Investors dumped AB InBev on the day of results (JSE: ANH)

They don’t even look that bad, to be honest

At the moment, the market is terrified of alcohol stocks. They are all doing badly, with concerns around demand for the product from younger generations who are more health conscious (and also more worried about ending up in social media videos for bad behaviour).

AB InBev’s share price fell 10.4% on the day of results, which would suggest that they were awful. But they really weren’t that bad at all, at least not in my opinion. Revenue was down admittedly, but that’s because of currency translations. Reported revenue fell by 4.2% for the half-year and 2.1% in the second quarter, while revenue on a constant currency basis was up 3% in the second quarter and 2.3% for the half. So not only was this purely a currency story, but there was positive momentum over the period.

The market was having none of it, choosing instead too focus on volumes dipping by 1.9%, with particular weakness in China and Brazil. I must point out that British American Tobacco is also dealing with lower volumes and positive revenue on a constant currency basis, yet the market is buying that stock at pace (see further down).

AB InBev managed normalised EBITDA growth of 7.2% for the half-year, with margin expanding by 166 basis points to 35.5%. Underlying profit for the half-year increased by 7% to $3.6 billion and underlying EPS was up 8% as reported. Diluted HEPS in USD increased by 46%!

Perhaps the market concern is around net debt to EBITDA, now at 3.27x vs. 3.42x as at 30 June 2024 and 2.89x as at December 2024. I’m really not sure what else could’ve driven such a sharp negative reaction, particularly as the expectation for full-year 2025 is for the stock to grow in line with the medium-term outlook for EBITDA of 4% to 8%.

Earnings have plummeted at Anglo American (JSE: AGL)

Don’t underestimate the impact of De Beers here

Anglo American does a great job from a PR and investor relations perspective. They manage to put the focus exactly where they want it: on the commodities that they plan to keep going forwards. The problem is that you can’t just pack up a mine and go home when you’re gatvol. Getting out of De Beers is going to be far more easily said than done, with no indication of improvement in the rough diamond sector at all.

Anglo’s timing of unbundlings and exits remains undefeated. They gave Thungela to shareholders just before that business generated a fortune. They reduced their stake in Valterra Platinum just as the PGM sector to rally. In fact, the best chance for the diamond sector at this point would be if Anglo gets out, as that will no doubt drive a recovery.

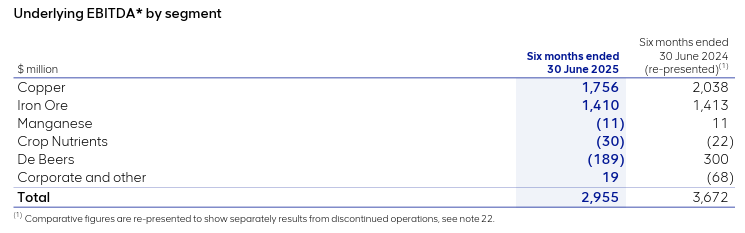

But underneath all the noise, there’s a worrying situation in not just De Beers, but in copper as well where production fell by 13%. This table of segmental EBITDA tells the story best:

That’s a 20% drop in underlying EBITDA, with De Beers as the only business they would prefer you to ignore in that table. And if we look at headline earnings, the numbers get much worse – for the six months to June, headline earnings fell by almost 70% to $274 million.

Here’s another shocker: attributable return on capital employed (ROCE) fell from 12% to 9%. This suggests that if all the capital in Anglo American was just invested in SA government bonds instead, they would be better off!

It’s not impossible that we reach a point where Anglo pays someone to take De Beers off their hands, like Spar had to do with their business in Poland.

No improvement in the steel market for ArcelorMittal (JSE: ACL)

The wind-down of the longs business remains scheduled for 30 September

ArcelorMittal released numbers for the six months to June 2025. Sadly, about the only good thing I can say is that at least the losses were quite consistent, with a headline loss of R1.01 billion vs. R1.11 billion in the prior period. They managed to get production up by 5%, but realised steel prices fell by 7% and sales volumes were down 11%.

Chinese steel exports remain the biggest issue, with an increasing number of countries putting in place protectionist policies. ArcelorMittal is of course lobbying as hard as possible for the government to put in place measures to protect the local steel industry. It doesn’t help their cause that we are so closely aligned with China from a geopolitical standpoint. It also certainly doesn’t help that South African investment in infrastructure has been so weak, leading to a sharp decline in domestic steel demand in recent years.

Here’s the really big problem though: ArcelorMittal’s cash from operations was R1.82 billion and this includes the IDC putting in R2.06 billion to keep the Longs business alive. In other words, even if we just ignore the Longs business, ArcelorMittal is cash flow negative from an operational perspective. This is a capex-heavy business, with R362 million just in sustaining capex in the period. They therefore cannot afford to be generating negative operating cash flow in the broader business.

Unless a miracle solution presents itself for the Longs business (paid for by taxpayers at the end of they day), that business is going to be placed into care and maintenance. ArcelorMittal will then focus on stabilising the Flats business.

The operating leverage in this business is immense, so any improvement to global steel prices can do wild things to the share price. You don’t even have to go that far back to see this play out:

Almost a fifth of British American Tobacco’s revenue is from “smokeless products” (JSE: BTI)

Earnings are up and the share price has had a massive year

British American Tobacco, an ESG index favourite for their positive contribution to society, now generates 18.2% of group revenue from “smokeless products” – as compared to combustibles, which are good ol’ fashioned cigarettes. The focus has been on growing the new categories business, while making sure they generate strong profits from people who can’t kick the combustibles habit.

It’s a strategy that works, with the share price up 43% year-to-date as investors cling to the stock for protection against inflation and currency depreciation, all while earning a dividend.

It’s worth giving the recent rally proper context:

Despite this chart, revenue is actually down 2.2% as reported, all thanks to negative currency movements. It’s up 1.8% in constant currency terms though, with the market excited about a return to growth in the US market. The New Categories revenue increased 2.4% in constant currency terms, so not much faster than the combustibles. That suits British American Tobacco just fine, as the contribution margin in New Categories is only 10.6% (admittedly up 280 basis points), which is miles off the group operating margin of 42.0%.

If you’re from the ESG agencies, then the company is all about those New Categories. But if you’re from the pension funds and you would like your dividend this year, then you best believe that the products you won’t find easily pictures of on the website are doing the heavy lifting.

Speaking of returns to shareholders, the share buyback programme has been increased by £200 million to £1.1 billion. The quarterly dividend was already announced in February, which is part of why investors like the stock – they have visibility over dividends.

The cash conversion ratio is much lower than usual, but the guidance for the full-year is that it will still exceed 90%, so it’s probably just a timing thing. In terms of other guidance, they expect global tobacco industry volume to be down 2% and for revenue to be up by between 1% and 2% on a constant currency basis, which means that price increases continue to be the driver of growth.

Auction revenues halved at Gemfields (JSE: GML)

And net debt is worse than a year ago, despite the rights issue

Gemfields released an operational update for the six months to June 2025. They note total auction revenues of $60 million year-to-date, which means revenue has halved from the $121 million achieved in the comparable period. Ouch.

The news then gets worse: net debt was $59.6 million as at 30 June 2025, net of the proceeds from the $30 million fully underwritten rights issue. A year ago, net debt was $44.4 million. In other words, the balance sheet is in worse shape despite shareholders having dug deep.

For the second half of the year, the focus is on ruby business MRM’s second processing plant, as well as the “moderated expansion” at Kagem emeralds while they process their stockpiles. The market is also waiting to see what Gemfields will do about Fabergé, the problematic luxury jewellery business that has been a perennial underperformer.

Along with revenue, the share price has halved over the past 12 months.

A busy day for Hammerson (JSE: HMN)

They released results and raised a casual R3.3 billion in one day

Hammerson certainly took a carpe diem approach to life on Thursday. Firstly, they released results for the six months to June 2025. Then, they raised a whopping R3.3 billion through a bookbuild process to support the acquisition of the remaining 50% in Bullring and Grand Central.

Let’s start with the results, which reflect like-for-like gross rental income up 5% and like-for-like net rental income up 4%. Total gross rental income was up 11%, supported by a significant deployment of capital (£321 million) in the past nine months at an average 8.5% yield. This supported a 5% increase in the dividend despite flat earnings, although earnings guidance for the full year has been increased.

Perhaps most importantly, the fund experienced its first gain in the portfolio valuation (up 11%) since interim 2017! It’s not quite as exciting on a per-share basis, with EPRA net tangible assets per share up 3%.

This would’ve given plenty of support to the bookrunners as they went to market to raise around R3.3 billion for the deal to acquire the remaining 50% in Bullring and Grand Central at a 7.7% blended net initial yield. They describe this as a top five UK destination that they will now have control over.

With the loan-to-value ratio having moved up from 30% to 35%, they needed strong support from the market for an equity raise to get the deal done. Through a combination of suspending the share buybacks, using existing cash resources and raising roughly 10% of its market cap in new equity, they will be able to complete this £319 million deal with a pro-forma loan-to-value ratio at 37% (and therefore within a healthy range).

By the end of the trading day, the company announced that the required amount was raised at a discount of 2.5% to the closing price on 30 July 2025, which is a pretty decent outcome for a capital raise of this size. Retail investors weren’t given a bite at this cherry unfortunately, with the company looking to do it as quickly as possible. In that situation, only institutional investors get an opportunity to acquire shares at this price.

Mondi’s underlying earnings improved (JSE: MNP)

The market dumped the stock anyway

Mondi announced results for the six months to June 2025. Although underlying EBITDA was almost perfectly flat at €564 million, this masks the good news that this EBITDA was achieved with much lower forestry fair value gains in this period vs. the comparable period (€18 million vs. €49 million).

I would therefore put this year’s earnings down as being of higher quality, supported by the improvement in cash generated from operations (€416 million vs. €372 million). The market doesn’t seem to agree, with a 10.5% drop in the share price. This might be because the dividend was flat year-on-year despite the improved cash quality of earnings. I don’t think the balance sheet led to too many smiles among investors either, with net debt to underlying EBITDA of 2.5x vs. 1.5x a year ago.

The good news story in underlying EBITDA was in Corrugated Packaging (up 42%) and Flexible Packaging (up 9%), while Uncoated Fine Paper suffered a decline of 51% based on lower average selling prices. Although that is now the smallest division in terms of profitability, it was actually a larger contributor than Corrugated Packaging in the comparable period, so that substantial drop in profitability really blunted the underlying growth.

Further pressure on the share price would’ve come from the guidance for higher net finance costs, along with a lower contribution from major capacity expansion projects.

The good news keeps on coming for MTN (JSE: MTN)

Key African subsidiary MTN Nigeria has upgraded FY25 guidance

It really wasn’t that long ago that every item of news around MTN was negative. Remember, this is the same company that needed to delay the maturity of MTN Zakhele Futhi because the MTN share price was in the doldrums and investors would’ve suffered as a result. Fast forward several months and that scheme paid out a strong amount to investors (relative to recent levels at least, if not the original entry point) and the MTN share price itself is up 66% year-to-date.

The driver of this strong performance is Africa, as that’s where the risk/return trade-off is at its most obvious. Case in point: Nigeria. For the six months to June 2025, Nigeria grew service revenue by 54.6% and EBITDA by 119.5%. EBITDA margin has jumped by 15 percentage points to 50.6%!

Admittedly, capex is up 288.4% as MTN has pushed the accelerator pedal on capex investment in response to a better market. Still, free cash flow is up 18%.

MTN Nigeria has upgraded full-year guidance to reflect expected service revenue growth and EBITDA margin of “at least low-50%” for both metrics, while they expect medium-term growth to settle in the low 20s for service revenue at an EBITDA margin of 53% to 55%.

This is exactly what investors want to see.

Signs of life in Woolworths South Africa, but Country Road ruined the party (JSE: WHL)

Australia is a gift that just keeps on giving

I remember when there was much excitement around Woolworths acquiring David Jones. Several years later, there was just as much excitement about them finally getting out of that utter catastrophe, with a plan to keep Country Road as the “success story” in the Australian market. Now, having hit the fast forward button on a few more years, we find that Country Road is ruining the numbers and suffering large impairments. Sigh.

Let’s start with the good news in the trading statement for the 52 weeks to 29 June 2025, as there is actually some good news. On a comparable basis (as the prior period had 53 weeks and didn’t include Absolute Pets), Woolworths Food grew sales by 9.2% for the year and 10.6% in the second half, which is encouraging momentum. Online sales were up 32.9% and now contribute 6.6% to total sales, with Dash up 41.6% as South Africans continued to choose convenience offerings. Price movement averaged 5.3% for the period and 4.2% in the second half, certainly a very different tune to what discount retailer Boxer has been singing. Woolworths customers aren’t shy to pay up for their favourite organic goodies.

Fashion, Beauty and Home has been the lame duck for a while now. This duck is starting to quack though, with sales growth of 7.0% in the second half and growth for the year of 5.1% in comparable stores. The Beauty business was the real highlight, growing 14.7% and showing that Woolworths still has the ability to win in retail. Total price movement was 2.2%, with fashion inflation at only 0.4%. Notably, they decreased trading space by 2.3% and saw online sales grow by 22.8%, now contributing 6.6% to total sales. Incidentally, that’s the same percentage contribution as you’ll see in Food!

As a quick note on Woolworths Financial Services, the book increased by 0.5% when adjusted for a large sale of part of the book. The impairment rate improved from 7.0% to 6.1%.

That all sounded lovely, didn’t it? Brace yourself: the Aussie leg of the tour is about to begin.

Country Road Group suffered a drop in sales of 6.8% on a comparable store basis. The rate of decline improved towards the end of the year, but was still in the red. To add to the poor sales result, there was also pressure on gross margin. Now add in the impact of store-level costs and you have an outcome where profits have headed down under – yet again.

Because of the size of Country Road, Woolworths expects adjusted HEPS (the most favourable lens) to drop by between 17% and 22% on a 52-week comparable basis. HEPS (adjusted or otherwise) excludes the impairments to Country Road.

The midpoint of the guided range for adjusted HEPS is roughly 300 cents. The share price is R50, so that’s a P/E of around 16.7x for a group that is going backwards. It’s little wonder that the share price is down 20% year-to-date.

Nibbles:

- Director dealings:

- Here’s one to take note of: the chairman of Raubex (JSE: RBX) sold shares worth R9.1 million.

- Associates of the CEO of Spear REIT (JSE: SEA) bought shares worth R106k.

- The astonishing “Please Call Me” matter is still going through the courts. The Constitutional Court has upheld Vodacom’s (JSE: VOD) appeal and has referred the case to a new panel of the Supreme Court of Appeal. There are literally billions of rands at stake here. I cannot even begin to explain to you how damaging it will be for employment in this country if an employee’s idea can lead to a corporate being gutted of its value, so I remain hopeful that common sense will prevail.

- Primeserv (JSE: PMV) released numbers for the year ended March 2025. This is a highly illiquid stock, so they just get a passing mention down here. There are some solid growth rates, with revenue up 13% and HEPS up 29%. The dividend per share has jumped by 25% to 12.50 cents per share, which is a fairly modest payout ratio vs. HEPS of 42.16 cents.

- Kore Potash (JSE: KP2) released its quarterly review for the three months to June. You may recall that in early June, the company announced that it had signed non-binding term sheets for the total funding requirement for the Kola Project. The words “non-binding” are very important here, as the counterparty (OWI-RAMS) needs to arrange a funding package of $2.2 billion through a blend of senior secured project finance and royalty financing. Thus, as things stand, there’s still no guarantee of the funding being available. To keep things ticking over, chairman David Hathorn subscribed for shares worth $0.5 million. The company ended the quarter with $3.49 million in cash.

- MC Mining (JSE: MCZ) released an activities report for the quarter ended June. The development of the Makhado Project is on schedule, with the commissioning of the coal handling and preparation plant expected by December 2025. Importantly, the operational improvement plan for Uitkomst Colliery has been completed and is due for full implementation in the coming quarter. Run-of-mine coal production from Uitkomst was up 3% quarter-on-quarter, but down 9% year-on-year. Despite this, sales of high-grade coal increased by 9%. Coal prices remain under pressure though. Cash at period end was $7.4 million, down from $9 million three months ago. $10 million in equity capital from Kinetic Development Group flowed during the quarter.

- Southern Palladium (JSE: SDL) has released its quarterly activities report. They recently completed the optimised pre-feasibility study for Bengwenyama, which suggests a net present value of $857 million with a 38% reduction in the lower peak funding requirement. In junior mining at the moment, these staged approaches that make the capital requirement more palatable are all the rage. It’s also worth pointing out that the current PGM basket price is 16.6% higher than the price used in that study, so a prolonged period of better prices would make a major positive difference to expected returns. Notably, the company also completed a strategic share placement of A$8 million before costs. The cash balance as at 30 June 2025 was A$9.92 million.

- Although there are some significant changes to the shareholder register of Nictus (JSE: NCS), a closer read reveals that it is more of a game of musical chairs for the Tromp family than anything else.

- Efora Energy (JSE: EEL) announced a delay to the release of results for the year ended February 2025. They are not meeting the previously communicated deadline of 31 July 2025 and they also haven’t provided a new date.

- Sebata Holdings (JSE: SEB) also missed its planned reporting deadline of end-July for the financials for the year ended March, with a new expected date of 29 August.

Not to long ago BTi was given a damning review by the article author , how fickle your outlook is , luckily I bought more at the time , based on your false accessment…

Hi Sean. Not sure there’s anything fickle about my outlook at all really – I still don’t want to own shares in a company that exists because they can keep putting pricing increases through on products that (1) their customers are addicted to and that (2) kill them over time. On top of that, there’s little or no growth in it – this is just a cash cow that does an incredible job of convincing ESG-focused investors that this belongs in their portfolios. The market is fickle though, which is why the share price has rallied so strongly despite the only real improvement being to the US market. I’m sure you have excellent reasons for holding the stock and I wish you luck with it.

Their are many addictive habits in life, personally I have never smoked , but do understand that you cannot stop people from doing what they are going to do, Prohibition during 20’s & 30’s in America is a typical example , where banning alcohol failed (another addictive habit). So ESG investment doesn’t make sense to me, as the individual decides whether to participate in a “bad” habit or not.

But best of luck with your investment approach.

I agree – that’s why these companies should be allowed to exist. But each investor will have a particular line, beyond which they won’t touch stuff. The ESG funds are a load of absolute nonsense as logically speaking, there’s no world in which BTI should be in such a fund. But beyond that, can you genuinely justify the recent rally based on the numbers? It’s a sincere question. The thing is behaving like a growth stock when it’s got negative volumes growth and slightly positive overall growth, all while focusing on margin-dilutive products to try and make the place look better.