A mixed bag at Anglo American (JSE: AGL)

This year looks fine, but there’s a caution around copper in 2026

Anglo American released a production report for the third quarter ended September 2025. They are on track for 2025 guidance in copper and iron ore, although the copper business in Chile has some question marks around production in 2026.

On the steelmaking coal front, the business is in recovery mode and Anglo will look to start finding a new buyer for the business in coming months after the previously planned disposal fell through. They are also in the process of regulatory approvals for the nickel transaction, as well as a structured sales process for De Beers.

From a growth perspective, all eyes are of course on the Teck Resources merger. I mean, merger of equals. Except they aren’t very equal at all, despite the press releases beating everyone with the we-are-actually-the-same-size stick at every opportunity.

Looking at selected numbers, copper production is down 9% on a nine-month basis, while iron ore is down 2% and manganese ore has jumped by 34% due to severe weather disruptions in the base period. In case you’re wondering, diamond production is down 5% year-to-date and up 38% for the quarter, with production from Q4 having been brought forward into Q3 (and thus artificially boosting the quarter).

Copper prices are up around 6%, while iron ore increased 2% (mainly thanks to Minas-Rio). Diamond prices are down 3% year-to-date in terms of average realised price, although the price index for diamonds is down 14%. Yikes.

The area of concern in the update is copper production for 2026, where lower-grade materials from stockpiles are affecting Collahuasi in Chile. They are talking about flat production in 2026 and a potential rebound in 2027. They will update 2026 guidance for copper during the first quarter of next year.

Ascendis Health has another tilt at going private (JSE: ASC)

Hopefully with far less drama this time

When Ascendis tried to go private last time, things got pretty ugly out there on the socials and surely behind closed doors as well. That deal was eventually canned. There’s now another attempt to go private, this time at an offer price of R0.97 per share. The previous attempt in late 2023 was for R0.80 per share. This price is 21.25% higher than before and comes nearly two years later, so it isn’t really very different to the 2023 offer when you consider the cost of capital.

The structure of this deal is an offer made by the company to shareholders, accompanied by a delisting. The price is an 18.2% premium to the 30-day VWAP. Holders of 72.07% of shares have indicated that they will not accept the offer. Holders of 57.03% of the voting class (i.e. the non-concert parties) have given their support to it. If shareholders would like to follow the company into the unlisted environment, then they are able to do so.

Interestingly, there’s a maximum acceptance condition of 20% of total shares in issue. 72.07% have already said no to the offer, so this leaves a question mark around what the remaining 27.93% will do. For this deal to go through, at least a portion of them need to be willing to move into the unlisted environment.

Forvis Mazars in South Africa has acted as independent expert and has opined that the deal is fair to Ascendis shareholders.

The Ascendis website is a great opportunity for this screenshot that tells a story of what life has been like for many JSE-listed mid-caps over the past decade:

The circular for this deal is available here.

Balwin is looking much better these days (JSE: BWN)

Importantly, gross margin from apartment sales is holding steady

Balwin Properties released results for the six months to August. The company has had a tough time over the years, with the share price still trading in line with mid-2020 levels. The company trades at a stubbornly low valuation, reflecting the patchy historical performance and general apathy for JSE mid-caps.

If they can make a habit of reporting numbers like the ones for the six months to August 2025, the market will pay a lot more attention. Revenue climbed 44% and HEPS was up 29%, with the group taking advantage of better conditions in the residential property market. This result was driven by a 45% rise in apartment handovers.

Balwin Annuity (gotta love a segment that does exactly what it says on the tin) increased its revenue by 55% and now contributes 8.3% of group revenue. This is a helpful underpin.

Although gross margin was down from 32% to 29%, this was because of the lack of land sales in this period. What really counts is apartment gross margin, which was steady at 23%.

The cash position improved from R254.8 million as at February 2025 to R303.4 million as at August 2025. There’s still no interim dividend, with the group continuing to focus on debt reduction (the loan-to-value ratio is a meaty 39.3%). When they feel ready for dividends, I hope that they do share buybacks instead. That should do wonders for the share price.

Kumba Iron Ore on track for annual guidance (JSE: KIO)

The market liked it, with the share price up 4.8% on the day

Kumba Iron Ore released a production and sales report for the third quarter of 2025. It tells a positive overall story, with sales up 7% despite production dipping by 2% due to maintenance at Sishen. This disconnect is thanks to improved rail performance, as Kumba sits on an stockpile that Transnet appears to be unable to ever catch up on. At least they made a small dent in the stockpile in this period, with ore railed to port increasing by 12%. Yay!

The Kolomela mine continues to do the heavy lifting, with production up 8% year-on-year for the quarter and 11% year-to-date. At Sishen, production is down 6% for both the quarter and year-to-date. From a cost perspective, Sishen is expected to be within guidance for the year, while Kolomela’s strong production performance could take it below the full year guidance for costs (i.e. more efficient than expected).

In terms of global selling prices, an improvement in demand for steel has given a boost to prices. They are now running at a consistent average realised FOB export price for the nine months year-to-date vs. the comparable period.

Kumba’s success is always at the mercy of Transnet. This is why the market feels good when Transnet seems to be making progress.

Old Mutual targets 6% – 9% dividend per share growth over the medium-term (JSE: OMU)

The capital markets day presentations are packed with insights

Capital markets days are lovely things. I wish that all companies would do them. These days are an opportunity for management (usually divisional execs as well) to present the business targets and strategies for the next few years.

Old Mutual is the latest such example, with all the presentations available here.

In terms of financial targets, the number that is easiest to focus on and remember is the planned growth in dividend per share. They want to achieve 6% to 9% growth over the medium-term. From FY22 to FY24, the compound annual growth rate (CAGR) was 6.4%, so they are targeting an acceleration (as one would hope). This comes with a change to the dividend policy that will be based on underlying cash generation rather than headline earnings.

They will achieve this through a mix of organic and inorganic growth. One of the acquisitions that the market will focus on is 10X, a way for Old Mutual to chase passive net inflows. Old Mutual is acquiring an 85% stake in 10X based on an enterprise value of R2.2 billion, with the deal expected to be completed in the first half of 2026.

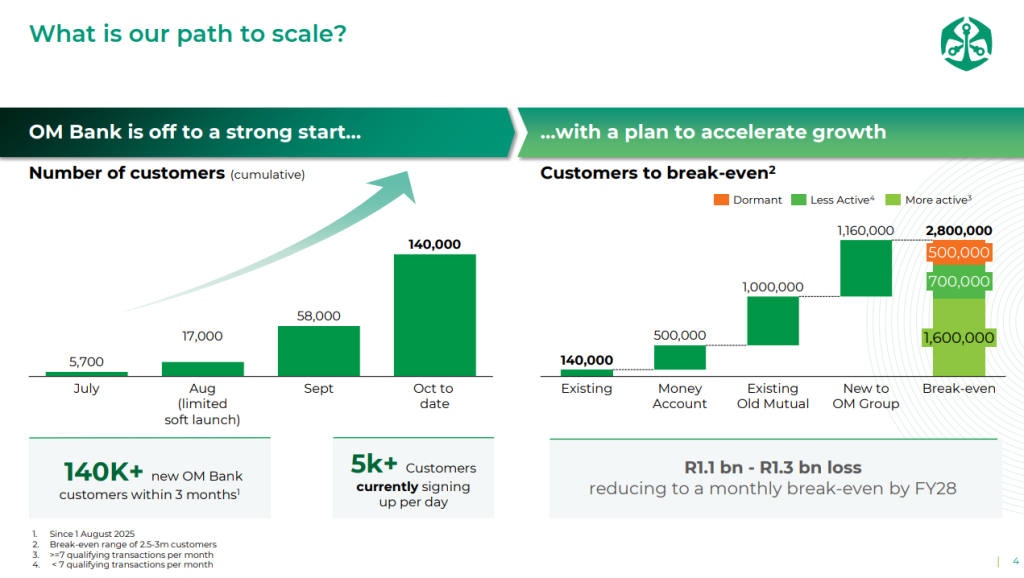

I remain skeptical about Old Mutual Bank and why it should even exist, but perhaps time will prove me wrong. This slide around the scale plan for the bank and the break-even target is certainly interesting:

Take note that they are targeting monthly break-even during FY28. These things take time.

Santova’s margins have dropped sharply due to lower global shipping rates (JSE: SNV)

But the company is confident – and on the hunt for deals

Santova has released interim results for the six months to August 2025 that have a very odd shape. You see, revenue and net interesting income increased by 56.3%, yet HEPS fell by 23.1%. Talk about a divergence!

This is because operating margin tanked from 26.3% to 14.0%, with Santova having to navigate a global trade environment that has seen a spectacular drop in freight rates. Shipping rates are expected to remain at pre-pandemic lows for the foreseeable future, with the double-whammy of oversupply and weak demand. It’s important to remember that operating margin will be structurally lower in future due to the acquisition of Seabourne, a business focused on fulfilment centres and express courier. This is less risky than being exposed to global shopping, but also carries lower margins.

The nastiest drop in profits in this period was Asia Pacific, where net profit after tax fell by 72.9%. It’s thankfully much smaller than the South African, European and UK businesses. The North American business is looking dicey, with restructuring to that business and an increase in loss from R3.7 million to R4.6 million.

Santova has an asset-light model relative to many other ways to play in the freight game, so this makes them more resilient. In fact, they are seeing this as an opportunity to consider acquisitions at a time when prices will be depressed. Kudos to them: this is the kind of thinking that is sorely needed in cyclical industries.

It’s worth noting that Seabourne’s net profit contribution was negligible in this period, with R8 million of profits (for three months) being offset by R6.3 million in acquisition costs and R1.7 million in interest on the acquisition debt. This situation will change going forwards, as the acquisition costs were non-recurring.

Valterra Platinum’s production has dipped (JSE: VAL)

The good news is that Amandelbult is back to steady state

Valterra Platinum released a production report for the third quarter ended September 2025. Despite the company being separated from Anglo American (JSE: AGL), they still released the update on the same day as the Anglo companies.

The good news is that Amandelbult has been ramped up to steady state production ahead of schedule, so that’s pretty good going since the flooding in February 2025. The bad news is that refined PGM production fell 5% this quarter and sales volumes were down 9%, some of which is due to volumes rolling into October.

Still, the group says that it remains on track for 2025 metal-in-concentrate production.

On a year-to-date basis, if you adjust for the change in model at Kroondal, PGM production is down 7% and sales volumes are down 16%. It’s just as well that PGM prices are up so strongly.

WeBuyCars punished heavily by the market as growth faltered (JSE: WBC)

There just aren’t enough details available at this stage to make a call

As regular readers will be aware, I’m long WeBuyCars and I’m a fan of the business model. This has worked out very well for me, even after the share price took a bath on Tuesday:

I’m very tempted to use this market panic to buy more, but I’m going to wait for the release of results on 17 November to make sure that there’s nothing fundamentally broken in the business. Core HEPS increased by between 0.8% and 6% for the year ended September 2025, a growth rate that definitely doesn’t cut it for a growth darling on the JSE. The midpoint of the guided range is 224.65 cents, which puts it on a P/E of 20.8x after the nasty sell-off. That’s typical of a quality company on the JSE, so it’s now at more reasonable levels, but not “cheap” in a way that will encourage people to jump back in.

With new car sales doing well recently (and kudos to CMH (JSE: CMH) for a particularly solid adaptation to what has happened in the market), I suspect that the influx of affordable Chinese and Indian vehicles has affected demand for used cars from legacy manufacturers. If that’s true, the depreciation curve on that shiny German car in your garage is going to be even worse than you feared. From a WeBuyCars perspective, I take comfort in the knowledge that whilst they might have a crummy period now and then due to a market dislocation, they’ve still managed to grow earnings during a year of immense disruption to the sector.

This is why I remain happily long, and why my tendency is to want to add to my position, not cut it. Roll on 17 November!

Nibbles:

- Director dealings:

- Merafe (JSE: MRF) released production numbers for the nine months to September. As we know, the ferrochrome smelter market is in crisis at the moment. Production from the joint venture with Glencore (JSE: GLN) suffered a 51% drop in production for the nine months as production was suspended based on adverse market conditions. Attributable chrome ore production was down 3% and attributable PGMs concentrate production increased 1% (in both cases on a nine-month basis as well).

- There’s an interesting play afoot at RMB Holdings (JSE: RMH), which has been trying to achieve a value unlock since forever. The major underlying asset is the stake in Atterbury, where there have been major disagreements between that company’s board and RMH’s board on the way forward. Things are getting even more interesting now, as Atterbury has acquired a stake of 28.35% in RMH and Coronation has sold out entirely. There are some clever people involved on both sides of the table here, so keep an eye on this.

- I don’t think Renergen’s (JSE: REN) current earnings are the most important element of that story, so I’m just mentioning the updated trading statement down here. For the six months to August 2025, the headline loss per share is expected to be between -R0.866 and -R0.957, an increase in the loss of between 89% and 109%. Aside from transaction costs related to the ASP Isotopes (JSE: ISO) transaction, there were higher depreciation and other costs based on the commissioning of the full Phase 1 plant. You know things haven’t exactly gone to plan when switching on your operations leads to higher losses.

- Africa Bitcoin Corporation (JSE: BAC) announced the results of their capital raise. I’m afraid that the excitement they tried to generate around the change in strategy hasn’t amounted to much, with only R4.05 million raised in the holding company towards buying bitcoin. They also raised just R62k for the Altvest Credit Opportunities Fund (JSE: BACC). I will say it for the millionth time: walking before you run is the right way to build trust in the market and to get people interested. I personally think that full focus should be on demonstrating that ACOF can be viable before they do anything else.

- I was wondering how long it would take to see changes to the top execs at MAS (JSE: MSP). Sure enough, CFO Bogdan Oslobeanu has now resigned. A successor hasn’t yet been named.

- Here’s an interesting capital raise for you: British American Tobacco (JSE: BTI) released a prospectus for the issuance of a mezzanine instrument that is subordinate to senior creditors. They are making allowances for up to €1.2 billion to be issued.

- Piet Viljoen has resigned from the board of Goldrush (JSE: GRSP). He also recently resigned from the board of Astoria (JSE: ARA) as part of refocusing his time.

- Delta Property Fund (JSE: DLT) announced the appointment of Mpho Makwana as an independent non-executive director and the chairman of the board, replacing Phumzile Langeni in that role. With prior experience at Eskom and ArcelorMittal, he clearly enjoys a challenge.

- Trustco (JSE: TTO) needed to find a new sponsor after the corporate finance team at Vunani (JSE: VUN) resigned as the company’s sponsor. Trustco has appointed Dea-Ru to act in that capacity.

- Murray & Roberts (JSE: MUR) announced that the High Court granted a final liquidation order for the liquidation of Murray & Roberts Holdings. Remember, the downstream subsidiary is in business rescue, so this only relates to the listed holding company.

- Deutsche Konsum’s (JSE: DKR) efforts to restructure the balance sheet will culminate in an extraordinary general meeting scheduled for 4 December.

Told you a long time ago that it was time to sell We Buy Cars

Triggering tax events on companies I want to hold long-term isn’t my style. But I do love buying their pullbacks – at the right time.

Has anybody tried to buy a car from “WeBuyCars”?… There is a reason why they are called “WeBuyCars” instead of “WeSellCars”… I think they have a some operations problems!