Attacq is on track to meet full-year guidance for distributable income per share (JSE: ATT)

This pre-close update comes at the perfect time for Unlock the Stock

Attacq has released a pre-close update dealing with the year ending June 2025. The timing is very helpful, as you can engage with the management team on Unlock the Stock this week. Attendance is free, but you must register here.

The key insight is that the group is on track for growth in distributable income per share (DIPS) of between 24.0% and 27.0%. There have been some major corporate actions sitting behind this number, as this is obviously not an indication of maintainable growth. The interim period saw the bulk of the increase, when DIPS was up by 49.1%.

Digging deeper into the pre-close update reveals a combination of organic growth metrics (like monthly trading density growth of between 2.2% and 7.2% in the second half of the year) and significant progress made in the development pipeline as well. Weighted average annual trading density growth of 3.8% is well below 5.8% in the prior year, so that’s something to keep a close eye on.

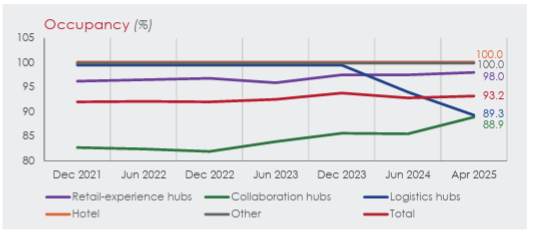

An encouraging sign is that occupancy in the “collaboration hubs” (what everyone else just calls office properties) has ticked higher:

They’ve had success in the leasing of the new office development The Ingress, noting that the property will achieve the required rental yield. This is another positive data point for the office sector, although this is a high quality building in a particularly sought-after area, so you have to be careful in assuming that the entire sector is doing better.

The next development that needs to do well is Aspire Waterfall City, which is a mixed-use development that has a large residential component (roughly 217 units). Given the unique nature of the property and where it is located, they will probably make a success of this.

Happily, the weighted-average cost of debt has dropped by 50 basis points from June 2024 to April 2025 and they are in the process of refinancing further facilities at lower margins. There are substantial debt maturities in the next 24 months, so this is a good time to be achieving better rates.

The market appreciates Capital Appreciation (JSE: CTA)

The Payments division is ensuring they live up to their name

In the year ended March 2025, Capital Appreciation grew revenue by 7.6%. Now, that might not sound like much, but it looks very juicy when you combine it with an 80 basis points increase in gross profit margin and then a whopping 340 basis points increase in EBITDA margin. This is enough to drive a 23.3% increase in EBITDA and then a 25.2% increase in HEPS. Lovely.

The high growth period has put strain on working capital, with cash generated from operations down by 34.8%. Despite this, the total dividend for the year came in 20% higher at 12 cents. Dividend growth has lagged HEPS growth though, so there is some caution around the balance sheet (despite the high current cash balance) and ensuring that they have cash available to support growth.

Growth is the thing they certainly aren’t short of, with an 18.8% increase in the number of terminals in the hands of customers. The base of installed devices is what drives revenue of course. Income from terminal sales increased 41.1% and from payments increased 18.6%.

The Software division is performing below expectations at the moment, although it did get better in the second half of the year relative to the first half. To give you an idea of the variance in performance across the divisions, Payments grew EBITDA by 25.4% and Software saw EBITDA fall by 31.8%!

The recent Dariel acquisition may be cause for concern, as the company achieved only 55% of the EBITDA warranty that formed the basis for the earn-out payment. Although that helps in terms of reducing the final purchase price, it would be far better to see strong performance in that business.

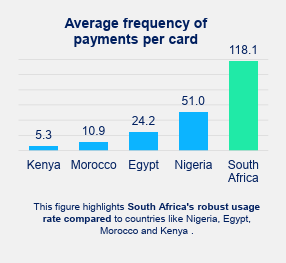

I think this chart is a nice way to finish off, showing how developed the South African economy is vs. some of our peers in terms of moving past cash transactions:

Can Grindrod maintain the second quarter momentum? (JSE: GND)

These numbers look weak and the CEO just left to rather go and be the CFO of Kumba

A few eyebrows were raised when news broke of Xolani Mbambo stepping down as CEO of Grindrod to go and be the CFO of Kumba Iron Ore instead. Sure, Kumba is a very large group, but you don’t often see a move from CEO to CFO. To add to this bearishness around Grindrod, the pre-close statement by the group isn’t particularly good.

The challenge is that it’s hard to know whether Grindrod will maintain their exit velocity. The second quarter was better than the first quarter, so a continuation of that trend would lead to a decent financial year overall.

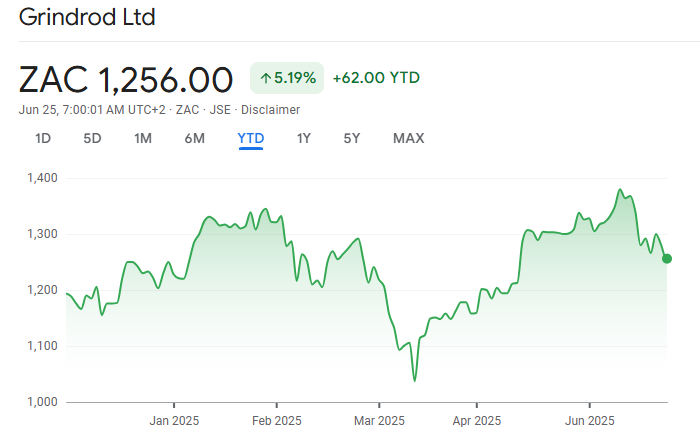

The choppy Grindrod share price reflects these concerns. This isn’t a chart that I would want to have a long position in right now:

With a weak global environment for most commodities in the first few months of 2025, the dry-bulk terminal at the Port of Maputo saw a drop in exports from 5.8 million tonnes per annum to 5.2 million tonnes per annum for the five months to May. But there were record volumes in May, so again it comes down to exit velocity.

In terms of the financial performance, Grindrod’s share of earnings from the Port of Maputo fell from R178 million to R165.9 million. Although EBITDA margin in the Port and Terminals segment increased from 33% to 35%, the Logistics EBITDA margin was down from 32% to 25%.

Despite the acquisition of the remaining 35% interest in the Matola terminal for R1.4 billion in this period, Grindrod’s group net debt is steady at R0.4 billion. This is despite a sharp increase in gross debt over the five months from R2.9 billion to R3.7 billion.

I would keep a close eye on this one.

A soft five months for Nedbank (JSE: NED)

Unlike at competitor Standard Bank, not-interest revenue isn’t saving the day

We are in a very awkward environment for the banks. Interest rates have come down just enough to start hurting their net interest margins, but not enough to drive meaningful demand for loans and advances. This immediately puts net interest income (NII) – the lifeblood of banks – under pressure. Now, this pressure can be mitigated by a strong performance in non-interest revenue (NIR), which is also a major boost to return on equity (ROE). This is what we saw play out at Standard Bank in their recent update. Sadly, Nedbank hasn’t enjoyed the same trajectory in NIR, but they’ve suffered the same fate in NII.

In terms of economic expectations, Nedbank reckons that South African GDP will grow just 1.0% in 2025, down from their original expectation of 1.4%. They specifically highlight weakness in the mining and manufacturing sectors. It’s so interesting that consumer spending has been strong this year, but I can’t see the consumer trend continuing if the underlying economy is weak. Notably, they expect a 25 basis points interest rate cut in July this year, after which rates will remain steady.

The broader economic environment led to just 5% growth in corporate loans and advances in the first quarter and then 7.5% in April, albeit off a weaker base in that month. Household credit growth was just 3.0%. Dovetailed with the recent trend in results at retailers where credit sales are doing well, this tells me that South Africans are borrowing from retailers (and buy-now-pay-later providers) to buy clothes, rather than from banks to buy cars and homes.

For the five months to May 2025, headline earnings came in flat. This is thanks to the lack of growth in NII and NIR, with even an improvement in the credit loss ratio being unable to offset this impact. Essentially, the increase in income was only enough to cover the typical growth in expenses.

Important metrics to note include NII growth in the low single digits, NIR growth above mid-single digits and the credit loss ratio within the top half of the through-the-cycle target range of 60 basis points to 100 basis points.

Nedbank’s strong performance on the market on the day of these results was thanks to global geopolitical factors, not these numbers. The share price is down 8% year-to-date. It’s worth noting that Absa is down 6.6% year-to-date, so neither of them are doing well at the moment.

Sephaku shareholders had a good day (JSE: SEP)

The market responded positively to a strong trading statement

Sephaku released a trading statement for the year ended March 2025. It guides an expected increase in HEPS of between 17% and 24%, which means coming in at between 30.0 cents and 32.0 cents vs. 25.71 cents in the base period.

This outcome was driven by improved results at both Métier and Sephaku Cement. Métier is having a better time of things right now (they talk about “strong growth” in revenue and profit), while Sephaku Cement was happy to just return to the previous year’s financial performance.

The share price closed 6.3% higher, which means that it is finally in the green year-to-date after a tough run.

Sirius Real Estate further diversifies its sources of debt (JSE: SRE)

A new credit facility sees a couple of banks lending to Sirius for the first time

Property funds need constant access to capital, as the way they grow is through property acquisitions. Although they can “recycle capital” by selling properties and reinvesting the proceeds, this is harder than raising money for new deals. Of course, being able to raise capital depends on management’s track record, so only the best funds are able to successfully raise – in a healthy market cycle, that is. When you see the sub-standard funds executing oversubscribed bookbuilds, it’s time to worry.

Thankfully, Sirius Real Estate is anything but sub-standard. They have a particularly good track record when it comes to active asset management in the property space, using various techniques to improve the valuation yield on properties over the period of ownership. This means that the market is happy to support regular equity capital raises.

Of course, a big part of the appeal of property funds is their use of leverage, so it’s equally important that they can raise debt funding as required. Sirius is also having no problems with this, with the latest example being a new €150 million unsecured revolving credit facility with a three-year term. Instead of being linked to a specific property or deal, this facility is simply available for Sirius to access as and when required. This makes it a helpful source of finance.

The facility is priced at 120 basis points above short-term EURIBOR, which in current pricing means 3.2% in euros. Importantly, it brings BNP Paribas into the fold as lenders to Sirius for the first time, with ABN AMRO also lending to the group for the first time in over a decade. The final bank in the consortium is HSBC

This is the firepower that Sirius needs to keep executing deals in Germany and the UK at a debt:equity ratio that makes the returns work for investors.

Nibbles:

- Director dealings:

- Des de Beer bought shares in Lighthouse Properties (JSE: LTE) worth R81k.

- Sun International (JSE: SUI) has managed to jump through the hoops required to get a work permit for Ulrik Bengtsson, the incoming CEO. He will take up the new role on 1 July 2025.

- If you’re interested in Naspers / Prosus (JSE: NPN | JSE: PRX), then be aware that the company is hosting a capital markets day in London on Wednesday 25th June. The presentation will be available after the event and I’ll be sure to cover some of the most interesting insights here in Ghost Bites.

- Vukile Property Fund (JSE: VKE) has decided to wind up the share purchase plan, in which loan funding was provided to directors and key executives to buy shares. This is fairly common in the property sector. The problem is that the scheme pre-dates COVID and hence the returns were very disappointing. By letting it run this long, participants are at least mostly at break-even or slightly in the green, although a few are in the red. Vukile has avoided an approach of simply writing off the underwater portion of the loan in previous years, as they are trying to be fair to all shareholders (without punishing their key staff). They’ve reached a point where 60% of the scheme has been wound-up and the rest will be disposed of in the coming months.

- Telemasters (JSE: TLM) has withdrawn the cautionary announcement related to an acquirer that has been sniffing around a potential offer. The acquirer has not managed to raise the required funding for a deal and there’s no point in Telemasters remaining under cautionary forever. If an approach is made down the line (backed by tangible funding), then the company will make additional announcements as required.

- Tiger Brands (JSE: TBS) has received SARB approval for the special dividend, with the payment date (7 July) unchanged. Similarly, SAB Zenzele Kabili (JSE: SZK) received SARB approval for its dividend, with that payment date having been changed to 7 July (a complete coincidence that it’s the same day as Tiger Brands).

- Cilo Cybin (JSE: CCC) has released a trading statement dealing with the year ended March 2025. The headline loss per share is expected to be between -0.8 cents and -0.9 cents. The loss has been driven by the costs incurred for the acquisition of Cilo Cybin Pharmaceutical as a viable asset.

I just want to say how much I look forward to my daily Ghostbite and thank you for a stimulating insightful witty and educational read

Such kind words Barbara, thank you!