Volatile EBITDA margins at AECI, but earnings are up overall (JSE: AFE)

The choppy share price reflects the underlying economics

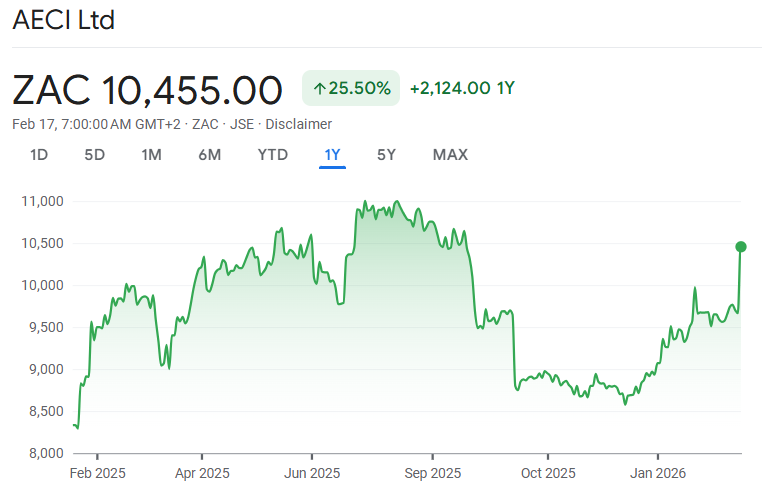

AECI’s share price has been on quite the journey. It’s up 25% in the past year, but this has been anything but a linear story. And as you can see from this chart, a major jump on Monday contributed strongly to the return over 12 months:

You’ll note that the starting date matters tremendously when we talk about the return over 12 months. If you had bought in June 2025 rather than February, you would now only be flat! As is so often the case, the volatility in the share price is echoing the underlying business.

For the year ended December 2025, even though there was pressure in revenue, the company expects Headline Earnings Per Share (HEPS) to be up by between 43% and 58%. This is a very encouraging update.

There are important discontinued operations here, as the company has been on a mission to exit non-core businesses and reduce debt. Disposal proceeds of R2.3 billion were put to good use in decreasing net debt. The gearing ratio is now just 5%, as net debt is only R460 million vs. R3.7 billion at the end of the prior period.

If you isolate continuing operations, then Earnings Per Share (EPS) from continuing operations is expected to increase by between 26% and 40%. EPS isn’t as useful a metric as HEPS because it doesn’t strip out many of the once-off distortions, but we have to work with what the company has given us in this trading update – and they haven’t given HEPS from continuing operations.

Group revenue is under pressure thanks to an 8% decline in AECI Mining’s revenue. There were lower sales volumes in both Mining Explosives and Mining Chemicals.

Despite this, AECI Mining’s EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation – in case you need a refresher) actually increased by more than 15%. Talk about a swing in margin!

They attribute the EBITDA move to better pricing and overall margin management, which I guess is a nice way of saying that they did their best to offset the pricing pressure. That’s a good outcome, especially in the context of operating challenges at the Modderfontein facilities.

At AECI Chemicals, we find the opposite situation. Revenue was up by 5%, yet EBITDA is expected to decline by 5% thanks to bad debts. Investors never want to see something like this. Although they collected a portion of the bad debt in the second half of the year, this is the kind of knock that the business didn’t need. In more positive news, they note a particularly strong performance in the Public Water area of the business.

In summary, the business has a much stronger balance sheet and has made plenty of progress in getting the core pieces in place. They’ve also demonstrated an ability to respond to a tough revenue period. With group HEPS expected to be between R10.22 and R11.31, the current share price of around R105 suggests a Price/Earnings multiple of around 9.8x at the midpoint of guidance. But we need to wait for HEPS from continuing operations to know for sure.

I’m curious to get your views on AECI, so please vote in the poll below:

Stefanutti Stocks has highlighted an improved order book (JSE: SSK)

The company is keeping investors informed every step of the way

Occasionally, a share price performance looks more like an adrenaline sport than anything else. Over the past five years, Stefanutti Stocks has returned nearly 1,700%! And no, there isn’t an extra zero in that number. See for yourself:

This is what can happen when a company narrowly escapes death. Shareholders had to be very patient along the way, which is a reminder of the different strategy that you need to be following if you play in shares like these.

Clear market communication has been a feature of this story. They are certainly continuing that trend, with the company announcing that the current order book has increased from R13.2 billion to R15.3 billion. Only R1.4 billion is for 2026, but they’ve got R8 billion lined up for 2027 and then the rest for 2028 and beyond.

To give you an idea of how these pipelines work, they have short-term potential awards of R12.5 billion and identified prospects of R144 billion.

The Standard Bank facility is down from R850 million to R250 million, which means that the interest charge is expected to drop by 70% for the year ending February 2027.

The share price closed 3.7% higher in response to this positive update.

Telkom’s momentum continues (JSE: TKG)

The performance in prepaid is particularly impressive

Telkom’s share price is up 66% in the past year. This made it a better choice over the past 12 months than any of the Big Tech names – yes, even Alphabet (the owner of Google).

This is because Telkom has been focusing on executing a turnaround that the market approves of, rather than a strategy of throwing gazillions at fancy new technology.

For the quarter ended December 2025, which is the third quarter of the financial year, group revenue was up 1.3%.

Data revenue (up 9.6%) is relevant here, now contributing 61.6% of group revenue. They give a further breakdown of that number, with mobile data up 12.9% and fibre-related data revenue up 8.9%. Openserve now passes 1.5 million homes and has a connectivity rate of 52.4%.

To remind you of how deflationary the products are, mobile data subscribers increased by 29.3% to 19.3 million. That’s much higher than the growth in data revenue.

The prepaid market has been highly competitive recently, with Telkom managing to grow revenue by 11.6%. Subscribers were up 5.8%, with Telkom noting a stable average revenue per user (ARPU) of R61. And no, I’m not sure how the ARPU can be consistent if there’s such a difference in growth between revenue and subscriber numbers.

In the postpaid (or contract) market, subscriber numbers were up 1.2% and ARPU increased to R187. Aside from the revenue visibility that it brings, you can see why these companies are keen to convert prepaid subscribers to contracts – the ARPU is more than three times higher.

These growth engines are dragged down by areas like BCX (down 9.3%) and other legacy offerings in the group, leading to only a modest increase in group revenue.

The overall revenue story is not exciting, but the increase in adjusted EBITDA of 8.4% is an inflation-beating performance. Adjusted EBITDA margin improved by 190 basis points to 29.1%. This was achieved through a decrease in adjusted costs for the quarter. Again, BCX remains a pressure point here, with EBITDA margin falling sharply by 460 basis points to 10.4%.

This means that the group is running ahead of the 25% – 27% EBITDA margin guidance, something that the market will be pleased about.

Further down the income statement, the group has highlighted a better credit performance that led to improved impairments of receivables.

The company might not have the wild capex profile of the data centre enthusiasts overseas, but they still invested R1.3 billion in capex in the third quarter. The focus of the capex strategy is on supporting the mobile and fibre businesses.

This is an increase in capex of 19% year-on-year, so capex intensity (capex as a percentage of revenue) increased by 170 basis points to 11.7%. This is something for investors to keep an eye on in terms of free cash flow, with the group having guided capex intensity of 12% to 15%.

The share price increased 6% on the day in response to this update. Telkom is trading on a Price/Earnings multiple of below 9x, a level that tends to get local value investors rather excited.

Nibbles:

- Director dealings:

- An associate of a director of Afrimat (JSE: AFT) sold shares worth around R5.4 million.

- An associate of a director of Visual International (JSE: VIS) sold shares worth R149k. And no, there’s still no working website.

- With RMB Holdings (JSE: RMH) having announced the AttBid offer, we are now seeing Atterbury Property Fund increase its stake by buying shares in the open market. The purchases have all taken place at R0.47 per share. Atterbury Property Fund now has a 32.01% stake in RMB Holdings.

- African Rainbow Minerals (JSE: ARI) announced that Dr Patrice Motsepe is stepping down as Executive Chairman. This is based on changes to the JSE Listings Requirements that no longer allow an executive chair. Dr Motsepe will be the non-executive Chairman going forwards, which means that he will technically no longer be an employee of the company that he founded. Along with this change, the company announced Jacques van der Bijl as the new COO of the group.

- The leadership changes at Copper 360 (JSE: CPR) continue. Company secretary Phillip Venter Attorneys has resigned from that role based on a “strategic realignment of the firm’s service offerings” – this is most unfortunate timing for such a realignment, given the other major recent changes at Copper 360. A replacement hasn’t been announced yet.

- In yet another example of how there’s never a dull moment at Trustco (JSE: TTO), the company’s general meeting (the one that was requisitioned at the request of Riskowitz Value Fund) didn’t go ahead after the chairman of the board ruled that the notice convening the meeting was defective. Shareholders were given a chance to condone the defective notice, but this vote failed. According to Trustco’s board, based on the proxies received and the shareholders present at the meeting, the resolutions would’ve failed anyway as there wasn’t a majority willing to vote in favour of them. And so the wheels turn.

- Putprop (JSE: PPR) announced the appointment of Janys Ann Finn as an independent non-executive director. For such a small fund, it’s impressive to have attracted a director to the board who is the ex-CFO of Redefine Properties (JSE: RDF) and other smaller REITs.