Despite delistings, the JSE itself is growing earnings (JSE: JSE)

The loss of small caps with low liquidity isn’t making much of a dent

It’s always fun for market newbies to learn that the JSE itself is a listed company. In fact, it’s listed on its own product! Hence, JSE: JSE is a share code.

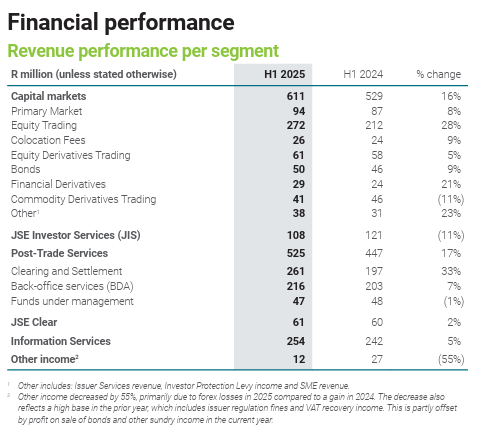

One might logically assume that with more delistings than IPOs, the numbers are under pressure. This would be an incorrect assumption. For the six months to June, revenue was up 11.8% and earnings before interest and tax (EBIT) jumped by 15.4%. This is despite personnel expenses climbing by 13.2%, which is a higher growth rate than revenue. Luckily, there are a lot of other overheads in the company and they grew at a far more palatable rate, hence the margin expansion.

Net finance income is very important at the JSE, as they sit on a huge amount of capital for regulatory purposes (ring-fenced and non-distributable cash and bonds of R1.31 billion). Although there was a 4.3% dip in that net finance income, net profit after tax came in 13.2% higher and HEPS was up 13.4%.

I think this table is pretty interesting, as it shows that the market is in a healthy space thanks to e.g. a 28% increase in the JSE’s cut on equity trading activity:

The share price is up 11.6% year-to-date and 27% over the past 12 months.

Not much growth at Nedbank to get excited about, with stubbornly low economic activity (JSE: NED)

But at least the direction of travel is up

Nedbank is a very handy way to take a view on the SA economy as a whole. They are playing a defensive game vs. the likes of Capitec, so their fortunes are tied mainly to the macro factors rather than any specific business decisions. And with less exposure to non-SA markets than other large peers, the macro influences on Nedbank are primarily South African. With plans at Nedbank to sell the stake in Ecobank, the relative exposure to South Africa will increase even more.

Thus, when South Africa has been devoid of much in the way of growth, it negatively affects Nedbank. For the six months to June, revenue was up just 4%. The 6% jump in HEPS (and the interim dividend) was mainly driven by a substantial improvement in the credit loss ratio from 104 basis points to 81 basis points. That’s unfortunately not a sustainable source of margin improvement, as the ratio is unlikely to improve further from the current level.

The thing to be most worried about, in my view, is the 9% increase in operating expenses. That’s way ahead of revenue growth and it shows the extent of the role played by the credit loss ratio in saving these numbers.

Of course, the group numbers are a roll-up of many underlying strategic decisions around where to focus. Banks actively manage their balance sheet exposures, with Nedbank having tilted towards home loans, vehicle finance and deposits. That may all sound obvious to you, but note the lack of e.g. commercial property in that list. Banks have a long list of products that they offer, so focusing on just a few makes a difference.

The thing that would help them most is growth in net interest income. With interest rates slowly coming down and putting pressure on net interest margin, this is only going to happen if demand for credit picks up. This is the SA macro story that I spoke about. Non-interest revenue growth did help in this period, contributing to a modest improvement in return on equity from 15.0% to 15.2%.

Overall, it’s an unexciting story that is at least positive overall. The market didn’t like it, with the share price closing 5.5% lower. This takes the year-to-date move to a rather ugly -16.6%. It’s hard not to compare this to Capitec, up 11% over the same period.

Positive momentum at Pick n Pay (JSE: PIK)

Franchise stores are still lagging corporate-owned stores

Pick n Pay has released a trading update for the 17 weeks to 29 June 2025. There are a number of encouraging signs in it.

I’ll start with the absolute highlight: the Clothing business. In standalone stores, they grew sales by an outrageous 12.5% on a like-for-like basis and 17.3% overall. There’s a soft base effect here and the timing of the onset of winter does make a significant difference in the clothing sector, but that’s still a great number. You can expect more modest growth as it normalises over the rest of the year.

I’ll just give a passing mention to Boxer, which is separately listed (JSE: BOX). Pick n Pay obviously benefits from Boxer’s performance, as they still have a controlling stake in that group. As we already know from the recent Boxer update, turnover was up 12.1% and like-for-like sales increased 3.9%.

From a Pick n Pay perspective though, the major focus in the market is on Pick n Pay Supermarkets themselves. Company-owned supermarkets have been outperforming franchise supermarkets recently and that trend has continued. It really is peculiar, as franchise stores usually do better due to being owner-managed. But at Pick n Pay, company-owned supermarkets grew 3.1% in H1’25, 3.6% in H2;25 and now 4.0% in the latest 17-week update, with clear positive momentum. Franchise-owned supermarkets are much scrappier, with moves of -1.4%, 1.1% and 0.2% for those three periods respectively.

Here’s another interesting point: Pick n Pay’s like-for-like sales growth came in at 3.6%, but turnover growth as reported was up just 0.1% if you include Rest of Africa, or flat at 0.0% if you exclude it. In other words, store closures are perfectly offsetting like-for-like sales, leading to flat total sales for the group. This is why retailers are usually hesitant to close stores, as it leads to a loss of market share. But sometimes, it’s the right choice for the group in terms of building a stronger and more profitable business.

Another point worth noting is that Grant Pattison (ex-Massmart and Edcon) will be joining the board. He certainly knows his way around a retail turnaround story, so that’s a useful addition I think.

The Pick n Pay share price was down roughly 10% year-to-date coming into this update. The market liked it though, so perhaps it will stage a recovery. A 2.2% positive move by close of play is a good start to clawing its way back.

Shoprite is achieving growth that feels almost impossible (JSE: SHP)

South Africa’s best retail story is still cooking – but watch that momentum

Shoprite has released a trading statement for the 52 weeks to 29 June 2025 and the numbers are astonishing. HEPS from total operations is expected to be between 15.2% to 25.2% higher. From continuing operations, they expect HEPS growth of 9.4% to 19.4%. To be pulling off those growth rates in this economy for a business the size of Shoprite is truly excellent.

Sale of merchandise in continuing operations was up 8.9%. Supermarkets RSA leads the way with 9.5% growth, while Supermarkets non-RSA was up 6.4% and other operating segments only grew 5.2%.

I must point out a concern around momentum here. Although overall sales are strong, they grew 8.1% in the second half of the year vs. 9.7% in the first half. In Supermarkets RSA, by far the most important segment, growth slowed from 10.4% in the first half to 8.5% in the second half. This is despite selling price inflation increasing from 1.9% to 2.7% in the second half, suggesting a significant slowdown in volumes growth. This is worth keeping an eye on.

Some of the selling price inflation is probably just the mix effect across the different stores, as Checkers and Checkers Hyper grew by 13.8% for the full period, while Shoprite and Usave were up 5.9%. One would realistically expect to see higher price inflation at Checkers and Checkers Hyper where there’s a wider assortment and customers are less sensitive to price than at Shoprite and especially Usave, so this could be impacting the inflation number.

The group continues to expand its footprint, opening 194 “main banner” supermarkets and 79 stores across their other formats, with Petshop Science as the fastest growing with 60 new stores. Little Me opened just 1 more store to get to 11 stores vs. Petshop Science at 144 stores. If ever you needed proof of the birth rate vs. pet ownership trends at the moment, there’s your answer. For most people, their “little me” these days is fluffy.

In case you’re wondering about the discontinued operations, these mainly relate to the furniture business that is being sold to Pepkor. Despite the Competition Commission initially being fine with the deal, the Competition Tribunal allowed Lewis to intervene in the process. This has now delayed the process while the Tribunal considers the applications. Shoprite believes that the deal is highly likely to close, but the timing is uncertain. Other discontinued operations include the businesses in Malawi and Ghana, as well as furniture in Mozambique and Angola.

If ever there was a chart that demonstrates that investment returns are a function of what you pay for the stock and how the company is performing, it’s this one of Shoprite vs. Pick n Pay over the past 12 months:

Before you question your sanity, here’s the five-year view:

And yes, eagled-eyed readers who noticed that the share prices are slightly different in the two charts, the price moved as the market was live while I was flicking between 5 years and 1 year! The joy of liquid stocks – the price never sits still.

Shoprite closed 0.5% lower on the day of results, showing just how much good news is already baked into the price.

The market expected more from Telkom (JSE: TKG)

Despite growing earnings, the share price fell more than 9%

It’s quite incredible that we’ve reached a point in Telkom’s journey where the market has high expectations of them. Imagine telling someone this just a few years ago, when Telkom was desperately trying to offset its dying legacy business?

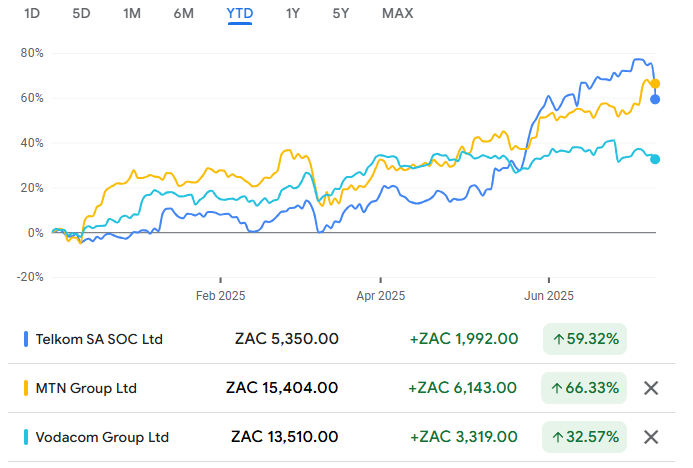

Even after a 9% drop on Tuesday, the share price is up 129% in the past 12 months. It makes for quite a chart:

Now, the drop could be due to profit taking by a couple of major players, which isn’t uncommon after such a large run in the price. But it could also be because revenue for the first quarter ended June 2025 was up 1.1% and EBITDA grew by 6.5%, which is helpful as protection against inflation, but certainly not exciting. It’s a lot less thrilling than what we’ve seen from MTN’s African subsidiaries in the past week or so, with the market expecting a strong announcement from MTN regarding group results.

In fact, adding in MTN and Vodacom on the above chart shows that Telkom has now dipped below MTN on a year-to-date basis, although all three have been lucrative:

The negative story in the Telkom numbers is clearly BCX, with a revenue decline of 8.3%. They are working on a “faster” turnaround in this business, so the market will watch that closely.

Elsewhere, key revenue drivers were up, like mobile data revenue up 9.6% and Openserve fibre data revenue up 11.3%. Another useful statistic is that homes passed by Openserve increased by 12.6% and homes connected were up 17.5%, so that speaks to successful conversion of potential customers. Data revenue is now almost 60% of group revenue!

Group EBITDA margin improved by 140 basis points to 25.9%. On such modest overall revenue growth, that’s encouraging. BCX is the bright red pimple here, with EBITDA margin down 150 basis points to just 6.5%.

In terms of the balance sheet, the Swiftnet disposal proceeds allowed them to settle R4.75 billion in debt. They paid a R500 million special dividend in July and retained the rest of the R6.6 billion proceeds for general corporate purposes. They also received R158 million from property sales, with a further R121 million from property sales expected to be received over the course of the year.

Overall, it’s a decent set of numbers for Telkom. It’s just less than the market was expecting, as there’s now too much exuberance in the telcos sector. I never thought the day would come where I could write that!

Nibbles:

- Director dealings:

- Adding to the extensive recent purchases by directors and senior execs of Primary Health Properties (JSE: PHP), the CEO bought shares worth R1.8 million.

- The buying of Vunani (JSE: VUN) shares by directors continues, but low liquidity in the market remains a struggle. The CEO bought shares worth R3k in an on-market trade. Another director bought shares worth R4.6k in an off-market trade.

- The board of MAS Real Estate (JSE: MSP) has noted the bid by Prime Kapital. The independent board will comment on the terms and risks “as soon as it is practicable” – while highlighting that the Prime Kapital offer also has an unusual offer timeline. They aren’t wrong about that, as the offer closes before the extraordinary general meeting that is scheduled for later this month.

- Although the market’s focus has been on the impact on FirstRand (JSE: FSR) of the ruling in the UK regarding the vehicle finance sector, there’s also relevance to shareholders in Investec (JSE: INP | JSE: INL). Investec has noted that whilst the judgement is a welcome step towards clarity, there is still uncertainty around their provision. Investec is carrying a provision of £30 million, with the UK Financial Conduct Authority expected to publish a consultation on an industry-wide redress scheme by October 2025.

- Novus (JSE: NVS) is buying up shares in Mustek (JSE: MST) while the process around the mandatory offer continues. The latest example is an on-market purchase for R290k, taking the Novus stake up from 39.92% to 39.95%. Together with concert parties, the move is from 60.20% to 60.24%.

- If you’re interested in Orion Minerals (JSE: ORN), you could check out the presentation that they just released to the market that gives a helpful overview of their story. You’ll find it here. I would also highly recommend watching the recording of their recent Unlock the Stock appearance, which you’ll find here.

- Glencore (JSE: GLN) shareholders gave strong approval to the plan for off-market share buybacks. Glencore’s share price has been under pressure and the company wants to use this point in the cycle to achieve meaningful buybacks. The theory is that this benefits the shareholders who decide to stick around.

- Regular readers may have seen the recent note in Nibbles (and certainly across local media) regarding the censure imposed by the Johannesburg Stock Exchange (JSE) on Anushka Bogdanov concerning academic qualifications she allegedly claimed while serving on the board of EOH (now iOCO). In response, her office issued the following statement: “I am aware of the SENS announcement published by the Johannesburg Stock Exchange (JSE) on 25 July 2025 referencing my academic qualifications. The announcement contains several factual inaccuracies and misrepresentations. I have submitted all relevant documentation from accredited institutions, including doctoral research, to the JSE in good faith and in full transparency, and I remain committed to engaging constructively to clarify and resolve the matter.” In my view, there are only three possible interpretations of “inaccuracies” in this context. Either Bogdanov did not claim the qualification in the manner described by the JSE, or she did claim it and does have it, or there is some other technical issue with the JSE process and announcement. I’ve posed these points to her office and am awaiting clarification. I guess time will tell.