Another bolt-on deal for Datatec (JSE: DTC)

Cybersecurity is an attractive space for deals

Datatec continues to increase its international footprint through bolt-on acquisitions that add to the business without creating significant risk. This is a clever and effective way to grow, although it does take longer. This is the benefit of investing alongside a founder CEO, rather than a “manager” CEO trying to move the dial and maximise earnings during a term of only a few years.

The latest deal is an acquisition by Logicalis US of Maple Woods Enterprises, a long-term cybersecurity partner of Logicalis US. The Maple Woods Overwatch offering is built for the US defence industry, so it’s clearly robust.

Cybersecurity is a priority area for the group, so I expect to see more deals like this in future.

Glencore does a deal with Orion for its DRC assets – but no, it’s not that Orion (JSE: GLN)

Orion Critical Mineral Consortium is a US-based entity

Glencore announced that Orion Critical Mineral Consortium will look to acquire a 40% stake in Glencore’s interests in the DRC assets. The implied combined enterprise value of the assets is around $9 billion, so this is a large transaction.

Orion Critical Mineral Consortium is focused on securing critical minerals (as the name suggests) for the US and its partners. This consortium was only established in October 2025, so this is firmly a Trump-era initiative. In this case, the minerals in question are copper and cobalt.

Encouragingly for the DRC and the people near the mines, Glencore will look for opportunities to expand and develop these mines. They will also be open to additional critical mineral projects and assets in the DRC alongside their new partner. There’s certainly no shortage of capital in the US, so being able to tap into the world’s deepest capital pool is helpful.

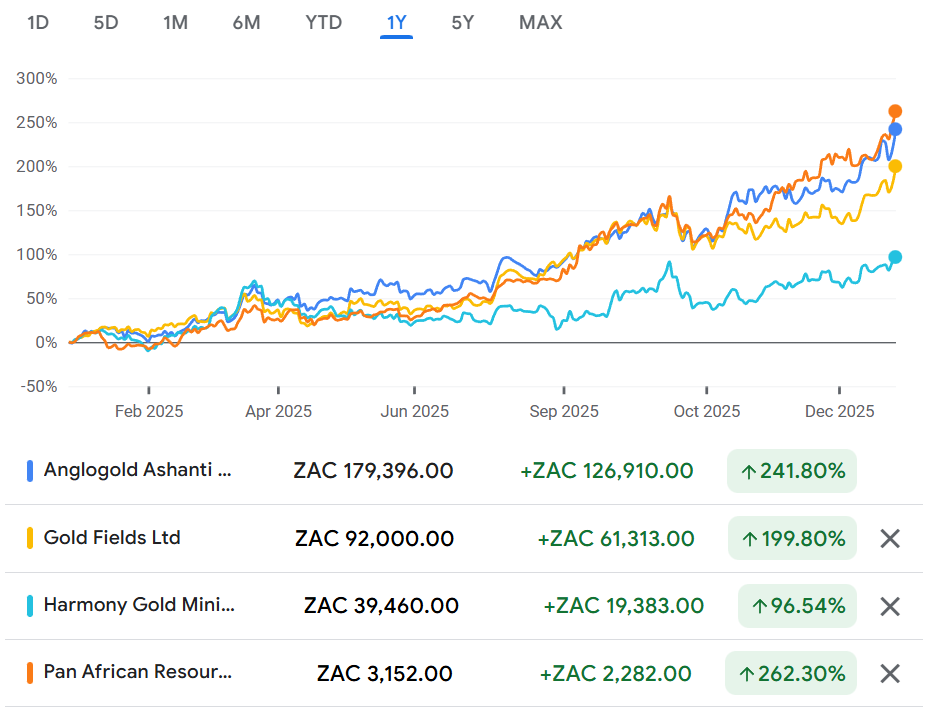

Harmony Gold had a wobbly, but they believe they can still achieve guidance (JSE: HAR)

Here’s another reminder that the commodity price is only half the battle won

The other half, of course, is getting the stuff out of the ground. For the six months to December 2025, Harmony Gold had some challenges in doing that.

A mill motor failure and a deferment of the final gold shipment at Hidden Valley to January 2026 will impact the interim numbers, but should be fine on a full-year basis. Other issues included disappointing recovered grades and an industry-wide cyanide shortage in South Africa.

Despite this, the company hopes to meet full-year production guidance and achieve the planned all-in sustaining cost.

The CSA copper operation in Australia is being integrated into the group after the recent acquisition, while the Eva Copper Project has an appointed EPC contractor that is expected to be on site during the March 2026 quarter.

Hyprop confirms the retail trend that we can all see: a shift from December to Black Friday (JSE: HYP)

South Africans love a deal even more than they love decorated trees

Hyprop released an update for the six months to December. We’ve seen in retailer commentary that sales growth in November seems to be stronger than December. The words “record Black Friday” have come up at various retailers. Hyprop has confirmed this trend, noting a pull-forward of sales from December to November.

This is of course great news for online adoption, as I would wager that Black Friday sales have higher online penetration rates than Christmas shopping when people are on holiday. In an omnichannel environment where orders are fulfilled from stores, my understanding is that Hyprop and other landlords still get a slice of that action.

In the South African portfolio, tenant turnover increased 5.6% in November and only 4% in December, so the trend is clearly visible there. Foot count is even more interesting, up 3.6% in November and thus similar to October at 3.5%. But December was only up 0.8%, supporting my thesis that a shift from Christmas to Black Friday will simply pull a portion of foot count out of the system forever. People aren’t going to the shops as often as they used to.

For the six months, tenant turnover was up 5% and trading density improved by 7.5%. These are decent metrics, particularly in a lower inflation environment.

In Eastern Europe, online adoption is even more obvious. Foot count has declined in every single month in the period, down by 3% overall. Tenant turnover was up 3.8% and trading density climbed 3.6%.

I’m fascinated by the concept of grocery stores as anchor tenants and how things just aren’t what they used to be in terms of these stores attracting people to the malls. It feels like it’s only going to get worse, not better.

Impala Platinum’s profits go to the moon (JSE: IMP)

This is what happens when commodity prices increase sharply

Impala Platinum has released a trading statement for the six months to December 2025. As you might expect, the numbers are incredible.

HEPS is expected to increase by between 392% and 411%, coming in at between R10.15 and R10.54 per share. Although these are interim numbers, annualising is a dangerous game in this sector because things can change so quickly. The share price trading at around R304 shows you how much is baked into this story in the market.

377 jobs on the line at Mpact’s Springs Mill (JSE: MPT)

The rand doesn’t help, but neither do hostile policies in South Africa towards employees and businesses

A weak rand has historically propped up local industrial companies who have managed to compete locally and globally despite the substantial inefficiencies that come with manufacturing in South Africa. We really don’t make it easy down here, with issues ranging from labour laws through to energy availability and costs.

With the rand now strengthening (and the SARB absolutely obsessed with avoiding any rate cuts), our manufacturers are coming under pressure. It’s a two-pronged issue, with exports becoming less lucrative and imported alternatives becoming cheaper.

Mpact is one of the first public examples of this issue playing out, but there will be others.

Mpact’s Springs Mill is the only domestic producer of cartonboard, competing directly with imports that have found a home in South Africa in an environment of overcapacity in the global cartonboard market. The largest customers of the mill can import cartonboard at prices that are 20% lower than the cost of local production. You can guess where this is going.

When you consider that operating profit for the year ended December 2024 was just R32 million based on revenue of R1.74 billion, you can see that there was no room to absorb this pricing pressure.

With the largest remaining customer notifying Mpact that they will be importing going forwards and no longer procuring from Springs Mill, the show is over for that facility. Production will run until the end of March, at which point 377 people are likely to lose their jobs.

Of course, in a vibrant economy, there should be 377 new jobs waiting for these people at companies that can flourish in a stronger rand environment. Alas, this isn’t a vibrant economy.

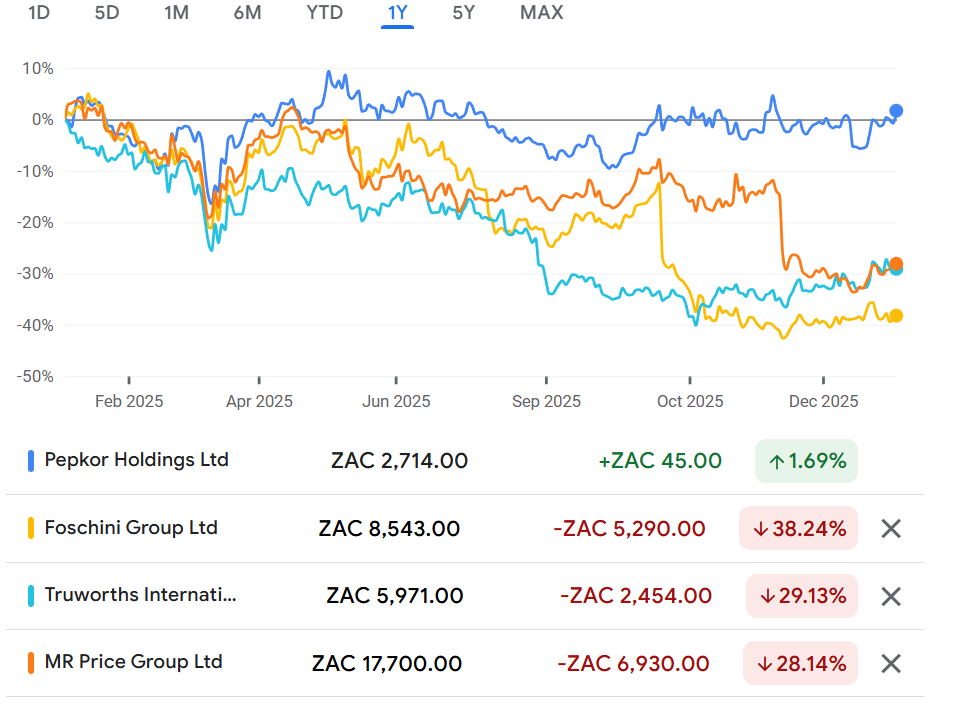

Hold on to your seats: the TFG bloodbath isn’t over (JSE: TFG)

The Foschini Group’s offshore results are going from bad to worse

The Foschini Group (TFG) is having a really tough time at the moment. It looks even worse in the context of 2025’s Capital Markets Day. Analysts felt that the targets shared that day were spicy to say the least, but I don’t think anyone expected this level of underperformance. I’m becoming concerned that TFG and Pick n Pay (JSE: PIK) might be in the same WhatsApp group.

TFG has released a trading update for the quarter and nine months ended 27 December 2025. There’s a lot of detail to unpack, but the overall theme is that TFG Africa is losing ground and the offshore businesses barely know where the ground is anymore.

Group sales increased 2.9% for the quarter, which is much lower than the 7.5% year-to-date growth. One of the reasons is that TFG Africa grew 3.5% for the quarter vs. 4.2% year-to-date, a noticeable slowdown. Another big reason is that White Stuff, part of TFG London, was acquired in October 2024 and was thus in the base for Q3. This is why TFG London was only up 6.5% for the quarter vs. 37.2% year-to-date where Q1 and Q2 weren’t comparable to the previous years.

It’s easy to grow by acquiring revenue, so that year-to-date number isn’t reflective of performance. Here’s the number that does show you the performance: if you strip out White Stuff, TFG London’s sales fell 2.4% in the third quarter and 2.6% over nine months. Yuck!

That’s still better than retail widowmaker Australia, down 2.6% for the quarter and 1.9% for the nine months.

And if you exclude White Stuff from the group numbers, then sales growth over nine months is only 2% instead of 7.5%. You get the idea.

The clear highlight is online sales. At group level, they increased 23.4% in the third quarter and 36.6% year-to-date, now contributing 14.3% to total retail sales. In TFG Africa, Bash did what it says on the tin and dished out pain to the competition, growing online sales 54.9% in the third quarter and 46.7% year-to-date. Online sales are now 7.9% of total sales in TFG Africa.

I’ll say the same thing that I said in the Pepkor (JSE: PPH) update this week: Mr Price (JSE: MRP) is asleep at the wheel in online sales and needs to stop throwing away market share by barely participating.

We may as well deal with TFG Africa, where like-for-like sales were up 1.2% in the third quarter and 2.9% year-to-date. I cannot for the life of me understand how Cellular sales can be down 2.5%, as that has been a very strong performer at major competitors. I guess for others to be winning, someone had to be losing! At least Beauty is a real highlight, up by 20.3% in the third quarter.

A meaty 26.1% of TFG Africa’s sales are on credit. The debtors book is 6.8% higher year-on-year, a surprising increase in the context of the credit sales performance of 5.3% year-to-date. They call it a steady risk environment, but that doesn’t seem particularly steady to me. Hopefully we won’t see credit challenges coming through as well, as TFG has more than enough to deal with already!

TFG London and TFG Australia continue to be huge headaches, with the group now expecting impairments of up to R750 million. This doesn’t impact HEPS, but it does indicate the extent of value destruction in those offshore businesses in recent times. This is just one of the many cautionary tales that Mr Price has opted to ignore in pursuit of NKD in Europe.

Before you feel that HEPS is safe, I must point out that TFG London’s gross margin has contracted by 90 basis points year-to-date based on inventory clearance. When you combine this with the pressures across the board, I suspect that investors are in for another rough ride in terms of HEPS. The company hasn’t given a range for HEPS in this update.

In terms of outlook and recent trading, TFG Africa’s sales grew 5.8% for the 5 weeks to 31 January 2026. TFG London increased 5.6% in local currency, which is an encouraging outcome. TFG Australia remains a mess, down 1.1% in local currency.

The share price is down 39% over 12 months. I personally don’t think we are anywhere near the bottom yet, but we will see how the market reacts to this update that came out at the close of play on Tuesday.

A bitter outcome for HEPS at RCL Foods (JSE: RCL)

The sugar is to blame

RCL Foods released a trading statement dealing with the six months to December 2025. I’m afraid that it isn’t good news, with HEPS expected to be at least 25% lower year-on-year.

The move is much bigger in earnings per share (EPS), but that’s because of numerous adjustments related to non-cash gains and insurance proceeds. This is exactly why the market focuses on HEPS instead, as it gives us a standardised metric that strips away as many of these distortions as possible.

So, what happened in HEPS? The answer lies in the sugar business.

A once-off partial recovery of the sugar industry levy in the base period is responsible for 5.6 cents of the “at least” 27.4 cents drop in HEPS. Kudos to the company for giving helpful and detailed disclosure here!

The remaining 21.8 cents is thanks to the performance in the sugar business itself, with the challenge being an influx of imports that led to local production being sold in the less lucrative export market.

This tells us that sugar is more expensive locally than it would be without tariffs. The importance of the growers and millers in the South African industry leads to government being willing to protect them, with RCL pushing for amendments to the tariffs to do something about these deep sea imports that have hurt the local industry.

Thankfully, the Groceries and Baking units are achieving higher profits despite pressure on volumes. It’s just not enough to offset the pain in Sugar as the largest individual segment from an EBITDA perspective.

Well, Sugar probably isn’t the largest segment anymore, as Baking has been hot on its heels and this update suggests that there might be a new pecking order within RCL.

Southern Sun will take a 50% stake in key properties in Sandton (JSE: SPG)

Liberty will be selling to Southern Sun and Pareto

Southern Sun currently operates the Sandton Sun, Sandton Towers, Garden Court Sandton City and Sandton Convention Centre under long-term contracts with Liberty and Pareto. Those two companies have stakes of 75% and 25% in the properties respectively.

Liberty is a wholly owned subsidiary of Standard Bank (JSE: SBK) and Pareto is owned by the Government Employee’s Pension Fund, managed by the PIC.

Liberty is going to sell its stake in Sandton Towers, Garden Court Sandton City, Sandton Convention Centre and the Virgin Active Sandton (but note: not Sandton Sun). Pareto will increase its stake from 25% to 50%, while Southern Sun will take the other 50%.

Strategically, this makes sense for Southern Sun. They own the majority of their hotel portfolio, giving them far more control than if they were purely an operator on behalf of others. Being able to take a 50% stake in these properties creates more strategic alignment with the rest of the portfolio.

Southern Sun’s 50% stake will cost them R735 million, payable from available debt facilities. This is in line with the independent valuation that was done as at December 2024.

This seems like a strong deal for Southern Sun, with the share price closing 4.3% higher in appreciation.

Super Group’s continuing operations live up to the name (JSE: SPG)

The same can’t be said for the automotive business in the UK

Super Group has released a trading statement for the six months to December 2025. HEPS is expected to be between 23.6% and 31.8% higher, which means a range of between 150 cents and 160 cents. To add to that good news, the balance sheet is in good shape and net debt ratios are healthy.

Great, but what about the discontinued operations?

If you include those operations and therefore look at the group total, then HEPS is between 134 cents and 145 cents. The year-on-year move is less relevant, as the disposal of SG Fleet in the prior year impacts comparability. The part that is relevant is that the UK automotive segment is in trouble.

The Hyundai and Suzuki dealerships in the UK have been closed. The UK KIA dealerships remain in discontinued operations. The automotive logistics segment has deteriorated thanks to a cyberattack on Jaguar Land Rover that led to a two-month shut down of production. If there are no cars being produced, there’s nothing to move around in the logistics business. This drove a trading loss in AMCO of R25.5 million for the six months. Overall, the UK is an unhappy place in the automotive space right now.

Super Group clearly believes in the mantra of your first loss being your best loss. They’ve decided to exit AMCO and they are looking for a buyer. This is why the business has landed in discontinued operations in this update. But with no guarantee of a buyer emerging quickly (or at a reasonable price), I don’t think it would be right to focus only on the continuing operations in this update.

The release of results on 24 February will have full details for investors.

Zeder finally has a buyer for Zaad (JSE: ZED)

The share price closed 18% higher on the day

Zeder has been a value unlock play for as long as anyone can remember. They’ve been selling off smaller assets in the group, but Zaad has always been the big fish that needed to find the right line to be hooked onto.

That line has come in the form of a consortium of WIPHOLD, the PIC, the IDC and Phatisa Food. This gives enough balance sheet muscle for Zeder and the minorities in Zaad to be able to sell their shares and claims for up to R1.42 billion. Zeder will receive R1.39 billion of that amount.

In case you aren’t familiar with the business, Zaad operates in the agri-inputs industry with a focus on emerging markets in Africa, the Middle East and Eastern Europe.

Nothing is ever quite this simple. As a precursor to this deal, excluded assets worth R801 million need to be sold separately or restructured out of Zaad Holdings. This means that Zeder will continue to own May Seed and various other assets. The assets other than May Seed are in the process of being disposed of.

Zeder intends to distribute a “significant portion” of the deal value to shareholders. They will give further information in the circular when it is released to shareholders (around 23 March 2026), as this is a Category 1 transaction.

The value of the shares and claims in the latest financials was R2 billion, but this included May Seed and the other “excluded assets” and isn’t directly comparable. This implies that they’ve sold roughly R1.2 billion worth of assets for R1.42 billion. Importantly, the share price was trading at a discount to the valuation anyway, so this price is significantly higher than the market cap was implying.

That’s how a value unlock is supposed to work!

Nibbles:

- Director dealings:

- Saul Saltzman, son of the founders of Dis-Chem (JSE: DCP), sold shares in the company worth R12.7 million.

- A prescribed officer of Life Healthcare (JSE: LHC) sold shares worth R9 million.

- A director of a subsidiary of RFG Holdings (JSE: RFG) bought shares worth R119k.

- A director of a major subsidiary of Insimbi Holdings (JSE: ISB) sold shares worth R71.5k.

- Bowler Metcalf (JSE: BCF) has a market cap of just over R1 billion, making it a small cap on the JSE and thus a company with limited liquidity in the stock. Recent results seem to be solid though, with revenue up 8% for the six months to December and HEPS up by 16%. The cash has followed suit, with the interim dividend up 16%. Nice!

- Tharisa (JSE: THA) is looking for a new CFO after the resignation of Michael Jones with effect from 31 July 2026. That’s a solid handover period that reflects an innings of 14 years as CFO. It will be interesting to see whether they have an internal replacement lined up vs. bringing in external ideas.

- Stefanutti Stocks (JSE: SSK) has made another repayment of R50 million to Standard Bank. The outstanding facility has been reduced from R300 million to R250 million.

- Sirius Real Estate (JSE: SRE) announced the results of the dividend reinvestment programme. Holders of 0.46% of issued shares in the UK and 3.0% of issued shares in South Africa opted to receive shares instead of cash. But here’s the nuance: settlement is through the purchase of shares in the market rather than the issuance of new shares. This is therefore non-dilutive to other shareholders.

- Between 26 November 2025 and 22 January 2026, Argent Industrial (JSE: ART) repurchased R11.4 million worth of shares at an average price of R33.34. The current price is R32.50. This only represents 0.63% of shares in issue and they have the authority to do far more.

- MTN Zakhele Futhi (JSE: MTNZF) shareholders will receive an “agterskot” payment thanks to the costs of unwinding the scheme being less than anticipated. The final payment is 23 cents per share, of which 8 cents is the agterskot and 15 cents is the scheme consideration.