also showing fragmented workflows, inconsistent data, very little transparency. Now, you’ve got digitised exchanges. There’s a lot more access to information. Everyone’s got a website where you can see an investor room.

Private credit is probably just there, and catching up. There’s probably a future where private/public becomes irrelevant. It becomes a question of structured or unstructured yield. More yield or less yield.

And I think, circling back, the regulatory costs have always been high. There’s always been this assumption that I must list to get access to capital. We’re certainly seeing that change, and investors are proving that that’s not the case.

And we haven’t even touched on multinationals. You can now fund in euros and do cross-currency swaps and fund their czar books with offshore cash. It’s just global capital.

All around the world, you’ve got dollars down. People are looking for emerging markets this year. I personally think the emerging market bonds are going to have a good year, but who knows? Don’t quote me on that.

But at the end of the day, we at Intengo see a role to just grease the wheels, provide the infrastructure, deeply integrate into the system.

We work very closely with people like Strate (who I think we’ve touched on before), who are an important part of our economy that people don’t even know the name of on the street. We work closely with them.

We work with all the banks. If banks are looking to ship risk, as we’ve talked about, Basel 3 Regs and other Regs needing them to sell, how do they sell? Well, we’re here for you in that way.

Plus, we connect to 90-plus asset managers now. So, we just see ourselves as the middle of that wheel, with all the spokes going out.

And we’re (as you’ve said a few times) at the coalface. We’re very privileged. We get to design new products on a daily basis to serve the market.

That includes government T-bill (Treasury Bill) trading. We trade T-bills all the time. That stimulates liquidity in different ways. So, very privileged position at Intengo. It’s very exciting.

We’re certainly not looking to IPO ourselves. We’ve got a long journey ahead (if you’re a private equity investor in us), but yeah, we look forward to what’s happening for SA. And it’s certainly happening fast. That’s definitely the most exciting part.

The Finance Ghost: No, it is. And it’s fantastic. I think we’re in a very exciting market. So, you’re in an exciting space in an exciting market where a lot is happening. Lots of focus on emerging markets at the moment.

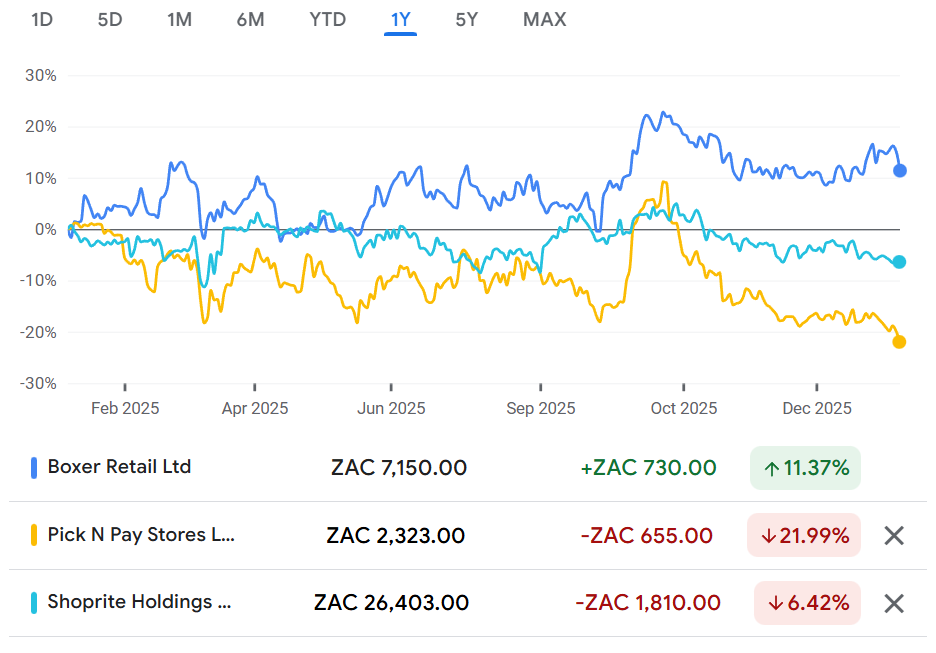

I think South Africa’s positioning is pretty interesting. You just have to look at what happened on our equity market last year – a lot of which was gold, sure, but it’s going to all filter through.

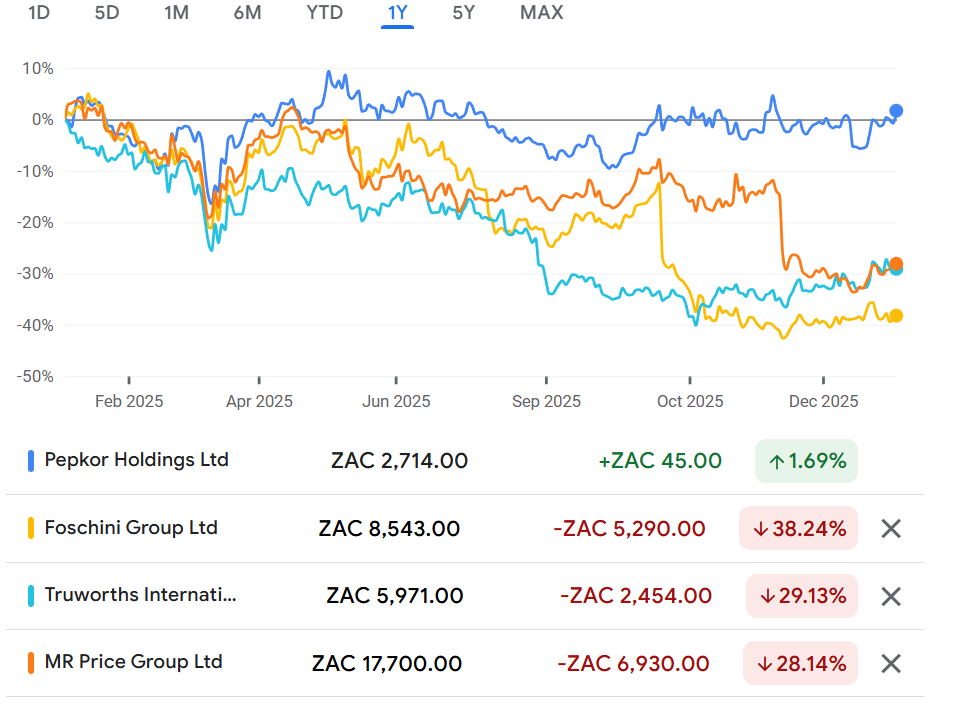

And there are some good signs. Some tough signs, too, if you have a look at South African retail. But of course, that’s investing. You’ve got to try and figure out where the good stuff is and where the bad stuff is.

It’s no different, really, in private credit. You’ve just also got to figure out how the instruments work, on top. And that, of course, creates the opportunity for you to do what you do.

So Ian, thank you. This has been another really insightful chat. I’ve been loving the insights you’ve been bringing into credit markets to the Ghost Mail audience.

And to listeners, who will vary from corporate treasurers right down to people who might be considering a career in this space, I would encourage them to reach out to you on LinkedIn if they want to chat and learn more about Intengo.

Ian Norden: For sure, yeah. I’m very active on LinkedIn if people want to reach out and connect, or through our website – we also have contact forms. But I’m happy to meet new people and share what we know.

The Finance Ghost: Fantastic. I’ll include that in the show notes. Ian, thank you so much, and I do hope to do another one of these with you. Wishing you the very best for 2026.

You’re a busy man. You guys are doing a lot on that side. It’s all very exciting, and no doubt it’ll go from strength to strength. Thank you.

Ian Norden: Thanks, Ghost. And likewise to you – may it be a good year.