Say goodbye to the Accelerate dividend (JSE: APF)

The pain for shareholders in Accelerate never seems to end

In March, Accelerate Property Fund released a trading statement dealing with the year ended March 2023. It suggested that the distribution would be at least 15% lower than the prior year, attributed to an increase in the number of shares in issue by 26.5%.

Rather shockingly, the company has now said that there is no distribution for the year. At all. This has nothing to do with the number of shares in issue and everything to do with a need to “strengthen its financial position and liquidity requirements” – in other words, they can’t afford to pay anything to shareholders.

Bell Equipment releases a great trading statement (JSE: BEL)

This is much happier news than the last update

The ink is barely dry on Bell Equipment’s last announcement that gave the market the surprising news of a resignation by the CEO. Leon Goosen will be leaving on a high note it seems, with incredibly strong HEPS growth in the six months ended June 2023.

HEPS will be at least 30% higher, which suggests a minimum of 273 cents for this interim period. On a share price of R15.30, you get to a pretty appealing valuation multiple if you annualise that number.

The increase has been attributed to stronger market conditions this year, so that’s also good news.

Some bites from Bytes in Ghost Bites (JSE: BYI)

There’s a brief update on recent trading from the AGM

Bytes Technology Group has had a cracking year. I’ve been very pleased to have it in my portfolio, up 53% this year alone.

This is a UK-based software, security and cloud services group that was unbundled by Altron. Ahead of the AGM on Wednesday afternoon, the company released a short update on recent trading conditions since the release of full year results on 23 May 2023.

The first four months of the new financial year have seen double digit growth in gross profit and adjusted operating profit, which is lovely. However, margins have come under pressure, with gross invoiced income growing at a significantly higher rate than gross profit. There have been high volume, lower gross margin software deals in this period.

So although the net picture looks good for shareholders, investors need to be mindful of the impact of potential margin pressures going forward. For now at least, double digit growth in earnings is rather delicious, although Bytes is trading on a fat multiple that reflects high growth expectations.

Bad news at Hulamin (JSE: HLM)

NUMSA has embarked on a strike

Perhaps the only saving grace for the South African economy is that we’ve seen relatively less labour action in recent years than I remember seeing a decade ago. Hulamin isn’t quite so lucky at the moment, with NUMSA deciding to embark on a strike.

The dispute relates to employee benefits, of course. Hulamin says that it is willing to engage on a complete agreement that is compliant with the law. This implies that NUMSA is only willing to discuss some parts of the agreement and not others.

Either way, this isn’t what any company needs right now.

Kibo Energy’s subsidiary locks in a joint venture (JSE: KBO)

Mast Energy Developments has agreed on a JV with a consortium of investors

Kibo Energy has announced that its UK-based subsidiary Mast Energy Developments (MED) has agreed a joint venture with a consortium led by institutional investors. Under the terms of the deal, MED will contribute low-carbon flexible gas generation peaker plants into the joint venture and the investors will put in £31 million in capital over time. The initial contribution is £5.9 million.

To be clear, there’s no cash contribution from MED, with the company holding 25.1% in the joint venture. Effectively, MED has sold off a 74.9% stake in its asset through contributing it to the joint venture. Interestingly, MED will have joint control of the board and full control of the operations. MED will be paid a fee under a five-year management services agreement.

The investors will receive 90% of profits until the investment has been recovered in full, at which point the dividends will revert to the percentage shareholdings.

It gets complicated, but the entire transaction also allows MED to repay £800k to Kibo Energy, leaving £432k owing to the listed group.

Groundbreaking stuff from Naspers / Prosus (JSE: NPN | JSE: PRX)

Imagine this: a structure without cross-holdings

The circular for the unwinding of the cross-holding structure in the Naspers / Prosus group has been released. If you want to read it, you’ll find the whole thing here.

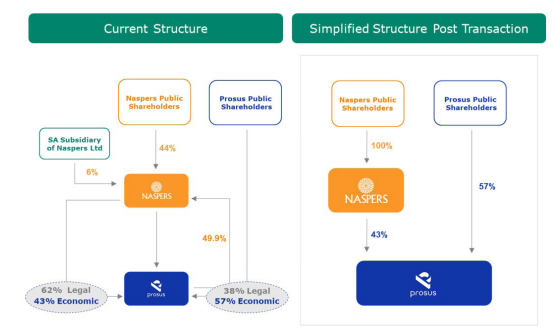

It’s a quantum leap forward for corporate structures. After all that time and money, they’ve arrived at the conclusion that the structure on the right is the correct one:

I know, right? Imagine a world in which Naspers shareholders hold Naspers, Prosus shareholders hold Prosus and Naspers has a big chunk of Prosus. Where is the fun in such a simple structure?

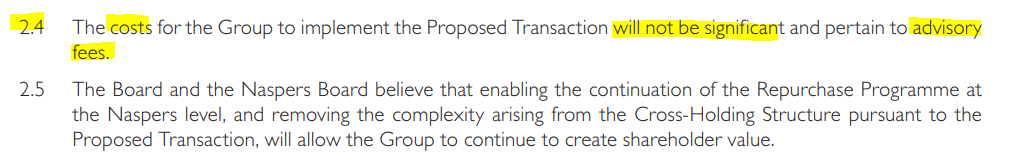

But the best is yet to come, dear JSE investors. I’ve never seen a company get away with not disclosing the costs of a circular, yet this is all that Prosus needed to disclose:

Not significant? What, as a percentage of the gigantic market cap? Come on.

Sasol is focused on air quality, not just earnings quality (JSE: SOL)

But not enough has been done

I’m certainly not going to pretend to be an expert in this space, or even a reasonably useful novice. Thankfully, the Sasol announcement about this issue is pretty clear.

Under the National Environmental Management: Air Quality Act 39 of 2004 (you need a breath of clean air just to be able to say that), Sasol needs atmospheric emission licences that are based on Minimum Emission Standards. There is the ability to apply for a facility or part of a facility to be regulated on an alternative emission load basis.

Sasol made this application for the boilers at the Secunda Operations and this application has been declined by the National Air Quality Officer. Sasol can (and will) appeal this to the Minister of Forestry, Fisheries and the Environment.

The group has spent over R7 billion over the past 5 years on emission reduction projects. This has led to 98% compliance with the Minimum Emission Standards. 98% is not 100%, as shareholders may now learn. Sulphur dioxide emissions from the boilers at the Secunda Operations are the major remaining challenge.

This isn’t something that can be fixed overnight and Sasol has an existing roadmap to try and achieve this. The regulator has clearly sent a message here. For investors, solutions come at a cost, so this isn’t good news for Sasol overall.

It’s probably good news for residents of Secunda and surrounding areas.

A smaller loss at Sebata – but still a loss (JSE: SEB)

The delayed results will be released this week

Sebata Holdings is late in the release of results for the year ended March 2023. Full results will be out this week, with a trading statement available to give shareholders an idea of what is coming.

The headline loss per share is between -13.98 cents and -14.98 cents, a very large improvement over -443.68 cents in the comparable period.

In case you’re wondering, the delay related to valuations that needed to be finalised for the current water and software B-BBEE deals.

Tharisa updates the market on quarterly production (JSE: THA)

Investors are as focused on the cash balance as they are on mining production

Tharisa’s share price has been getting properly whacked in recent weeks, driven by weakness in PGM prices. The 52-week low of R16.70 was hit on 10th July, a far cry from the 52-week high of R26 that we saw in December 2022.

Tharisa can’t control its share price and certainly can’t control commodity pricing. It can control its production and capital allocation though, which is why this quarterly update is important.

PGM output increased by 7.9% in Q3 vs. Q2, thanks to improved recoveries and a steady yield. In chrome, output fell by 6.4% despite a comment that grades, yield and recoveries were steady.

Pricing is where it all went wrong, with PGM prices down 16.6% in Q3 vs. Q2. Metallurgical grade chrome thankfully saw a 7.8% increase in price over the same period.

If we look at the nine months to June instead of just the third quarter, then year-on-year production is almost identical in chrome and is almost 15% lower in PGMs. Pricing for chrome is up by a very healthy 28%, with PGM pricing down nearly 22%. In those statistics, we can see why Tharisa is happy to have both commodities rather than just PGMs.

Importantly, cash on hand has increased from $205.8 million at the end of March 2023 to $242.6 million at the end of June. The net cash position is up from $101.1 million to $141.5 million over the same period. So with a market cap of roughly R5.6 billion, around R2.65 billion is in net cash.

The Karo project is on track, with a $135 million equity contribution by Tharisa over the course of the project. A recently concluded $130 million facility is undrawn as at the reporting period.

Tharisa seems to offer better PGM exposure than some of the alternatives in the market, though you can’t ignore the impact of PGM pricing on the share price.

At the end of June, Tharisa joined the Unlock the Stock platform (alongside property group Attacq) for a management presentation and Q&A. You can watch it here:

Little Bites:

- Director dealings:

- A director of Oceana (JSE: OCE) has sold shares worth R764.5k.

- An associate of a director of Afrimat (JSE: AFT) has sold shares worth R234k.

- A director of Growthpoint (JSE: GRT) has sold shares worth nearly R78k.

- The scheme to delist Premier Fishing and Brands (JSE: PFB) has become unconditional and the delisting date has been set as 1 August 2023.

- The COO of Fortress Real Estate Investments (JSE: FFA | JSE: FFB), Donnovan Pydigadu, has resigned. He will stick around until 31 December 2023 until moving on to new opportunities. He has been with the group for six years.

- Delta Property Fund (JSE: DLT) has appointed Fikile Mhlontlo as CFO. His previous roles have included some tricky public sector posts like Denel and SAA, so he seems to bring experience in dealing with difficult financial circumstances.

- In case you’re keeping score, Impala Platinum (JSE: IMP) now holds a 56.43% stake in Royal Bafokeng Platinum (JSE: RBP).

- If you’re in the audit industry, you may find it interesting that Telkom (JSE: TKG) has transitioned from joint auditors to a single auditor. The current auditors are PwC and SNG Grant Thornton, with Telkom selecting PwC as the sole auditor going forward. Shareholders will need to ratify this at the Telkom AGM.

- Sable Exploration and Mining (JSE: SXM) could be the smallest company on the JSE, with a market cap of R2.5 million. It now has a full time financial director at least, with the part time director having resigned.