Listen to the show using this podcast player:

Intengo Market is a revolutionary independent digital marketplace for debt instruments in South Africa. Incubated by RMB in 2020 and having launched as a standalone business in 2024, the platform is growing to improve the market for all participants through outcomes like increased liquidity and price discovery. You can look forward to receiving insights into the debt market in South Africa from Intengo in months to come.

In this podcast, we covered topics like:

- Why is the debt market so important?

- For what reason would a company or state-owned enterprise go the route of public debt markets?

- What are the trends in public vs. private debt markets?

- How does Intengo play a role in price discovery, debt raising strategies and the associated processes?

- What role do ratings agencies play in this ecosystem?

If you’re ready to learn about debt markets, you’re in the right place.

Debt arrangers, advisors, treasurers, CFOs and debt investors who want to learn more about Intengo Market can visit the website here.

Full transcript:

Intengo Market is a revolutionary independent digital marketplace for debt instruments in South Africa. Incubated by RMB in 2020 and having launched as a standalone business in 2024, the platform is growing to improve the market for all participants through outcomes like increased liquidity and price discovery. You can look forward to receiving insights into the debt market in South Africa from Intengo in months to come.

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast, coming to you in a week that has been absolutely bonkers in equity markets. I’m actually quite excited to be talking about a completely different point on the capital stack. We are not talking about equity today; we are talking about debt.

It’s going to be super interesting. We’ve got Ian Norden on the call. He is the founder and CEO of Intengo Market and if you look on their website, they call themselves a corporate debt marketplace using a digital platform to revolutionise how corporate debt instruments are issued and traded in South Africa. Very nice, Ian. Luckily we are going to spend the next half an hour or so explaining what that actually is and how debt works in South Africa, because this is a side of the public markets that I think most investors have had very little exposure to and they don’t really see it unless they read every SENS announcement – or Ghost Bites for that matter – and they see stories about companies raising debt, etc.

But if you haven’t seen any of that, then I think there’s going to be a lot of new stuff for you on this podcast – and if you are listening to this as someone who is already in the debt space, then I think Ian’s insights are going to be fantastic. So, Ian, thank you for joining this podcast and for doing this with me. It’s going to be a fun one.

Ian Norden: Hi Ghost. Yes, I’m looking forward to it. Thanks for having me here.

The Finance Ghost: Look, I see you’ve got your fintech startup golf shirt and you’ve got your very cool coffee shop noise-cancelling headphones, which means that the business must be doing very well! This is the surefire sign – if you were dressed up in a fancy shirt and you didn’t have the headphones, because you only work in an office and not in a coffee shop, I’d be quite worried about the future of this business. I’d be very worried that you might be out there just focusing on, I don’t know, LinkedIn webinars as opposed to actually doing successful things.

Ian Norden: Yeah, I think the biggest shift in moving from banking to fintech is the wardrobe change.

The Finance Ghost: There we go.

Ian Norden: You have to live your brand.

The Finance Ghost: 100%, there it is. So, we’re going to talk about the brand, but I think before we do that, we’re definitely going to talk about just the overarching picture here, the umbrella story, which that most people listening to this podcast are I’m sure very familiar with – the equity side of the JSE and of other exchanges worldwide for that matter. That’s been in all the headlines this week really, is what’s happening in equity markets. And this is where you’ll find the shares that you know and you love and a few that might have hurt you, especially in the last couple of weeks. Really, it’s been a bit wild!

But the market also has this vibrant debt side where companies go and obtain funding from public markets in the form of debt. They do stuff like domestic medium term note programmes and you also have state owned enterprises that raise debt through much the same way.

Just how big and important is this side of the market, Ian? This somewhat hidden side that a lot of retail investors don’t actually know much about?

Ian Norden: Ghost, that’s a great intro to it. I think as you said, is probably not as public in terms of the retail side, but from an importance perspective, certainly a very important part of the capital structure of most companies. And then if you look at, just globally, look at governments, look at the debt issues the US are having for example, and South Africa’s got a lot of debt so certainly debt’s not going away and companies are no different.

We can talk a little bit more about how they’re raising debt and maybe some of the shifts we’re seeing in the market. But as a tool, I think it’s been around for a long time and it’s not going anywhere.

The Finance Ghost: What sort of numbers are we talking here? I mean this is billions and billions and billions and billions and billions, right? To quote the man who’s currently making the world a bit of a crazy place, it’s many, many billions of rands that are happening out there when you see these note programmes and all these debt issuances, right?

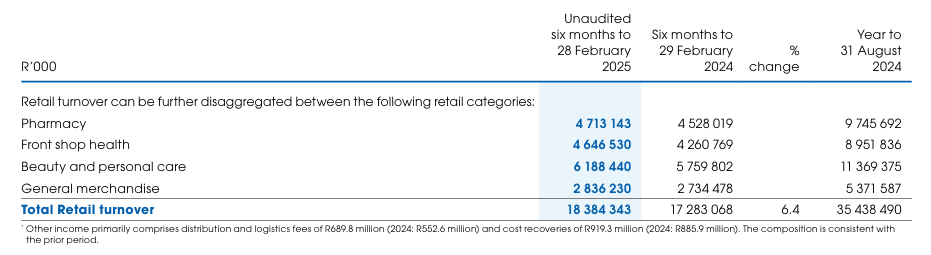

Ian Norden: Yeah. So a note programme – maybe to jump ahead – when you register a note programme with one of the exchanges, you do have to set a limit and it’s hopefully a limit you don’t hit. But generally these limits are in the R5 to R10 billion range per corporate. These aren’t banks who would have much bigger – I think R100 billion could be some of the bank limits. To put it into perspective, we’re probably servicing through our platform about 30% of the market in terms of new corporate and non-government issues. We’ve seen about R160 billion of debt come through in the last three years. So if you proxy that out, you could probably say the market is roughly about that per annum – R150, R160 billion of debt. And again, that’s just in the listed space. Something we need to talk to as well as the difference between private and public debt, because there’s certainly been a big shift in that space too.

The Finance Ghost: Yeah, absolutely. I remember in the early days of Ghost Mail I wrote – back when it was weekly – I wrote this piece about how the debt:equity ratio for a business is a bit like when you go to the beach and you’re getting a soft serve and then you pick two of the flavours and you got to get the mix just right, otherwise you have a problem. And if you put too much ice cream on top of the cone and it can’t support it, then you have an even bigger problem. I think that analogy still rings true today.

Companies, treasurers, CFOs – they’re constantly trying to just optimise the way they have funded their business. And when people refer to the capital stack, they’re talking to all the different ways that you can fund a company. Obviously you’ve got equity at one extreme, which is the most expensive way to do it. People who have studied finance will understand that. But for those who haven’t, it’s not to say that oh, it has the highest interest rate – equity doesn’t have an interest rate! It pays dividends and it’s not forced to pay dividends. So what does it mean to say the cost is higher there than in debt?

The reason is that an equity investor expects a higher return than a debt investor. There’s dilution of your existing shareholders when you go and issue equities. A lot of JSE listed companies trade at a discount to their net asset value in many cases. They go and they issue equity and it turns out to be quite an expensive way to raise funding.

So then, what are their options? And this is when you start to move down the capital stack effectively and you find stuff like mezzanine finance. You don’t see that too often in the public space. To your point, that’s more like private markets, a private equity kind of thing. But what you do see is a lot of companies raising debt through these programmes and then raising from banks, for example. Stuff like term loans, revolving credit facilities, similar sort of structures. Why do these two different things exist? Why is there a public debt market as opposed to just going and knocking on the door of your local bank and saying, hey, we need a few billion in debt?

Ian Norden: That’s a great question because as you said, there are immediate cost benefits of raising debt. I think if we park the – one of the overarching common traits of debt is that it is tax deductible, we’ll park that as a common feature and look at interest in the debt space.

What are your options? Maybe it’s useful to talk about the evolution of a corporate’s journey. So you might start out, as you’ve said, with some equity. You might raise that from friends and family or angel investors. You might then IPO if you grow to scale or raise more money through different private equity models. But when you get to debt, you generally start your journey with a relationship bank. And that bank will lend you money from time to time with a business loan. As you grow, that might become a revolving credit facility as you say, which is really a facility similar to a listed programme where you can draw down on it from time to time.

Then, you might have a GBF or bank guaranteed facility, where it’s essentially the same but just for longer-term debt. And then you might get to a point where the bank says, hang on, I actually can’t lend you any more money because from a credit line perspective I’ve hit my limit. So then what you do is in South Africa specifically – we have four or five very large banks relative to others and relative to other markets – what you might do is then go to those other banks and essentially wash, rinse, repeat, do the same thing.

And then as you continue to grow, and let’s use real estate investment trusts as a good example, they also need lots of debt to buy lots of properties and they are probably the most active in the listed space. Those entities would say right now what I need is I need more debt, and I need it from different sources because I’ve hit my limits with the banks. Then it gets interesting, because now there’s a cost to this. The next stage might be to say, well, I’m doing a specific project, so I’m going to go raise project finance from maybe a life insurance origination team who has an interest in a property deal that’s very long-term because they want to match their long-term retirement liabilities that they’ve got to their clients. You could look at project finance or project bonds or structured bonds. Those obviously need expertise. You have to pay someone to help you do that.

But if you can get to a point where your business doesn’t need structured debt, it can just raise money off the strength of its balance sheet. Then a listed programme becomes quite attractive because you’re immediately going to diversify across a range of different investors.

And this is public – we can talk to who actually can and does buy debt on the market. It becomes a public offering of sorts. You can tap asset managers, you can tap life insurers, you can tap high-net worth individuals if you want. What’s nice about these is they all have different hurdle rates. Where a bank would have a cost of capital, often set by regulation – Basel 3 or Basel 2 or whatever the current Basel is – that will almost set a floor for how low a bank can lend you money, regardless of how strong your credit worthiness is, where an asset manager doesn’t have that or a life insurer will have different regulation. You can start tapping into those nuances of the market and hopefully when you add an element of competitiveness to the process, you can bring down your cost of funding.

So in theory, you get low interest rates, not always the case, but you certainly get greater flexibility and diversification. You can also raise longer-term debt. As I mentioned, some of the players might be more interested in longer-term debt than shorter-term debt.

Generally to help you through this journey, you’d bring an arranger on board, which is traditionally the – some of the big banks do that, but there are smaller houses that will help you – because you need someone to guide you through this process and understand what it is you’re trying to do.

Maybe as an aside, one of the best benefits of debt versus equity is you’re not diluting ownership. Coming to public markets, you actually do have companies that would have just have listed debt and not have listed equity, because the reasons they’re looking for is maybe they don’t need capital from a fundraising perspective in that sense, and they don’t want to elude ownership, but they do need debt diversification. It’s a very interesting area and I think very different to the way equity operates.

The Finance Ghost: Yeah, it’s interesting. You referenced earlier that the property funds are so active in the space and that’s because of the way these REIT structures work where they basically need to continuously be distributing their profits at the end of the day. This is very different to a company that say, hangs onto its profits. We did Berkshire Hathaway recently in Magic Markets Premium, and that’s just a fascinating example because they’ve paid one dividend ever. That’s Warren Buffett’s famous company, one ever. The rest is all reinvested in the group.

There’s lots of debt. They use debt, obviously they use a variety of notes, etc. but I don’t think you’re going to see Berkshire Hathaway doing any capital raises on the equity side anytime soon because they can hang onto all of their dividends and they can reinvest it accordingly. Some companies are not in that boat. The property sector, as I’ve mentioned, right up there, so you’ll often see the REITs doing a combination of equity raises and then debt raises.

What is actually quite interesting is the equity raises in their business are inevitably for expansion. It’s like, hey, we want to go buy new properties, hence we need to go and raise equity. And then they will still need to raise debt in that example because they’ll always make sure they’re doing a debt:equity split that gets the property returns up. But even if they don’t go and buy new properties, they need to keep rolling their debt. They need to go and raise new debt as old debt comes off the books, effectively.

It’s quite a vibrant market because debt capital is not forever. Yes, it can be quite long-term and you’ve talked about how investors like pension funds or insurers are looking to match liabilities. That’s all very interesting and it’s absolutely right. But it can’t be forever. Debt cannot be infinite. So it just keeps rolling, and this leads to this very, very vibrant market where there’s always activity and in some cases perhaps more vibrant than equities.

So, do we see the same sort of trend on the debt markets that we see on the equity side? We’re always talking about delistings on the JSE. The London Stock Exchange has got almost exactly the same problem as the JSE, it’s actually really interesting. People think it’s only the JSE – it’s not! London is cut and paste effectively.

On the debt side, is it a similar issue, or is it actually growing? Is it just getting bigger and better all the time?

Ian Norden: I think on the listed side, it’s the same. You have to look at, and this is where I touched on earlier, private credit and public debt and what the market will call private credit is essentially debt from the borrower’s perspective. So what we have is we’ve got certain industries like you’ve mentioned, like the REITs, who have a continuous need and there’s structural efficiency in setting up a REIT to raise debt in that way. But then you’ve got other companies who are saying, I can raise private credit from a lot of these same players now, and I can achieve a lot of the same goals with a fraction of the operational and regulatory costs.

If we pull back to some of the systemic trends in the market, there have been over the last few years, a couple of incidents, let’s say, that have triggered some outcry from some of the larger investors, institutional investors, saying there’s not enough governance in the debt space. And so, for example, to be a director of a company that issues debt had a different standard to be a director of a company who has public debt and public equity.

The question would be why?

And so if you’re not getting the governance protection of listed debt as a lender, and you’re not getting a lot of the benefits from a lender’s perspective, this is on a regulated exchange and the exchange has almost a duty of care to make sure that the assets is coming from a reputable place. When those start breaking down and we’ve had one or two incidents, which I won’t go into, then people start questioning, well, is this worth it?

So what a lot of the asset managers and institutions do is they will have origination teams in-house and they will start looking for private deals which would normally only fall to a bank. Now you go back to the reasons for setting up a listed programme and you say, well, I was previously setting this up because I wanted to access these people, but now they’re phoning me anyway. That’s happening globally. I think if you then add technology onto that and you say, well, private debt is traditionally opaque, hard to find, you can now set up a bulletin board or think of Facebook marketplace for debt instruments and you can post this and people can see these deals now.

Again, there might be some hurdles you have to overcome to get the deal from person A to person B, but with technology and even things like the Electronic Communications Act, allowing for the electronic signing of things on a computer screen, those barriers are breaking down.

There are myriad other reasons. It’s an incredibly fascinating space at the moment. But there is a global shift from public to private and that’s certainly something that I think is not going to change. But in saying that, locally we have seen, I’d say post-Covid, we have seen a steady uptick in certainly the number of issuers. I think in the corporate space we’re seeing the usual suspects come to market. There’s an element of loyalty as well that the issuers will give to their lenders to say, look, I’m going to be something you can invest in continuously that drives some of the repeat business.

Obviously people aren’t going to borrow money for the sake of it. But certainly in the public space, you also want to make sure that when you do need money, you’re not coming to market and they go, who are you again? You know, what’s your credit story? We haven’t seen you for three, four years!

Capitec is actually a very good example in that space because they generally don’t need a lot of cash on their balance sheet. They’re very cash positive business in terms of the way they’re structured as a bank and their clients. But they come to market once a year to make sure that if they ever do need cash from the public market through their debt programme, there’s been a recent auction which is a recent price anchor and there’s familiarity with the lending base. As you’re gathering from this, many reasons to be in the public space. Individually, certain companies will probably always be in the public space, but systematically, they’re shifting.

The Finance Ghost: Super interesting, right? Because it’s quite a challenge for the banks in that they’ve now got these insurance companies coming and trying to eat their lunch on the debt market – ultimately private debt market that is – and well, in some respects public. But it sounds like traditionally, by the time a company gets to the public markets, it’s typically because banks have kind of tapped out, whereas this is something different. This is to say, hey, instead of going to a big bank, why don’t you raise from some kind of asset manager, for example, or pension fund or insurance house?

It’s interesting because banks should have such a low cost of capital because they’re raising deposits, they’re paying very little on things like current accounts, etc. But they obviously have a blended cost of funding across all kinds of things, including their own wholesale debt. And the insurance houses, I guess are looking at this and saying, well, we’re quite happy actually for our policyholders etc. to go and get these kind of returns over time. So you create this beautiful free market that we all know and love, where what will happen is what will happen over time.

I’m interested in how Intengo fits into this ecosystem then. Are you only focused on the public debt side? Are you focused a little bit on the private debt side as well? How does Intengo actually fit into this rather exciting world?

Ian Norden: Yeah, thanks for asking that. We’re obviously excited about what we’re doing, so it’s always great to talk about that. At our core, we are helping grease the wheels. So we are helping – a bank team, for example, would take a large issuer through a journey of raising debt. And that process, if you think of it almost as like mini-IPOs every time, but you generally don’t IPO once every three months. But some corporates might raise debt once every three months, so there needs to be a workflow system that that makes that process as seamless as possible and as cost effective as possible. So, preserve the integrity of the process, minimize risks and decrease costs.

To talk through the process, if you are bringing a new company to market, whether it’s a repeat of their programme – let’s maybe go back to bringing a new company. You need to set up a program. You bring some lawyers in, you have a sponsor, you go to one of the exchanges, most of them do debt now, and you then set up a programme for your client. That client then wants to raise money. Where Intengo can help is we can do things like saying these are particularly good days of the year to raise money. If we think about the investor universe, these lenders, if they are asset managers, a lot of their liquidity is coming from their existing instruments, the existing holdings. So we can say to the market through our analytics tools, we can say to the bank and to the corporate, this is a good day because this is a day when a government bond, for example, is paying a coupon and many investors are going to have cash that day.

We want to increase your chances of success. We want to increase competition. And increased competition should mean tighter pricing and a lower cost of funding. So that’s one side where we use some of our analytics tools.

But again, it’s an add on to the workflow because the workflow is then right, I want to create an auction. Our tool is an easy-to-use wizard where you can set parameters. This is the data I want. Whether you use our help or not, this is the structure I want. Do I want three-year or five-year? We’ve got many years of data at a very granular level. We can tell you what the market’s currently in favour of. Are they in favour of seven-year, five-year, three-year? If you are indifferent, you can at least have the best, most informed decision as to where to start.

Then we can also do things like relative pricing curves, because a five-year debt instrument should, because of the yield curve being upward sloping normally, be cheaper than seven-year debt. But is it? Absolutely. Is it relatively cheaper? To what? To what curve? We can overlay our own estimation of what we think fair value is for each corporate issuer. And those are also very useful for corporates to say, okay, this is roughly where I might price. This is where the different terms of debt are pricing and maybe where I should target my fundraise. The next phase would be, as I mentioned, this formal offering.

So in South Africa, most exchanges run what’s called the Dutch auction process. That process is where let’s say there are 30 institutions out there who bid in this primary auction, they want to get a piece of your debt. You come into market, you’ve said you’re going to raise a billion rand, your Sasol for example, that billion rand – essentially think of it as a bucket. And the first asset manager will say, I will lend to you at 7%. And the next one will say I’ll lend you at 7.2%. And whoever says the level that fills that bucket – let’s say first asset manager, simple example, R500 million at 7%. Second asset manager, R500 million at 7.2%. Everyone gets 7.2%. The bucket is full at 7.2% and everyone gets that number.

That’s a Dutch auction. It does mean that if the issuer decides, hang on, I’m just going to take R500 million, the price of the debt is significantly cheaper. Suddenly it would be 7%. There is an element of supply and demand that can affect pricing, which we can go into. But again, that process of receiving those bids and ranking them and finding an optimal outcome for the issuer is also one of the tools we offer. We don’t do it – we offer it as a tool to the bank arranger and the corporate so they can have a very interesting discussion during an auction as opposed to working out the maths behind okay, which bids should I take?

It is much more complicated than that. Some corporates might say, I don’t want to borrow from banks because banks already lend to me and I want to preserve my credit lines. As we’ve mentioned, this is one of the reasons you might want to go to public markets. We also need to easily identify which are the banks coming into an auction because they’re also welcome to participate. And we can also show the arranger quite easily who the banks are. We can show certain ratios. You can set targeted ratios to say I want max 30% bank exposure, I want max three-year debt of this and five-year debt of that. I’m massively oversimplifying the bid process, but that’s really where our tool earns its stripes.

The Finance Ghost: Yeah, I think anything complicated can be explained simply. Whether it can be executed simply is something different. I always think if someone can explain something to make it sound simple, it’s because they actually understand it. So, well done on that.

What I do want to just make absolutely clear, also for myself and for anyone listening, it sounds like your client is effectively the treasurer, the CFO, the arranger, the corporate financier, basically on the issuer side of that fence, as opposed to the investor side of that fence. Is that a reasonable summary of how you operate?

Ian Norden: Yeah, I think the market is an ecosystem. As you see on our website, we do talk to two or three different clients. At the core the issue is the client, but they’re very well serviced by the bank arranger. And not just the bank – I say bank arranger, there are other arrangers that aren’t banks – so by the debt arranger, we see the debt arranger as our core client in that regard.

If we can service the debt arranger very well, they can offer a very good service to their corporate clients. We very rarely have direct issuer clients that aren’t brought to us through an arranger. However, there is an option on our platform to self-arrange. Obviously, you then have to sell your own credit and sell your own story. Arranging teams have a distribution function and I think those are very valuable. We position ourselves as a fintech enablement platform, not a disruptive platform. We’re not trying to take someone out of the equation, we’re trying to enable those in the current functions that they’re in to have a more efficient, easier time of it.

If you look at the investor side, investors have many ways to bid on these auctions, whether it’s primary or secondary trading. They can use the phone, they can use Bloomberg, they can use WhatsApp, email, however they choose. We don’t see ourselves as the only way to do it, but certainly another use of our analytics is to offer insights to the investors into what’s trending, what’s pricing well, what’s not pricing well. And by building our own models, we can be an independent voice on what we think the fair value of an asset might be, because there are a lot of supply and demand factors that affect bond prices that might be driven by a certain event, but don’t essentially affect the underlying fair value of the instrument.

The Finance Ghost: Ian, thanks, I think that helps a lot in terms of just setting the scene of who you are really looking to talk to. I think just another point of clarification, also just for me to understand, private companies that are looking to raise debt from interesting places and I think there are quite a few of these, if they’re looking to not necessarily do a listed program, but they want to just have a look in the market at who they should speak to, who are the investors who would invest in notes of this tenure and maybe this credit rating, for example, would that also be an example of your kind of client?

I know that’s probably a bit left field for you, maybe a bit small, but do you also have those sort of clients, the boutique corporate finance houses advising these clients?

Ian Norden: No, we do. I think we’ve grown organically, certainly this year – the last three months, our biggest growth has been in smaller companies coming through, smaller arrangers who’ve gotten wind of us. I think what’s also helped is that the cost of, if we talk about listing a DMTN program on a one of the exchanges, some of the upfront cost is legal. Paying a lawyer to draft a programme memorandum, which is essentially your governing terms and conditions of the program, that cost has come down significantly. You could probably get away with R400,000 or R500,000 now, where it used to be a couple of million a few years ago. I don’t know if that’s cheap for every company, but relatively it’s not a lot of money for some of the bigger companies.

So, to answer your question, if a small company has debt as a priority and we’re seeing some of them come through now, it’s not a big cost because the long-term benefit of setting a program would be significant. If those companies want to come and try and approach private credit providers, I think from experience the best place would be approach a private credit arranging team. And there are lots of them. I don’t want to name any because I’ll alienate someone and they are all potential clients, if not clients. But there are certainly ways to access the private credit markets and get good advice. I think it is important that you do seek advice in this space, even as a large corporate, because there are nuances to raising debt, private or public.

The Finance Ghost: Yeah, absolutely, and that’s why I think this is such an interesting partnership to bring into the Ghost Mail ecosystem, because what you do is so different actually to a lot of other players in the market ultimately, and so focused on debt. It really is such an important source of capital for South African entities, full stop.

And for South African investors, even though typically people are getting exposure to this through their pension funds, for example, or you can go and buy these bond funds, and then they often have a mix of government bonds and corporate bonds as well – so some people do have exposure to this kind of stuff. But, as a retail investor, you’re not going to go and bid directly on a corporate bond on the market in all likelihood. It’s quite big numbers that these things tend to change hands at.

What we will also do in months to come is I think we’ll get some pretty interesting insights from you around this broader debt space. I want to maybe touch on just one other element of it as we start to bring this to a close, which is just the way that ratings agencies work in this ecosystem, because those words, “junk status”, are unfortunately well known to many South Africans who actually have no reason to know it other than because they understand our country’s economic situation. So it’s just one of those things, junk status should not be a relatively household term. It’s an unfortunate situation when it is.

How do these ratings agencies actually add value to this debt ecosystem? And then how different are the costs of debt at these different debt levels? Is that really – you talk about how you grease the wheels in the space. It feels like sometimes the rating agencies are the cars and the wheels and almost the entire story, really?

Ian Norden: Yeah. Junk status, certainly on the face of it, a scary term, probably worth starting with a nuance of credit ratings in that there’s an international view of a company, of a government, and there’s a local view, and every ratings agency will have a mapping table.

So if we look in South Africa, the sovereign government is risk-free because they can just print more money. If you lend to the SA government or any entity they guarantee, they can – whether they will or not is another question – but they can print more rand to pay back that debt. When they raise money overseas in dollars, they can’t do that. They can’t print dollars. They don’t have the dollar press. It sits obviously with the United States.

That is where a global scale might come in and say, South Africa’s junk. I think for the purposes of this discussion and we can maybe go into the global sphere in the future – but for today, if we look at South Africa, everyone then is relatively rated off South Africa. So we go and say, right, South Africa as a government is AAA, what is everything else below that? And then we have a local scale. Certainly in South Africa they are still junk bonds and a junk bond is generally regarded as something that’s uninvestable. You wouldn’t really be putting it into a credit fund that doesn’t have that mandate to be taking big risk. That risk is that you might lose your capital because most of the asset managers out there, they’re offering a balanced fund or a money market fund as a relatively safe haven relative to equities. We only have to look at the last five days to understand the chaos in equity markets with tariffs – they didn’t have the same effects certainly on local bond yields that they had a muted effect on US treasuries for example. But that’s one of the benefits of debt versus equity, is hopefully low volatility and a little bit less correlation.

On a rating side then, you have to look at what’s happened in the last 20 years. And it’s scary to think it was 17 years ago now because I was, well, alive and active in the market. But the financial crisis happened and the financial crisis, I think one of the biggest changes it made to the debt space was it removed a bit of a reliance, a blind reliance on ratings agencies. So some people – I remember doing an open top bus tour of New York and they still teased that AIG was responsible for the financial crash and the insurance companies. But it was also linked to the ratings agencies saying: this is AAA, we think it’s risk free, go and buy it. And again, we won’t comment on whether that was right or wrong, but what happened was a lot of the asset managers locally and globally in-housed their own credit expertise. Now what you find is a large asset manager will certainly look to a rating and say, well, there’s some guidance there and there’s certainly value in having companies be rated. But from a reliance perspective, they’ll have their own teams. They’ll then do the credit work, they’ll come up with their own credit spread, which is a proxy for the riskiness of the bond and they will then use that as their best estimate and rather use the rating as a second check. Whereas I think previously it was the other way around.

So ratings certainly have a place. A rating, when you list a programme, shows on a fundamental balance sheet and company strength analysis that someone’s come in and done some good due diligence on your company and it’s got a relative strength. But from a day-to-day perspective, we must remember companies aren’t being rated every day, so they have to just be another tool in the market. I don’t think they must be the only tool.

The Finance Ghost: I think this has been a really interesting podcast. Thank you. I do have to chuckle slightly in that if anyone could hear a bit of background noise, it’s actually because as much as Ian has got these wonderful noise-cancelling coffee shop headphones, they were not designed for window cleaning behind him with this beautiful view over Cape Town in the building he’s currently in. That was not in the startup design spec! They didn’t think about fancy windows getting cleaned behind there. So maybe next time, we’ll have to do it from a coffee shop – you can go full fintech on us and the noise cancelling will work. It’s just mildly funny. There are a lot of windows there and of course this was the window that was getting cleaned during the podcast.

But I always enjoy these things because they actually – that’s just part of the game, right? I try not to actually take them out because they almost – it’s just…

Ian Norden: …it wouldn’t be a talk about the markets, you know Ghost, if we didn’t have a black swan event, would it really be a talk about the markets?

The Finance Ghost: There we go. 100%. What I can tell you is the risk of that one window being the one getting cleaned right now is surely higher than some of these corporate bonds falling over. I think we’ll leave it there. We’re going to see more and hear more from Intengo in Ghost Mail in months to come as you bring insights into this debt market to the audience. And for those who have listened to this and gone, that’s interesting, we’re active in the debt market, we want to understand more about how Intengo can help us, what is the right way to get hold of you?

Ian Norden: I think the simplest is to go to our website as you mentioned, intengomarket.com, we have a contact us button that’s actively managed, that mailbox. Alternatively, drop me a mail at ian@intengomarket.com very simple. And yeah, we look forward to engaging with yourself, Ghost and your listeners more over time. Thank you.

The Finance Ghost: Brilliant. Thanks, Ian. And we look forward to that. Ciao.

Ian Norden: Thanks.

For more information, visit intengomarket.com.