Absa’s ROE is moving higher, but watch those margins (JSE: ABG)

The recent momentum in the share price might be too strong

In the B-league of local banking, Absa and Nedbank (JSE: NED) fight it out for best of the rest. Their share prices have decoupled this year, with Absa pulling away with 17% growth vs. Nedbank down almost 10%.

The five-year picture is much closer, with the improvement in macroeconomic conditions in the rest of Africa giving Absa a lovely boost this year and helping it make back most of the lost ground:

For context, Capitec (JSE: CPI) is up 184% over the same period!

Absa’s strong share price momentum in the second half of 2025 is thanks mainly to the low valuation it was on. Yes, there’s growth in the business, but not much to get excited about.

In a voluntary trading update for the year ended December 2025, they flag mid-single digit revenue growth. From a return on equity (ROE) perspective, the good news is that growth in non-interest revenue was ahead of net interest income. Non-interest revenue is a more capital-efficient way to generate income, so it juices up ROE.

The credit loss ratio has been the biggest highlight, improving from 103 basis points (outside the target range) to be within the upper half of the through-the-cycle target range of 75 to 100 basis points.

The concern, like at Nedbank, lies in expenses. The cost-to-income ratio is going the wrong way, as expenses are up by mid-single digits and revenue growth is slightly lower than that.

Thanks to the mix effect of higher non-interest revenue and of course the reduction in the credit loss ratio, ROE is expected to improve from 14.8% to 15.0%. HEPS growth will be in the low double digits. This is difficult to extrapolate though, as the credit loss ratio moving back within range is a step change in the numbers that won’t happen every year.

Looking ahead to 2026, they expect mid-single digit revenue growth, slightly positive Jaws (this means revenue growth ahead of expenses and thus margin expansion – that’s a big one to watch) and further improvement in the credit loss ratio. This should take them to ROE of 16%. The ROE target range for 2027 to 2030 is 16% to 19%.

Let’s see if they can pull it off!

Capitec acquires Walletdoc for up to R400 million (JSE: CPI)

This is a classic example of the outcome that startups look for

The venture capital (VC) industry is built around pumping money into startups that stand a decent chance of being acquired one day. Very few such startups are built to be financially viable on their own, as the goal is to scale quickly and build something that would be appealing to a corporate buyer who could plug the company into a larger ecosystem.

I have no idea at this stage if Walletdoc is profitable on a standalone basis, but we do know that Capitec is going to pay up to R400 million to acquire the business. This will undoubtedly inspire a zillion LinkedIn posts by VCs who will point to this deal as an example of success in the local fintech sector.

R300 million is payable up-front in cash, with the remaining R100 million being structured as a deferred earn-out over three years subject to achieving certain milestones. The earn-out would be settled in Capitec shares.

What does it mean for Capitec? Well, Walletdoc has been building its payments business since 2015. They offer various payment solutions for merchants and all kinds of tech integrations that seem to focus on smartphones and digital wallets. There is a clear strategic fit around financial services accessibility and Capitec’s push into business banking as well.

Capitec is such a behemoth that the R300 million cash portion of this deal is only 0.06% of the group’s market cap!

No Christmas cheer at Italtile I’m afraid (JSE: ITE)

Sales are weak and margins are under pressure

Italtile released a trading update dealing with 1 July to 30 November 2025. I’m afraid that there isn’t much good news to report.

Management has been incredibly transparent for ages now when it comes to the challenges facing the industry. They’ve highlighted the risks from cheap imports combined with overcapacity in local manufacturing and weak demand. This has resulted in a 6.2% drop in manufacturing sales, which means reduced capacity utilisation and thus even more pressure on margins despite management initiatives around costs.

The retail side of the business (CTM / Italtile Retail / TopT) could only increase system-wide turnover by 1.2%. Average selling prices fell year-on-year due to high levels of competition and poor consumer confidence. Despite all the positivity around South Africa this year and the reduction in interest rates, Italtile hasn’t seen an uptick in construction activity.

The update doesn’t give a specific indication of profitability, but it’s not rocket science to read between the lines here. Italtile is suffering, with the share price down 36% year-to-date and no sign of improvement in the business.

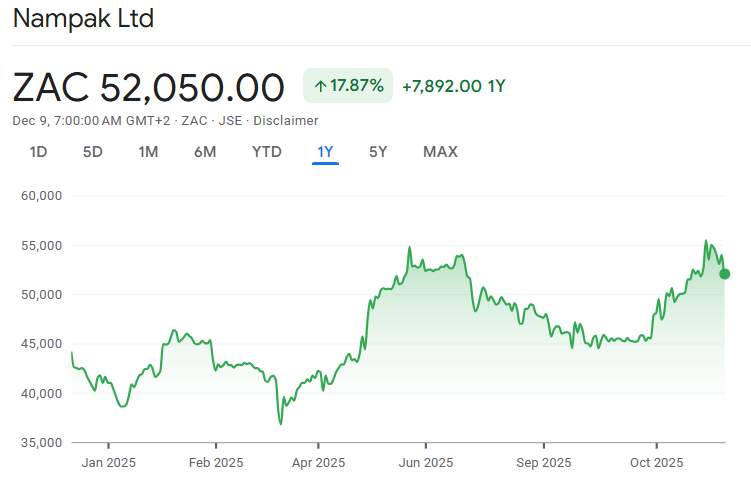

Nampak’s results look good, but the share price lacked momentum to break higher (JSE: NPK)

This is the danger of buying stocks at or near the 52-week high

Nampak’s share price hit a new 52-week high on 27 November in response to the release of a trading statement. It can be very tempting in those situations to jump on the hype train and buy the trading statement.

Personally, I’ve learnt two lessons about these situations. The first is to always wait for the release of full results to see what’s actually going on. The second is to wait for a confirmed break higher vs. buying at a strong resistance level and then hoping it breaks through.

These lessons helped me avoid some pain on this one, as Nampak has dropped by nearly 9% since that recent high:

So, the break higher clearly wasn’t confirmed, but what do the full results look like?

Nampak is executing an impressive turnaround story, with revenue from continuing operations up by 8% and trading profit jumping by 26% as the trading profit margin improved from 10.5% to 12.3%. To add to the party on the income statement, net finance costs were down 45% as net debt excluding lease liabilities dropped by 52%. This is why HEPS excluding once-off items jumped by a delightful 46%.

HEPS as reported was actually up 213%, but that’s obviously not a reflection of maintainable growth. The fact that adjusted HEPS was up by 46% shows you just how well the company is doing.

It wasn’t a perfect year. For example, the Beverage South Africa segment kicked off this period by being unable to fully meet customer demand at the end of 2024 due to production challenges that have subsequently been addressed. They have significant can capacity in Beverage South Africa and will look to take advantage of improved local conditions. Even with these challenges, this segment delivered EBITDA growth of 13% for the year.

Diversified South Africa had a much tougher time, with EBITDA down 5% due to consumer spending issues in certain categories and major customers changing their packaging strategies.

Beverage Angola performed beautifully, with EBITDA up by 30% thanks to a stable currency and a more favourable operating environment. As a sense of size, this segment contributed EBITDA of R360 million – now higher than the R310 million in Diversified South Africa. And in case you’re wondering, Beverage South Africa is bigger than both of them combined, with EBITDA of R907 million.

Cash flow from total operations increased by 38% and free cash flow was almost 5x higher at over R1 billion.

There’s still a bit of cleaning up to do, like the disposal of Nampak Zimbabwe after the initial deal to sell that business fell through. On the whole though, Nampak is putting forward a strong story here.

If you use adjusted HEPS of R77.40, then the current share price is a P/E of around 6.7x. I think the reason for the drop from the 52-week high is that the trading statement created too much hype around HEPS due to the once-offs affecting that number. This adjusted P/E multiple suggests that there might be room for some upside.

Update: an earlier version of this Ghost Bite inadvertently used the prior year adjusted HEPS for an implied P/E closer to 10x. This error and the associated commentary has been corrected.

Spar sees a “clear pathway to shareholder returns” – but that path remains treacherous (JSE: SPP)

There is a severe lack of revenue growth

Spar has released results for the 52 weeks ended 26 September 2025. The past couple of years have seen Spar executing tough decisions related to the European businesses. With the strategic restructuring largely behind them, they now need to deliver improvement in the core business in South Africa and Ireland.

With group net debt down by 40% to R5.4 billion, they have more breathing room on the balance sheet to do it. The financial position was assisted by growth in cash generated from total operations of 13.3%. They still have the hangover of the debt incurred in South Africa to get rid of the business in Poland, but at least there’s now certainty over that situation.

The trouble lies in just how competitive this market is, with turnover in Southern Africa up just 2.3% and Ireland managing just 0.6% growth in euros. Both businesses experienced a minor improvement in gross margin, so gross profit was up 4.4% and 2.2% respectively. The story diverges at operating profit level though, with Southern Africa up 6.8% and Ireland down 2.8% due to pressure in that market on wage and overhead costs. We can only hope that Ireland won’t end up going the way of Poland and Switzerland for Spar.

It’s been an ugly year for the share price, down 28% in 2025. Spar may be talking about a “clear pathway to shareholder returns” but the market isn’t buying that story just yet.

Sygnia’s dividend growth is now really lagging profits (JSE: SYG)

It feels like this should be more of a cash cow

Sygnia is a solid business. With a focus on low-cost investment funds, the group has been pursuing a lucrative strategy. This is evidenced by the 12.8% increase in revenue for the year ended September 2025.

Having now decided that South Africa’s living conditions aren’t as bad as the UK’s tax burden, CEO Magda Wierzycka has moved back to the land of sunshine and Bokke. Her CEO report talks about concepts like wanting to promote venture capital growth in South Africa and being alert to opportunities around cryptocurrencies. She also talks about AI for Africa, but I think we are dreaming if we believe that South Africa has any role to play in the current global AI arms race.

It therefore seems likely that some interesting products could emerge from Sygnia in the near-term. But in the meantime, investors will have to stomach a worrying situation in which expense growth of 13.4% was higher than revenue growth. This means that profit after tax increased by only 10.4% – a solid result when viewed in isolation, but disappointing in the context of the revenue growth.

I’m afraid it gets worse when you look at the dividend, with growth of just 6.5% to 231 cents per share. In what is essentially a capital-light model, seeing the dividend grow at approximately half the revenue growth rate isn’t encouraging. This could be why the share price dipped 4.4% on the day of results.

It’s been a great year nonetheless, with Sygnia’s share price up 65% as sentiment has swung firmly in favour of emerging market businesses.

Nibbles:

- Director dealings:

- A director of a subsidiary of Invicta (JSE: IVT) bought shares worth R973k.

- The spouse of a director of a major subsidiary of Growthpoint (JSE: GRT) bought shares worth R694k.

- A director of Spear REIT (JSE: SEA) bought shares worth R275k. Separately, a family investment entity linked to the CEO of Spear refinanced a loan from Investec for R41 million, with R90.7 million in shares pledged as security for the loan. Top executives of REITs tend to make use of debt to increase their holdings over time.

- The company secretary of Famous Brands (JSE: FBR) sold shares worth R56k.

- Datatec’s (JSE: DTC) scrip dividend was a success. Based on the elections by shareholders to receive more shares in lieu of cash dividends, Datatec capitalised profits of R300 million and paid out cash dividends of R110 million. Of course, it helps that the company founder and other directors have so many shares, as they supported the scrip distribution alternative.

- Nictus (JSE: NCS) has brought an extraordinary period to a close. This obscure small cap has almost doubled its share price in 2025, yet liquidity remains really low. For the six months to September 2025, HEPS jumped from 26.51 cents to 41.04 cents. It’s all about the jump in insurance revenue in the group, with furniture retail revenue actually dropping slightly.

- Copper 360 (JSE: CPR) announced the results of the claw-back offer to raise capital. The full R400 million in fresh equity was raised, but that’s not a surprise based on how the offer was structured. The underwriter has ended up with a big chunk of the raise, as shareholders only subscribed for 63.3% of the rights offer shares. In addition to this raise, debt instruments worth R715 million will convert into shares. With the share price having shed over 70% of its value in 2025, this capital raise is the last roll of the dice for Copper 360. They cannot afford to miss any milestones now.

- Southern Palladium (JSE: SDL) issued a tranche of shares to raise A$12.74 million at an issue price of A$1.10 per share. This relates to the approval granted at the AGM held on 28 November 2025.

- MultiChoice (JSE: MCG) is bringing its JSE-listed era to an end. The delisting will proceed on 10 December. But remember, Canal+ will be back with an inward listing within 9 months. Best of all, this will include the entire Canal+ group, not just MultiChoice. I look forward to that day!

- Now that the compliance certificate required from the Takeover Regulation Panel (TRP) has been received, Safari Investments (JSE: SAR) will be suspended from trading on 17 December and will then pay the clean-out distribution before being delisted on 23 December.

- Anglo American (JSE: AGL) withdrew Resolution 2 from the agenda of the 9 December shareholder meeting. This resolution related to amendments to long-term incentive plans in light of the deal with Teck Resources. This only happens when engagement with shareholders before the meeting suggests that the resolution will fail to pass.

- In case you’re wondering, Curro (JSE: COH) is still waiting for confirmation of the dates of the Competition Tribunal’s approval process.

- Trustco (JSE: TTO) is never far away from drama, with the company refusing to entertain an attempt by the Riskowitz Value Fund to get various new directors appointed to the board. Trustco’s view is that the notice sent to the company by Riskowitz was legally defective. I can just about guarantee that this fight is only warming up.

- Oasis Crescent (JSE: OAS) announced that holders of 57.05% of units elected to receive the cash distribution, while the holders of the remaining 42.95% of units elected to reinvest their distribution in the property fund.

- As another reminder to the market that they are very serious about the bitcoin strategy, Africa Bitcoin Corporation (JSE: BAC) has appointed Dr Saifedean Ammous as Bitcoin Strategic Advisor.