Altvest goes all-in on a bitcoin strategy (JSE: ALV)

This gets the crypto crew excited, but what about all the brand equity built up until now?

It wasn’t a secret that Altvest has been looking at a bitcoin strategy. In fact, they’ve had their eye on international bitcoin treasury companies for a while, which are really just companies that have large holdings of bitcoin – for better or worse, depending on what the bitcoin price has been doing.

Now, if you’ve been following the Altvest story, you’ll know that the company has been trying to build a lot of different things at the same time in an effort to scale. They’ve also invested heavily in the Altvest brand, including billboards and the like. This makes it somewhat jarring that the way forward is a rebranding of the listed company to The Africa Bitcoin Corporation Limited (subject to shareholder approval).

Did they really need to bet the farm on the bitcoin story, as opposed to making it one of the verticals within the group, thereby taking advantage of all the work done up until now to get the group to understand that Altvest consists of many unrelated verticals? Instead, we now have a situation where a company with bitcoin in the name has exposure to a game lodge, a family restaurant and a credit fund.

They will keep the Altvest brand for the credit opportunities fund and I’m sure in other places as well, but it still feels like they are walking away from significant brand investment here. It also feels like this is going to kick off another period of management spending their time explaining to people what they actually do.

We’ve dealt with the cons. What are the pros?

Well, for those interested in crypto and especially bitcoin, Altvest is becoming a way to get exposure to bitcoin by holding listed shares. Now, I’m not a bitcoin investor and hence I struggle to see the value of this vs. just holding the coins myself, which would mean pure-play exposure to bitcoin that I’m in full control of. But as I said, I’m not even remotely the target market here.

The company press release notes a capital raising target of $210 million over 3 years (which is oddly specific), a bold target to say the least. It looks like an especially big number in the context of the announced capital raise of R11 million (yes, rand) that accompanied the announcement re: the change of name. They are looking to raise the capital at R11 per share, which is vastly above the current price of R4.60 per share.

If the management team was hoping for a strongly positive response in the share price, they didn’t get it. They got quite the opposite, with the price closing 4.2% lower on the day. In my opinion, taking the approach of focusing so heavily on bitcoin going forwards is going to be a bridge too far for most local investors, particularly as they really needed to show more execution on current projects before drumming up support for the next one.

Time will tell on this one!

AVI’s reputation for turning revenue-flavoured water into HEPS-flavoured wine remains intact (JSE: AVI)

Just 1% revenue growth was enough for them to keep moving forward

If AVI is involved in a big, sweaty ruck, then you just know that the ball is going to magically pop out on their side. The company grinds out a decent performance more often than not, even when the consumer demand environment is weak.

Heaven knows what would happen if we were actually in a strong consumer environment in South Africa! AVI would surely make a fortune thanks to people having more money for coffee and biscuits.

Such a consumer environment is just a pipe dream at the moment. In this environment, AVI could only manage revenue growth of 1% for the year ended June 2025. Despite this, gross profit margin was up 240 basis points (thanks to the beverages business) and gross profit increased by 3.4%. Add in the benefit of solid cost control and you get a 7.8% improvement in operating profit. They actually refer to it as “fastidious” cost control – a word that I can’t recall seeing any other company use! With these numbers, they can use whichever flavourful word they like.

A few other lines later (including higher net finance costs) and you land at HEPS growth of 6.1% – an inflation-beating return achieved off revenue growth of just 1%! Cash quality of earnings is high, as the total dividend is also up 6.1%.

The important thing to note with AVI is that although the group numbers look good, the performance at segmental level shows incredible divergence between the best and worst businesses. AVI has a questionable market position in Personal Care as well as Footwear & Apparel, a competitive bloodbath in which it feels to me like they have no obvious moat.

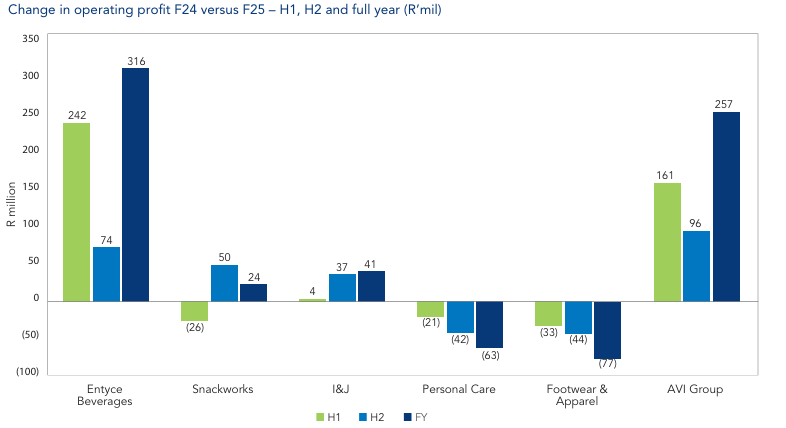

Just take a look at this chart from the investor presentation:

As you can see, Entyce Beverages is doing all the heavy lifting, particularly in the first half of this year (yay for tea and coffee). Snackworks had a strong second half that pulled the full year picture into the green (or in the case of this chart, the dark blue). I&J had a strong second half after a flat first half. But over at Personal Care and Footwear & Apparel, the second half was worse than the first half, blunting the overall second half performance.

AVI has incurred significant restructuring costs and will see those benefits come through in the next financial year. Aside from the usual factors that influence performance (like fishing performance in I&J), they are hoping for a better year in the Spitz brand within Footwear & Apparel as they move past supply chain disruptions.

Clientèle has complicated numbers, but it looks like the core business had a tough year (JSE: CLI)

Recent acquisitions have made the numbers harder to interpret

Clientèle, like all life insurance businesses, has a complicated set of numbers. Insurance sector accounting is an art unto itself, with metrics that you won’t see anywhere else (like Embedded Value). To add to the complexity, Clientèle’s acquisition of 1Life is now in the numbers.

The narrative suggests that things are far from easy in the core Clientèle business. Lower-income South Africans are struggling (as usual) and this leads to withdrawals, suspension of debit order mandates and more disputes. Clientèle has increased its assumptions around withdrawals to reflect this pressure.

The pressure is clearly visible in revenue from contracts with customers in Clientèle’s business, which fell by 3.6%. Thanks to the addition of 1Life, total group revenue was up by 3%.

The good news is that Clientèle’s cost-saving measures helped blunt the impact, with costs down 1.4% in that part of the business. But the addition of 1Life and other adjustments means that operating expenses were up by 31%! As I said, the numbers are full of complexities – and I’m barely scratching the surface here.

HEPS for the year was up by 49%, so that shows you that even the concept of headline earnings hasn’t caught all the distortions from the 1Life acquisition. Perhaps the safest thing would be to follow the cash, with the dividend up by 5.6% year-on-year.

I must also highlight the improvement in Recurring Return on Embedded Value, up from 12.0% to 16.8%. This is a key driver of the valuation of the group.

The share price is up 12% year-to-date and 24% over 12 months.

Margin pressure impacts Metrofile (JSE: MFL)

Will the company finally attract a juicy take-private offer?

Metrofile has released results for the year ended June 2025. Revenue excluding a disposed business increased by 5%, with the cloud business at least demonstrating some growth and now contributing 34% of digital services revenue (up from 32%).

Storage box volumes are down, with destruction requests having come through from clients. Therein lies the problem: I’m pretty sure that because of digitalisation, each year there are fewer new documents coming through than before. As older vintages are secured after a set period of time, I therefore don’t see how they avoid a decrease in volumes over time. Gross box volume intake was 6% and destructions and withdrawals were 8%, so they are on the wrong side of that maths.

Speaking of the wrong side of the maths, operating profit was down 12% and EBITDA fell 4%. Although there was a once-off in the base period in Kenya that unsustainably boosted prior year margins, there’s still a margin pressure story here.

Normalised HEPS fell by 19%, so the group has casually shed a fifth of its earnings base in the past year. The silver lining here is that they at least generated cash and managed to reduce net debt by 11%.

Of course, none of this will matter to existing shareholders if a juicy offer comes through for the company. Negotiations are at “an advanced stage” but the timeline has been extended based on regulatory engagements. The potential acquirer is a Delaware company held by WndrCo LLC, an investment firm built around consumerisation of software.

Speculation around the pricing of an offer (if it comes) is why the share price is up 17% year-to-date despite these weak results.

Sun International is fighting a battle for margins, but at least HEPS growth was decent (JSE: SUI)

Casinos remain a tough gig these days

Sun International has released earnings for the six months to June 2025. The numbers were negatively impacted by the Table Bay Hotel lease cessation, so the group has shown adjusted numbers as well to help investors form a view on the continuing operations.

On that adjusted basis, group income was up 6.7% and EBITDA increased by 1.1%. This immediately tells you that margins are under significant pressure. Thankfully, a 15.1% decrease in net finance costs (a function of lower debt and interest rates) led to adjusted HEPS increasing by 6.5%. HEPS as reported increased by 60.5% but that’s clearly no indication at all of sustainable growth. It’s always sensible to look at the dividend, which in this case was up 6.8%. Therein lies the best indication of the growth achieved in this period.

Unsurprisingly, online betting is the growth engine in the group. Sunbet grew income by 70.7%, while urban casinos suffered an income drop of 1.4%. They are talking about “reassessing” their “approach” to the casinos. That’s a pretty interesting comment in the context of new management and the group having walked away from the Peermont deal. There’s also a comment in the outlook statement about “redirecting resources to strategic growth areas” – another interesting comment.

Resorts and Hotels grew revenue by 4.3% (excluding Table Bay Hotel) and over at Sun Slots, income was up 2.2%. These parts of the business are at least ticking over.

The share price is up 5% year-to-date and just 2% over 12 months. The market is incredibly nervous about this sector at the moment and with good reason, as everything outside of online betting is proving to be difficult to grow.

Nibbles:

- Director dealings:

- The CFO of Sabvest Capital (JSE: SBP) bought shares in the company worth R7.49 million.

- The CEO of RCL Foods (JSE: RCL) bought shares worth R2.6 million.

- The finance director of Jubilee Metals (JSE: JBL) bought shares in the company worth R736k. It looks like these are the only shares currently held by this director in the company.

- An associate of the current CFO and soon to be CEO of KAP (JSE: KAP) bought shares worth R498k.

- A director of a major subsidiary of PBT Group (JSE: PBG) bought shares worth R24k.

- ASP Isotopes (JSE: ISO) announced the appointment of Ralph Hunter Jr. to the board. He has over three decades of experience in nuclear power, including vast experience in the regulatory environment in key markets like the US. ASP Isotopes is clearly bulking up its route-to-market strategy.

- There’s an interesting change to the board at Alphamin (JSE: APH), with majority shareholder International Resources Holding appointing two new non-executive directors to the board. The company’s constitution doesn’t allow for a big enough board for this, so we have a weird situation where the CFO will no longer be a director. Another director has also resigned, but will continue as a technical mining consultant. Strange indeed.

- Here’s some good news for shareholders in Pan African Resources (JSE: PAN) – the company is looking to move its listing from the AIM to the Main Market in London. This is equivalent to graduating from the AltX to the JSE Main Board locally. They are doing this at a time when earnings are strong, which makes sense. The potential benefit is that the company will have a stronger profile among investors, as institutional investor mandates often restrict large funds from holding shares listed on development boards. The hope is that Pan African will therefore be a viable choice for more large investors, creating a higher quality shareholder register along the way.

- Thungela (JSE: TGA) confirmed that new CEO Moses Madondo will be appointed to the board of the company on 5 September 2025.

- Standard Bank (JSE: SBK) announced that David Hodnett, current Group Chief Risk Officer, has been appointed as the new CEO of Standard Bank South Africa. Thabani Ndwandwe, the current Chief Risk Officer of Standard Bank South Africa, will be promoted to the group role to replace Hodnett.

- Remgro (JSE: REM) announced that the distribution of N shares in eMedia Holdings (JSE: EMN) will take place in the final week or so of September. As I’ve written before, this feels like a far more important deal for eMedia than for Remgro. It might show some intent from Remgro towards closing the traded discount to NAV, but it’s too small to really make any kind of dent.

- SAB Zenzele Kabili (JSE: SZK) has released a trading statement dealing with the six months to June 2025. Thanks to an improved AB InBev (JSE: ANH) share price, they’ve experienced a substantial swing in earnings from a headline loss to positive headline earnings. More important is the net asset value per share, which is expected to be between R53.78 and R59.40, up between 11% and 22% vs. the prior year. The share price is R35.96.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.