Advanced Health releases the delisting circular (JSE: AVL)

The proposal is to take the company private at 80 cents per share

After a firm intention announcement was released back in June, Advanced Health has now released the circular for the offer being made by Eenhede Konsultante. There are certain shareholders who are moving into the private space with the offeror, with a collective existing holding of 71.13% in the company. In other words, the scheme will be voted on by shareholders who have 28.87% of the company.

The offer price is more than double the 30-day VWAP before the date of the firm intention announcement. A big premium like this is rare, though it becomes necessary when there is a small voting class.

Based on the opinion from BDO, the Independent Board has determined that the scheme is fair and reasonable to shareholders.

Kudos to the corporate advisors Questco for putting together such a fresh looking scheme document. Circulars are normally very ugly things, but this circular looks fantastic.

AECI: earnings up and dividend down (JSE: AFE)

There’s too much debt at this point in the cycle, so the banks are first in line for cash flow

In the six months ended June 2023, AECI posted a solid set of numbers until you get below the EBIT (Earnings Before Interest and Taxes) line. Let’s start at the top.

Revenue increased by 19%, which is a solid start to any story. Operating margins also look good, with EBIT up by 20% despite a R180 million loss in the problematic Schirm Germany business. This is significantly worse than the loss of R86 million in the prior period. A turnaround strategy is underway in Germany.

EBITDA and EBIT margins were stable at 10% and 7% respectively. This brings us to the end of the good news.

HEPS has only increased by 5%, a direct result of net finance costs increasing from R124 million to R274 million. This is because net debt is up to R5.7 billion, which is pretty chunky vs. interim EBITDA of R1.8 billion. You would need to annualise that number to work out a net debt to EBITDA ratio. The company indicates net debt to EBITDA of 1.6x.

The company acknowledges that gearing is too high at this point in the cycle. Reducing this is a priority, helped by a solid working capital performance that saw cash from operations increase by 20%, ahead of EBITDA growth of 18%.

The clear need to focus on the debt is why the dividend is 48% lower at 100 cents per share.

Altron: a creative use of “once-offs” (JSE: AEL)

The slide in the share price continues

Altron’s recent financial reporting has highlighted some incredibly dubious “once-offs” – theoretically, unusual items that shouldn’t happen again. A problem in the core business that is a clear business risk is not a once-off.

For example, Altron Nexus (now a discontinued operation) engages in public sector work. We know that this is risky stuff, so the fact that the contract for phase 3 of the Gauteng Broadband Network (GBN) contract wasn’t awarded to the business despite having personnel and infrastructure in place from phases 1 and 2 isn’t a once-off. It’s a business risk of a contract not being awarded or renewed!

As another example, the heavily debt burdened City of Tshwane owes money to Thobela Telecoms. Altron Nexus is the EPC contractor to Thobela and won’t get paid unless Thobela gets paid. Again, the government not paying people isn’t a once-off.

Altron Nexus just keeps taking bullets, as there is also litigation underway by Aeonova (a sub-contractor on the GBN contract). It initially looked like the possibility of an arbitration award was remote, but subsequent proceedings have led to a revised view. No provision has been raised as of yet for this matter, so this issue may still be coming in the numbers.

Total provisions for R336 million have been raised for Altron Nexus, which is held as a discontinued operation. Cash restructuring costs of R11 million have also been incurred. There’s a further goodwill impairment of R33 million.

But wait folks, there’s more.

After the failed disposal of Altron Document Solutions, new management was appointed to restructure the business. With two of its large customers facing financial difficulties, provisions of R95 million have been raised against this asset which is also recognised as a discontinued operation.

Together, Altron Nexus and Altron Document Solutions contributed 21% to group revenue in the year ended February. They were loss-making, so no profit will be lost here once they are out of the system.

The continuing operations are Netstar and Altron Systems Integration, with the update giving a more positive outlook on their profitability.

For the six months ending August 2023, Altron expects to generate HEPS from continuing operations of between 43 cents and 51 cents, representing an increase of between 5% and 24%. They really need to sort out the troublesome businesses though, as the headline loss per share from total operations will be between -64 cents and -57 cents, an ugly swing from headline earnings per share of 34 cents in the comparable period.

I could only laugh at this comment in the announcement. If management intervention is required to ensure that “once-offs” do not recur, then they weren’t once-offs in the first place!

AVI managed to push through selling price increases (JSE: AVI)

Even I&J increased revenue – but only just!

For the year ended June 2023, AVI managed to increase revenue by 7.8%. The star of the show was Snackworks, with growth of 11.9% and a contribution of 35% to revenue. As we’ve seen in PepsiCo on the global stage, people are willing to cut their food cost but not when it comes to their favourite snacks!

Footwear & Apparel also did well with a 12.3% increase, though it is the second-smallest segment in the group. The laggard was I&J, up just 0.5% and contributing 16.7% to group revenue. There were various reasons for this, including a fire at one of the I&J facilities.

The overall revenue increase was attributed to selling price increases. Gross profit margin improved slightly, which I think is very impressive in this environment. The revenue mix is a factor here, with higher margin categories doing well in this period.

A less ideal situation is that selling and administrative expenses increased at a rate above inflation, with fuel prices as the major culprit. There were other costs pressures as well.

So, despite revenue growing 7.8%, operating profit was only 6.9% higher. I&J’s earnings were lower because of the sideways performance in revenue. Every other segment experienced positive earnings growth.

Cash conversion sounds promising, with the company noting a decrease in working capital. Net debt is within target range, despite an increase in capital expenditure vs. the prior year as the group caught up on projects that had been delayed during Covid.

As there are more shares in issue than before because of incentive schemes, consolidated HEPS will only increase by between 3% and 5%. AVI is a remarkably defensive business but the share price has been the victim of a valuation that was simply too high.

British American Tobacco is crawling along (JSE: BTI)

Low single-digit growth remains the order of the day

I don’t really understand the appeal of British American Tobacco to investors. I get the arguments around being a rand hedge, as well as the high dividend yield, but that doesn’t make it a great investment. There’s an argument around how defensive the model is, yet I’m quite sure that pharmaceuticals and perhaps alcohol businesses will offer more defensive characteristics in years to come, especially as the British American Tobacco business transitions into “non-combustibles” with unproven profitability.

Interestingly, neither British American Tobacco nor AB InBev have done well over 5 years, though the cigarettes offer a much higher dividend than the beers:

In the six months to June 2023, British American Tobacco achieved revenue growth of 4.4% (or 2.6% in constant currency). New Categories grew by 26.6% and is now 16.6% of group revenue, yet still isn’t profitable.

Reported profit is up substantially because of major once-offs in the base. Adjusted profit is up 3.6% in constant currency, with margin up 40 basis points to 44.3%.

Adjusted net debt has decreased by 2.3% to £37 billion. Yes, billion. This group is an absolute monster, with a market cap of R1.47 trillion. Yes, trillion.

The company is currently paying a quarterly dividend of 57.72 pence per share. That’s roughly R13 per quarter, or R52 a year off a share price of R612.

Are lab-grown diamonds starting to hurt De Beers? (JSE: AGL)

The company is blaming macroeconomic challenges for a slowdown in sales

Luxury groups like Richemont and more recently LVMH have flagged a slowdown in US sales, although Asia seems to be doing just fine. Diamonds are a bit different to these luxury products in my view, as social pressures means that most married couples have bought a diamond at some point even though they can’t possibly afford a Richemont or LVMH product.

This makes diamonds more vulnerable to economic slowdowns than true luxury brands. If that’s the real reason for the drop in sales value at De Beers (part of Anglo American), then so be it. There’s another potential reason though: lab-grown diamonds. I can’t find a reliable estimate of lab-grown diamond market share, but it isn’t insignificant and it is definitely growing quickly.

I suspect that it will be a long time until De Beers publicly acknowledges this issue in a sales value update. With Cycle 6 sales of just $410 million vs. $456 million in Cycle 5 and $638 million in Cycle 6 of 2022, can we really attribute the drop purely to macroeconomic conditions?

Labat is making progress, but is paying big multiples (JSE: LAB)

Acquisitions and store rollouts are underway

Labat Healthcare (the cannabis business) seems to be making progress.

On the acquisition front, the company will acquire the remaining 30% in CannAfrica for a price of R6.4 million, partly settled through the issuance of Labat shares at R0.12 per share. That’s higher than the current price of R0.07 per share. There’s also a cash payment of R2.8 million.

CannAfrica’s profit before tax for the year ended May 2023 was R672k and the net asset value was -R2.4 million. Ignoring the negative net asset value, that’s a gigantic valuation. If we scale up that price to a 100% stake, it implies a value of over R21.3 million or a Price/Earnings multiple of 31.7x! I can see why shares are being issued at a premium to the current price to pay for it.

Importantly, the rollout of Labat Healthcare stores seems to be going rather well. There were 10 franchised stores and four owned stores in the recent financial period, with two of the owned stores sold to franchisees after the end of the period. It’s a good sign that people are willing to buy the stores, as this suggests that the economics are decent.

There’s a long list of identified locations for further store rollouts. That’s meaningless until the stores actually exist.

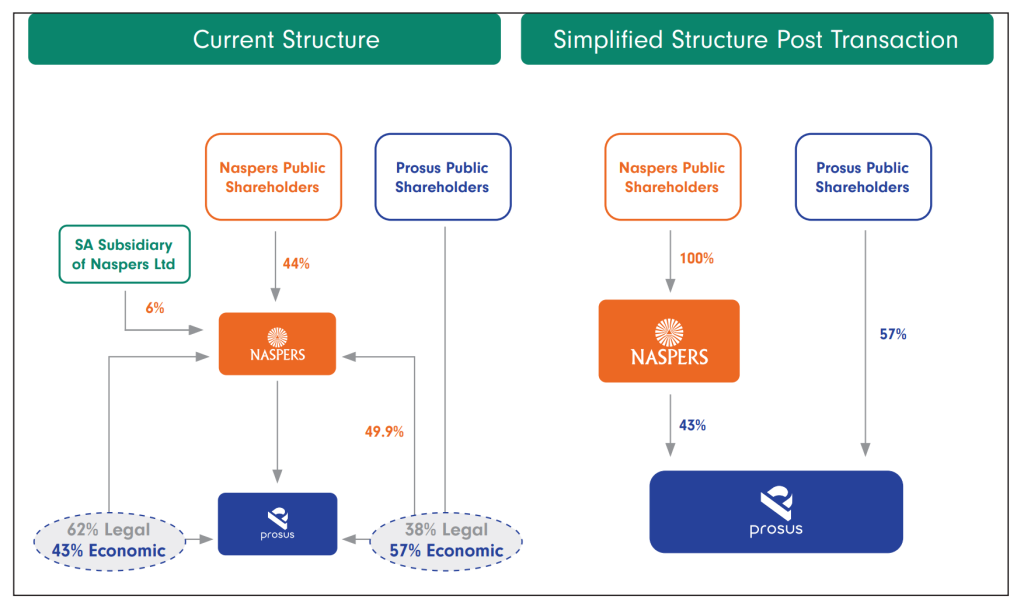

Naspers publishes the cross-holding removal circular (JSE: NPN | JSE: PRX)

The unwind of the century is upon us

Naspers wants to make sure that shareholders have seen this notice. In fact, they’ve published the full notice in Ghost Mail here.

The other thing you need to read (including if you are a Prosus shareholder) is the actual circular, which you’ll find at this link.

Although the Naspers – Prosus structure is still complicated and has no shortage of critics, this is at least a step in the right direction:

A brief update from RAC (JSE: RACP)

The owner of Goldrush has given an update at the AGM on trading conditions

In an update from RECM and Calibre (RAC), we learn that alternative gaming business Goldrush has seen its trade “recover somewhat” during the first four months of the new financial year. The issue here has been load shedding. You can’t play electronic bingo without electricity, unfortunately.

With power generation shortcomings resolved, the bingo and limited payout machine (LPM) divisions have generated revenue in line with the prior year. The retail sports betting and online divisions are up year-on-year, taking group level results into the green for this period on both a sales and profit basis.

Little Bites:

- Shareholders of Steinhoff (JSE: SNH) have resolved to dissolve the company. I have no idea why the share price recently more than tripled from 4 cents a share to 13 cents a share. It’s back down to 7 cents.

- Suspended company Efora Energy (JSE: EEL) is way behind on its financial reporting. The external auditor is reviewing the 2022 interim and annual results, with a plan to finish this process by the end of August.

- 4Sight Holdings (JSE: 4SI) is changing its financial year-end from 31 December to 28 February. This means that annual results for the next period will be for a 14-month period.