If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Mediclinic’s earnings are a mixed bag

As the group is currently under offer, there is no dividend

In the six months ended September, Mediclinic’s revenue increased by 10% and the adjusted EBITDA margin fell from 15.8% to 14.2% due to increased operating expenses.

Despite an 8% drop in operating profit, headline earnings per share (HEPS) increased by 36% to 11.3 pence.

Cash conversion was poor in this period, dropping from 104% to 72%. This resulted in a higher leverage ratio vs. the comparable period.

Because of the current offer on the table from Remgro and MSC Mediterranean Shipping Company, no interim dividend has been declared.

PPC expects a substantial drop in earnings

The only good news is that net debt is much lower

The PPC recovery story has had a considerable wobbly this year. The share price has lost more than half its value in 2022, which must be heartbreaking for those who didn’t take profit after a huge 2021 for the stock:

There are significant cost pressures in the group and the competitive nature of the industry means that sales price increases were limited to 5% in the six months to September 2022. This has led to the two words that no investor wants to see: EBITDA compression.

Understanding the numbers is difficult, as hyperinflation in Zimbabwe is skewing the results.

In South Africa and Botswana, sales volumes were down 2.6% and revenue was up 4% thanks to price increases and product mix. The impact on margin is severe unfortunately, dropping from 18.7% to 12.2%. The good news is that positive cash generation resulted in net debt reducing by R140 million to R935 million.

In Rwanda (the CIMERWA business), volumes increased by 11% and EBITDA jumped by 63% to R249 million. Margins increased from 28.3% to 32.3%. This is a terrific result, with the business in a net cash position of R345 million.

In Zimbabwe, a planned kiln shut-down in the first quarter and some other factors led to a decline of 13% in volumes. Reported EBITDA fell by 48%, impacted by hyperinflationary accounting in addition to the pressures in the business. With more foreign currency available, PPC Zimbabwe paid a dividend of $4.4 million to PPC in June. The business ended the period with R253 million in cash.

Group EBITDA fell by 23% for the period. Excluding PPC Zimbabwe, EBITDA fell by 12%. The net debt of the group improved at least, reducing to R677 million from over R1 billion in March.

With Zimbabwe included, HEPS is now negative. Excluding Zimbabwe, the drop in HEPS is still pretty ugly, from 10 cents per share to between 2 cents and 6 cents.

The focus remains on cash generation and operational efficiencies.

I’m glad I gave up on Spar

The market was rather horrified at a 51% drop in the dividend

The Spar announcement started with commentary on a “resilient performance” for the year ended September 2022, yet the market was having none of it. The share price fell 12.3% on the day despite a 6% increase in group turnover.

Margins are under serious pressure at Spar. Operating profit increased by just 1.1%, with Spar taking pain from load shedding and fuel cost pressures in South Africa. Remember, Spar is a wholesaler that supplies franchisees, so this is mainly a logistics play.

Diluted HEPS fell by 2.9% to 1,159.1 cents per share, putting the group on a 12.5x Price/Earnings multiple after the sharp fall in the share price.

Although Spar had previously told the market about an expected decrease in the pay-out ratio, the extent of that decrease was clearly a shock. The group is making a strategic investment in SAP and shareholders will have to stomach a lower dividend for a period of two years.

In South Africa, the core grocery business grew sales by 5.3%. Against a Covid-ruined base, TOPS at SPAR grew by 42.6% and reaffirmed its position as the “number one liquor brand” in South Africa. A far more impressive number is Build it growing by 3.1% at a time when the DIY market has been hammered.

BWG Group in Ireland and South West England grew turnover by 7.6% in euros. The story in Switzerland is far less appealing, with consumers having returned to large supermarkets as the pandemic waned. Turnover in that country fell by 3% in local currency, though it is 14.4% higher than pre-pandemic levels. In Poland, turnover grew by 8.2% and operating losses reduced by 9.5%.

In my view, Spar is stretched thin with many operations and challenges in each one. There are no “easy wins” at the moment and the more focused competitors are winning this fight. As a case in point, Spar reckons that the SPAR2U on-demand offering is achieving positive feedback from consumers.

I just wish I knew who those consumers are, because I don’t know a single person who has used SPAR2U and I’ve never heard anyone talking about it. Meanwhile, the on-demand offerings from Checkers, Pick n Pay and Woolworths are all clearly visible on our roads. When I asked on Twitter, it seems as though some people are impressed with the SPAR2U offering, but few have ever even heard of it.

I’m glad I gave up on Spar after I bought the share in late 2021 after the first set of bad results out of Poland. I sold it a few months later. At one stage, it looked like a cute value play. It turned out to be a value trap of note.

I got it badly wrong with Tiger Brands

The business has achieved more pricing power than I expected

Full credit to the team at Tiger Brands: they managed to pull off a much better result than I anticipated. With consumers clearly under pressure and inflation running away from all of us, I didn’t give Tiger Brands much credit for its pricing power. In the second half of the financial year, the company clearly managed to push price increases through to consumers.

In an updated trading statement for the year ended September, HEPS from total operations is expected to be between 48% and 53% higher than in the comparable year. This suggests a range of 1,668 cents to 1,724 cents. After the share price closed 2.5% higher, the Price/Earnings multiple is between 11.4x and 11.8x.

A 37% increase in the share price in the past six months has been highly rewarding for punters who believed that the worst was behind Tiger Brands.

I remain bearish on the business in general. With a track record that has been in the headlines for all the wrong reasons, Tiger Brands isn’t a company I ever see myself investing in. Those who are interested in this sector should also refer to Brait’s announcements this week regarding the separate listing of Premier, a business that competes directly with Tiger Brands.

Woolworths continues a strong run

I’m becoming increasingly impressed with the new management team

Woolworths has released a trading update for the 20 weeks ended 13 November 2022.

Before you get excited by the percentages that I’ll shortly be giving you, it’s worth remembering that the prior period included terrible lockdowns in Australia and the aftermath of the riots in South Africa. Still, sales are up 23.3% in this period.

Interestingly, online sales fell by 13.7% as customers returned to stores. Online sales now contribute 10.1% to group turnover, which is still a meaningful contribution.

In Southern Africa, the Fashion Beauty Home (FBH) business grew turnover by 10.8%. The biggest win is in profitability rather than sales, with full-priced sales up 15.2% and clearance sales down 20%. This game is all about driving margins, not just revenue at any cost. In a perfect example of why I like what I’m seeing at Woolworths these days, the winter sale was the smallest and most profitable to date. Trading space reduced by 2.4%.

The local Woolworths Food business is still investing in price to be more competitive against the likes of Checkers and Pick n Pay. Product inflation was 7.9% and price movement was 6.3%, which means Woolworths had to eat some of the increases itself. With Food turnover up by 7.3% and online sales up 26% thanks to the success of Dash, we will have to wait for more detailed results to see the net impact on profits.

Comparing the two businesses in terms of online sales is fascinating. Online grew by 26% in FBH, now contributing 4.2% of sales. In Food, online is now 3.6% of total sales. Long-term, I think online penetration in Food will be significantly higher than in FBH. Based on comments on Twitter though, there is still grumpiness around the user experience in Dash and the integration with the broader online offering. Woolworths has more work to do.

Keep an eye on South African consumer health. The annualised impairment rate in Woolworths Financial Services increased to 6.2% vs. 4.1% in the prior period. That’s not good.

In the lands of kangaroos and kiwis, Country Road Group grew sales by 36.2% and reduced space by 5.1%. David Jones increased turnover by 55.3% and decreased trading space by 3.7%. In both cases, the growth rate is flattered by extensive lockdowns in Australia in the comparable period.

For the 26 weeks ending 25 December 2022, Woolworths expects HEPS to be at least 20% higher than the comparable period. This is the minimum percentage that triggers a trading statement. Based on these numbers, I’m expecting a significantly higher growth number than that.

Little Bites:

- Director dealings:

- A non-executive director of African Rainbow Minerals has sold shares worth R9.7 million (that’s a big one) and a director of a subsidiary of the company has sold shares worth R1.45 million

- Des de Beer has bought more shares in Lighthouse Properties, this time worth R675k

- The CEO of Motus has sold shares in the company worth R3.8 million

- A director of a subsidiary of Shoprite has sold shares worth just under R3 million

- The CEO of Altron is still buying shares in the company, this time for just over R900k

- I was waiting for this one – a director of Santova has sold shares to cover the tax on the options trades, but they have retained the rest of the shares (usually the announcements of the award and the sale are made at the same time)

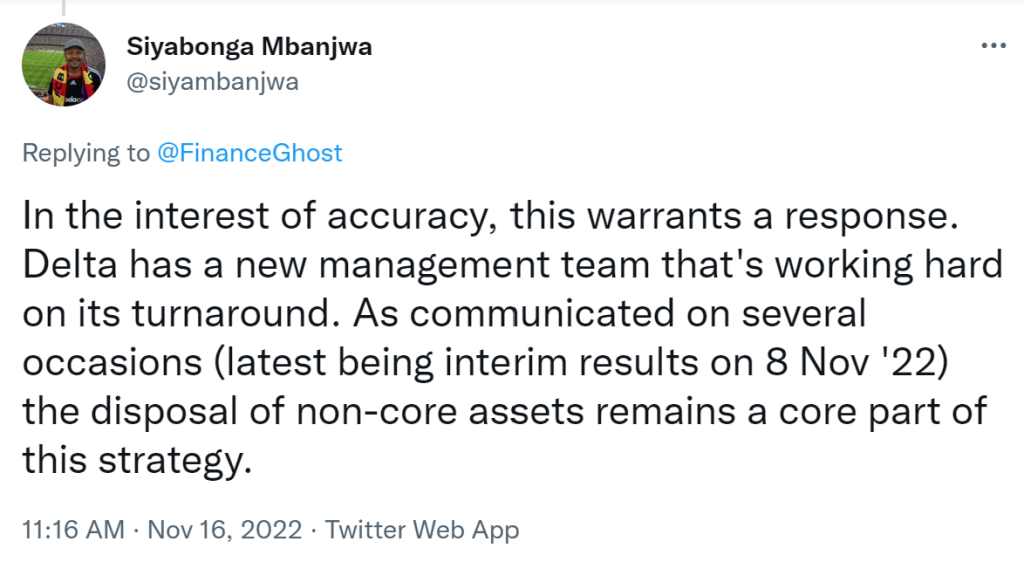

- After my commentary on Delta Property Fund in yesterday’s Ghost Bites, the CEO responded to me on Twitter (an approach which I always have a lot of respect for). This was in relation to the timing of a share purchase by a director relative to the announcement of a disposal of property. I offered to republish the full response here in Ghost Bites (along with my final comment on the matter):

- Investec Property Fund released interim results for the six months to September. Distributable income per share has increased by 2.7%. The balance sheet is stable with a loan-to-value (LTV) ratio of 38.3%. The net asset value per share increased by 4% to R17.36 and the current share price is R10.20 – a significant discount to NAV.

- In good news for Murray & Roberts, the refinancing of debt with South African lenders has been completed and the facility has been upsized from R1.675 billion to R2 billion. The structure is a R1.35 billion term loan facility for 18 months and a R650 million overdraft repayable on-demand. This gives the company breathing room to make progress on the deleveraging plan.

- Argent Industrial released results for the six months ended September. Revenue increased by 13.5%, EBITDA jumped by 19.5% (so margins improved in the process) and HEPS was 22.4% higher. This is the perfect shape to an income statement, with operating leverage and financial leverage at play. This is why a percentage increase in revenue leads to higher increases in EBITDA (operating profit) and HEPS. An interim dividend of 45 cents per share has been declared.

- Dipula Income Fund released results for the year ended August 2022. The net asset value (NAV) per share is R6.63 and the share price is R4.15, so this is yet another property fund trading at a discount to NAV. This was an important year for Dipula, as the fund collapsed its dual share class structure into a single share class structure. This limits comparability with previous years. The dividend is 30.977724 cents per share.

- Reinet Investments released results for the six months ended September 2022. The net asset value has grown at 8.8% in euro terms since March 2009. The latest growth isn’t nearly as pretty as that number, with a decrease of 7.6% between March 2022 and September 2022.

- Premier Fishing and Brands released results for the year ended August 2022. Although revenue fell by 17%, EBITDA was 11% higher. The group swung into a profit, with HEPS increasing from a loss of 3.39 cents to a profit of 5.65 cents. If you’re wondering how profits improved against that revenue result, the answer lies primarily in a grant from the Department of Trade Industry and Competition.

- Load shedding is really hurting eMedia’s business, as there are simply fewer eyeballs watching TV. When combined with a more depressed economic environment, market share gains by e.tv couldn’t offset the negative impact on advertising revenue. To add to the struggles, the company is taking MultiChoice South Africa to the Competition Commission regarding the removal of four entertainment channels off the bouquet. Against this backdrop, the earnings for the six months ended September 2022 have taken a significant knock. HEPS from continuing operations will decrease by between approximately 18% and 29%. Even the famous Anaconda reruns couldn’t save this result!

- Anglo American announced De Beers’ rough diamond sales value for the ninth sales cycle of 2022. Provisional sales of $450 million are higher than $438 million in the comparable cycle last year. This is a traditionally quieter sales cycle, so a drop vs. $508 million in the eighth sales cycle was expected.

- In a separate announcement, Anglo American announced that it has secured the supply of 100% renewable electricity for the Australian steelmaking operations. The source is two major wind and solar projects in Queensland. From 2025, the company expects 60% of global electricity requirements to be met from renewable sources. As I’ve said before, Anglo is doing a lot more than just paying lip service to the carbon reduction push.

- The shareholders of African Rainbow Capital Investments were almost unanimous in their approval of the new management fees structure. It’s not hard to improve on the old structure, so I guess they will take whatever they can get.

- Stefanutti Stocks is executing various disposals in line with a restructuring plan. This has initiated a split of the accounting into continuing and discontinued operations. For the six months ended August, HEPS from continuing operations is expected to be a loss of between 29.47 cents and 18.76 cents vs. a loss of 53.59 cents in the comparable period. From all operations, the loss is between 30.20 cents and 16.78 cents per share vs. 67.12 cents in the comparable period. Either way, it’s all rather ugly.

- In a rather unusual step, BDO’s status as external auditor of Putprop was terminated with immediate effect because shareholders didn’t approve the resolution to appoint BDO as external auditor.

- Southern Palladium has released more drilling results. Unless you have a qualification in geology, it’s best to just skip to the commentary by the Managing Director on the results. He sounds happy with the results.

- Globe Trade Centre’s FFO (Funds From Operations) increased marginally from EUR52 million to EUR54 million in the nine months ended September. I have no idea why the company bothers with a JSE listing as you’re more likely to have two months of no load shedding than see a trade on the local market.

- In the related party transaction between AEEI and Sekunjalo, Merchantec was appointed as independent expert and has opined that the transaction is fair to shareholders of AEEI.

Who is benefitting from the gas extraction at the Ibhubisi gas fields project along our West Coast?

What is the status of current gas and exploration projects along the South African Coastline?

The major Ocean currents along the South African coast average about 6-8 knots, what projects are currently exploring exploiting this source of energy?

First, thank you for the write ups. They are proving to be much more useful.

I am intrigued by the Delta disposal, especially since it was noted that its to a private indivual but the trading statement says the disposal was to Zeder Investments. Am I missing something here?

Fully agree with your comments on Delta finance ghost. it is one thing to announce a strategy of non-core asset disposal. if a deal on a specific transaction is close to signing, this is not public and needs to be announced prior to dealing. given, as we saw, that the announcement was indeed price sensitive.

Exactly. It might not have broken any rules as per the CEO’s response but it sure doesn’t look good.