AYO releases the GEPF repurchase circular (JSE: AYO)

The AYO board has effectively chosen the lesser of two evils

AYO Technology has released the circular dealing with the repurchase of 17.2 million shares from the Government Employees Pension Fund (GEPF) for R619.4 million.

There’s some interesting commentary in the announcement. The independent expert notes that the repurchase is unfair to AYO shareholders. The board says that it is unfair but reasonable to shareholders. That decision is based on the board’s view that the alternative is much worse, being protracted legal action with the PIC and GEPF and the risk of a negative outcome that would “potentially have resulted in the liquidation of AYO.”

It’s a mess, either way.

Clientele is sniffing around a potential acquisition (JSE: CLI)

This cautionary announcement has more details than the last one

Clientele released a cautionary announcement on 15 June that didn’t give the market anything to work with. With the release of a further cautionary announcement, we now know that Clientele is considering a potential acquisition in the insurance sector.

At this stage, there is absolutely no guarantee of a transaction being announced, let alone successfully finalised. That’s exactly why shareholders are warned to act with caution.

Delta Property just can’t catch a break (JSE: DLT)

Transactions with DMFT Property Developers have fallen through

With a share price down 97% over five years, Delta Property Fund is one of those companies that just cannot seem to catch a break. The very last thing the company needs is for transactions to fall through, especially when they went through the expense of issuing a circular and getting all the required approvals.

It’s rare to see an unconditional transaction fall through for reasons other than regulators blocking the deal. In this case, the buyer (DMFT Property Developers) failed to provide the bank guarantee or the required cash. In other words, they didn’t have the money. This sounds a lot like breach of contract, but the announcement doesn’t give any indication that the company is seeking damages. If they can’t afford the properties, I guess there isn’t much available for damages either.

The Capital Towers disposal is thus no longer proceeding. Four other enterprises were also being negotiated for disposal to DMFT. Those deals are also dead, with DMFT trying to reduce the purchase price in a way that is unacceptable to Delta.

That really is bad luck for the company.

A number of ship transactions at Grindrod Shipping (JSE: GSH)

This industry is all about managing the fleet

There’s an argument that this announcement is business as usual, as shipping companies are constantly managing the size and age of the fleet. Perhaps the sheer number of transactions triggered the Grindrod Shipping management team to release this announcement.

Without going into too much detail on the underlying transactions, the interesting thing is to take note of the different types of transactions. For example, one of the deals was to exercise the purchase option on a chartered-in supramax bulk carrier. The company also charters boats out to other shipping companies.

To give you an idea of the value of each vessel, the prices on the various transactions range from $10.8 million to $33.75 million. Age and size are relevant factors.

As a final comment, the announcement talks about “disinterested members” of the board. That always makes me laugh. It means that they have no economic interest in the transactions, not that they were bored at the meeting!

Perhaps the more important announcement relates to disclosures made by Taylor Maritime Investments (which holds 83.23% in Grindrod Shipping) about the company. It notes that the net time charter equivalent (TCE) across the Taylor and Grindrod fleet was $12,735 per day for the quarter. The breakeven level (including finance costs) is $11,700 per day. Again, this is for both fleets, so there isn’t a direct read-through to Grindrod Shipping.

Taylor also disclosed that Grindrod Shipping has repaid $28 million in debt during the quarter, with debt to gross assets now at 37.8% at the end of June 2023 vs. 38.9% at the end of March. That ratio includes Taylor and Grindrod Shipping.

If you follow Grindrod Shipping very closely, that might help with your financial modelling. Just be careful of these numbers as they apply to the broader group, not just Grindrod Shipping.

A changing of the guard at Netcare (JSE: NTC)

After a long innings as CEO, Dr Richard Friedland is retiring

Dr Richard Friedland has been around at Netcare for a very long time: 30 years in total, 18 of which have been as CEO. He will be stepping down as CEO with effect from 30 September 2024. I guess after being in charge for this long, you need to give a lot of notice!

The past few years haven’t been easy at all. Ironically, the pandemic caused a lot of problems for healthcare groups, as evidenced by this chart:

A successor will be named in due course. Goodness knows they have enough time to find someone!

Old Mutual strategic update (JSE: OMU)

There’s a lot of fluff, but there’s some good stuff too

If you like, you can refer to the full presentation from the investor update at this link. You likely need to make time to listen to the recording though, as many of the slides aren’t hugely relevant without the associated voiceover.

The section that caught me eye relates to the launch of Old Mutual’s bank, with a targeted launch in 2024 and breakeven in 2027. As Discovery will tell you, successfully building a bank is a helluva thing.

The benefit to Old Mutual is that retail deposits offer the cheapest source of funding around. Your current account pays you no interest and most savings accounts don’t pay much. This is how banks with a strong deposit base enjoy cheap funding and high net interest margin, as they lend the money out at much higher rates than they pay to depositors.

The presentation notes that the bank will be differentiated by cost. Are we seeing a potential competitor to Capitec here?

Within six years, Old Mutual hopes to be achieving a return on net asset value equal to the cost of equity plus 600 basis points. If they get that right, it would justify the price trading at a substantial premium to book value.

Of course, plans on a slide are easy. Execution is hard, especially in this economy.

Salungano gives some encouraging news (JSE: SLG)

It’s been a weird time for the group

There’s an ongoing delay in the publication of Salungano’s results for the year ended March. Shareholders don’t like that, especially when the delay is because of funding negotiations with lenders that needed to be finalised before results could be released.

It certainly doesn’t help that three directors have resigned during this period, with no replacements named as of yet.

With the share price down a whopping 51% in the past three months, the company needs to get it together. The good news is that the commercial terms for the refinancing have been agreed, subject to lenders’ credit approval. That doesn’t necessarily mean that the worst is over. It’s just a step in the right direction.

The company has committed to released results by no later than 31 August.

Spar announces its new executive team (JSE: SPP)

Megan Pydigadu certainly enjoys a challenge

Mike Bosman has been filling in as CEO after the significant recent upheaval of the Spar management team. New brooms have now arrived to sweep clean, with Bosman returning to his role as Chairman.

In the CEO chair, we find Angelo Swartz who has been with the Spar group for 16 years. His current role is Divisional Managing Director of SPAR KwaZulu-Natal, so he must’ve been having loads of fun with the disastrous ERP implementation that severely affected inventory flow in the region.

Megan Pydigadu joins as COO, moving to the retailer from EOH where she steered the group to financial sustainability as its CFO. She clearly enjoys a turnaround challenge, although Spar is in nowhere near as much trouble as EOH was when she joined.

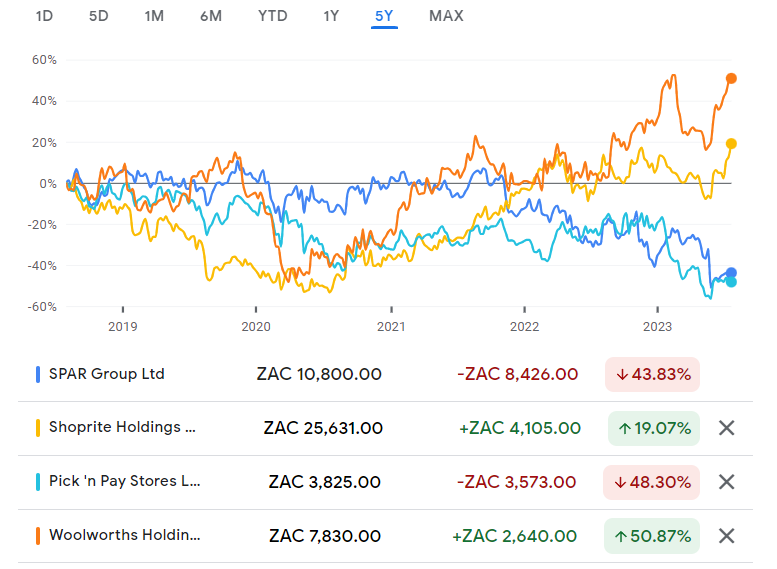

The divergence in five-year share price performance in this sector is breathtaking:

Woolworths expects a decent HEPS uplift (JSE: WHL)

The share price didn’t really react to this update

In the 52 weeks to 25 June 2023, Woolworths needs to split its results into continued and discontinued operations. The latter is David Jones, which was disposed of with effect from 27 March 2023. It wouldn’t make sense to include those numbers in a financial analysis of Woolworths.

From continuing operations (i.e. excluding David Jones), sales increased by 10.8% for the year and 9.3% on a like-for-like basis. Despite the very tough local conditions in the second half of the year, sales increased 9.2% in H2.

There’s been solid follow-through in online sales, up 9.3% and now contributing 8.3% to group turnover.

In the Woolworths Food business, turnover grew 8.5% and 6.3% on a same-store basis. That’s way below the numbers being achieved by Checkers, though that’s not an entirely fair comparison as Checkers has a much broader product range and has likely won most of its market share from Pick n Pay in the past year. The second half of the year was impressive in Woolworths Food, with growth of 9.4% overall and 7.2% on a like-for-like basis.

With price inflation of 8.3% for the year, volumes are down by around 2%. Woolworths is being squeezed on price by competitors. Product inflation was 9.9%, which means the retailer had to absorb some of the pressure in its gross margin.

Online sales in Woolies Food increased by a substantial 28.5%, now contributing 3.8% of sales.

There has been significant focus on Fashion, Beauty and Home at Woolworths. The FBH business grew turnover by 8.9% and 8.3% on a like-for-like basis. Price inflation of 11.6% suggests a 3.3% drop in volumes. Unlike in Food where sales accelerated in the second half of the year, FBH only booked growth of 6.7% in the second half of the year. Online sales grew 3.8% and contributed 4.3% of local sales.

In Woolworths Financial Services, the book increased 14.5% year-on-year which suggests a higher proportion of credit sales. The impairment rate was up to 7.3% from 4.7% in the prior year, a clear reflection on the economic health of consumers.

In Australia and New Zealand, the only business that matters now is Country Road Group. It grew sales by 12% overall and 12.4% on a like-for-like basis. When like-for-like growth is below total growth, it tells you that trading space has been reduced (in this case by 3.9%). Price inflation unfortunately isn’t disclosed. Sales growth in the second half was just 0.6%, so that’s not encouraging. Online sales contributed 27.1% to total sales vs. 31.6% in the prior year, so there has been a return to bricks-and-mortar shopping in the region.

For the 52 weeks ended June, HEPS from continuing operations should be between 10% and 20% higher. If you are happy to work with adjusted HEPS, the range is 396.2 to 432.2 cents. At the midpoint, this implies a Price/Earnings multiple of 18.9x.

Little Bites:

- Director dealings:

- An associate of the ex-CEO of Emira Property Fund (JSE: EMI) acquired shares worth R249k.

- The post-commencement finance facility at Tongaat Hulett (JSE: TON) has been extended to 6 October. This is critical to the ongoing nature of the business rescue process.

- Conduit Capital (JSE: CND) is in the process of selling CRIH and CLL to TMM Holdings for R55 million. The fulfilment date for conditions precedent has been extended to 1 September. It’s already been extended once before, from 1 July to 1 August.

- African Dawn Capital (JSE: ADW) has a market cap of just R8.5 million. That’s worth about as much as a successful restaurant! For the year ended February 2023, the headline loss per share will be between 23.49 cents and 25.52 cents. The share price is just 12 cents.