Accelerate Property Fund finds a buyer for 73 Hertzog Boulevard (JSE: APF)

This disposal is at a discount to NAV

The Accelerate Property Fund share price is fascinating at the moment. The company is trading at a gigantic discount to net asset value (NAV) per share, as there are a number of share price overhangs (like the related party issue). This means that if the entire NAV was converted to cash tomorrow and distributed to shareholders, the returns would be wonderful.

Now, converting a NAV to cash isn’t easy. There are no plans to sell Fourways Mall, so a full “value unlock” isn’t the strategy right now. But what Accelerate is doing is offloading as many other properties as it can.

Here’s the thing that the market is responding quite strangely to: if you sell a property at a discount to NAV, then it can still be at a premium to the implied value based on where the share price is trading. Using a simple example, if the NAV is R100 and the share price is R40, then converting the NAV to cash of R80 is a 20% discount to NAV and a 100% uptick in value for shareholders! It’s not quite that simple obviously as the fund would still trade at a slight discount to even its cash NAV, but you hopefully get the idea.

In the case of 73 Hertzog Boulevard, Accelerate has sold the property for R68 million. They need to pay sales commission of 3% and some other costs, so they are looking at R66 million in net proceeds. The valuation as at March 2025 was R78 million. Net of costs, that’s roughly a 15% discount to NAV. There are some very good property companies on the JSE that trade at a higher discount than that. Accelerate trades at a discount to NAV of 80%, so you would expect the market to celebrate this update.

Instead, the share price dropped 12% on the day on strong volumes (by Accelerate’s standards). The key seems to be the Portside circular and getting that deal across the line, as I think the market is concerned that the small deals are getting done and the Portside circular has been delayed.

Ascendis Health wants to delist (JSE: ASC)

This time, the company wants to do it itself

You may recall a lot of social media activity and accusations flying all over the place the last time that Ascendis Health was trying to delist from the market. That time around, the potential delisting was structured as an offer to shareholders by a consortium of parties (including related parties). The price at the time was R0.80 a share.

That was back in November 2023, almost two years ago. We are now at a point where the company is considering a delisting via a repurchase of shares, which means the delisting is achieved through the use of the company’s balance sheet rather than an offer from a third party.

A cautionary announcement tells us that this delisting will be priced at R0.97 a share. Although that’s 21% higher than the previous offer, you have to think about the cost of capital over nearly a two-year period. Viewed through that lens, this offer is actually quite similar to the previous one.

The share price closed nearly 10% higher on the day at R0.90. Now we wait and see if the cautionary evolves into a firm plan to do this.

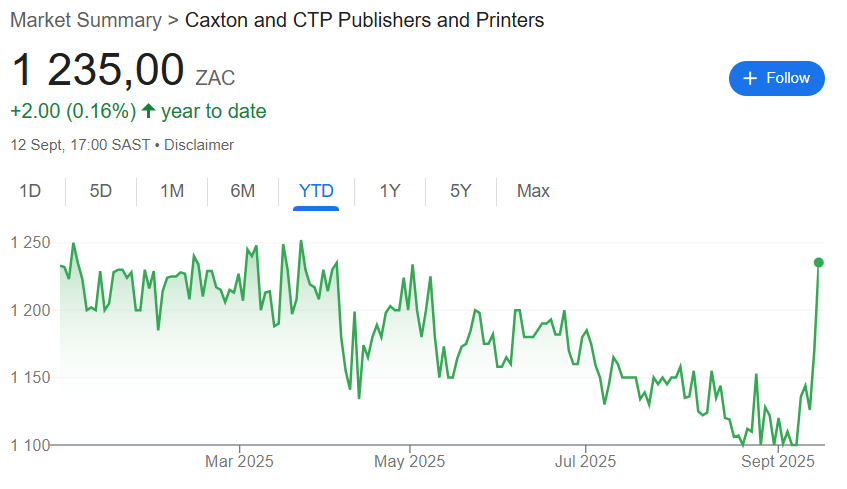

Revenue growth is hard to find at Caxton & CTP Publishers and Printers (JSE: CAT)

Kudos to management: operating profit was up in both major segments

Caxton closed 5.6% higher after releasing results that reflect a 16.7% increase in the dividend. Based on that growth, you might be expecting to see an exciting revenue outcome. Instead, revenue was up by just 0.9%! The good news is that operating costs increased by only 0.1%, so this revenue growth was sufficient to drive an improvement to operating profit in both major segments.

In Caxton’s publishing, printing and distribution business, they continued to suffer a decline in advertising revenues. Advertising was down 3%, with grocery retailers keeping local newspapers going. Encouragingly, The Citizen newspaper managed to grow revenue by 3%, with the focus on the Legal Notice market paying off (literally). Overall, Caxton has to manage a difficult treadmill in which newspaper tonnages at the printing plants are under pressure, mitigated by the volumes that Caxton is winning from retailers. Magazines are just as bad if not worse, with Caxton hoping that the education book demand from the proposed Foundation Phase curriculum rewrite will be in place for the start of the 2026 school year. As we know in South Africa, depending on government for anything is a risky strategy.

Moving on to the packaging and stationery business, Caxton has difficult underlying exposures to the alcohol industry. We know that the global trend at the moment is one of reduced consumption, so that’s something to think about over the long term. To add to the questions around structural demand, they also have a cigarette packaging operation. Thankfully, they also have exposure to quick service restaurants and the FMCG sector. These might be more cyclical industries, but they arguably have better structural demand opportunities.

Speaking of structural challenges, Caxton also has a stationery division that operates in the back-to-school space. The birth rate (and the recent news around Curro (JSE: COH) being taken private) tells us that this is also going to be a low-growth area.

As you can see, nothing comes easy at Caxton. They therefore have to focus on cost control and being as efficient as possible, something they seem to have done really well in this period.

If you work through the underlying results, you’ll see that HEPS fell by 8.8% without any normalisation adjustments. This is because of a non-recurring insurance receipt in the base period that was recognised as income. If you normalise for that, then HEPS was up 12.0%. The increase in the dividend tells us that the normalised number has high cash quality of earnings, so I’m happy to go with that.

As year-to-date share price charts go, this is quite a thing:

Gemfields executed its first emerald auction since November 2024 (JSE: GML)

They seem to be happy with the outcome

The challenge with gemstones is that their value is as much a function of their flaws and non-homogenous nature as anything else. This makes it really hard to compare the trend in auctions at Gemfields, as the underlying mix of quality is always different. This is just an unfortunate reality of the sector and it makes things trickier for investors.

One thing we know for sure is that emeralds have been in a bad place, with Gemfields having last held an auction in November 2024. They then suspended the mining operations at Kagem in January 2025 based on weak supply and demand dynamics in the market. Mining recommenced in May and they’ve now gone back to market with the first auction in nearly a year!

Thankfully, they sold all the lots including a particularly fancy gemstone named Imboo. The fact that individual stones have names tells you just how difficult it is to track any kind of trend in this space.

Management seems happy with the outcome, talking about “strong demand” and “robust prices” that “validated” the decisions they’ve taken. In the context of all the caveats I’ve provided here about comparing auctions, the price per carat tells us that this auction was way ahead of November 2024 (41% better pricing) and roughly in line with auctions in mid-2023 and mid-2024.

The Gemfields share price is down 11% year-to-date. It’s worth noting that there was a rights issue a few months ago that had a negative impact on the share price. It has recovered quite well from the mid-year pressure related to that capital raise though! The latest auction results can only help.

Schroder European Real Estate Investment Trust’s dividend is higher than its earnings (JSE: SCD)

Unsurprisingly, the market didn’t love this

Schroder European Real Estate announced a dip in quarterly earnings due to the sale of the Frankfurt DIY asset in the previous quarter. This unfortunately means that the quarterly dividend was only 90% covered by adjusted EPRA earnings (the European standard). Or, put differently, the payout ratio is more than 100%! This obviously cannot carry on forever, so the market is quite correctly being cautious here.

A much bigger risk to the dividend is the ongoing tax fight in France, where the French Tax Authority has demanded the payment of €14.2 million including interest and penalties. The group will appeal this decision and has not raised a provision, but they are ring-fencing this amount from cash reserves.

With the share price closing 6.9% lower on the day, the market is clearly concerned about what the forward dividend yield will look like. The underlying portfolio was valued at roughly the same level as the previous quarter, so there also hasn’t been any recent capital growth to get excited about.

Nibbles:

- Director dealings:

- The CEO of Argent Industrial (JSE: ART) sold shares worth R2.46 million.

- Shareholders in Fortress Real Estate (JSE: FFB) are being given the choice to either receive a cash dividend or a dividend in specie of shares in NEPI Rockcastle (JSE: NRP). This is in line with the recent approach taken by Fortress regarding creatives uses for its 15.2% stake in NEPI Rockcastle.

- Altvest Capital (JSE: ALV) will start trading under its new name Africa Bitcoin Corporation from Tuesday 23rd September. The new share code is JSE: BAC and the underlying preference shares will also all change their stock codes.

- Kore Potash (JSE: KP2) released its interim financials for the six months to June 2025. As an exploration company, the progress made on developing the project is usually more important than the specifics of the financials. The company is still in the process of finalising the funding package with OWI-RAMS GMBH, with full focus on moving towards financial close. The company had a cash and cash equivalents balance of $3.5 million as at 30 June 2025.