Absa’s trading update has a positive tone (JSE: ABG)

This is better than we’ve seen from the peer group

Absa released a voluntary update for the six months ending June. There’s quite a bit of good news actually, including the favourable recent trend in African currencies and how this benefits Absa’s reported earnings.

In terms of revenue, they expect mid-single digit growth overall. As we’ve seen across the sector, non-interest revenue (NIR) is doing the heavy lifting (high single digit growth) at a time when net interest income (NII) is struggling with limited loan growth (mid-single digits) and pressure on net interest margin as rates have started coming down.

There’s a question mark around costs here, as operating expenses are up mid-single digits and the cost-to-income ratio is expected to move slightly higher. This tells us that there’s some margin pressure on pre-provision profit.

The best news in this update is that the credit loss ratio has improved from 123 basis points in the comparable period to the top end of the through-the-cycle target of 75 to 100 basis points. This has driven mid-teens earnings growth for Absa and a significant uptick in return on equity from 14.0% to 14.8%.

The balance sheet is in good shape overall and the payout ratio of around 55% is expected to be maintained.

In terms of other insights, I found it interesting that Absa noted a reduced risk appetite in personal loans. This once again speaks to the recent trend of retailers and BNPL players disrupting the banks and getting more credit into the system at point of sale. The big question is whether there’s a nasty outcome down the line in which the retailers and alternative credit providers find themselves on the wrong side of a credit bubble that the banks slowly stepped away from.

For Absa investors, as great as these numbers look, it’s important to recognise that the major growth is coming from the improvement in the credit loss ratio and they are now within their target range, so further improvements are likely to be limited.

Crookes is a reminder of how volatile the agri space is (JSE: CKS)

Bananas did the hard work here

You might find a more contentious issue in South African than “the land” – a favourite of politicians and comedians alike. The agriculture sector is an incredibly tough way to make money, with volatility based on factors that go way beyond the control of the farmers. Crookes Brothers is a rare example of this in the listed space, with a portfolio that includes sugar cane, bananas and macadamias as the major products.

Diversification is your friend here, as you’ll shortly see. Group revenue for the year ended March 2025 increased by 15% and HEPS grew by 27%. Lovely as that might sound, cash generated from operating activities fell by 28% and the dividend was 25% lower as well. This was no doubt influenced by a sharp increase in capital expenditure from R32.8 million to R81.6 million.

In sugar cane, revenue was just 1% higher and operating profit before biological asset movements was down 12%. In farming, these biological asset revaluations cause significant volatility in earnings and are an attempt to recognise what the future value of the existing crop might be. For example, the positive fair value change in sugar cane was 91% lower than the prior year! If you feel like you’ve heard of these fair value adjustments before, it might be from following a company like York Timber, where the fair value moves are always a major feature of earnings. To finish off on sugar cane, profit after the biological assets fair value move fell by 28%.

The second most important segment is bananas, where revenue was up 31% and operating profit before biological asset moves was up by a ridiculous 173%. The “going bananas” jokes write themselves. This is despite severe weather and bad storms in the Lowveld.

Over in macadamias, despite revenue increasing by 116%, there was still an operating loss before biological asset moves of -R36 million as they dealt with issues like heat damage to nuts in transit and severe damage to the macadamia factory from a storm. For context, the operating profit in bananas was around R50 million vs. sugar cane as the largest segment at R144 million.

Crookes also has a property business that grew revenue by 181% and swung from an operating loss of R8.8 million to an operating profit of R20.5 million. It says something about agriculture that the property division achieved the best margins in the group.

The outlook is negative for sugar cane prices in 2025, driven by weaker world sugar prices and higher imports into South Africa. The pricing of bananas is expected to remain favourable, so that’s bad news for anyone trying to coax their toddlers away from the sweets and towards the fruit.

Lesaka agrees to acquire Bank Zero in a major step for both companies (JSE: LSK)

Hopefully Lesaka’s stock liquidity will improve going forwards as well

Lesaka got plenty of attention on Friday morning with the announcement of the acquisition of Bank Zero. This is mostly a share-based deal, as the cash component is only R91 million and Bank Zero has been valued at R1.1 billion, so current Bank Zero shareholders will receive a stake worth around R1 billion in Lesaka (this will obviously fluctuate based on the Lesaka share price). In terms of shareholding, current Bank Zero shareholders will have 12% of the enlarged entity and will be subject to lock-ups ranging from 18 to 36 months post-completion.

Bank Zero was founded in 2018, so a vast amount of value has been created in just seven years. This is why fintech attracts so much attention, as businesses can scale quickly. As at the end of April 2025, Bank Zero had deposits of over R400 million and over 40,000 funded accounts in South Africa.

Critically, this puts a banking licence inside Lesaka’s broader fintech and distribution ecosystem. This is exciting, as Lesaka will be able to introduce new products and cross-sell across its divisions. They will also have access to cheaper funding in the form of customer deposits, thereby improving the economics of lending activities. In fact, as this is essentially a large injection of equity into the broader Lesaka group and an opportunity to significantly change the funding profile, they expect to achieve a R1 billion reduction in gross debt – and this does wonders for Lesaka’s balance sheet. Talk is cheap and implementation is what counts, but I can see why the parties are excited about this.

Importantly, Lesaka expects Bank Zero to be profitable in the first financial year after the transaction, so the deal should be accretive to shareholders from day one.

Michael Jordaan will join the Lesaka board, while Yatin Narsai will continue as CEO of Bank Zero. The full Bank Zero leadership team will remain in place.

Various regulatory conditions need to be met for the deal to be completed. In the meantime, further information will be made available when Lesaka releases results in early September. I think there will be plenty of focus on the valuation of Bank Zero, as the obvious risk here is overpaying for the asset. But if the numbers stack up, then this acquisition should improve Lesaka’s stock liquidity, as I suspect that more investors will take notice of their story.

Growth is hard to come by at PBT Group at the moment (JSE: PBG)

Can this share price regain some of its shine?

PBT Group was quite the story over the pandemic. The stock rallied from relative obscurity into the limelight, with a share price move from below R2 to over R10 (and a weird spike in the chart to over R12). Today, it’s at R5.65 and struggling to find any forward momentum, which is really just a reflection of how growth has tapered off for the company.

PBT has some of the best financial reporting you’ll find at any JSE small cap, so kudos to them for doing a great job of explaining the way in which the company makes money. Essentially, this is an IT consulting group that sells time. People are quick to dismiss this model, but there are many highly valuable consulting groups in the world. The challenge is that there is little operating leverage, with a mainly variable cost structure that is based on hiring consultants and then deploying them to clients. The key is to manage the utilisation rate in such a way that the correct margins are locked in.

The flurry of demand during the pandemic has settled down and created a challenge for PBT, with revenue growth of just 1.4% for the year ended March 2025. Operating profit was up 1.9%, but HEPS fell by 3.8% and normalised HEPS was down 0.6%. Although cash generated from operations decreased by 2.1%, the total dividend was 3.3% higher at 62 cents per share.

The business is sideways at the moment, but I must point out that the trailing dividend yield is now almost 11%, so shareholders are certainly getting paid while they wait for some capital growth.

Will Reinet let go of Pension Insurance Corporation? (JSE: RNI)

And if they do, what would they really have left?

Reinet no longer has any shares in British American Tobacco. This means that the company’s main exposure is the investment in Pension Insurance Corporation, with the rest of the investments spread across a number of funds and other assets.

We might be in for another massive move by the company, with Reinet responding to press speculation by confirming that they are in talks regarding a possible sale of Pension Insurance Corporation after being approached by a potential buyer. There’s absolutely no certainty at this point of a transaction happening, so you should treat this as a very low probability outcome at this stage.

If this does happen though, one really has to wonder whether Reinet would have a future as a listed entity. I think there would be significant shareholder pressure to just wind up the structure and return the value to investors. Ultimately, what Johann Rupert wants is what will happen. This is one to watch.

Remgro will unbundle its investment in eMedia’s subsidiary (JSE: REM | JSE: EMH)

As value unlock trades go, this one isn’t going to light up the markets – but it’s a start

Remgro trades at a persistently high discount to net asset value. As they would sooner give up their first-borns than stop paying dividends in favour of share buybacks, the only other meaningful way to try reduce the discount is to either dispose of assets and return cash to shareholders, or unbundle assets to shareholders.

The stake held by Remgro’s Venfin in eMedia Investments is literally a drop in the ocean for Remgro, but this is where they’ve decided to show some intent in reducing the discount to NAV. eMedia Investments is currently a 67.69% held subsidiary of eMedia Holdings, the local media business that is part of the broader HCI stable and responsible for far more showings of Anaconda than was ever necessary.

This deal is actually far more interesting for eMedia than it is for Remgro. You see, Venfin will initially subscribe for eMedia Holdings N shares (currently listed as an additional share class in eMedia, but with no liquidity) worth R59.5 million, so there’s a cash injection into the group. Then, Venfin wiill swap its existing 32.31% stake in eMedia Investments for more eMedia Holdings N shares, thereby giving eMeda Holdings a 100% stake in its key subsidiary. Finally, Remgro will unbundle the N shares to its shareholders, in the hope that this creates more liquidity in the stock.

To give you an idea of size, the 32.31% stake is valued at R715 million. Add in the share subscription and you have value of roughly R775 million being unbundled to Remgro holders. That’s the size of a small-cap company when viewed in isolation, but it’s less than 1% of Remgro’s R82 billion market cap. As I said, this is a more important deal for eMedia in terms of scale and liquidity than it is for Remgro.

RMB Holdings has reached the hard part of the value unlock (JSE: RMH)

And the large discount to NAV reflects this

RMB Holdings has nothing whatsoever to do with the banking group or the broader FirstRand story anymore. It’s just a legacy structure with some property assets that need to be monetised over time. The challenge is that the “easy” part is behind them, with 91% of the portfolio being the stake in Atterbury. It’s been a strained relationship with Atterbury and RMH is only a minority shareholder there, so this is far from a lucrative position to be in.

The net asset value per share is 65.8 cents and the current RMB Holdings share price is 43 cents. At a discount of 35% to NAV, the market isn’t holding its breath for this big value unlock.

The six months to March 2025 saw a 3.5% increase in the underlying NAV of Atterbury, but also an additional expected loss on the Integer shareholders’ loan (Integer is the other asset in the group). RMB Holdings isn’t even generating enough of a yield on cash to cover its operating expenses as a listed company, so they are not-so-gently eating into their remaining cash balance.

Atterbury isn’t exactly set up to be a cash cow. This isn’t a REIT, so the loan-to-value (LTV) can be much higher than what you’re used to seeing in listed REITs. Atterbury’s LTV is 62.6%, so they are looking to juice up return on equity rather than spit out dividends. There are also problematic underlying exposures, like the Newtown Precinct in Joburg which has a large vacancy rate and an overall bearish tone.

In the outlook statement, the RMB Holdings board notes that they are “circumspect” on NAV growth for the foreseeable future. They are looking at ways to unlock value, but they are sitting on a portfolio of property investments that is going to be very difficult to sell to a third party buyer. The market isn’t putting much faith in the NAV and neither am I, as this strikes me as a portfolio that will end up being sold at a significant discount to NAV.

SA Corporate Real Estate’s pre-close update flags 4% to 5% growth (JSE: SAC)

But there are more interesting insights than that

SA Corporate Real Estate has released a pre-close update for the six months to June. Don’t let the name confuse you – this isn’t an office portfolio. Ironically, they have exposure to everything other than office properties, including a large residential portfolio!

The overall story is one of 5% growth in like-for-like net property income. The distribution for the interim period is expected to be between 4% and 5% higher than the comparable period, with a similar growth rate for the full year as well. So, this is the kind of typical, steady property performance that you hope to see in the sector. The performance across the different property types is remarkably consistent: industrial +4.1%, detail +4.7% and Afhco (mainly residential) +4.7%.

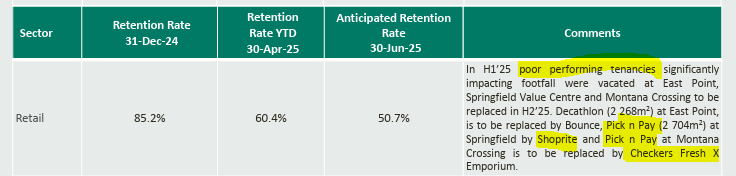

In the retail portfolio, they are running at positive reversions of 3.0% on renewals. But there’s a far more interesting insight that paints a pretty bearish picture (albeit with a very small sample size) of the turnaround at Pick n Pay:

Two “poor performing” Pick n Pays replaced by Shoprite group offerings, one in the lower income space and one as a flagship store? Good luck out there, Pick n Pay bulls. They also make reference to a Boxer replacing Pick n Pay at Umlazi Mega City and having a positive impact on trading densities. As a format, Pick n Pay just isn’t working.

The industrial portfolio is fully let and has a very small renewal base, so there isn’t much you can take from reversions that are anticipated to be 2.9% by the end of June.

The Afhco portfolio has residential and retail elements. The residential side is more interesting here, with vacancies in line with historical levels on a portfolio basis. Reversions are expected to be 2.8% for the period. They transferred 196 apartments from October 2024 to June 2025 and contracted to sell another 713 apartments. There are still 2,660 apartments that they want to sell.

The Zambian portfolio doesn’t get much attention, but I’ll just mention that the forecast is for positive reversions of 1.3% for the period (in USD).

The loan-to-value ratio has improved from 42% to 41%. Although that’s still higher than where most funds are comfortable operating, they are successfully refinancing debt and have received more favourable covenants. The weighted average debt margin has improved by 16.2 basis points vs. Decembeer 2024.

Sea Harvest is having a strong interim period (JSE: SHG)

That initial trading statement was very conservative vs. the performance they are really achieving

Whenever you see a trading statement come out with an expected increase in earnings of at least 20%, then you must keep in mind that this is the minimum level of disclosure required under JSE rules. In other words, the increase might be 20.1% or 200%, yet there is no need for the company to be more specific than “at least 20%”.

The good news is that most companies have better disclosure than that. The typical approach is to release the basic trading statement as soon as they are certain that the increase will exceed 20%, with a further trading statement released when the company has a better idea of the expected move.

This is exactly what we’ve now seen at Sea Harvest, where the initial trading statement came out on 29 May. An updated trading statement for the six months ending June reflects expected growth in HEPS of at least 60%, which is much more exciting than the initial trading statement. They attribute this to better sales price, improved catch rates and cost efficiencies in the South African business.

The words “at least” are still involved here, so the earnings increase may be even better than this trading statement has suggested. I wouldn’t assume a huge difference though, as they now have excellent visibility on this reporting period.

Nibbles:

- Director dealings:

- In settlement of a portion of a hedging and financing transaction, an associate of Michiel le Roux sold shares in Capitec (JSE: CPI) worth R74.8 million. The associated entity intends to implement another hedging and financing transaction, which would typically mean the use of shares as security and then a put/call structure to protect everyone involved.

- Des de Beer has bought shares in Lighthouse (JSE: LTE) worth R3.2 million.

- A director of a subsidiary of AVI (JSE: AVI) received share awards and sold the whole lot worth R575k.

- To add to the recent selling by various ADvTECH (JSE: ADH) directors, we now have yet another example. This time, it’s a director of a tertiary education subsidiary. The sale is worth R248.5k. Either this is a lemmings off a cliff scenario, or bad news is coming.

- The CEO of Vunani has bought shares worth R65k.

- Sean Riskowitz continues to fight a battle against illiquidity to get more Finbond (JSE: FGL) shares, with the latest purchase being for just R4.4k worth of shares.

- Here’s some good news for Barloworld (JSE: BAW): they expect to meet the US Department of Commerce, Bureau of Industry and Security revised deadline of 2 September for the voluntary self-disclosure of “apparent US export control violations” – and the even better news is that investigations to date have not revealed any violations of sanctions.

- The mandatory offer by Novus (JSE: NVS) to Mustek (JSE: MST) shareholders is currently open. Novus announced that they’ve picked up shares in Mustek that increased their holding from 38.60% to 39.92% (in both cases, excluding concert parties). These shares were paid for on a share-for-share basis, with Novus transferring treasury shares to the seller.

- Marshall Monteagle (JSE: MMP) has pretty limited liquidity in its stock, so it only gets a mention down here on an otherwise busy day of news. It’s an odd thing really, with exposure to listed international companies, industrial property in South Africa and global financing and trading companies. Sadly, a 2% drop in revenue for the year ended March 2025 drove a horrible 62% decrease in HEPS. The state of international trade is putting pressure on the business and although they comment in the results on how strong the balance sheet is, there’s also reference to an upcoming rights offer. Ouch.

- Castleview (JSE: CVW) is an R8 billion property fund with excellent underlying assets and absolutely no liquidity in its stock. Whether or not that will meaningfully change over time is debatable, as it strikes me as a pooling of strategic assets rather than a fund designed to have many shareholders. In the year ended March 2025, the net asset value increased by 9.7% to 953.94 cents. The dividend has decreased by 27% though, with a significant subscription for shares in DL Invest having taken place in the period. The loan-to-value is 46.2%, down from 48.9% in March 2024.

I’m wondering if the decision by Bank Zero not to provide loans but rather just invest deposits was due to their banking license restrictions (mutual bank) or other considerations. If it’s a licensing restriction, Lesaka will not really benefit by having access to cheaper funding and it’s more of a payments and transactional play rather than a funding play.