Anglo American and Teck Resources shareholders approve the merger (JSE: AGL)

Hopefully, the “merger of equals” spam will soon leave us on SENS

If there’s one thing that Anglo American has tried very hard to convince us of, it’s that the deal with Teck Resources is a “merger of equals” – and the problem is that it actually isn’t. If it was a merger of companies of similar value, they wouldn’t need to shout at us constantly about it!

Anyway, the merger of not-really-equals has been approved by the shareholders of both Anglo American and Teck Resources. The combined group will have more than 70% of its exposure in copper. It’s incredible to see the focus on copper among the mining giants. They better all hope that demand doesn’t disappoint.

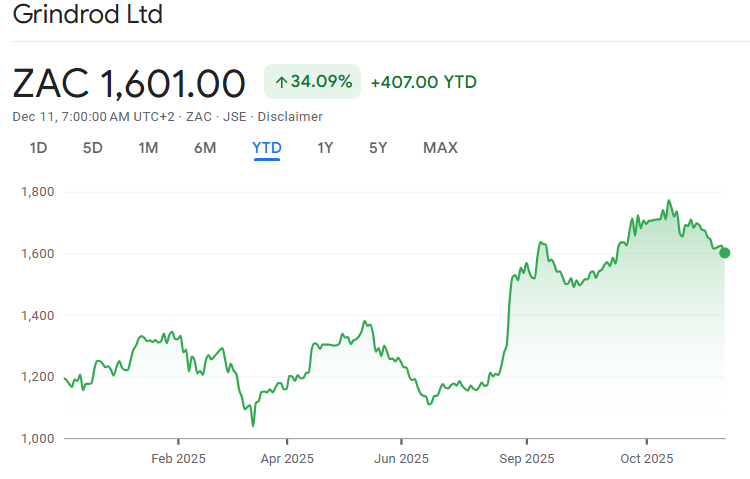

Grindrod releases a sobering update after a strong share price run (JSE: GND)

This chart looks vulnerable to me

Grindrod is up 34% year-to-date. The share price made it all the way up to R18 before falling to the current level of R16. It looks less stable than your favourite uncle after his 8th drink at the family Christmas jol:

The pre-close update is a mixed bag, so that makes this chart even more interesting. As you’ll shortly see, volumes are weak but margins are strong.

Mining commodity markets have had a tough year once you go beyond gold and platinum. Grindrod’s dry-bulk commodities experienced a 12% decline in the period. Demand for iron ore and chrome was thankfully resilient, but the reality is that Grindrod makes more money when its mining clients are making more money and shipping more products.

The dry-bulk terminal at the Port of Maputo exported 13.9 Mt for the period vs. 13.2 Mt in 2024. Grindrod’s dry-bulk terminals were good for 15.2 Mt vs. 15.5 Mt last year. Elsewhere in the business, the ship agency and clearing/forwarding operations were described as “resilient” and the recovery in the container and graphite handling businesses is slow. Low deployment of locomotives impacted their rail performance. Overall, other than Port of Maputo, volumes look tough.

The saving grace is the margin story. In the Port and Terminals segment, EBITDA margin increased from 35% to 39%. The Logistics EBITDA margin, excluding transport brokering, is down from 27% to 25%. Thankfully, Port and Terminals is the most profitable part of the business (headline earnings of R448 million in the interim period vs. R140 million in Logistics). And at Port of Maputo, the share of earnings increased by 5.6% to R338.3 million.

Although gross debt increased from R2.9 billion to R3.7 billion, the group actually improved from net debt of R0.4 billion to net cash of R0.2 billion.

There are some good news stories in here, but is it enough to support such a sharp increase in the share price this year?

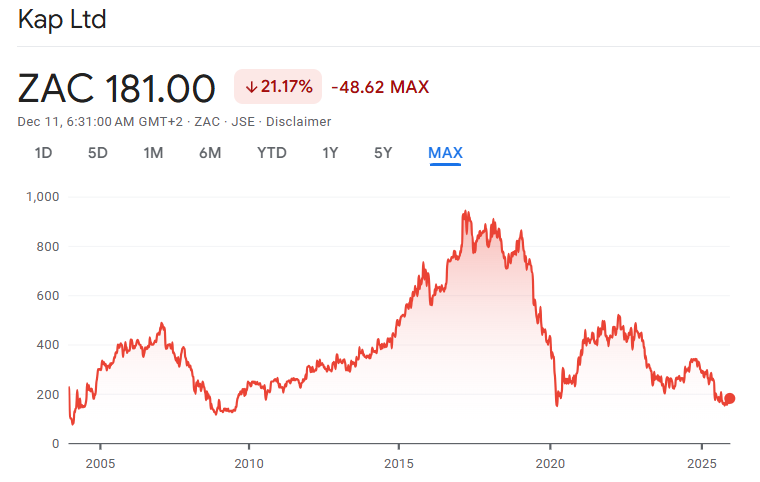

Has KAP finally found the bottom and turned higher? (JSE: KAP)

This update is strong and the market liked it

KAP closed a casual 13% higher on Wednesday on strong trading volumes. The share price is still very ill, as this long-term chart shows:

You can’t see it on this chart, but the share price is down 38% year-to-date even after the rally on Wednesday. If the bottom is indeed in, then there’s a long runway for a turnaround.

The results for the year ended June were poor. They were hit by major pressure points, including lower OEM vehicle production that impacted the Feltex business, as well as the ramp-up costs of the PG Bison MDF line that was commissioned during a period of weak demand. It’s a low base for comparison, so take that into account when you consider the trading statement for the six months to December 2025 that reflects an increase in HEPS of more than 20%.

Here’s another thing to keep in mind: the concept of “at least 20%” is the bare minimum disclosure for a trading statement. It could be only slightly higher, or it could be much higher. In all likelihood, a further trading statement will be released in January.

Where has the improvement come from? Well, PG Bison has increased its volumes and seen a better performance in revenue and operating profit. Unitrans managed to improve margins despite a decline in revenue, as the transport company is focusing on higher margin work. Feltex enjoyed higher domestic vehicle assembly volumes.

Of course, as we are accustomed to at KAP, there are one or two divisions that are still having a bad time. Safripol is the most worrying one, as this is a core division that is struggling with overcapacity in the market. It’s so bad that they stopped production at the PET plant in Durban for five weeks to rather work their way through elevated inventory levels! Both revenue and profit were down vs. the prior period at Safripol.

Finally, obscure startup Optix suffered a decline in profit. It’s long overdue that KAP got out of this one.

The scary capex cycle is behind them, with spend over the next three to five years focused on higher capacity at PG Bison and improving the average fleet age at Unitrans.

Aside from a target like R700 million annual operating profit at Unitrans over the medium term, the group is targeting a net debt reduction of R500 million in FY26. That will certainly help.

It’s great to see some positivity at KAP. But time has taught me that this diversified industrials group always has a headache somewhere, so I’m approaching it with caution. The market really loved it though, as evidenced by the share price jump.

Libstar exits fresh mushrooms and is still in talks with potential acquirers for the whole group (JSE: LBR)

The share price has been volatile in anticipation of a potential deal

As you can see on this chart, Libstar’s share price was deep in a hole earlier this year. Like the fresh mushrooms that it is now disposing of, the chart managed to spring up overnight in response to news of a potential acquirer swooping in for Libstar. Since then, it’s been choppy:

The good news is that Libstar is still engaging with the potential acquirers regarding the expressions of interest that were received. There’s no guarantee of a deal going ahead, but there’s still a good chance.

The other good news is that the company is moving ahead with cleaning up the group. For example, they’ve announced the disposal of the fresh mushroom business, other than the property in the Western Cape and the Denny brand itself which Libstar will license to the purchaser. This is because Libstar wants to keep producing certain Denny-branded products. The disposal will trigger a loss on sale of between R45 million and R55 million. This is an accounting measure of the difference between the book value of the assets and the selling price. It isn’t a reflection of whether the sale is the right decision or not.

Libstar is also assessing non-binding expressions of interest regarding the remaining Household and Personal Care business. They need to get out of that space and simplify the group as soon as practically possible.

To give a sense of trading performance, they’ve delivered a pre-close trading update for the 47 weeks to 21 November. They’ve excluded the fresh mushrooms business that is being sold anyway.

Revenue increased by 6.7%. There were some significant extraordinary items due to bulk sales, inventory clearances and business closures. If you adjust for this, then volumes were up 3.1% and price/mix contributed 3.6%. Encouragingly, gross margins were up for the year, so that speaks to an improved trading performance overall.

They are also on track to deliver the year-end debt guidance, with net debt to normalised EBITDA improving from the 1.3x reported for the interim period.

Looking at the segments, Ambient Products looks fine, with revenue up 5.6%. Volumes were down 0.4% (or up 4.5% on an adjusted basis) and price/mix contributed 5.9%. But then we get to Perishables where things went rather mad, with revenue growth of 8.1% thanks to wild swings of positive 23.2% in volumes and a price/mix reduction of 15.0%. The adjusted volumes growth is 1.4%. You can see why they’ve disclosed the adjusted numbers to try and give investors a better idea of the true performance.

Results are due for release on 17 March. The big question is whether some kind of deal announcement will happen before then.

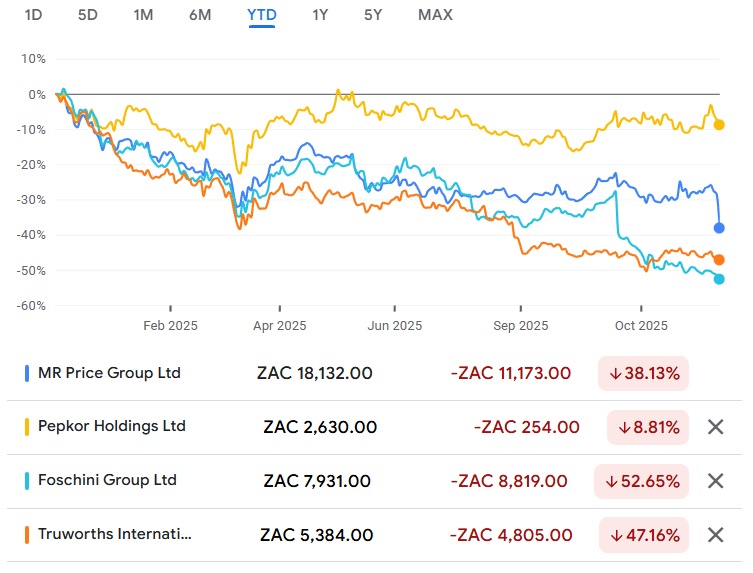

Mr Price throws a stick of dynamite at its investment thesis – and share price (JSE: MRP)

The share price tanked 13.7% in response to this inability to read the room

Until Wednesday, there were two types of FMCG companies on the local market right now: those who are executing turnarounds, cleaning up after a decade of dicey deal making and reaping the rewards, and those who haven’t figured out yet that the market is tired of ownership of non-core assets.

But now we have a third type: Mr Price. 2014 called and wants its dumb offshore strategy back, please.

In an announcement of a deal that feels like a fever dream, Mr Price announced the acquisition of 100% (first problem) of European (second problem) value retailer NKD Group GmbH from a private equity seller (third problem).

Let’s just deal with the three immediate issues.

Firstly, offshore acquisitions should always be a smaller stake with a pathway to control and eventually 100% once the business is fully understood. Running straight into a 100% stake is such poor structuring that I can’t believe the board signed off on this.

The second issue is that this business is in Europe. How many more South African retailers are going to try and get it right in Europe? NKD may be an apparel and homeware retailer in Central and Eastern Europe and thus Mr Price feels like they understand that model, but we have endless examples of local management teams who made similar mistakes in faraway lands.

Thirdly, the seller is a private equity house. Buying from private equity is rarely a great idea. These people are experts at packaging a business with a big shiny bow on it, even if the underlying business has issues. They are also focused on maximising the exit price. Negotiating with private equity houses is a dance with wolves. You might get it right, but there’s a good chance of getting bitten.

We then get to the biggest issue of all: instead of dipping their toes overseas, Mr Price has dived headfirst into a rip current near the rocks. They are paying a whopping R9.66 billion for the group, or roughly a fifth of the Mr Price market cap after the obliteration of the share price (down 13.7% on the day) in response to this news.

Mr Price notes that NKD achieved sales of nearly R14.2 billion in 2024. They are therefore paying nearly 0.7x sales for the acquisition. Yes, that’s less than the 1.2x that Mr Price trades at, but it’s not cheap.

With NKD expected to be roughly 25% of group sales after the acquisition, they are literally baking in a substantial drag on the group valuation until they rebuild trust in the market. The old days of roll-up strategies where you buy something “cheap” and the market magically re-rates those earnings once you own them are far behind us.

As a sign of just how significant the shift in sentiment in response to offshore deals has been, most of the deal value was wiped off the Mr Price market cap a short while after the announcement. The market has declared this acquisition to be almost worthless. That might be an opportunity for those willing to trust the Mr Price management team in the hope that they won’t do any more bonkers deals.

NKD did generate a significant net loss in the 6 months to June 2025, but that was because of debt refinancing and hedging derivative valuation charges. If you remove those, profit after tax was roughly R129 million for the six months. How exciting. If you go back to December 2024, the annual profit was R261 million. This means that Mr Price is paying a Price/Earnings multiple of 37x for this asset.

What on earth are they thinking?

They describe NKD as a “high performing business with a strong track record” and they talk about how value retailing is growing in popularity in Europe. They also talk about “limited distraction for both management teams” – goodness knows nobody is going to take that seriously. No amount of perfume can possibly be put on this valuation pig.

As the final nail in the coffin, they have to fund this with a mix of existing cash and debt.

This is a Category 2 transaction, so shareholders won’t be asked to vote on the transaction. They voted with their feet though, as shown on the share price chart. Unsurprisingly, Mr Price’s share price has now dived down towards where Foschini Group (JSE: TFG) and Truworths (JSE: TRU) find themselves:

The biggest irritation is that my entire investment thesis here was based on Mr Price being a simpler group than peers with more focused exposure. It was working, with Mr Price having stabilised at my in-price and looking good for a recovery towards where Pepkor (JSE: PPH) is trading. Mr Price has now thrown a stick of dynamite at that thesis and people are quite rightfully angry.

Nibbles:

- Director dealings:

- Now here’s a share purchase worth paying attention to: two entities associated with Johnny Copelyn, the CEO of Hosken Consolidated Investments (JSE: HCI), bought shares worth almost R119 million! That’s a serious show of faith.

- Nampak (JSE: NPL) CEO Phil Roux’s hedging transaction has been closed out and the underlying shares have been sold in the market. The value of the transaction that was unwound is R49 million.

- An associate of a director of Lewis Group (JSE: LEW) bought shares worth R41k.

- African Rainbow Minerals (JSE: ARI) announced that they have received R1.5 billion from Assmang in respect of the year ended June 2025.

- Labat Africa (JSE: LAB) announced that Brian van Rooyen is retiring from the board. He co-founded the company all the way back in 1995, so this really does signal the final changing of the guard. The future of the company is all about the IT sector rather than the cannabis assets that the Labat brand was known for. I wouldn’t be surprised at all to see a name change.

- Salungano Group (JSE: SLG) is suspended from trading, but they are making progress towards catching up on financial reporting. We know this because they’ve released a trading statement for the six months to September 2024 – and no, that isn’t a typo. In case you care about that period, HEPS was between 21 cents and 24 cents vs. a headline loss of 90 cents for the six months to September 2023 (which feels like a lifetime ago).

Great note on Mr Price – a shocking deal.

SA retailers all disappoint – Woolies, Tru, Foschini, Italtile, Cashbuild.

Even the CEO of Shoprite is selling shares.

Bottom line – only SA retailer to buy is Lewis and possibly Pepkor.

Everything either disappoints or is over-valued.