Accelerate Property Fund has sold two buildings at NAV – yet the market didn’t like it (JSE: APF)

Shareholders are clearly still panicky when it comes to this stock

There are a lot of reasons to worry about Accelerate Property Fund. There are significant overhangs on the share price, not least of all the related party issues that have become problematic once more. The ongoing turnaround of Fourways Mall remains uncertain, although there are significant green shoots. The TL;DR is that this is a risky play.

The fund trades at a huge discount to net asset value (NAV) due to these issues, which tells you at least one thing for sure: selling properties at NAV can only be a good thing. In fact, it would be a fantastic outcome for shareholders if the fund could sell absolutely all its assets at NAV, settle its liabilities and pay the rest to shareholders.

Now, a sale of the full portfolio isn’t on the cards right now, but partial sales along the way should be most welcomed. Instead, the share price closed 7% lower on the news of Accelerate selling The Buzz and Waterford Centre for a total price of R215 million, which is equal to the directors’ valuation (i.e. the NAV) as at 31 March this year.

It’s an odd response from the market that demonstrates just how much confusion and panic there is around this share price. Therein lies the opportunity for speculators of course, with the caveat that this is a high-risk turnaround story.

The buyer of the two properties is Dorpstraat Capital Growth Fund, with a number of backers including Rabie Property Group (a name you may know). The Buzz and Waterford are both situated in Fourways, as per usual when it comes to Accelerate Property Fund.

There are unfortunately some hurdles that need to be overcome for the sale, including a rezoning to unlock the final R10 million of the purchase price and an unconditional Competition Commission approval to get the entire transaction done. Thankfully there are no sales commissions at play though, as the parties have clearly been negotiating directly with each other. This means that the proceeds of R215 million can be fully applied to debt reduction and overall flexibility on the Accelerate balance sheet. It’s just going to take a few months to get the cash.

The disposal yield is 9.5% based on one-year forward income and taking into account Pick n Pay’s exit from The Buzz.

Down 7% for the day and now at R0.39 per share, the share price is changing hands below the recent rights offer price of R0.40 per share. Either the investors dumping the stock are wrong, or the anchor shareholders are wrong, but someone is wrong here. Only time will tell, but my view is that a sell-off in the stock in response to a sale of properties at NAV is a sign of an irrational market.

Cashbuild managed to increase earnings this year (JSE: CSB)

But nothing is coming easy at the moment

As we saw with Italtile (JSE: ITE) earlier this week, consumer discretionary retail has been a real slog this year. It’s hardly any better in the US by the way, with the likes of Home Depot and Lowe’s reporting that consumers are more willing to do small DIY projects than large projects at the moment. The reason is the same on both sides of the pond: interest rates are stubbornly high and consumers are taking strain.

With a retail-focused model rather than a manufacturing arm like Italtile has, Cashbuild is better equipped to weather the storm. It’s hard enough trying to generate decent returns from a store footprint. Once you add on the fixed costs of manufacturing, then operating leverage really kicks in and a weak consumer environment kicks you harder.

This is why Cashbuild’s trading performance for the 52 weeks to 29 June 2025 is well ahead of Italtile, with HEPS growth of between 7% and 12%. Italtile could only manage 2% over the same period. Given the underlying business model differences, I think both companies did pretty well under the circumstances!

Cashbuild is expected to release results by 3 September.

It looks likely that Mahube Infrastructure will be leaving the JSE (JSE: MHB)

Another day, another takeout offer

Mahube Infrastructure released a cautionary announcement on Tuesday and ended the day 32% higher. This combination usually means only one thing: a takeout bid is coming.

Sure enough, the cautionary confirms that the company has been approached by a third-party offeror looking to make a cash offer for all the shares in Mahube in the form of a scheme of arrangement, which would naturally lead to the delisting of the company if the scheme is approved.

It’s very important to note that nothing is finalised or guaranteed at this point. The company also hasn’t indicated the price of the potential offer, so the market is taking a guess right now around whether there’s more upside in this thing.

The board has constituted an independent board of directors to consider the proposal. More details will be announced when they are ready. I’ll say it again: nothing is guaranteed here.

Master Drilling managed to grind out some growth in this period (JSE: MDI)

The impairment reversals may not be in HEPS, but they are important nonetheless

Master Drilling released results for the six months to June. They work hard to convince you to look at the results in US dollars rather than in rand, despite only 48% of group revenue being in hard currencies vs. emerging currencies. There’s some selected additional disclosure of rand movements (like in HEPS), but the rest is in US dollars.

Revenue was up 4.9% in US dollars for the period and HEPS was up 6.7% on the same basis, or 4.7% in rand. It’s so refreshing to be in a situation where the rand recently strengthened against the US dollar, hence the rand growth rate in HEPS is actually lower than the US dollar growth rate. There haven’t been many times in the past couple of decades when we can say that!

Importantly, the committed order book of $305.6 million is significantly higher than $271.4 million as at June 2024. This bodes well for the second half of the year and beyond.

Impairments are non-cash items and don’t affect HEPS, so you’ll rarely see me paying much attention to them. In this case though, the good news at Master Drilling is that a previously recognised impairment on the Mobile Tunnel Boring Machine has been partially reversed. Why does this matter? Well, it shows that the machinery has more of a use case than previously thought, which indicates a lower risk of obsolescence due to market factors.

Keep an eye on the capital allocation here, as cash generated from operations was $11 million and capital spend was $13.9 million. Sure, it’s only one period, but you don’t need to get the calculator out to see that this doesn’t leave any cashflow for shareholders in this particular period. It also tells you exactly why technological obsolescence is such an important point, as this is a capex-heavy business.

The market was happy with what it saw, with Master Drilling closing 6.5% higher on the day.

Motus had a better second half and enjoyed lower net finance costs (JSE: MTH)

Revenue has come out roughly flat for the year

Motus has released a trading update for the year ended June 2025. Before considering the full-year numbers, it’s worth reflecting on the interim results, where revenue was down 2% and HEPS was up 1%. The second half was better than the first half, boosted by decent numbers in the South African vehicle market. This is why for the full year, revenue moved by between -1% and +1% (i.e. flat at the midpoint) and HEPS came in between 3% and 5% higher.

The biggest boost to the numbers came from a decrease in net finance costs of between 12% and 14%. These businesses are highly sensitive to interest rates not just because of the impact on consumer demand for vehicles, but also because of the impact they have on floor finance at the dealerships.

The share price closed 2.6% higher on the day, taking the year-to-date drop to 13.9%.

Old Mutual’s adjusted HEPS moved higher – but that’s only if you exclude Zimbabwe (JSE: OMU)

The issue is the functional currency change in Zimbabwe

Old Mutual’s share price is up 13.9% year-to-date, while arch-rival Sanlam (JSE: SLM) is only up 3.3%. This outperformance all happened in the past week, driven by the market’s favourable response to Old Mutual’s earnings. I now need to remind you that over 5 years, Sanlam is up 56% while Old Mutual has managed just 22%. There’s a lot of catching up to do.

The latest trading statement from Old Mutual deals with the six months to June and it shows that things are at least headed in the right direction. Old Mutual Insure did well and financial market were favourable to the returns of the insurance group. To add to this, the prior period included some significant negative once-offs.

The Zimbabwean business has skewed the numbers, as HEPS without any adjustments has dropped by between 37% and 17% for the period due to the change in functional currency from Zimbabwe Gold to the US dollar. Adjusting for that impact shows that HEPS actually increased by between 21% and 41%.

Here’s the good news: it’s the base period that is driving that huge difference, as HEPS in interim 2024 was 133.6 cents without the adjustment and 73.5 cents with it. That’s good news, as the guidance for interim 2025 doesn’t change dramatically when you look at reported (84.2 cents to 110.9 cents) vs. adjusted (88.9 cents to 103.6 cents) numbers.

Interim results are due for release on 10 September.

Redefine Properties has upgraded the midpoint of its FY25 guidance (JSE: RDF)

The company released a pre-close update for the year ending 31 August

Redefine Properties came into this pre-close update with a share price that is up 10% year-to-date. That compares favourably to local property ETFs that are up around 7% over that period, so Redefine has outperformed the broader sector.

Redefine’s previous guidance for the year ending 31 August 2025 for distributable income per share was 50 cents to 53 cents. The company has upgraded that guidance to between 51.5 cents and 52.5 cents. Although the top-end of the range is lower, the mid-point has shifted from 51.5 cents to 52.0 cents, hence it counts as an upgrade.

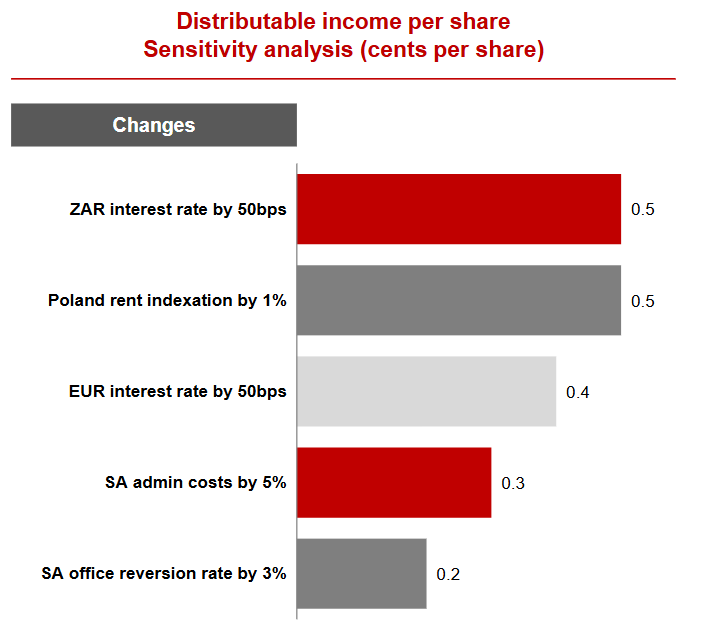

I think this is the most interesting chart from the presentation, showing the sensitivity of earnings to various variables:

As you can see, the most sensitive factor is South African interest rates, followed by rental increases in Poland and then European interest rates. I don’t think this list is exhaustive, as I would’ve expected to see South African rent indexation / portfolio-wide reversions on the list. It remains useful though as a way to understand the relative impact of some of the key drivers of performance.

If we look deeper at the performance, the overall South African portfolio (which is 45% Retail, 34% Office, 20% Industrial and 1% Specialised) saw occupancy rates improve from 93.2% in August last year to 94.1% as at the end of July this year. Reversions have improved from -5.9% to -5.2%, but are clearly still negative.

You wouldn’t be off the mark to think that the office portfolio is at fault here for the overall negative situation, as reversions in that segment were -12.3% in this period. But that’s actually slightly better than -13.9% in the prior period, so the office portfolio has contributed to the year-on-year improvement. The worrying trend is in the industrial portfolio, with reversions of -0.2% vs. +5.5% in the comparable period. This is admittedly on only a small part of the overall portfolio that churns in each period, so it’s dangerous to read too much into that trend. As for the retail portfolio, reversions improved from +0.2% to +1.6%.

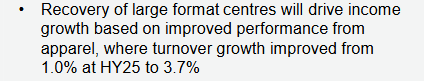

There’s an important nugget of information in the presentation that offers a read-through for the apparel sector, where I recently took a long position in Mr Price (JSE: MRP) as the pick of the local litter in that space (in my opinion at least):

The importance of reading widely just cannot be overstated. You can read about a property fund and learn something about clothing retail in the process!

Moving across to Poland, the eCommerce threat is becoming clearer – footfall across the EPP portfolio was down by 2% year-on-year. Turnover was up 2%, so things are still trending in the right direction, but I do think that eCommerce is a significant part of the bear case for these retail-focused property funds. As part of the fund’s diversification strategy, the portfolio in Poland also includes logistics and self-storage assets, with a solid improvement in the vacancy rate in the past year.

In terms of the balance sheet, the see-through loan-to-value (LTV) was 46.8% as at the end of May 2025, an improvement from 47.9% as at August 2024. The weighted average cost of debt fell by a significant 90 basis points to 6.6%. And as that useful sensitivity chart showed us, decreases in borrowing rates make a big difference to property funds.

Nibbles:

- Director dealings:

- A few directors of Spur (JSE: SUR) received share awards and sold the taxable portion, but one director kept the entire award worth R997k i.e. funded the tax other than through selling shares.

- An independent non-executive director of Bytes Technology Group (JSE: BYI) bought shares worth around R600k.

- Shareholders in Phuthuma Nathi, the B-BBEE scheme related to MultiChoice South Africa within MultiChoice Group (JSE: MCG), have voted in favour of the restructuring required to get the broader deal with Canal+ across the line. No surprise there really, as I think it’s their only realistic chance of getting decent long-term value from the business. That share price is up roughly 18% over 30 days and is still down 21% over 90 days, showing how much volatility there has been.

- Vukile Property Fund (JSE: VKE) has put in place a building block for further growth, with an announcement that the Domestic Medium Term Note Programme amount has been increased from R5 billion to R10 billion.

- British American Tobacco (JSE: BTI) announced that CFO Soraya Benchikh will be stepping down as CFO with effect from 26 August 2025 (i.e. immediately), with availability to support the team until the end of 2025. That does feel very sudden, as evidenced by the current Director of Digital and Information stepping into the Finance Director role on an interim basis. British American Tobacco will now need to look for a permanent successor.

- Delta Property Fund (JSE: DLT) continues to take every opportunity that it can to sell off non-core properties. The latest example is the sale of a building in Parkmore for R19 million to Afrocentric Intellectual Property. From what I could see online, this company has nothing to do with the listed AfroCentric, just in case you were wondering. The property was previously valued at R18.1 million, so this is a rare example of a sale above book value! The fund announced that the sales of the Du Toitspan and Pine Parkade properties have also been finalised and that transfer has taken place. Slowly but surely, they are chipping away at the group debt.

- Labat Africa (JSE: LAB) has renewed the cautionary announcement regarding the potential disposal of certain subsidiaries. Although this has been going on for a while, there are still no guarantees of a deal happening here.

- Conduit Capital (JSE: CND) has renewed its cautionary announcement for what feels like the gazillionth time. There’s still no clear way out of that mess, with the group’s main subsidiary placed into liquidation.