At Brait, Virgin Active is less dumbbell, more belle of the ball (JSE: BAT)

Things are finally on the up for the gyms

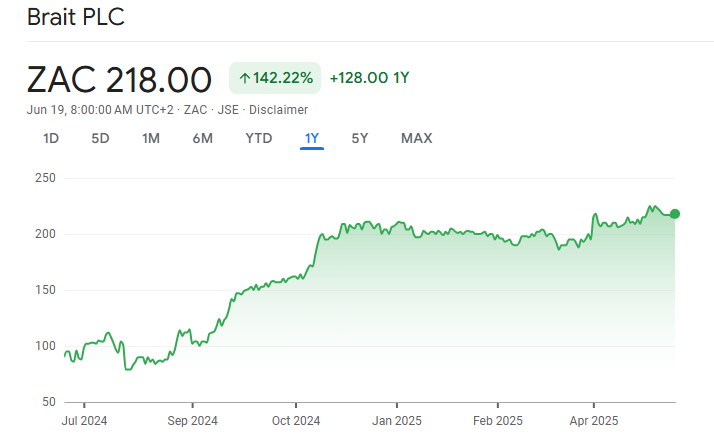

The Brait share price chart has to be seen to be believed. In fact, if you really feel like a challenge, try get one of those fancy exercise bikes to match the gradient of your cycle to the profile of this chart:

I feel tired just from looking at it.

But hidden inside that absolute mess is the performance over the past 12 months, with Brait enjoying some excellent momentum:

The results for the year ended March are a strong indication of why the chart is looking so much better. Virgin Active (62% of Brait’s assets) and Premier (32% of Brait’s assets) are doing the heavy lifting, pun shamelessly intended.

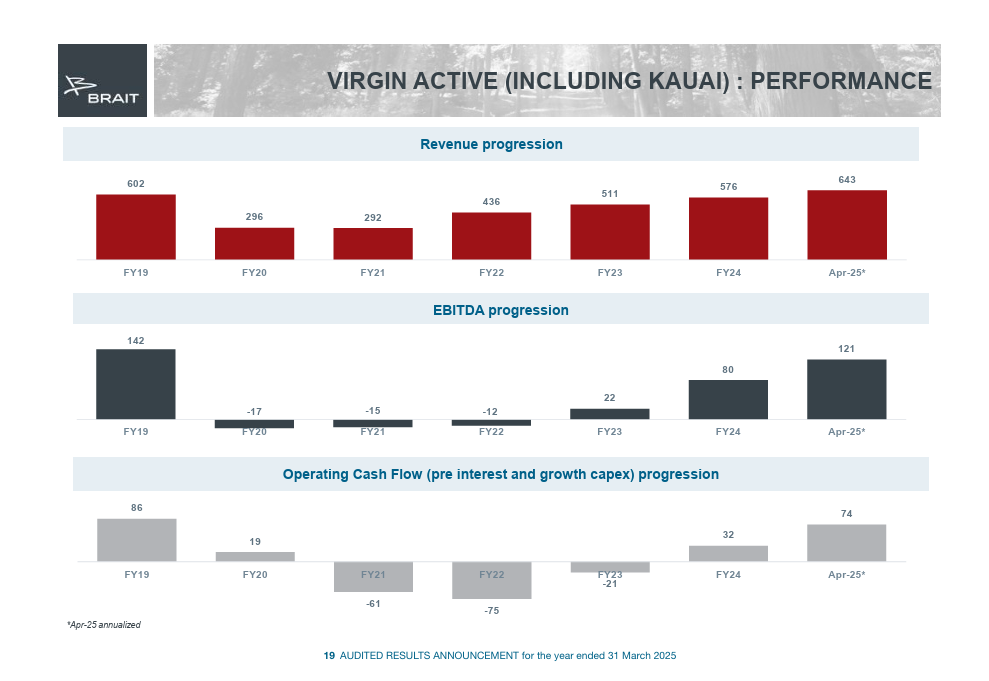

Virgin Active’s revenue increased by 13%, with positive contributions from both volumes and pricing. This is more than good enough to drive EBITDA margin higher, assisted by cost decisions like the absolutely tiny television on the wall at my local gym. Football highlights look like a group of ants on the grass on that thing. It seems to work though, with a 45% increase in EBITDA. Jokes aside, they do note a significant refurbishment programme at their gyms – I just can’t see any evidence of it at mine.

Virgin Active is far more than just a Fourways boet factory. Southern Africa is only 35% of group revenue, with Italy contributing 27%, the UK at 24% and Asia Pacific at 14%. Most regions are doing well, with the exception of Australia where they’ve now changed the management team.

As a big fan of Kauai’s offering, I’m not even slightly surprised that their revenue is up by 37%. Kauai is consistently excellent and by far my favourite choice for a healthy, convenient meal. EBITDA for the chain is up by 25% though, so there’s some margin pressure coming through there.

I thought that this slide from the results presentation tells an excellent story of the impact of the pandemic on Virgin Active and how well the recovery is going:

We have to give Premier a mention, even though that group is separately listed these days. With revenue growth of 7% and EBITDA growth of 15%, Premier has been an excellent performer. The Premier share price has literally doubled over the past 12 months, doing wonders for the Brait look-through valuation.

New Look in the UK is still a reminder of the bad old days of Brait, with a 4% drop in sales and a 3% decrease in gross profit. The UK retail fashion industry seems to be far too difficult to really be worth it. Brait is looking to sell the business and is transitioning it from an in-store to online focus.

With all said and done, the net asset value (NAV) per share at Brait increased by 6% (adjusting for the recapitalisation) to R3.06. Brait is trading at R2.18, so that’s a 29% discount to the reported NAV per share. By investment holding company standards, that discount is on the low side. This means that the market is giving more credit to Virgin Active’s valuation than before (despite the meaty forward EBITDA multiple of 9x), with the group also enjoying the value unlock of having separately listed Premier and sold down a part of that stake.

Notably, New Look’s valuation has dropped so severely that the business is now just 3% of Brait’s total assets (vs. 7% in the comparable period). Brait didn’t participate in the recent equity injection in that company, so they’ve finally stopped throwing good money after bad.

It’s great to see so much improvement at Brait, with the next obvious catalyst being the potential separate listing of Virgin Active.

Metrofile is still in the “will they / won’t they” bucket (JSE: MFL)

The company has released a further cautionary announcement

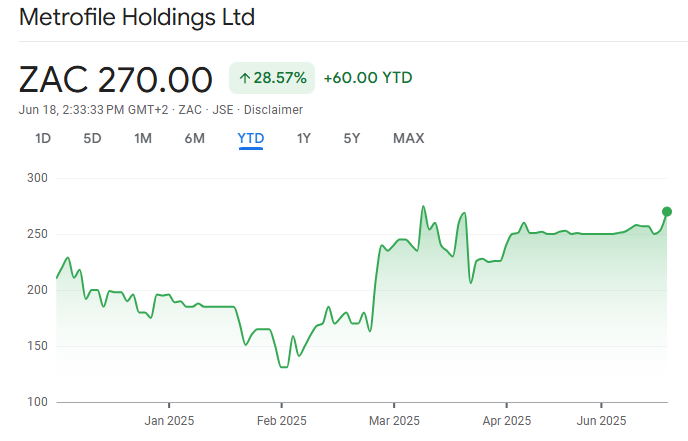

Back in March this year, Metrofile released a cautionary announcement in which they indicated that discussions were in progress regarding a potential acquisition of the company. Metrofile has been down this road before, although it was becoming harder to find people who believed that the day for a deal might actually come.

The cautionary announcement certainly breathed some life into the share price:

Here’s the more important view though, demonstrating why it was becoming increasingly difficult to find Metrofile bulls:

After the initial announcement in March, there was a further announcement in May that confirmed that a single party was negotiating with Metrofile and was ready to commence with a high level due diligence.

The latest cautionary announcement is lighter on details, merely confirming that discussions are ongoing. Shareholders must continue to wait with bated breath.

Another stop-start quarter at Renergen (JSE: REN)

Will ASP Isotopes be able to improve these operations?

The latest quarterly update at Renergen is another example of stop-start operations. On the LNG side, production dipped from 1,371 tons to 1,311 tons quarter-on-quarter (a 4.4% drop, despite the announcement calling this “steady” production). The all-important helium business sold precisely one dewar to a customer before halting production to look for an optimised filling solution. They believe that this has been achieved and that helium filling will resume in due course.

So, it’s much the same as usual then – the resource is there, but it’s difficult to monetise. This is of course the opportunity for ASP Isotopes, as they will look to come in as strong engineering operators.

In this quarter alone, Renergen burnt through R88.5 million in cash through operating activities and another R78.5 million through investing activities. The only reason why the cash balance has jumped from R28 million to R152 million is because of the R290 million net inflow from financing activities.

Above all else, Renergen is a case study in how any asset with a weak balance sheet can become a sitting duck for a plucky acquirer. In my view, Renergen was headed for business rescue if not for the ASP Isotopes deal and associated capital injection.

Nibbles:

- Director dealings:

- Three directors of Lucky Star, the all-important subsidiary of Oceana (JSE: OCE), received Oceana shares linked to share-based awards. One of the directors only sold the taxable portion and retained R1.8 million in shares, while the other two directors sold the entire awards worth R5.3 million in aggregate.

- Santam (JSE: SNT) announced some director dealings. Although there are a few nuances here, including minimum shareholding requirements and sales to fund the tax on awards, there’s also an outright sale of shares worth R584k by the company secretary.

- SA Corporate Real Estate (JSE: SAC) also has a variety of director dealings, including sales to fund taxes and the acceptance of new awards. There was some selling of shares in excess of the tax though, including the CFO selling 72.5% of the vested shares (a total trade of R3.6 million) and the company secretary selling the full award (R1.1 million).

- The CEO of Spear REIT (JSE: SEA) bought shares for himself and his minor children worth around R105k.

- A director of Finbond (JSE: FGL) and his associate bought shares worth R84k.

- Grindrod (JSE: GND) announced that Xolani Mbambo is stepping down as CEO with effect from 31 December 2025. He’s been with the group for 12 years and the recent strategic initiatives really have cleaned up and focused the group for the next chapter of its growth. At this stage, his successor has not been named.

- Hammerson (JSE: HMN) had very little uptake for its dividend reinvestment plan alternative, with most shareholders choosing to receive cash instead. Holders of just 1.17% of shares on the UK register and 1.14% of shares on the SA register elected to reinvest their dividends in shares.

- Anglo American (JSE: AGL) has made some changes to its executive team following the demerger of Anglo American Platinum (now called Valterra Platinum). They are taking the opportunity to appoint Ruben Fernandes as COO for the group, with Themba Mkhwanazi (currently the Regional Director – Africa and Australia) stepping down at the end of June after 11 years with Anglo American. For now at least, Al Cook (CEO of De Beers) is part of the top structure, but we know that Anglo is actively looking to offload that asset. Notably, Mkhwanazi is also stepping down from the board of Kumba Iron Ore (JSE: KIO) where he was Anglo’s representative, with Fernandes taking up that directorship.

- In another great show of AYO Technology’s (JSE: AYO) attention to detail, the company had to release an announcement correcting the calculation for the total number of shares outstanding for purposes of the Sekunjalo offer. Sigh.