AfroCentric’s revenue growth is non-existent (JSE: ACT)

But profits seem to have stabilised

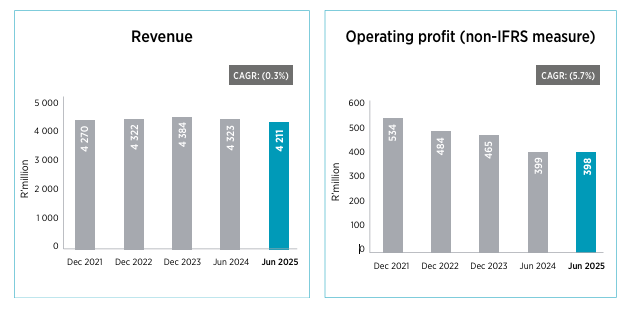

Let me begin by saying that I admire company disclosure that is consistent and transparent even when the underlying story is negative. These charts at AfroCentric are a perfect example, as no investor wants to see this combination of flat revenue and decreasing profits:

In this particular period, revenue dipped because of lower private patient scripts (they lost the designated service provider contracts in Pharmacy Direct) and the loss of margin in hospital projects. The Retail Cluster is where you’ll find these issues, with a 14.2% reduction in revenue and a 13.2% decrease in operating earnings.

The Services Cluster is a lot more encouraging, with an 8.7% increase in revenue. This only translated into a 3.7% increase in earnings though, so that’s a concern around margins.

The silver lining on those charts is that the drop in profits seems to have stopped. They’ve stabilised at the current level. Whether they will now move higher will come down to the relationship with Sanlam (JSE: SLM). Sanlam has a controlling stake in the company after a deal finalised a couple of years ago, so there’s no shortage of alignment there in making it a success.

ArcelorMittal has begun preparations to close the Longs business (JSE: ACL)

If there’s a hero out there, tell them that we’ve reached the 11th hour

The ArcelorMittal situation with the Longs business is a difficult one. The social cost of business failure is obvious and can get very ugly, but you also can’t have a situation where a business loses a fortune forever. This eventually makes it reliant on government and thus taxpayers.

This isn’t to say that ArcelorMittal and government haven’t tried to find solutions. We will never know exactly what has happened behind closed doors in terms of government’s strategy to try and save the Longs business and how seriously they actually took it, but the official company narrative is that “significant effort” was put into considering structural interventions.

Unfortunately, making an effort isn’t enough. There either needed to be huge changes (ideally in terms of both regulations and funding to protect the local industry) or the show is over. The IDC due diligence process is ongoing, so there’s still a sliver of hope for the people being impacted.

The planned closure date is 30 September, so there are still a few weeks left for a miracle to happen. In the meantime, ArcelorMittal has to start the process to shut things down, as it doesn’t happen overnight. For example, the Newcastle blast furnace has been placed into care and maintenance and further steps are now being taken towards the closure of the Longs business.

ASP Isotopes ships Ytterbium-176 and Silicon-28 (JSE: ISO)

Long story short: the commercialisation of the business has begun

In very high-tech businesses that sound like Iron Man was involved somewhere, it takes a while to get from the R&D phase to the commercial phase. But once they get there, the pain of the journey becomes the width of the moat.

At ASP Isotopes, a letter to shareholders has confirmed that the company has shipped the first samples of both Ytterbium-176 and Silicon-28. This is a hugely important step, with the company looking to fulfil customer demand of $50 million to $70 million in revenue during 2026 and 2027 just from these isotopes.

This business is all about a long-term view, with the company also planning to construct four new laser production plants starting in the first quarter of 2026. These will be used for four other isotopes where customers have indicated significant interest.

Within the ASP Isotopes stable, they are incubating a company called Quantum Leap Energy that they plan to spin-out later this year. My understanding is that this will focus on HALEU and Lithium isotopes, with the idea being to construct a critical materials plant in the US. Essentially, ASP’s strategy seems to be focused on developing routes to market and taking advantage of the current geopolitical mood in the US – not a bad approach at all.

Don’t forget PET Labs, a business that describes itself as operating in “precision oncology” – and as a particular highlight, treatments to children under 18 are free of charge. I love that.

The Renergen merger is on track to close this quarter, with just one regulatory approval outstanding. Thanks to the capital that flowed in from ASP Isotopes as part of the deal, there are now seven active drilling units on site at Renergen and the expectation is for at least $20 million in revenues during 2026. This is expected to put the business in a cash flow positive state. The conclusion of the Renergen deal should also create liquidity in the ASP Isotopes shares.

The group goal is over $300 million in EBITDA in 2030. The company is planning an analyst event in November where they will provide details on the financial plan to get there.

Here’s another fun fact about the company to finish off: 20% of the 170 employees have a PhD. 20%!

Barloworld gets through a major deal condition (JSE: BAW)

The investigation into potential US sanctions violations has been completed

Barloworld announced that the investigation into potential violations of US export regulations is done. The company needed to submit a final narrative account of voluntary self-disclosure to the US Department of Commerce, Bureau of Industry and Security (BIS).

The good news is that they didn’t find any violations of US sanctions. The bad news is that they did identify apparent violations of US export controls. The company is busy addressing these issues. That sounds like more good news than bad at this stage, but I’m definitely no expert on this stuff.

What it does mean is that the deal condition related to this matter has been fulfilled. The remaining conditions for the standby offer are competition approvals by COMESA and in Angola and Namibia. The standby offer remains open for acceptance by Barloworld shareholders.

Invicta acquires Spaldings in the UK (JSE: IVT)

The offshore growth strategy continues

Invicta has announced the acquisition of 100% of Spaldings, a distributor of agricultural products in the UK. The business has been going for roughly 70 years, so there’s plenty of track record here.

Aside from the strength of the business on a standalone basis, Invicta has been attracted to the procurement synergies that could be unlocked through collaboration between Spaldings and the rest of Invicta’s business. Buying 100% in the company right off the bat suggests that they will put in quite the integration effort, something that is more difficult when there are still minority shareholders.

The deal value is R282 million (based on current exchange rates), with an adjustment made for changes to the net asset value. There is a cap on the purchase price of roughly R322 million. Roughly 90% of the purchase price is payable on closing of the deal and the remaining 10% is held in escrow for 18 months to cover any warranty risks.

The sustainable net profit for 2025 is expected to be between R32.2 million and R36.8 million (again, at current exchange rates). The Price/Earnings multiple for the deal is therefore around 8.2x at the midpoint.

The market seemed to like it, with the share price up 2.4% on an otherwise red day for the JSE.

iOCO is on a firm footing these days (JSE: IOC)

Now we wait and see whether they can grow revenue

After a long and very difficult path to clean up the mess that was EOH and to emerge as iOCO in its new form, the company has released a trading update for the year ended July 2025 that will create plenty of smiles.

EBITDA is up by between 60% and 70% and HEPS is expected to be in a range of 35 cents to 45 cents. That’s a pretty wild swing from a loss of 10 cents for the prior year.

The share price is currently R4.20, so the mid-point of that range suggests a Price/Earnings multiple of over 10x. That seems pretty fully valued to me unless they can find significant revenue growth.

The balance sheet is also in good shape at least, with net debt to EBITDA improving from 2.7x to below 1x.

Detailed results will be released on 28 October.

Motus boosted by lower finance costs (JSE: MTH)

But market share has dipped in South Africa

If you just look around you on the road, you’ll see that things have changed in the South African car market. Chinese brands are everywhere, which means there have been substantial changes to market share at brand level. For the large companies in this space, like Motus, the change in overall group market share depends on the exact underlying mix of brands.

The disruption to the market means that Motus has seen its South African market share drop from 21.6% as at June 2024 to 20.1% in the latest period. That may not sound like much, but it’s a trend that needs to be watched carefully, particularly as the South African business contributes 56% to group revenue and 65% to EBITDA.

A mitigating factor here is that non-vehicle revenue contributed 55% to EBITDA, so the group isn’t just reliant on car sales. Their aftermarkets parts business is an important earnings underpin.

Speaking of the group, overall revenue was down 1% and operating profit was flat. It’s interesting to see that new vehicle sales suffered a 6% drop in revenue (primarily in the international businesses), while pre-owned vehicle sales were up 6%. A sign of the times?

Despite the tough results at the top of the income statement, Motus managed to grow HEPS by 5% thanks to a significant drop in net finance costs. Automotive businesses are particularly exposed to interest rates as they affect not just affordability for consumers, but also the cost of floorplan finance for the dealers. In this case though, the drop in finance costs was thanks to a reduction in debt (net debt to EBITDA improved from 1.9x to 1.5x) rather than the effect of lower interest rates.

Cash quality of earnings is strong here, with the dividend up by 6%. The confidence to maintain the payout ratio would’ve come from the performance in the second half of the year, which was much better than the first half. Momentum is a powerful thing.

More excellent numbers at Shoprite (JSE: SHP)

What more can they possibly do for the share price to start heading higher again?

Shoprite took an interesting approach in the narrative for the results for the 52 weeks ended 29 June 2025. Instead of just mentioning the percentage growth in sales as most companies do, they’ve highlighted the rand value of sales growth. I guess when another R20.6 billion is going through your tills to take you past the R250 billion revenue milestone, that’s worth shouting about.

R6.5 billion of that growth is from Shoprite and Usave, with a sales increase of 5.9%. Pricing inflation in this part of the business was below 2%, which shows just how hard it is to compete with Shoprite for their highly price sensitive customers. Despite this, they managed to move the dial in the right direction on gross margin!

Checkers was even more impressive, as has been the case for a while. An additional R11.6 billion in sales translates to growth of 13.8%. The phenomenon that is Sixty60 is still going strong, with sales up 47.7% (an incredible follow-on vs. sales growth of 58.1% in the prior year). If there are any retail executives out there in the market who still don’t think that digital is the battle that needs to be won, then it’s time for them to retire. Omnichannel isn’t the future – it’s the present. Sixty60 is now servicing customers from 694 stores, up from 539 stores in the prior period. I have confirmed with Shoprite’s CEO that when they consider opening new stores, they now wear an omnichannel hat that sees them as fulfilment centres, not just new in-store opportunities.

The strength in digital and omnichannel retail has driven growth in marketing and media revenue of 36.8%, taking it to R647 million for the period and second only to commissions received when it comes to alternative revenue. This is an important driver of gross margin.

Looking at group numbers (which includes several other businesses as well), sales were up 8.9%, gross margin expanded from 23.9% to 24.3% and trading profit increased by 16.6% thanks to expense growth being contained at 7.4% despite some substantial underlying pressures like energy costs. By the time you reach HEPS, growth was 15.8%. Interestingly, dividend per share growth was nowhere near as exciting, coming in at 9.7%.

Speaking of less exciting businesses, sales in Supermarkets non-RSA only increased by 6.4%, which is well below the 9.5% in Supermarkets RSA. In constant currency terms though, sales were up 14.2% in Supermarkets non-RSA, so there’s a currency effect here. Shoprite’s business outside of South Africa is focused on seven countries, all of which are within SADC. They are taking a low risk strategy when it comes to the rest of Africa.

Are there any reasons for concern? Well, the sale momentum in Supermarkets RSA isn’t great. Like-for-like sales increased by 6.1% in the first half and 3.6% in the second half, which means full-year growth of 4.8%.

Here’s a fun fact for you: private label participation (i.e. the percentage of sales in Supermarkets RSA from house brands) decreased from 21.3% to 20.5%. Grocery stores want to see this go up rather than down, with the negative trend explained by Shoprite having to change its chicken procurement strategy based on the closure of a local supplier in the second half of the year. If you ever wondered just how important chicken is, now you know.

The “adjacent businesses” get a lot of attention in the media, as this includes initiatives like Petshop Science, UNIQ and others. Sales grew by a substantial 39.1% in this segment, reflecting the rollout of stores in addition to underlying growth. They remain absolutely tiny in the grand scheme of things, contributing just 0.5% of Supermarkets RSA sales. But watch this space…

Shoprite’s sale of the furniture business to Pepkor (JSE: PPH) is ongoing, with regulatory approval delays at the Competition Commission due to the regulator allowing Lewis (JSE: LEW) to intervene in the deal. It’s uncertain how this will play out and what the timing will be. I think the disposal is the right strategy for Shoprite, as they need to focus on businesses where they have natural competency. Furniture is always going to be more of a credit play than anything else, hence why Pepkor is a better owner of that business.

In terms of the outlook for the new financial year, the overall flavour is one of cautious optimism. Shoprite has reminded the market of how strong its competitive positioning is, while also pointing out the tough environment. They have a trading margin target of 6% (vs 5.9% in FY25) and there are plans to keep rolling out plenty of new stores, so it’s probably silly to bet against them.

If anything, the bear case here is that the valuation is demanding in the South African context. But is it really? HEPS just grew by 15.8% and the Price/Earnings multiple is below 19x if you include the discontinued operations, or almost 20x if you exclude them. The share price has been heading steadily lower for the past year now. It feels like it’s probably due an upswing.

Nibbles:

- Sirius Real Estate (JSE: SRE) has completed the previously announced acquisitions of business parks in Dresden (Germany) and Southampton (UK). The Dresden property was acquired on a net initial yield of 9.13% and is the fourth asset held by Sirius in that area. They’ve already started the repositioning as a multi-tenanted business park. The Southampton business park was acquired on a net initial yield of 5.5% and includes adjacent development land, with discussions underway with a prospective tenant for the property.

- If you’re a shareholder in EPE Capital Partners (JSE: EPE) – which everyone calls Ethos Capital – or if you are curious about the Optasia business, then be aware that Optasia has released a corporate presentation that is available here. Ethos Capital will release results on 25 September. The reason why they are highlighting Optasia in the meantime is that Optasia is around 50% of the company’s last reported NAV.

- In the extremely unlikely scenario that you are Deutsche Konsum (JSE: DKR) shareholder, then you’ll want to check out the details of the capital restructuring plan for the company. It will include a debt-to-equity swap, the disposal of properties and an equity raise from shareholders. An extraordinary general meeting will be scheduled for October for this.

- Here’s another incredibly obscure property name: Globe Trade Centre (JSE: GTC). The company released results for the six months to June 2025. Although revenue was up 9%, the net tangible asset value per share was flat over six months. The net loan-to-value (LTV) improved from 52.7% as at December 2024 to 51.8% as at June 2025.

- AYO Technology (JSE: AYO) announced that its auditors resigned due to “capacity constraints within the firm” – this comes after 5 years of Crowe JHB acting as auditor. SkX Protiviti has been appointed as the new auditor.