A much better credit loss ratio drove higher earnings at Absa (JSE: ABG)

This is how modest income growth led to 16.5% growth in HEPS

Absa’s results for the six months to June 2025 offer a fascinating way to learn about the drivers of banking earnings. The overall story looks great for investors, with the dividend up 14.6% thanks to a 16.5% jump in HEPS. Return on Equity – a key driver of bank valuations – increased from 14.0% to 14.5%.

And yet, net interest income (the core source of income for banks) increased by just 3%. What happened here?

Firstly, you need to understand that Absa finds itself in a situation where the decline in interest rates hasn’t driven a substantial increase in economic activity. Total loans and advances increased by 8%, but net interest margin contracted from 4.69% to 4.58%. That was enough to blunt the growth in net interest income to just 3%, as mentioned.

Then, you need to understand that although net interest income is the biggest source of income (R36.3 billion), they also have non-interest income at R20.2 billion. Thankfully, that was up 10% thanks to juicy underlying numbers like a 36% increase in net trading income. As non-interest income is far less capital hungry than net interest income, growth in this area is great news for return on equity.

The next critical point is that net interest income is measured before credit provisions. Absa’s credit loss ratio has improved sharply from 1.23% to 1.00%, which means the impairments charge in this period was 14% lower than in the prior year.

What does this mean in practice? Well, pre-provision income (including all sources of income) was up just 5.2%, whereas operating profit (after impairments) was up 8.6%. When you compare this to operating expenses growth of 6%, it shows you that the much-improved credit loss ratio helped Absa get on the right side of margin growth.

This tells us that although shareholders have something to smile about here, the reality is that Absa’s numbers were boosted by an increase in the credit loss ratio that won’t happen every year. Once the ratio is back within target range, impairments tend to move by a similar percentage to the overall book. Absa is less of a growth story right now and more of a recovery story, which is why the share price is actually flat year-to-date.

Another way to look at this is to take the segmental earnings, where there are wild swings in headline earnings that reflect how difficult things are in some of the underlying businesses. Focusing on the client-facing segments, Personal and Private Banking was up 23%, Business Banking fell 12%, Absa Regional Operations (rest of Africa) grew by a lovely 35% and Corporate and Investment Banking was up 10%. The rest of Africa did the heavy lifting in this period.

Aveng may need the Avengers at this rate (JSE: AEG)

And I’m talking about the superheroes, not the Covid-era shareholders they had

The pandemic delivered some pretty incredible cultural moments in the market, not least of all the self-styled “Avengers” on X (then Twitter) who were punting at Aveng. This was in the pre-share consolidation days, when Aveng was trading at literally a few cents a share – a genuine penny stock.

Sadly, after an 18.6% drop on Monday to take the year-to-date performance to a drop of 62%, the Aveng share price seems to miss its penny stock days and wants to get back down there as quickly as possible. It is now at R4.80 per share, way off the near-R30 levels it traded at after the consolidation.

This is unfortunately what happens when you swing from HEPS of R3.64 to a headline loss per share of -R7.44 for the year ended June, driven by huge losses in major projects like J108 and Kidston. This is precisely why I avoid the construction industry completely: just one or two projects need to go wrong and earnings get obliterated.

Silver linings? Well, there was still a free cash inflow of R257 million, so there’s that. The net cash position actually improved from R2.1 billion to R2.5 billion. They’ve also come into the new financial year with higher work in hand of R37.5 billion (up slightly from R37.2 billion).

In case you’re wondering, it’s the Australian Infrastructure business that is breaking the income statement. I wish someone had the time to do the research on just how many South African listed companies have been given an Ellis Park-level drubbing by the Australian market. For whatever reason, the business environment there is even more frightening than the spiders.

The other two major segments (Built Environs and Mining) both reported improved operating earnings. Before you get too excited, there’s an “Aveng Legacy” book of problematic non-core assets that contributed a significant operating loss.

Aveng’s corporate strategy is to split the group in two, which means the sale of Moolmans (the local Mining segment). They have made “significant progress with a preferred party” on that sale. This would leave them with the businesses in Australasia and Southeast Asia, which is like being left with your least favourite family member on a three-day hiking trip with no access to cellphones. You may survive, but it won’t be fun.

CA Sales flags high-teens growth (JSE: CAA)

The impressive growth story continues

Although there are some worries in the market around the risks to the Botswana economy from the collapse in the diamond market and what this might mean for the likes of CA Sales Holdings with significant exposure to that country, there’s no indication at this stage that growth is suffering. Quite the opposite, in fact, with the company releasing an encouraging trading statement.

For the six months to June 2025, CA Sales expects HEPS to increase by between 14% and 19%. As is the norm for the group, the growth is coming from a mix of organic sources (i.e. existing businesses they already owned) and the integration of new businesses that they’ve acquired (bolt-on acquisitions are core to the growth plan).

Detailed results are due for release on 1 September.

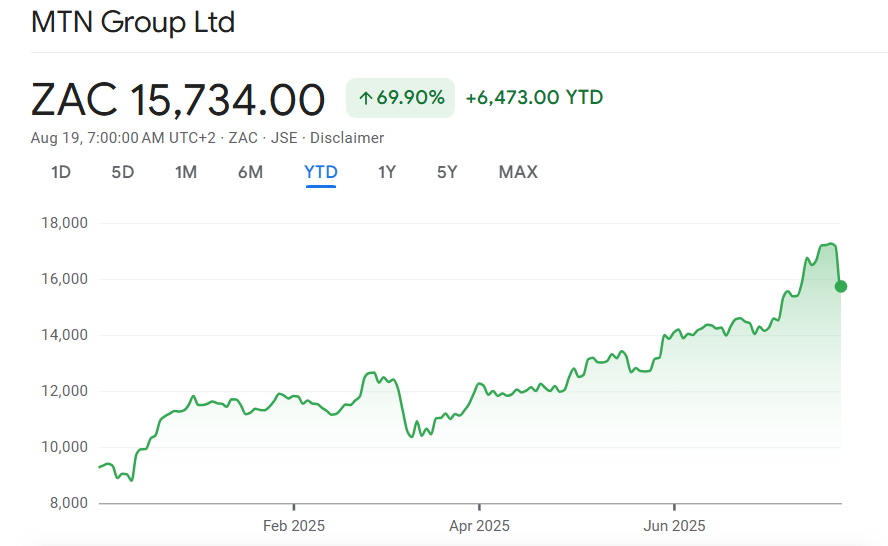

MTN released incredible overall numbers – yet the share price closed over 8% lower (JSE: MTN)

The likely reason for this is very close to home

MTN saw a monumental improvement in its overall business in the six months to June 2025. Driven by the results in the rest of Africa, group service revenue was up 23.2% as reported, or 22.4% in constant currency – and it’s lovely to see such a small difference between those numbers, as currencies in Africa stabilised recently thanks to dollar weakness and other factors.

When it comes to EBITDA, the jump was 60.6% as reported or 42.3% in constant currency. The gap is much larger there, but both those growth rates are fantastic. EBITDA margin was 42.7% as reported or 44.2% in constant currency.

The growth rate in HEPS was a bit daft really, up 352%. It’s easier to understand this as a swing from negative to positive, with a headline loss per share of -256 cents in the prior period and positive HEPS of 645 cents in this period.

As the icing on the cake, MTN upgraded its medium-term guidance to reflect group service revenue growth of “at least high-teens” vs. the previous level that reflected mid-teens.

It’s almost easy to forget a time when MTN was focusing on its balance sheet metrics rather than revenue growth, with huge challenges in getting the cash from the African subsidiaries to the mothership. Thankfully, those problems are largely behind them, with Holdco net debt to EBITDA at 1.5x (stable vs. 1.4x as at December 2024) and group net debt to EBITDA at just 0.5x. Non-rand debt at Holdco level was 17%, well below their upper limit of 40%.

Free cash flow conversion remains a challenge in this sector, as the large companies need to invest a fortune in their networks. Although reported EBITDA was a meaty R46.6 billion, free cash flow was just R6.7 billion. Aside from interest and tax payments, R22 billion in capex is the major reason for that gap.

In South Africa, service revenue growth was just 2.3%. It won’t surprise you that voice was down 2.2%, while data was up 4.3%. Despite a substantial drop in cost of sales, the South African business saw EBITDA fall by 3.6%. This could be why the market reacted negatively to the news, as South Africa is meant to be the steady anchor for the group. There’s also surely an element of profit-taking in the market here, as MTN has been on an incredible run and investors often get jittery in the search for a reason to exit.

In a separate announcement, MTN noted a restructuring of its group into three platforms: Connectivity, Fintech and Digital Infrastructure. There is plenty of reshuffling of chairs at Exco level to make this happen, including a new CEO in South Africa.

Here’s what Monday’s profit-taking exercise looks like on the chart:

For traders, this chart needs to come down and test moving averages that haven’t had a chance yet to catch up to the recent rally. I suspect that MTN is therefore firmly on the watchlist for punters!

Northam Platinum’s recent numbers reflect how rough things got in the PGM space (JSE: NPH)

The rally in share prices in the sector this year has been firmly forward-looking

Although the PGM sector has dished up some massive share price returns in 2025, you certainly won’t find the reason for this in the earnings over the past year or so. Across the board, earnings in the sector have been rough, with everyone looking ahead to hopefully better times thanks to higher PGM basket prices.

Northam Platinum is another perfect example of this, with a 6.9% increase in sales revenue for the year ended June 2025 and an 8.1% increase in the cash cost per ounce. The revenue increase thus wasn’t enough to offset mining inflation, leading to a 25.5% decrease in operating profit.

By the time we reach HEPS, Northam Platinum expects a drop of between 9.4% and 19.4%.

If we dig a bit deeper, the Eland mine is clearly the culprit. The cash cost per ounce jumped by 17.2%. To make matters worse, it was already the least efficient mine in the group, so the cash cost per 4E ounce is now up at R40,562. Compare this to Zondereinde (R26,758) and especially Booysendal (R18,502) and you can see the problem. For reference, the revenue per refined 4E ounce was R32,690, so Eland must have been heavily loss making in this period.

Importantly, Northam expects costs at Eland to normalise over the next two years, with the performance in this period attributed to safety interventions that limited production (even though total production was still up). Either way, the numbers are disappointing for shareholders.

For all the exuberance in the sector, Northam’s outlook statement includes plenty of sobering commentary and a reminder of how cyclical this market is. The share price is up 122% year-to-date, with the market piling into the sector regardless of the risks.

Orion Minerals raised roughly half of the planned amount under the Share Purchase Plan (JSE: ORN)

Under the circumstances, that’s pretty good

Sadly, when companies need to raise equity capital, the default setting is to work through brokers and advisors who bring large institutional investors to the table. This leads to a quick capital raising process that achieves the objectives of the company, but that also tends to shut out retail investors who aren’t given the opportunity to participate.

Full credit goes to Orion Minerals here: they are one of the few companies that give retail investors a fair chance to get involved. The share price has had a rough time this year (down 28% year-to-date), so I was curious to see how the latest Share Purchase Plan would turn out in terms of investor appetite. This was especially the case after the recent Unlock the Stock event with the company, in which retail investors peppered the management team with questions. Getting a wide range of investors onto the shareholder register can be a double-edged sword!

It looks like there’s still strong support from investors, with Orion managing to raise R22.2 million under this initiative. They initially targeted up to R46 million, but that was always going to be a long shot. Encouragingly, they raised R20.6 million from South African investors, so the overwhelming majority of the support came from investors who are close to where the assets are: right here in SA.

Thungela’s profits plummeted, but they’ve maintained the dividend (JSE: TGA)

In fact, the payout ratio for the period is more than 100%!

Things haven’t been pretty in the coal market. Thungela’s revenue fell by 12% for the six months to June 2024, which was enough to drive a rather hideous 80% drop in HEPS. Welcome to cyclical mining companies, particularly those with single-commodity exposure rather than a diversified basket.

Despite HEPS dropping from 952 to 192 cents, Thungela has maintained the dividend at 200 cents per share. This means that they are now paying out more than they earned for this interim period, which is an unusual situation. They would sooner sell their first-born children at Thungela than cut the dividend.

Tempting as it may be to point to the 21% drop in capital expenditure as the reason for the maintenance of the dividend, the reality is that adjusted operating free cash flow fell by 48%. Sure, the capital expenditure decrease helped blunt some of the impact of lower earnings, but there’s still a huge year-on-year drop here that isn’t reflected in the dividend.

The outlook for the second half of the year isn’t exactly bullish, with Thungela referencing risks to the coal price from global economic growth. Much will depend on the restocking activities in the Northern Hemisphere, along with levels of global production and how the supply – demand dynamic plays out.

Not only has Thungela maintained the dividend, but they’ve also approved another share buyback programme. With the share price down 35% year-to-date, that’s probably a sensible allocation of capital.

Nibbles:

- Director dealings:

- A prescribed officer of Standard Bank (JSE: SBK) sold shares worth R5.1 million.

- Des de Beer is back on the bid for Lighthouse (JSE: LTE) shares, picking up another R2.14 million in the company.

- The CEO of Crookes Brothers (JSE: CKS) sold share awards worth R191k (not just the taxable portion from what I can see).

- With Hulamin (JSE: HMN) having previously flagged that the poor performance of the extrusions business has led to a strategic review, they’ve now released a cautionary announcement noting that they have entered into negotiations for a potential disposal of that asset. No other details are available yet.

- Although it is very likely that a deal gets approval from the Competition Tribunal when it has been recommended by the Competition Commission, it’s not a guarantee. It’s therefore an important milestone for Barloworld (JSE: BAW) that the consortium’s offer to shareholders has now been given the green light by the Tribunal. The parties are working towards getting the remainder of the conditions precedent ticked off the list.

- Omnia (JSE: OMN) announced that its credit rating has been affirmed by GCR Ratings. Although a credit rating isn’t an indication of equity returns, an affirmed rating does mean that the cost of borrowing should be steady (assuming constant rates in the market as well), which helps the company plan for growth and ultimately benefits shareholders as well.

Just a slight slip of a finger… Hulamin is (JSE:HLM) and not (JSE:HMN) as indicated.

Thank you so much – fixed! Appreciate it.

A prescribed officer of Standard Bank (JSE: SBK) sold shares worth R5.1 billion.

Serias?

Billion?

Hi Rian! Odd – that typo was fixed this morning but didn’t update for some reason. Fixed it now (and it saved correctly!)

If only corporate jobs were lucrative enough for billions hey…