Cashbuild paints a worrying picture about our economy (JSE: CSB)

Where is the consumer discretionary spending?

In theory, Cashbuild should be doing well. There’s no load shedding. Interest rates have come down (a bit). The rand is getting stronger all the time. And yet, the share price fell 6.8% on Monday in response to poor sales in the second quarter.

The metric that matters is same-store growth, which they disclose based on stores that existed before July 2024. Cashbuild South Africa is the most important business (83% of group sales), so I’ll also focus there for now. Sadly, after a 5% increase in same-store sales in the first quarter of the year, they suffered a 1% decline in the second quarter. Yuck.

It gets even worse in the other segments, with P&L Hardware clearly still struggling with a drop of 11% in Q1 and 10% in Q2. Cashbuild recently acquired Amper Alles in December, so I’m hoping that business will turn out a lot better than P&L Hardware.

With the impact of new stores included, the second quarter was up 1% for Cashbuild South Africa and for the total group. The market is smarter than that though, with same-store sales as the important focus area.

The typical relationship between inflation and volumes just isn’t coming through. Inflation was only 0.8% at the end of December, yet same-store volumes fell by 1% in the second quarter. If inflation comes down and volumes don’t move higher, retailers very quickly have a bad time.

The share price is down 26% over 12 months. It rallied nicely into the end of 2025, but this update will likely take the wind right out of their sails. There’s certainly no wind in their sales!

Pan African Resources is printing cash (JSE: PAN)

Gold production is way up at exactly the right time

Pan African Resources was the fighter that I chose in the gold sector last year. My average purchase price is R8.64 per share. Currently trading at R31.52 per share, that’s a delicious 264% return!

This isn’t just because of the gold price, although that’s obviously the main driver. I loved the fact that Pan African would be ramping up gold production significantly. My thesis at the time was that the company offered a combination of gold price exposure and production upside.

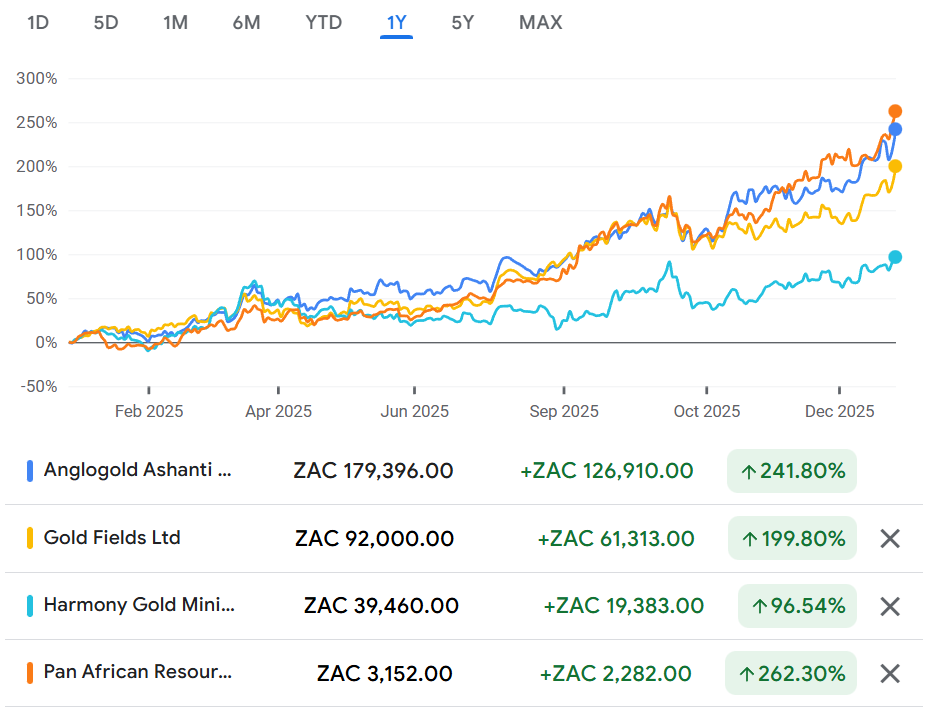

So far, so good – it’s beaten the sector over the past year, although there was money to be made everywhere:

The latest from the company is an operational update for the six months to December 2025. With gold production up by 51%, they have such a good story to tell. They expect the run-rate to improve even further in the second half.

Still, it’s not a perfect result.

The first blemish on this story is that the Mogale Tailings Retreatment operations are running at roughly 10% lower than expected in terms of production. They have increased capacity and hope to see improved recoveries.

The second blemish is that all-in sustaining cost (AISC) of production has come in way above guidance. They expected between $1,525/oz and $1,575/oz, but they’ve come in at between $1,825/oz and $1,875/oz!

The stronger rand has hurt them by a substantial $115/oz, while higher share-based payments (due to the share price performance) are responsible for another $80/oz. There were a couple of other operational factors as well. They do at least expect the costs per ounce to improve in the second half, although the ongoing trajectory of the rand won’t help.

I must of course point out that the weaker dollar and the higher gold price are linked concepts. It’s pretty unlikely that we would have one without the other right now.

Looking at the balance sheet, net debt has dropped by more than 65% to below $50 million. Such is the level of profitability at the moment that the company expects to be a debt-free mining house by February 2026, an astonishing outcome when you consider the extensive recent investment in capacity (and the record dividend paid in December).

Speaking of the dividend, they intend to pay 12 cents per share as an interim dividend. This is important because it would be the company’s first-ever interim dividend. They are making so much money that they need to pay it out twice a year!

As you would expect, there are further expansion opportunities in the pipeline. They are planning to complete a definitive feasibility study for the Soweto Cluster Tailings Storage Facilities by June 2026. At Tennant Mines in Australia, various targets for further exploration have been identified.

I am a happy shareholder.

Spear REIT upgrades full-year earnings guidance (JSE: SEA)

The Western Cape growth story continues

Spear REIT may be focused on the Western Cape, the property jewel of South Africa, but that doesn’t mean that they can afford to throw capital at every opportunity that they find. Cape Town is the furthest thing from a hidden gem, as everyone knows that it is the most desirable city in the country. This means that properties in the region carry a valuation premium that can easily catch you out if you get too hot for the deal.

This is why you’ll hear management talk about their underweight exposure to highly priced retail assets, although they are still willing to do selective deals in this space (like Maynard Mall). For the most part, Spear loves industrial assets that tap into the underlying growth in the Western Cape.

Acquisitions during the 10 months to December 2025 were made at an average acquisition yield of 9.54%. This is above their weighted average cost of capital (a good thing). It’s also a reminder of how difficult it is to make money from property without a corporate balance sheet that has a low cost of borrowing. If you ask the bank for money, you’ll be doing well to get it below 9.5%.

These acquisitions have taken the loan-to-value back to 25%, slightly lower than the 27% as at February 2025. The half-year results were an anomaly of under 14% based on the timing of major disposals and acquisitions. Operating in the mid-20s is a very healthy level for a REIT and is well below many of the other players in the market.

With occupancy rates at their highest since the pandemic, Spear is executing well. They also note that tenants reported strong trading over the festive season. This is interesting, as we aren’t exactly seeing this coming through in the updates from the major retailers thus far this year. It’s important to remember that Spear’s Western Cape portfolio isn’t necessarily representative of the performance for national chains.

Having achieved distributable income per share growth of 5.7% for the 10 months to December 2025, the fund has upgraded its full-year guidance to reflect expected growth of between 5% and 6%. I went back and checked their interim results for the previous guidance, and found that it was between 4% and 6%. In other words, the upgraded guidance is a positive shift in the mid-point rather than the top of the guided range.

Spear is trading on a dividend yield of 7% and achieved share price growth of nearly 22% in the past year. That’s been a much easier way to generate returns from the Western Cape property market than the alternative of sending out rental invoices and calling out the plumber when your tenant’s taps are broken!

Nibbles:

- Director dealings:

- Here’s a meaty trade: an associate of a director of Dis-Chem (JSE: DCP) sold shares worth R35.4 million. The director in question is Stanley Goetsch, not a member of the Saltzman family.

- The CEO and CFO of Clicks (JSE: CLS) each bought shares in the company. The combined value of the purchases is almost R2 million. Will this do anything to address the slide in the price?

- A director of a major subsidiary of Ninety One (JSE: N91 | JSE: NY1) sold shares earlier this month to the value of R1.4 million. The share price has rallied significantly since then, so that must be rather frustrating.

- A director of a major subsidiary of Southern Sun (JSE: SSU) sold shares worth R551k.

- Fortress Real Estate (JSE: FFB) announced that Moody’s has affirmed its credit rating and its stable outlook. Access to finance and an attractive cost of borrowing are key inputs for the economics of property funds, so this is good news.

- Africa Bitcoin Corporation (JSE: BAC) has appointed Maxim Group LLC as its general advisor in the US. I wonder whether they feel that the best chance for the company is to sell the bitcoin treasury company story overseas – although such things already exist there, so I’m not 100% sure what their unique selling proposition would be. I guess that’s why they’ve chosen to work with an advisor! Perhaps I’m wrong and they are going to promote the credit fund instead, which is by far the most interesting business in the group. This advice from Maxim doesn’t come for free of course. The company is paying Maxim in shares, with a fee equal to around 4% of currently issued share capital, issued in various tranches in 2026.

- Mahube Infrastructure (JSE: MHB) announced in December 2025 that Sustent Holdings would be making an offer for the shares and delisting the company. Interestingly, Mahube has now announced that an entity called Five Words Capital has taken a 5.01% stake in the company. I’m not sure what’s going on in the background here, but it’s worth keeping an eye on.

- When companies have significant development costs ahead and are tight on cash (like junior mining houses), they tend to look for opportunities to settle fees in shares rather than cash. Shuka Minerals (JSE: SKA) has taken this route with the issuance of shares to Gathoni Muchai Investments (yes, the investor that took forever to put in cash) and company executives in lieu of historical fees. A total of 6.56 million shares are being issued. The company will have 127 million shares outstanding after this issuance.

- aReit (JSE: APO) is still suspended from trading. They are looking for a new auditor, while trying to get the previous auditors to sign off the financials for the year ended December 2023. Long-time readers will remember my somewhat blunt views on this one when it listed.