Blu Label Unlimited’s results are still impacted by once-offs (JSE: BLU)

But they have taken a big step towards “clean” numbers

Blu Label’s economic relationship with (now separately listed) Cell C (JSE: CCD) has no doubt inspired many a sadistic FinAcc IV examiner. With a reputation for arguably the most confusing set of financials in the local listed market, the hope is that the separation of Cell C will help create more understandable numbers going forward.

But we aren’t quite there yet. Cell C only listed at the end of 2025, so Blu Label’s numbers for the six months to November 2025 are still full of complexities. There also happens to be an impairment of R6 billion on The Prepaid Company’s investment in Cell C, partially offset by a gain on remeasurement.

Thankfully, the trading statement gives us some numbers that are actually useful. If you strip out everything related to the restructuring of Cell C, you arrive at revenue for Blu Label of R5 billion, EBITDA of R535 million and net profit after tax of R389 million. Core headline earnings of R398 million translates to 44.19 cents per share in earnings.

Notably, Cell C will be equity accounted by the group, as Blu Label has retained a non-controlling 49.47% interest. Equity accounting is much simpler than consolidation accounting, as any tired and weary accounting student will tell you.

But here’s something else to chew on: core HEPS is down by between 10% and 14% year-on-year. Even if you use the simpler numbers, it doesn’t look like the business had a great year.

Those who bought this story in 2023/2024 did extremely well, with high returns in a short period of time. But those who bought the hype in the run-up to the Cell C listing have been smashed. I haven’t participated at all, as I only buy things that I think I understand.

The markets are hard enough without backing yourself to win a game of musical chairs:

City Lodge’s results would be so much better without the forex movements (JSE: CLH)

At least the dividend is up strongly

My City Lodge position is currently up 16%. That’s certainly not bad, although recent weakness in the share price has taken some of the shine off the returns.

Group occupancy rates for the six months to December 2025 tell a positive story, increasing by 420 basis points to 61.6%. This is the highest occupancy rate since pre-Covid. Combined with an average room rate growth of 4%, revenue was up by 12%. It’s also worth highlighting that rooms revenue increased 10%, while food and beverage revenue was up 17%.

Food and beverage revenue is now 20.5% of total revenue, an exceptional example of management’s strategic execution in recent years.

With total costs up 9% (a solid outcome in the context of higher occupancies), adjusted EBITDAR was up by 16%. And no, the R on the end isn’t a typo – EBITDAR is the industry standard in hospitality.

Adjusted EBITDAR margin was 130 basis points higher at 32.5%. In terms of cash returns, their cash generated from operations increased by 39%. That’s another encouraging metric for the underlying performance.

It all sounds great so far, right? Well… there’s a catch.

Sadly, HEPS actually fell by 0.5% thanks to forex movements. The stronger rand gave them an unrealised loss on forex of R24.7 million vs. a gain of R10.9 million in the prior period – a nasty year-on-year swing. This mainly relates to an intercompany rand-denominated loan in Mozambique.

The group reports adjusted HEPS growth of 33% in an effort to convince investors to focus on that number. It helps that the dividend also increased by 33%, as there’s nothing quite like cash returns to help focus the minds of investors.

The HEPS performance was assisted by share repurchases in the past year, as City Lodge has repurchased 6% of shares in issue at an average price of R4.00 per share. The current share price is R4.75.

Despite this promising underlying narrative and a number of refurbishment projects underway to take advantage of improving local conditions, January occupancy levels were irritatingly weak. They fell by 200 basis points to 42%. Total revenue was up 4% year-on-year, but that’s not great. February was even worse, with occupancy down 400 basis points to 56%. At least they’ve managed to achieve better average room rates and food and beverage revenue in February, with total revenue up 5% despite the drop in occupancy.

The second half of February is showing some momentum. They are hoping it continues.

At least I wasn’t hallucinating the slow start to the year. I couldn’t understand how things were taking so long to get going. Based on this update, people clearly took their time to get out of bed in 2026. I still can’t really figure out why.

Equites Property Fund affirms guidance and highlights appealing metrics (JSE: EQU)

Their portfolio has locked in above-inflation returns

Equites Property Fund has released a pre-close update dealing with the year ending February 2026. With a low portfolio vacancy rate of 0.3% and weighted average lease escalations of 6.2% in the portfolio, key metrics look good. Guidance for growth in distribution per share of 5% to 7% is unchanged for FY26.

As Equites quite correctly points out, their weighted average lease escalations are more than double the current SARB inflation target. With a weighted average lease expiry in the portfolio of 14.1 years, they are poised to significantly beat inflation for a long time. And thanks to triple-net leases that put cost exposure on the tenants rather than the landlord, the fund feels good about turning revenue growth into distributable profits.

The loan-to-value is expected to be 34.2% at the end of the period, down from 36.0% at the end of FY25. The balance sheet is therefore in good shape.

The loan-to-value ratio will come down further when more of the UK disposals are concluded. Some properties in the UK are being held while rent reviews are finalised, as this improves the chances of a successful exit. They do still have development plans in Equites Newlands Group Limited (ENGL), the platform in the UK that Equites owns alongside Newlands Property Development LLP.

But the real focus is on South Africa, where logistics space demand has remained strong. The R21 corridor is particularly appealing to Equites, with a joint venture in place with Tridevco to maximise their chances of capturing this demand. Overall, sector vacancies are just 2%.

A good example of a typical project is a development for Tiger Brands (in partnership with Tridevco), with a yield of 9% on a development cost of R1 billion. They are in advanced stages of negotiating further development leases with an expected capital investment value of R1 billion over the next 12 to 18 months.

In case you’re wondering about how this development yield compares to the cost of funding, Equites has a cost of debt of 8.2%. They’ve had some encouraging recent bond issuances and debt refinancings, so that helps to keep their cost of debt on the right side of their development yield.

Although construction cost inflation helps the value of existing properties, it can also make it difficult to achieve an attractive yield on new builds. Equites noted that the Construction Input Price Index (CIPI) showed average inflation for the year of just 1.5%, well below the 5-year and 10-year averages of 8% and 6% respectively. It picked up towards the end of the year though, so that is something that Equites will need to carefully manage.

There is limited exposure to renewals in the next 24 months. Although you might think that is a good thing, it can actually be a drag on earnings if we are in an environment of positive reversions. It looks like the FY27 renewals could achieve a significant positive reversion of 17%, while FY28 is far less appealing with an expected negative reversion of -9%. The logistics funds have lumpy leases vs. retail funds.

And for the renewable energy enthusiasts, you’ll find it interesting that the sector is generating 16% of total energy demand from solar (according to Nedbank CIB Market Research). It helps that distribution centres have huge roofs! This is an obvious area of investment by logistics property funds, particularly with so much pressure on electricity tariffs.

I’m curious to get your views on the property sector. Which asset class do you like the most?

Gold Fields joins the earnings party in the sector (JSE: GFI)

As you know by now, the gold miners have been printing cash

Gold Fields has now added its name to the list of gold mining houses that made a fortune in 2025. For the year ended December 2025, they achieved a jump in attributable profit from approximately $1.25 billion to $3.6 billion. The move in headline earnings was a slightly less thrilling increase from $1.2 billion to $2.6 billion.

On a per-share basis, this means that HEPS more than doubled from 133 US cents to 288 US cents. The base dividend per share for the year was R25.50, up from R10.00 in the prior year. In addition to this, they have declared a special dividend of R4.50 per share.

This kind of dividend growth is made possible by adjusted free cash flow jumping from $0.6 billion to nearly $3 billion.

One of the highlights is that all-in sustaining costs only increased from $1,629/oz to $1,645/oz. In a period where the gold price moved higher, that’s obviously a huge boost to profits.

The jump in earnings helped them reduce net debt from $2.1 billion to $1.4 billion. The entire sector is deleveraging at the moment, with bumper profits being used to repay lenders.

Although there’s obviously more variance in performance once you dig down into the individual mines, the group results are clearly good news for shareholders. The Gold Fields share price is up 134% in the past year – well behind Pan African Resources (JSE: PAN) as my lucky pick that managed to increase by 311%!

Jubilee Metals is on track for 2026 copper production guidance (JSE: JBL)

This is despite the rainfall in Zambia

Mining is a tough game. There are many external risks, with the weather being just one of them. If there’s enough rainfall, then extracting metals from the ground becomes difficult – and sometimes, impossible.

In an update covering the six months to December 2025, the Jubilee Metals narrative is one of strong production despite the expected rainfall.

The Roan Operations hit their targeted production level of a feed rate of 30,000 tonnes per month. Copper production was up 172.8% for the first half of the year vs. the comparable period in the prior year.

The Molefe Mine operations seemed to get the worst of the rain, with damage to road and bridge infrastructure in the surrounding area. Nonetheless, operations were expanded and they delivered product to the Sable Refinery.

With initial resource drilling at Molefe Mine awaiting lab results, Phase 2 of the expanded resource drilling at the asset commenced in February 2026.

Total saleable copper units produced increased by 8.7% vs. the prior year. This excludes stockpiled concentrate at Roan and mined material at Molefe. This tells you that Sable is essentially the bottleneck in the value chain.

Copper production guidance for FY26 is unchanged at 4,500 tonnes to 5,100 tonnes. This is much higher than 2,211 tonnes in the prior year.

Of course, this guidance depends on what happens with further rainfall. It’s hard enough to forecast what might be coming out of the ground. It only gets harder when you also have to consider what might fall out the sky.

Margins move higher at Kumba Iron Ore (JSE: KIO)

But free cash flow went the other way

Kumba Iron Ore has released results for the year ended December 2025. The story isn’t exciting on a top-line level, with revenue up just 2%. This is because production volumes increased by just 1% and export sales volumes were up 2%.

Thanks to the classic mining strategy of controlling their controllables (something we can all learn from), Kumba achieved cost savings of R673 million and improved their adjusted EBITDA margin from 41% to 46%. This drove an impressive 18% increase in HEPS! Major constraints like Transnet’s capacity have forced Kumba to look inwards for every possible efficiency gain.

On a per-unit basis, material cost savings were achieved at Kolomela (cash cost down 7%) rather than Sishen (flat cash cost).

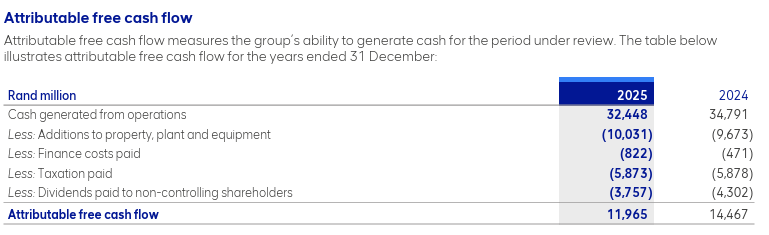

Despite this earnings growth, the total dividend for the year was down 17.2%. This is very similar to the 17.2% drop in attributable free cash flow.

When you see something strange like this, it’s worth digging further.

Your base assumption might be that higher capex is to blame. But if you find the note for attributable free cash flow in the financials, you’ll see that capex (the “Additions to property, plant and equipment”) increased by less than R400 million year-on-year. This is only part of the reason why free cash flow has dropped by R2.5 billion:

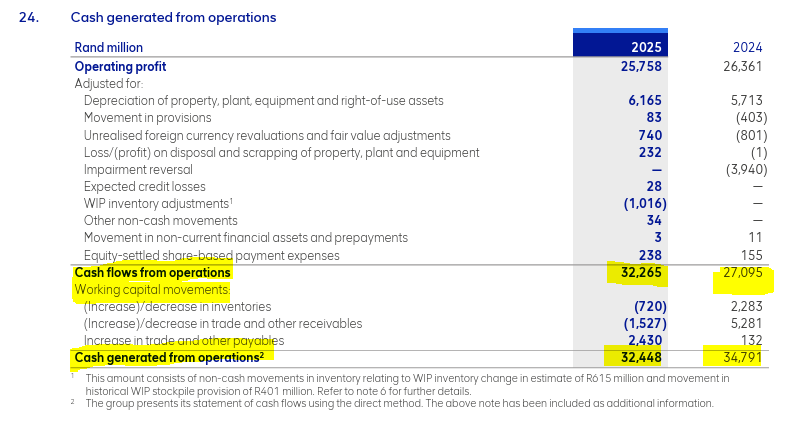

This table shows us that we need to go digging into cash generated from operations to actually understand what’s going on here. If the swing isn’t because of capex, then it’s usually because of working capital (debtors / creditors / inventory). Sure enough, that’s where you’ll find the big movements:

As you can see, cash flows from operations (the first yellow highlight) increased year-on-year as you would expect when profits are higher. But in the prior year, there were massive swings in working capital thanks to a decrease in inventory and receivables, i.e. they worked through inventory and collected old debtors. This creates an impossibly high base for comparison for cash generated from operations (which is net of working capital).

In simple terms, 2024 was a catch-up year and thus 2025 had an unfair base for comparison.

The lesson here? It’s too easy to skim read (or ask your favourite AI model) and quickly conclude that capex is the main pressure point. In this example, whilst there is some capex pressure, it’s really a high base effect in working capital that drove this year-on-year move in free cash flow.

This is also relevant for shareholders in Anglo American (JSE: AGL), which owns just under 70% of Kumba Iron Ore. The increase in attributable earnings will certainly be helpful, but Anglo American could’ve done with a higher dividend to go with it.

A billion euros in EBITDA at Mondi – but only just (JSE: MNP)

Margins have contracted and HEPS has fallen

Mondi operates in a challenging sector. Packaging and paper is a highly cyclical industry, with the current point in the cycle being rather ugly. Sector peer Sappi (JSE: SPP) has found this out the hard way, coming into this part of the sector with a balance sheet that was stretched too thin.

Mondi has fared better than Sappi, but that’s not saying much:

For the year ended December 2025, revenue increased by 3% and EBITDA declined by 5% to just over €1 billion. This means that underlying EBITDA margin contracted by 100 basis points to 13.1%.

There’s a lot that happens between EBITDA and HEPS, so a weak performance in EBITDA is unlikely to deliver many smiles by the time you reach the bottom of the income statement. Sure enough, HEPS fell by 21%.

That’s still modest compared to the hideous decline in the dividend. 2024’s dividend of 70 euro cents is firmly in the rear-view mirror, with 2025 only managing a dividend of 28.25 euro cents – a decline of around 60%.

Mondi will need to be careful with the balance sheet, or they might end up joining the Sappi share price at the bottom of the dustbin where things get really gross. Net debt to underlying EBITDA increased from 1.7x to 2.6x.

With an uncertain outlook for 2026 and ongoing pressure in paper prices in the first quarter of 2026 thus far, it looks like Mondi will have to fight hard just to go sideways.

Vukile Property Fund is lining up further capital raises (JSE: VKE)

They are looking to get shareholder approvals in place now

As the JSE is such a highly regulated environment, companies need to think ahead and get certain approvals in place if they hope to move quickly on deals.

Companies in most sectors can’t actually do this, as shareholders will rarely give directors the authority to issue a significant number of new shares without the specifics of what they are being used for. But because Real Estate Investment Trusts (REITs) acquire properties in the ordinary course of business, you’ll find that successful companies in that sector find it quite easy to get shareholder approval to issue shares.

Vukile Property Fund is definitely in the “successful” bucket on the JSE, widely recognised as one of the best REITs we have here. They had no problem raising R2.65 billion in October 2025 in an oversubscribed equity raise, which means that there was more demand for shares than supply. This represented 10% of its total shares in issue, so they used up their full authority to issue shares that shareholders had granted at the last AGM.

Now, this is where it gets interesting. Management expects “yield compression” in Iberia and Europe, which means more demand for transactions. This implies a seller’s market rather than a buyer’s market, which is a risky situation for the REITs as they may overpay for assets. Nonetheless, in order to have the flexibility to move quickly on deals, Vukile wants to be able to raise more capital.

This is why Vukile is calling a meeting to ask shareholders for a general authority to issue up to 9% of current shares in issue, with that authority lasting until the next AGM. 9% of the current market cap is nearly R3.2 billion, so we aren’t talking about small numbers here.

The general meeting to approve this resolution will take place on 20 March. I doubt they will have any problems getting the approval. My best current dating advice for you is to find someone who looks at you the way institutional investors look at Vukile.

Nibbles

- Director dealings:

- You can say what you want about ASP Isotopes (JSE: ISO), but the company certainly knows how to keep things ticking over on SENS. The latest news is that Quantum Leap Energy has formed a strategic advisory board with leaders in the nuclear fuel and advanced materials industry. Full focus at the moment is on making that subsidiary as attractive as possible for an IPO.

- The next step in the Trustco (JSE: TTO) – Riskowitz Value Fund (RVF) battle is that the Legal Shield Holdings transaction is being unwound. Trustco believes that RVF has repudiated the deal, which means the 200 million shares issued to RVF are undergoing formal rescission. Think of it as a bar fight with lawyers instead of beer bottles and pool cues.