Assura releases the response document to explain why they turned away from KKR / Stonepeak (JSE: AHR)

Just finding the document on their website is half the battle won

Takeover processes are highly regulated things. Boards are required to issue various important documents. Under UK law, the Assura board was required to issue a response letter dealing with their views on the KKR / Stonepeak. And if you spend half your life scrolling down on this page, you’ll even find that document.

As a reminder, the KKR / Stonepeak offer came to an effective 52.1 pence per share, which is a 39.2% premium to the price on 13 February 2025 (the day prior to the commencement of the offer period). Based on the latest available prices, this bid is a discount of a laughably small 0.7% to the implied value of the Primary Health Properties (JSE: PHP) offer.

If you’ve been paying attention to Ghost Bites recently, you’ll know that the acceptance rate by Assura shareholders of the Primary Health Properties offer is very low.

In my view, this is for three reasons. Firstly, the KKR / Stonepeak offer is a cash offer at almost the same implied price, without the volatility of a share-based offer where the implied value changes every day. Secondly, the Primary Health Properties offer comes with plenty of merger risk, whereas the KKR / Stonepeak offer is a clean break. Thirdly, KKR / Stonepeak exercised their right to switch from a scheme to a takeover offer, which means that shareholders can choose to accept that offer instead.

Funnily enough, as there were directors of Assura who gave irrevocable undertakings to KKR / Stonepeak to accept their offer, they are still bound by those undertakings! This comes to only 0.1% of Assura’s shares in issue.

As I’ve said throughout this process, the Assura board’s decision to switch to a recommendation of the merger rather than the cash deal simply doesn’t make sense. The arguments are based on the benefits of a “larger and more efficient REIT” (words that don’t tend to go together) and enhanced visibility. But again, this is all fluff, whereas KKR and Stonepeak have put cold, hard cash on the table.

My guess is that the Primary Health Properties bid is going to fail and that shareholders will act against the recommendation of the board by accepting the KKR / Stonepeak bid. Let’s see what happens.

As an aside, the accelerated dividend that has been part of all the bid calculations has now been declared. It will only be paid if the Primary Health Properties offer becomes unconditional though, so don’t hold your breath.

Labat Africa might dispose of some businesses (JSE: LAB)

They are in discussions with a company called All Trading

Labat Africa is going through significant changes. They’ve now released a cautionary announcement regarding a potential disposal of “some” of their subsidiaries, with the counterparty being All Trading (Pty) Ltd.

There are no further details at the moment. One would have to assume that they are looking to get rid of legacy assets, leaving them to focus entirely on the new push into the technology sector.

MC Mining decided to use SENS as a PR tool (JSE: MCZ)

Points for creativity, I guess

If there’s one thing that small listed companies love doing, it’s using SENS as a public relations distribution tool. You don’t see it too often thankfully, as the JSE tends to clamp down on this behaviour when it gets out of line. Every now and then though, you’ll see some pomp and ceremony coming out on SENS.

MC Mining is a perfect example. They released an announced with this title: “MC Mining’s steel making coal strategy enters new growth phase through reimagined Uitkomst Colliery” – reimagined, nogal.

The TL;DR is that Uitkomst Colliery is now implementing a revised turnaround plan. Metalla Tutum Engineering has been appointed to assist with this, in case that means anything to you. Aside from reworking the mining layouts, they are reducing headcount from 430 to 366, with “minimal forced retrenchments” – so some of this reimagining will be people reimagining where they earn their wages.

Full marks to the PR company, with the share price closing 15% higher after basically telling the market that their asset is broken and they need to retrench people.

Ninety One’s AUM has moved higher (JSE: N91 | JSE: NY1)

And yes, this is the case even after adjusting for the Sanlam deal

Ninety One announced its assets under management (AUM) as at 30 June 2025. This is the first quarter of the 2026 financial year. AUM is the key metric for this group as it forms the basis upon which they earn management fees.

AUM was £139.7 billion, up from £128.6 billion as at June 2024 and £130.8 billion as at March 2025. This includes £1.9 billion from the transfer of Sanlam Investments UK’s active asset management business. The South African tranche of that transaction is still to follow.

If we split out that bump, then growth over 12 months in AUM is 7.2% and over 3 months is 6.8%. In other words, it was a strong quarter!

They don’t give any information on the extent to which this was driven by net flows vs. changes in overall asset pricing. That’s the real test of success in the asset management game.

Orion presses the green button on its share purchase plan (JSE: ORN)

We desperately need to see more of this on the JSE

Orion Minerals does things the right way when it comes to capital raising. They need to raise chunky amounts from strategic investors for their mining projects, but they also give the little guy a chance by allowing retail investors to get more shares at the same price as the strategic investors. In a world where companies do accelerated bookbuilds at a discount to institutional investors, while retail investors are left out in the cold, this is great to see.

The latest such plan allows shareholders to subscribe for shares in parcels from A$170 to A$30,000 (roughly R2,000 to R355,000). The issue price is 1.1 AUD cents per share or R0.13 per share, which is in line with the current share price of R0.14. The offer applies regardless of how many shares each eligible shareholder currently holds, so this is very different to a rights issue.

The raise from strategic investors will add equity of around R67 million to the balance sheet, some of which is from loan conversions. The share purchase plan could be as large as R46 million, although I’ll be surprised if they get to a number of that size. The funds raised will be used to develop the Prieska Copper Zinc Mine and the Okiep Copper Project.

Here’s the “catch” – the offer is only open to eligible shareholders, which means those who were already in the register on the record date of 7th July. In other words, you can’t buy shares now to take part in the offer.

The offer is now open and will close on 5 August 2025. I hope they raise a meaningful amount!

Southern Palladium has released a presentation with their optimised prefeasibility study (JSE: SDL)

It includes some pretty interesting charts

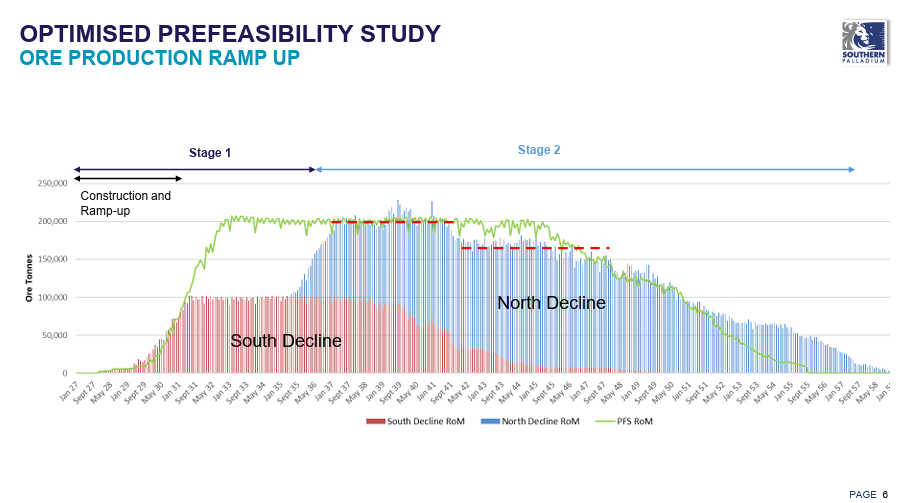

Southern Palladium recently announced the staged plan in its optimised prefeasibility study. As I wrote at the time, the goal is always to maximise the internal rate of return (IRR) and minimise the maximum capital requirement. Achieving this often requires a phased approach.

The company has made its roadshow presentation available, including some charts that show you what that phased approach looks like:

The expected post-tax IRR for stage 1 is 21.8% and for stage 2 is 26.4%. The peak funding requirement is $279 million, which is 38% less than they estimated in the prefeasibility study.

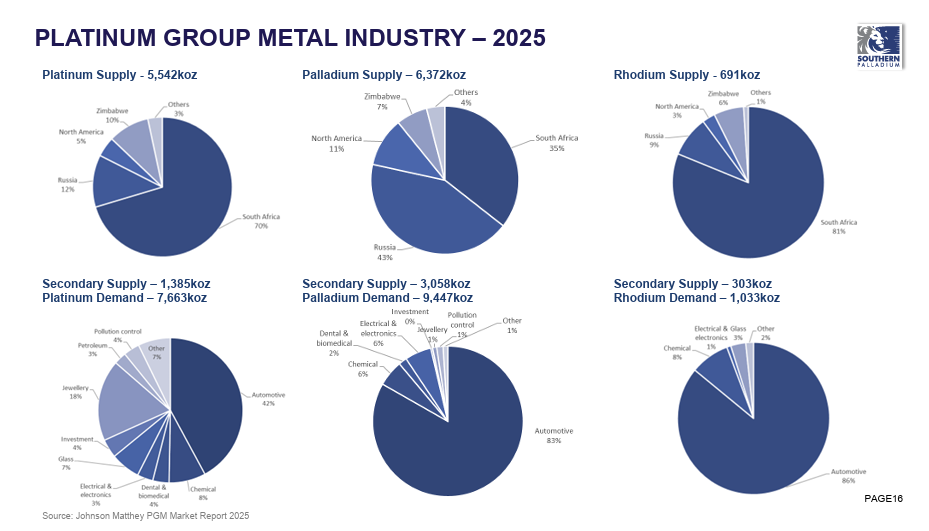

The deck also includes this slide showing the main suppliers of each of platinum, palladium and rhodium, along with the sources of demand:

You’ll find the presentation here.

Nibbles:

- Director dealings:

- Vukile Property Fund (JSE: VKE) has finished winding up the share purchase plan that was previously put in place for executives. This frees up R280 million in capital to deploy into other opportunities. Although this led to vast amounts in director dealings, these aren’t sales in the traditional sense i.e. they don’t tell you anything about the current level of the share price.

- There’s a rather unusual announcement by enX (JSE: ENX) regarding three minority shareholders coming onto the register. Lockstock Investments now holds 7.07% of enX’s shares, Berkeley Capital has 5.22% and Skilgannon CC has 6.66%. I’m struggling to find any other information on these entities, including whether they are the counterparties for any of the recent corporate actions. I would keep an eye on this, as it’s not the norm to see a register churn like this as part of the ordinary course of trade in the shares.

- Lewis Group (JSE: LEW) announced that Global Credit Ratings (GCR) affirmed its long- and short-term national scale issuer ratings at A+(ZA) and A1(ZA) respectively. Importantly, the outlook has been improved from Stable to Positive. This is informed by both the recent trading performance and the strength of the balance sheet. With Lewis having such a focus on credit sales, access to affordable debt (assisted by a strong credit rating) is key to the business model. So, this is good news!

- HomeChoice’s (JSE: HIL) change of name has met all approval requirements and will become effective from 23 July. The new share code will be JSE: WVR.

- It turns out that MTN Zakhele Futhi (JSE: MTNZF) didn’t need approval from the SARB for the special distribution that will pay R20 per share to investors. That’s a return of almost all of the current value of the company, with another R2 – R3 per share to go.

- In case you were wondering what’s happening at Conduit Capital (JSE: CND) – and I know you you probably weren’t – the company has renewed its cautionary announcement. There’s no real update here, with the company still engaging with the liquidator of CICL and needing to publish financials for the year ended June 2023.