Clicks’ share price put itself on special (JSE: CLS)

The trading update drove a 6% drop on the day

Clicks released a trading update for the 20 weeks to 11 January 2026. This naturally includes the all-important Black Friday and festive periods. Although growth was positive, the market had no love for the trend.

We may as well deal with the problematic number first: same-store sales increased by 3.7%, a much softer outcome than 5.9% in the comparable period. Although a 110 basis points decline in selling price inflation was part of the reason (coming in at just 2.4% vs. 3.5% previously), the most likely culprit that set hares running in the market is the slowdown in growth in volumes from 2.4% to 1.3%.

If inflation was lighter than before, then volumes growth should be accelerating rather than decelerating.

One of the reasons for this odd outcome is a warehouse management systems issue that affected retail sales by around R120 million, particularly in the Western Cape. The group didn’t disclose total retail sales for this period, but did disclose group turnover of R19.5 billion. This systems issue therefore affected group turnover by around 0.6%. Once you split out retail turnover, it’s likely that the systems issue is the major reason for the lost ground in volumes growth. Importantly, this situation is expected to be fully rectified during February, at which point Clicks needs to claw back that market share.

As Clicks has been expanding its footprint, the total retail sales growth of 6% looks better than the aforementioned same-store sales number. Pharmacy turnover was a particular highlight, up 9%. But the market is smart enough to place greater importance on same-store sales.

There’s also a concern around margins, with Clicks flagging “aggressive competitor discounting activity” over the festive trading period. They also had record Black Friday sales. I doubt that gross margin has a happy story to tell over this period.

On the wholesale side of the business, distribution turnover was up by an encouraging 11.4% (vs. 9.5% in the comparable period). This was boosted by the strong Clicks pharmacy turnover result of course, as well as non-Clicks pharmacies that are supplied by UPD. They did lose two contracts with bulk agency distribution clients though, leading to managed turnover falling by 0.2% for the period.

Interim results for the six months to February 2026 are due for release on 23 April. In the meantime, investors will have to weigh up a Clicks share price that is currently at its 52-week lows:

Reinet’s NAV looks to have dipped slightly (JSE: RNI)

The direction of travel for Reinet Fund gives us a good hint

Reinet Investments (the listed company) always releases the net asset value (NAV) of Reinet Fund as a precursor to the release of results for the holding company. Although there are other assets and liabilities at holding company level, the fund holds the major investments and thus typically drives the direction of travel for the group NAV.

The fund’s NAV per share dipped by just over 1% between September 2025 and December 2025. It’s worth reminding you that the portfolio these days (post the exit of the long-held stake in British American Tobacco in early 2025) is just Pension Insurance Corporation and various odds and ends spread across diversified portfolios.

The share price has been choppy over the past few months, reflecting the effects of currency and geopolitical shifts rather than material changes in the value of the underlying portfolio. Investors will now wait for confirmation of the listed company NAV.

Sasol punters are celebrating (JSE: SOL)

Will it last?

There are many local investors that find themselves in an abusive relationship with the Sasol share price. The volatility is incredible, which means the good days are great and the bad days are terrible. For example, the 52-week low is R53.01 and the 52-week high is R129.09!

Sasol closed at R114.46 on Thursday (a casual 14% higher) after the release of business performance metrics for the six months to December 2025. Much of the joy is thanks to the destoning plant reaching beneficial operation in December, which means that coal quality is improving. This allows them to operate the previously closed low-quality mining sections, driving 6% higher production at Secunda Operations on a quarter-on-quarter basis. If you look at the year-on-year numbers for the six-month period, production was 10% higher!

This was accompanied by a better performance by Natref in the quarter, leading to higher fuel volumes in South Africa at better margins. This fuel performance is exactly why the Sasol share price is up 31% in the past year despite oil prices being sharply lower.

Of course, it would be too easy if everything was going well at Sasol. For example, a dip in gas supply from Mozambique has led to a significant downgrade in gas production guidance for the year.

There are also bigger problems, like the important chemicals business suffering a decline in revenue thanks to weak pricing. Chemicals Africa’s revenue is down 3% quarter-on-quarter, while Chemicals America fell by a nasty 9% thanks to an outage at Louisiana in the quarter. Chemicals Eurasia fell by 11% quarter-on-quarter due to lower volumes and prices. The picture internationally is less severe if you look over six months rather than just the latest quarter, but the reality at Sasol is that the volatility in the share price is a reflection of the volatility in the operations!

This is therefore very much a fuel volumes story, with Sasol upgrading guidance for FY26 from expected growth of 0% – 3% to a new range of 5% – 10%. They are certainly doing their best in a hostile oil price environment.

With the first half behind them, South32 has maintained production guidance (JSE: S32)

And of course, they have the magic word: copper

South32 released an update dealing with the quarter ended December 2025. This marks the halfway point of their financial year. The overall story is that production guidance for FY26 has been maintained, with operating costs on a per-unit basis also in line with guidance.

There’s a small caveat here: guidance for non-operated Brazil Aluminium is under review as there were lower quarterly volumes than planned.

On the plus side, the hottest of hot assets (copper) is doing well, with Sierra Gorda currently performing ahead of FY26 guidance. They haven’t taken the step of updating guidance yet, but things are clearly heading in the right direction.

Another highlight that caught my eye is a 58% increase in manganese production as Australia Manganese returned to normalised production rates and the South Africa Manganese operations completed their planned maintenance.

Alumina production increased by 3% for the period and aluminium was up 2%. Remember that there is an issue coming down the line, with Mozal Aluminium set to be placed on care and maintenance in March 2026 due to an inability to secure an economically viable electricity supply.

Commodity pricing has been all over the place over the past year. Although payable copper was up by a delightful 45%, alumina prices were down 22% at Worsley Alumina and 37% at Brazil Alumina. Aluminium prices were up by between 7% and 10%, depending on which operations you look at.

Helpfully, operating costs on a per-unit basis are looking good. They are generally in line with or below current guidance.

There are a number of important projects underway at South32. Aside from corporate activity like the completed divestment of Cerro Matoso in early December 2025 (nickel in Colombia), they are also busy with construction at Hermosa’s Taylor zinc-lead-silver project, as well as exploration work at the Clark battery-grade manganese deposit.

South32’s share price is up 17% over the past year. Recent momentum is very strong though, up more than 30% over 90 days.

Truworths is going from bad to worse locally, while Office UK is doing all the heavy lifting (JSE: TRU)

The Truworths Africa decline has perfectly offset the Office UK growth

The year is 2030. Office, a JSE-listed retailer, has released results. They talk about how they are just finishing off the disposal of the charred remains of that once-great South African retailer, Truworths. But it’s really just a footnote, as the group has been renamed to make sure that investors only pay attention to the Office UK business.

Cheeky? Sure. Impossible? Not in the slightest. Based on the recent trajectory of the two major segments in Truworths, this is a plausible outcome.

For the 26 weeks to 28 December 2025, a period that avoids that awkward week after Christmas where nobody knows who they are or why they are, Truworths’ group sales were flat year-on-year. That’s right folks, flat!

But if you dig deeper, you’ll see that the segmental performance continues to tell a story of divergence.

Truworths Africa suffered a drop in sales of 3.6%, although gross margin was at least slightly higher. Management continues to give primarily macroeconomic commentary, as though they are merely passengers on the South African journey. They certainly aren’t being paid like passengers, that much I can tell you.

Account sales in Truworths Africa were down 2.7% and cash sales fell by 5.8%. They talk about being disciplined with credit, yet cash sales still fell faster than credit sales. The only highlight is that online was up 23.3%, now contributing 7.4% of Truworths Africa’s sales (vs. 5.8% previously).

Perhaps worst of all, this result was suffered despite a 1% increase in trading space for the period. Not good.

In Office UK, Truworths is bucking the trend of local retailers being obliterated offshore. Sales were up 6.4% in British pounds and 7.1% in rands. As this market is far more mature in terms of omnichannel retail, online sales were up 7.5% and contributed 45.7% of segmental sales (vs. 45.2% in the prior period).

Trading space is expected to jump by between 10% and 12% for the full 2026 financial period, so they are investing heavily in space. If they are increasing space by double digits, then one would hope to see a similar increase in sales, otherwise trading density is dropping.

Surprisingly, flat group sales were enough for group HEPS to be up by between 0% and 2% for the interim period. They clearly weren’t joking about the improved margins in Truworths Africa.

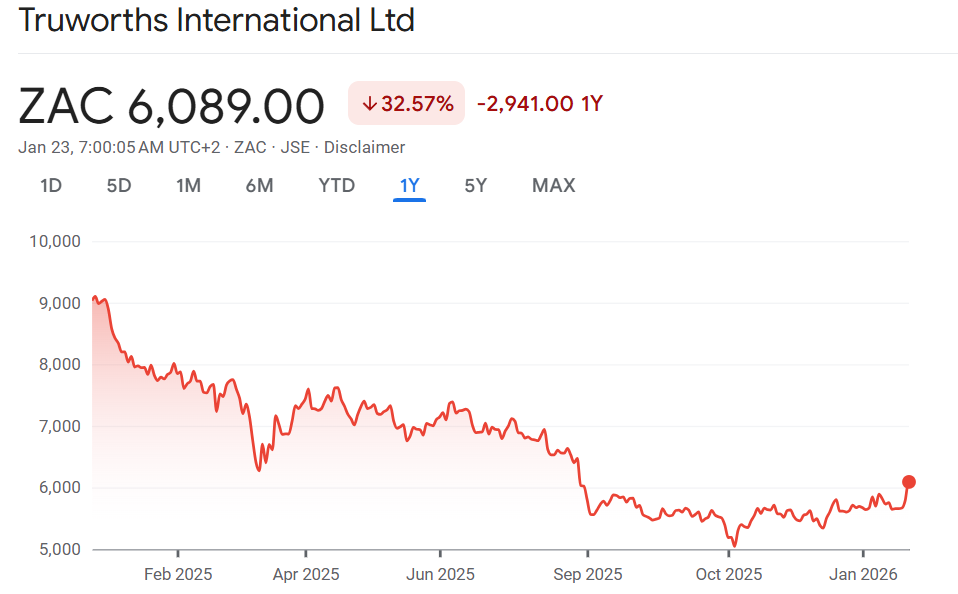

Expectations for this stock are so low that the share price closed 5% higher on the day. It’s still down by nearly a third over 12 months:

Nibbles:

- ArcelorMittal (JSE: ACL) is still in negotiations with the IDC regarding a potential transaction. One wonders where those negotiations lie on a spectrum of purely commercial deals through to thinly-veiled government bail-outs. Only time will tell, with no guarantee at this stage that a transaction will be announced.

- RMB Holdings (JSE: RMH) renewed the cautionary related to the non-binding indicative proposal received from Atterbury Property Fund. The parties are still negotiating the terms.

- Southern Palladium (JSE: SDL) made a whoopsie in its recent presentation at the Future Minerals Forum. Slide 9 in the presentation gave updated forecast financial information for the Bengwenyama Project based on a basket price of $2,000 per 6E oz. That’s a substantial 30% higher than the $1,557 per 6E oz used in the optimised pre-feasibility study. Although market prices have certainly moved up, the company isn’t allowed to do this unless there’s an updated pre-feasibility study. After getting a rap on the knuckles from the Australian Stock Exchange (ASX), the company has retracted those sections of the presentation and referred shareholders back to the original pre-feasibility study.

- Labat Africa (JSE: LAB) is on the radar of many local investors this year as a potentially lucrative speculative punt. The company has applied to list R52 million worth of shares at 14 cents per share. That’s more than double the share price before the announcement, but is still well below their view of underlying asset value (25 cents per share).

- 4Sight Holdings (JSE: 4SI) has released the circular dealing with the proposed repurchase of R10 million worth of shares from Silver Knight Trustees at a price of 55 cents per share. The current share price is 75 cents, so that looks like a decent deal for 4Sight shareholders. It’s very difficult to get out of illiquid holdings like these, hence the discount that Silver Knight was clearly willing to accept.