Balwin is having a much better time of things (JSE: BWN)

Imagine what further interest rate decreases could achieve?

Balwin has been a tough story in the aftermath of the pandemic, as high interest rates really hurt demand for properties. Just take a look at this share price chart for context:

As you’ll notice on the chart though, there’s been quite a rally in the past few months. Balwin is up more than 40% over six months, rewarding those who managed to get the timing right.

The results for the six months to August justify the move, with a trading statement telling us that HEPS will be up by between 25% and 30%. The midpoint of the guided range suggests interim HEPS of 20.735 cents. If we make the dangerous assumption of annualising this number, we arrive at a forward P/E multiple of 6.6x.

Balwin isn’t dirt cheap anymore, but it’s still cheap – provided that this performance can continue and free cash flow looks good. To help with that assessment, detailed results are expected to be released on 28 October.

Another day, another Cell C presentation by Blu Label (JSE: BLU)

This brings the tally to three presentations in the past month or so

With Cell C being dressed up for its IPO, Blu Label is doing everything possible to keep the market appraised of the progress of the pre-IPO restructuring and the strategy of the company. That’s exactly what they need to do at this stage in the process, so this isn’t a surprise.

The trigger for the latest presentation is in all likelihood the Blu Label shareholder meeting that took place on Monday 20th October (the day of release of the presentation). There are many complex steps to this dance, as the web of balance sheet relationships between Blu Label’s subsidiary TPC and Cell C would make even the most ambitious spider blush.

Shareholders said yes to the dress on this one, with holders of 99.99% of shares present at the meeting voting in favour of the transaction. I think the other 0.01% of holders are probably still trying to understand the presentations.

To get involved here, investors would need to take a leap of faith. If you look at Cell C in its pre-restructuring form, growth in revenue was only 1.9% in 2024 and 2.6% in 2025. But after the adjustments for the restructuring, the pro forma 2025 number is 26.4% higher than the prior year (this isn’t an indication of maintainable growth). You’ll find a similar theme in EBITDA in terms of the adjustments to 2025 making a big difference. This limits the usefulness of historical numbers and makes the guidance that much more important, with Cell C expecting net revenue growth in the medium-term of mid-single digits and EBIT margin of mid-to-high teens. They intend to pay 30% to 50% of free cash flow as a dividend, while maintaining the balance sheet at a net debt to EBITDA ratio below 1x.

When all is said and done, the group will have gross debt to EBITDA of 1.3x. Importantly, almost half the debt is related to leases, with the rest related to financial debt.

Leases are a constant source of irritation in financials at the moment. For example, Cell C’s free cash flow conversion rate is 39.4%. That sounds unexciting for a capex-light model, but this is based on free cash flow as a percentage of EBITDA – and EBITDA doesn’t include the cost of leases, which you’ll now find on the net finance costs line. No matter how capex-light you are, you still need to pay for things like space!

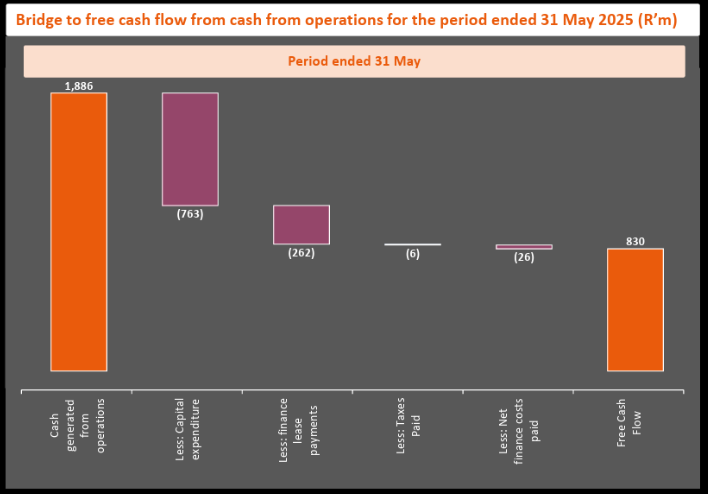

Here’s the cash flow bridge that distinguishes between capex in the traditional sense and finance lease payments. It’s a good reminder that capex-light isn’t the same thing as capex-free:

You’ll find all the recent presentations here.

Coronation’s assets under management grew nearly R100 billion in the past 12 months (JSE: CML)

Local market performance would certainly have helped here

There really are only three certainties in life: death, taxes and Coronation releasing assets under management (AUM) without giving a single comparable number in the announcement. This sends investors on a treasure hunt through SENS to find sensible numbers to give context to the latest AUM.

As at September 2025, AUM was R761 billion. In September 2024, they were at R667 billion. That’s a 14% increase in the past 12 months! The trading statement doesn’t give an indication of net flows vs. market performance, but there’s no doubt that the strength of the JSE over the past year helped them.

The HEPS move is badly skewed by the reversal of the SARS tax provision in the base period. If you exclude that, then fund management earnings per share is expected to increase by between 5% and 15%. It’s a pity that there isn’t more operating leverage in this thing, as I’m sure investors would’ve hoped for more exciting earnings growth in the context of this AUM move.

Coronation’s share price is up 22.5% year-to-date. The midpoint of HEPS guidance is around 473 cents, which puts the P/E multiple on just over 10x.

KAL group is having a strong year (JSE: KAL)

Will this bring some positive momentum to the share price?

KAL Group has released a voluntary trading update for the year ended September 2025. They plan to release detailed results on 27 November, so this update is just the hors d’oeuvre for investors.

It’s a tasty one, with the group indicating that recurring HEPS is expected to be between 7% and 13% higher for the period. When combined with a balance sheet in excellent shape (the lowest debt levels in 15 years), things are looking good.

Digging deeper reveals an acceleration across the business. The Retail channel grew trading profit by 6.4% in the second half vs. 2.1% in the first half, with better margins helping to offset some of the broader sales pressure. The Agri channel was the star of the show though, with growth of 12.2% in the second half vs. 5.2% in the first half. This was driven by better farming conditions and exports despite all the fears around tariffs. In the Fuel channel, growth in the second half was 7.7% vs. 2.8% in the first half, with better market share in farm fuel among other drivers of this performance.

This is a positive update with a strong read-through for conditions in the agri sector in South Africa.

Optasia has released the pre-listing statement (JSE: OPA)

Ethos Capital (JSE: EPE) shareholder will want to pay attention here

New listings on the JSE are such exciting things. Sure, you can already access Optasia through buying shares in Ethos Capital, but nothing beats direct exposure.

Optasia has released the pre-listing statement for an IPO that will see around R6.3 billion in value change hands, so this is a meaty transaction. Best of all, this is firmly an emerging and frontier markets story, with Optasia offering fintech services across 38 countries where levels of banking penetration remain low. They have a vast network of distribution partners and financial institutions, with Optasia operating as the platform that connects people to products like airtime credit and micro financing.

In the year ended December 2024, Optasia generated revenue of $151.2 million and had adjusted EBITDA of $75.1 million. From 2022 to 2024, they grew EBITDA at a compound annual growth rate (CAGR) of 13.1%. Things have really accelerated recently though, with EBITDA up 91.3% in the six months to June 2025! The J-curve is a beautiful thing.

The company itself will raise approximately R1.3 billion, while the other R5 billion will flow from new shareholders to the selling shareholders who will take money off the table. The selling shareholders reserve the right to increase the number of shares on offer if market demand allows it.

Up to 30.4% of the company’s shares may be on offer here at an indicative price of R15.50 to R19.00 per share. Participation in the offer is restricted to qualifying investors in South Africa, which means institutions and those who can acquire at least R1 million in shares. Before your hang your head in disappointment, remember that the shares will trade in the secondary market and hence there will be opportunities to buy shares, although the usual situation would be for the share price to start trading above the offer price. That’s the sign of a successful IPO.

If you’re keen to learn more about the listing, you’ll find everything on the IPO section of the website.

Sirius Real Estate’s defence strategy is on display in the latest acquisition (JSE: SRE)

This is a clever plan to participate in growth in Europe

Before you panic, Sirius Real Estate isn’t about to pivot from properties to panzers. Instead, they’ve recognised the defence sector as a clear growth area in Europe. These tenants tend to have specialist requirements, which is where the opportunity for Sirius comes in. To make sure they get it right, the group recently appointed a retired Major General.

Sirius is known for its dealmaking prowess and they’ve not wasted any time on announcing their first acquisition in this space. The target is a business park near Munich for €43.7 million, acquired on a net initial yield of 7.8%. The anchor tenant is Excelitas, which manufactures optical and photonic (light-related) solutions for the defence, aerospace, medical and industrial sectors. They occupy 72% of the park.

Knowing Sirius as we do, it’s no surprise that they will look to maximise rental from the rest of the space where there are far shorter-dated leases that create opportunities for rental uplift.

Southern Palladium looks to raise A$20 million (JSE: SDL)

The trading halt in Australia means we knew this was coming

Southern Palladium announced a trading halt in Australia last week in anticipation of the company releasing a capital raising announcement. The JSE doesn’t have an equivalent mechanism. The halt in Australia therefore serves as a warning that the announcement is coming, with the shares still able to trade on the JSE. This is just a weird regulatory issue for companies listed in both Australia and South Africa.

Southern Palladium will raise A$20 million at only a 2.7% discount to the 15-day VWAP, while also offering a share purchase plan of up to A$1 million to allow retail shareholders to participate. Bravo Southern Palladium – this is the model that I love to see!

The proceeds of the capital raise will be used to complete the Definitive Feasibility Study, the next critical milestone for this junior mining group. They will also be able to undertake near-term mine development activities with this capital.

The share purchase plan will allow shareholders to each subscribe for up to A$30k in shares. As for the rest of the raise, the company has achieved support from the largest existing shareholder and three new global institutional investors. It’s lovely to see this show of faith in the South African mining industry!

Spear is delivering on its mid-single digits promise (JSE: SEA)

For investors looking for yield and inflation protection, this is the kind of property fund that is appealing

Spear REIT is focused exclusively on the Western Cape, which means that the fund holds a solid portfolio of properties in the most stable province in the country from an investment perspective.

This means that investors are happy to pay up for the exposure, with Spear currently trading at around R11.15 vs. the net asset value (NAV) per share of R12.10. That’s a discount of only 8%, which is really light by property fund standards.

Spear’s guidance for the year is to grow distributable income per share by between 4% and 6%. The interim period is well within that range, with growth of 5.2%. Spear targets a payout ratio of 95%. If the payout ratio stays constant, then growth in the dividend per share will be in line with growth in distributable income per share.

It’s always very important to look at growth on a per-share basis, particularly when a property fund has been active with acquisitions. Although total distributable income is up nearly 56%, the number of net shares in issue is up 23.5%. The fund is much bigger than before, but it also needs to be divided into many more slices.

The balance sheet is in astonishingly good health, with the loan-to-value LTV ratio at just 13.85% vs. 27.09% as at the end of FY25. Most property funds run at 35% to 40%, so this is well below the average. Debt shouldn’t be seen in a negative light in the context of property funds. The idea is to be in a target range that optimises for financial risk vs. return on equity. There are at least three major acquisitions being implemented by Spear at the moment, so the LTV won’t stay down there (and nor should it).

A major driver of return on equity is the yield on which Spear can acquire more properties. Acquisitions during this period totaled R1.07 billion with an average acquisition yield of 9.54%. Debt funding is hard to come by in South Africa at lower rates than this, which is why capital growth is an important component of returns. The Western Cape positioning of Spear has been useful in this regard.

Looking deeper into the portfolio, it’s no surprise that the industrial and retail properties continue to enjoy strong demand. The commercial portfolio is the most interesting one to track, as there’s constant discussion in the market around the steady-state performance for office property and where demand will settle. A driver of growth that seems to be specific to Cape Town office property is the demand by international companies in the business process outsourcing and other sectors.

Overall, Spear remains a consistent and solid performer.

Nibbles:

- Barloworld (JSE: BAW) announced that the offeror is up to a 62.2% stake in the company. Together with concert and related parties, the stake is up to 85.5%. Will they get high enough to invoke a squeeze-out and end up with 100% in Barloworld?

- Metrofile (JSE: MFL) is running late with the circular related to the firm intention announcement that went out on 17 September. This does happen in the market from time to time. The TRP has granted an extension to Friday 24 October, so they need to get it out this week.

- Copper 360 (JSE: CPR) renewed the cautionary announcement related to planned capital raising activity. The circular for the claw-back offer and rights offer is waiting for the sign-off by the JSE of the fairness opinions prepared by the independent expert in respect of small related party transactions. The share price is down by more than 70% this year!

- I don’t often comment on non-executive director appointments, but my eyebrows were certainly raised by Nedbank (JSE: NED) announcing that ex-Sasol (JSE: SOL) CEO Fleetwood Grobler would be appointed as an independent non-executive director and member of the Nedbank Sustainability and Climate Resilience Committee. If guess if anyone understands how to deal with environmental activism and target setting, it’s a Sasol exec!

- Wesizwe Platinum (JSE: WEZ) may have caught up on the financials for the year ended December 2024, but they still need to get the interims for the six months to June 2025 done. This is why the listing is still suspended at this stage.