Altron gives much tighter earnings guidance (JSE: AEL)

Results will be released on 26 May

Altron has released a further trading statement for the year ended 28 February 2025. They previously gave the market guidance that continuing HEPS would be at least 40% higher than the comparable period. They also previously indicated that group HEPS would swing into the green vs. a loss of -29 cents in the comparable period.

The updated trading statement gives much tighter guidance. We now know that continuing HEPS will be up by between 68% and 75%, which means a range of 173 cents to 180 cents. Group HEPS will be between 131 and 136 cents, so that’s a substantial swing from the prior period (which was the loss referenced above).

The share price is up 92% in the past year and these numbers show you why.

BHP releases a conference presentation and transcript (JSE: BHG)

Every opportunity to learn should always be taken

As you’ll also see further down in the South32 section, there’s a Bank of America 2025 Global Metals, Mining & Steel Conference taking place in Spain that is leading to useful presentations being released by major mining groups. It also sounds like a good excuse to me for London investors and bankers to escape the weather and enjoy some time in a better climate with much tastier food.

These conferences always help with showing what companies are actually focused on. For example, this slide comes in pretty early and shows that BHP isn’t scared of putting more debt on the balance sheet:

Again, this isn’t new information. It’s just very interesting. It also ties in with a response from the CEO to a question about tariffs and volatility, in which he referred to the power of being able to invest through the cycle. Right now, BHP wants shareholders to understand that they are ready to pounce on any assets that become available at juicy prices. It may not necessarily be in copper, as there’s also a comment around how challenging the valuations have become in that space.

You’ll find the presentation, speech and Q&A transcript at this link.

Solid growth at Bytes, but it’s what the market expects to see (JSE: BYI)

High valuations create equally high expectations

When a company is trading on a P/E multiple in the mid to high 20s, the market is expecting to see plenty of growth. Although Bytes grew HEPS by 16.5% (in GBP) in the year ended February 2025, the share price is only 8% higher over 12 months. It’s had quite the run on a year-to-date basis though, up more than 32%!

The first nuance when looking at Bytes is to distinguish between gross invoiced income (GII) and revenue. GII is a driver of working capital requirements at Bytes, as they invoice much larger amounts than they actually earn. This is because they sell software and other services on behalf of major providers like Microsoft, which means they collect the full amount and then retain a commission. This puts the working capital burden on Bytes, so the software providers aren’t doing this by accident.

Although GII was up by 15.2%, revenue was up just 4.9%. This shows you that the working capital pressures are getting worse relative to revenue. Thankfully, gross profit was up 12% and operating profit was 17.1% higher, so the structure of Bytes’ business means that they could turn that modest revenue growth into a strong outcome.

Excellent cash conversion supported dividend growth of around 15%, through a combination of an ordinary and special dividend.

They expect to achieve another year of double-digit gross profit growth in 2026, but they only expect high single-digit operating profit growth. This might be why the market responded negatively to the announcement, with Bytes down 3.5% on the day. Single-digit growth isn’t high enough to support the current valuation.

Exxaro announces an R11.7 billion acquisition of Manganese assets (JSE: EXX)

This is a significant deal

With a capital markets day coming up on 9 July, Exxaro now has something particularly interesting to talk about. The group is known for its coal business, but the latest deal is a step into a different area.

They aren’t messing around here, as this is a R11.67 billion deal to acquire the largest single mine manganese exporter in South Africa, as well as another mine in the Kalahari Manganese Field. There are a number of other shareholders in the structure, although Exxaro will have 100% in a couple of underlying assets as part of the deal. It’s quite a web of holdings to untangle.

Technically, depending on how the closing adjustments play out, the purchase price could come down to R9 billion. As you would expect, if there’s scope for it to decrease, there’s also the potential for it to go up. Based on tag-along rights and other price adjustments, it could go as high as R14.64 billion. The amount of R11.67 billion is the unadjusted amount and is effectively the base case for the deal, although it’s unlikely that it will be the final amount.

Either way, Exxaro will fund the deal from existing cash and undrawn bank facilities, despite it being such a large amount. It’s also only a Category 2 transaction due to the sheer size of Exxaro, so shareholders won’t be asked to vote on this deal.

The deal is only expected to close in Q1 2026, so there are still some hurdles that they need to jump over from a regulatory perspective. It’s a complex deal with many moving parts, making it quite difficult to really get a handle on the valuation here.

The upcoming capital markets day is going to be interesting!

Grindrod exits marine fuel trading (JSE: GND)

The non-core assets have finally been dealt with

Grindrod has been on a journey of cleaning up its portfolio and focusing on the stuff that investors actually want. Although share price growth has stalled based on broader economic concerns, the market has been in favour of this approach.

The final step in the dance (in terms of material assets, at least) is the exit of the marine fuel trading business, Cockett. It’s an unusual approach, as this is a solvent winding down of the business rather than a disposal. This is the result of an agreement with the other shareholder in Cockett to take this course of action.

Grindrod has received $22 million under this agreement, which is 61% of the carrying value of the investment as at December 2024. In other words, you can expect to see an impairment here.

Octodec managed a small amount of growth (JSE: OCT)

It’s a grind in the property sector at the moment

In case you haven’t noticed, the SARB isn’t keen to drop interest rates by meaningful levels. We tend to get 25 basis points at a time, like a dog being fed scraps off the table instead of a proper piece of fat from a steak. It’s better than nothing, but not by much.

This is making life harder for property funds, as the economy isn’t exactly shooting the lights out either. Although we are seeing some growth in distributions per share at the moment, it’s in the low single digits for the most part.

Octodec is the latest such example. For the six months to February, the REIT’s diversified portfolio (including residential – unusual for property funds) managed distributable income per share growth of just 1.0%. They increased the distribution per share by 3.3%, so an uptick in the payout ratio made these numbers seem better than they are. Octodec has quite a low payout ratio by REIT standards (just under 75% in this period), so they have this headroom.

The net asset value (NAV) per share was 0.6% higher at R24.26. The market doesn’t seem to care much about the NAV, with the share price at R10.31. Local investors are only interested in valuing REITs based on cash dividends, not the NAV.

Another excellent quarter for Santam (JSE: SNT)

Insurance businesses are having a good time at the moment

Despite a difficult broader economic environment, Santam is finding ways to grow. They managed double-digit growth in gross written premiums in this quarter, as well as an underwriting margin above the upper end of the 5% to 10% target range. Annualised return on capital came in above 30%. These are great numbers!

Santam has a number of underlying insurance businesses and channels. This is important, as they don’t all do well at the same time. For example, although MiWay grew by double digits, the agri business saw a decline in volumes due to timing differences. But overall, the story is one of growth.

To add to the good news, the prevailing high interest rates and decent market returns by the group’s investment managers led to growth in the investment return earned on insurance funds vs. the comparable period. Investment returns were 2.5% of the net earned premium. This is a key source of returns for any insurance group. In fact, Berkshire Hathaway spent a long time showing us just how powerful this model is.

The group has warned of the potential impact of inflation. When it spikes, there tends to be a lag between an increase in the value of claims and the ability of Santam to put premiums up. And of course, they are always at risk of major natural disasters and other issues, although much of that risk is removed through reinsurance.

Santam’s share price is up 39% over 12 months and looks set to continue growing based on this update.

South32’s strategy update is a useful overview of the company (JSE: S32)

The presentation from a global mining conference has been made available

It’s easy to just ignore announcements about presentations from conferences, but you would be doing yourself a disservice. Sure, you won’t be getting any updated numbers (this would have to be formally released on SENS), but you can get plenty of nuggets about the strategy and the path that the company took to get here.

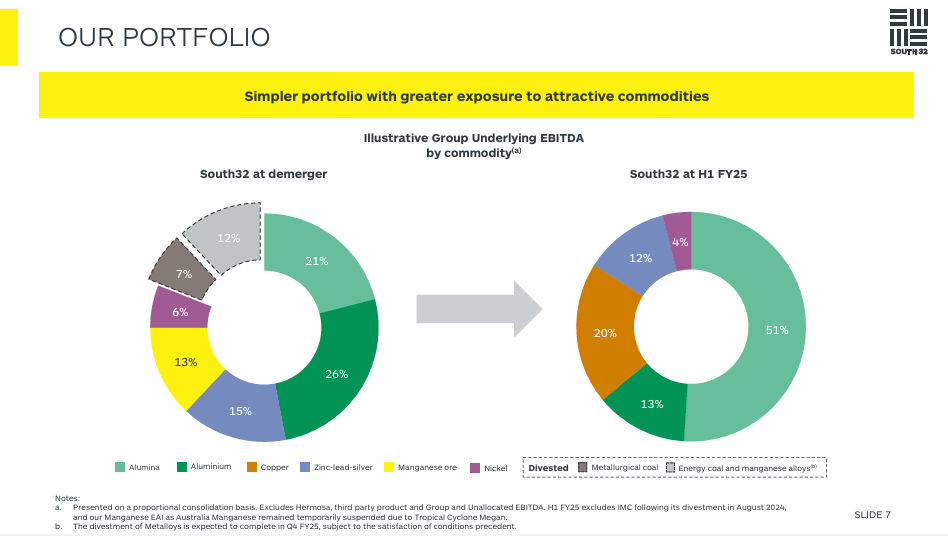

For example, this slide from the South32 presentation at the BofA Securities Global Metals, Mining & Steel Conference tells a story that has played out across a number of mining groups who have stepped away from coal:

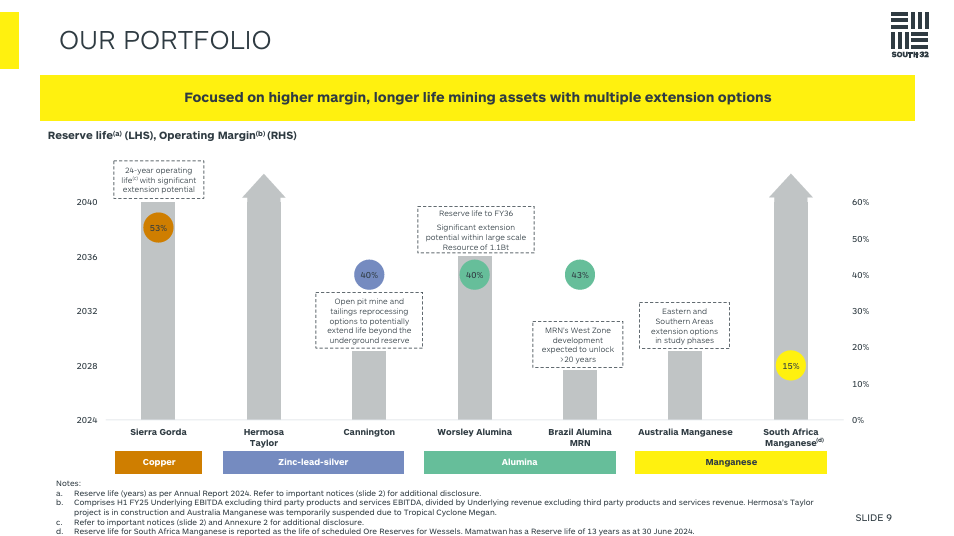

I’ll include one more slide to show you the value of looking through these presentations. Although I don’t love what they’ve done at the top here with the arrows and the scaling of the chart, the underlying message is that the focus at South32 (and most mining groups) is to chase the holy grail: long-life assets with high operating margins. This chart helps you understand why you’ll often read about mining groups undertaking development activities to extend the life of mine:

You get the idea. If you want to have a detailed look, you’ll find the presentation at this link.

Nibbles:

- Director dealings:

- AH-Vest (JSE: AHL) is one of the most obscure listings you’ll find on the local market. It’s therefore not surprising to see the company announcing that an expression of interest has been received from its holding company, Eastern Trading, to acquire the shares not already held by that company and its concert parties. This would naturally include a delisting. At this stage, there’s still no guarantee of a deal happening.

- If you’re interested in the cost of debt in Europe, then AB InBev’s (JSE: ANH) pricing of its latest offering of notes will be relevant to you. The 8-year notes are priced at 3.375%. The 13-year notes are at 3.875% and the 20-year notes are at 4.125%.

- Here’s another data point from the debt market: Gold Fields (JSE: GFI) raised $750 million in 7-year notes with a coupon of 5.854%. This will be used to repay the outstanding amount under the $750 million bridge facility for the Osisko Mining acquisition in October 2024, as well as for general corporate purposes.

- For those keeping track, Cresthold (which was one of the concert parties in the failed take-private attempt) now holds 10.2% in Ascendis (JSE: ASC).

- Texton (JSE: TEX) has obtained SARB approval for its special dividend and return of contributed tax capital, a total payment of 100 cents per share before tax. The payment will be made to shareholders on 26th May.