Africa Bitcoin Corporation and core investment Altvest Credit Opportunities Fund released numbers (JSE: BAC | JSE: BACC)

At least they have fresh numbers for the capital raise

Africa Bitcoin Corporation, previously Altvest, has been busy with a lot of things lately. Still, it’s disappointing that the trading statement for the six months to August 2025 came out on the same day as results were released. I’ll say it again: trading statements are meant to be early warning systems. I’m somewhat more forgiving of smaller companies, particularly when they’ve been snowed under with corporate actions, but it’s still not good enough.

We can skip the starter and go straight to the main course, as we have detailed results to work with rather than the trading statement. The company has thrown absolutely everything behind the bitcoin branding at group level and you’ll see that everywhere in the reporting. Gone is the Altvest style of branding that so much effort (and money) was put into. Personally, I think they should’ve just introduced a new class of shares for the bitcoin endeavours, as the entire structure was perfectly set up for that approach.

If you read the executive chairman commentary, you’ll see that the group is focused on two things: (1) building the bitcoin holdings over time, and (2) deploying capital to SMEs through the Altvest Credit Opportunities Fund (ACOF). There’s no shortage of ambition, with a dream of growing from the current level to having a top 100 market cap in Africa within 5 years. They plan to raise R3.8 billion over the next 3 years. Aim for the stars, hey.

Back down on earth, there’s a long way to go. You might be forgiven at this point for forgetting about Umganu Lodge (a sideways NAV story) and Bambanani Family Group (which can only dream of a sideways NAV). There’s little reason for investors to pay much attention to the A and B shares that represent these assets respectively, so don’t feel too bad about forgetting.

The C shares are a lot more interesting, as they give access to ACOF. ACOF is still losing money at an alarming rate. Although it is early in its J-curve journey, I was hoping to see a stronger improvement in the unit economics in this period. Profit before impairment and operating expenses (i.e. net of funding costs) increased from R2 million to R9.6 million, but operating expenses jumped from R10.3 million to R16.9 million. I don’t really understand why that would be necessary at this point. This means that the net loss for the period before tax was R14.6 million vs. R17.2 million in the comparable period. With ACOF looking to raise equity capital, they really needed to show a better rate of improvement in the underlying economics. Just how viable is it to lend at SMEs at such competitive rates?

Despite such a modest decrease in the loss, the valuation of ACOF has jumped from R163 million to R253 million. You can decide for yourself if that sounds reasonable.

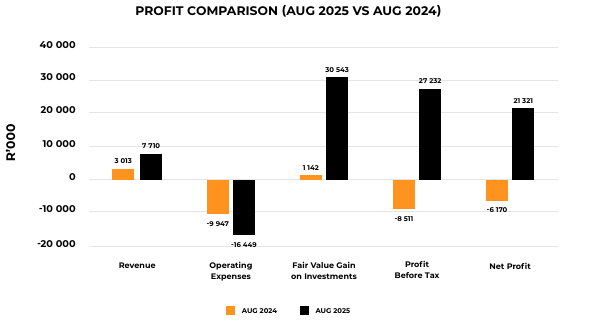

Although Africa Bitcoin Corporation reported a profit at group level, this is thanks to the fair value gains on investments. In other words, you have to be comfortable with the incredibly spicy uptick in value in ACOF to feel good about this performance:

I’ve always appreciated the very constructive and candid approach that the top management at the company have taken in their engagements with me. But my concerns remain high and my money remains uninvolved in this story. The main thing I was looking for was a sign of vastly improved unit economics in ACOF. Perhaps it will come in the next period.

Curro has released the deal circular and expects to delist by December (JSE: COH)

This is truly a landmark deal in South Africa

The Jannie Mouton Stigting (Foundation) currently holds 3.36% of the shares in Curro. As we know from following Curro in recent years, there are a number of factors that led to an incredibly disappointing outcome for shareholders vs. the high hopes that the market had for the group a decade ago. Recognising the role that Curro plays from a societal perspective, the major players involved decided that Curro would be more suited to being a Public Benefit Organisation (PBO) rather than a for-profit company that is expected to show annual growth.

This is effectively a social enterprise approach, as Curro is certainly capable of washing its own face and doesn’t need handouts. The challenge is that the business model just isn’t appealing enough to investors, which is why the share price has been under so much pressure. This could’ve led to strategies that could be damaging to the core ethos of the business, like a reduction in capital expenditure at the schools.

Despite much of the ill-informed and often malicious commentary I’ve seen on social media, what we have here is an exceptional example of a billionaire (and those running his family legacy) stepping up and doing the right thing. Instead of trying to buy Curro at a cheeky price, the scheme of arrangement is priced at R13 per share, a 53% premium to the 30-day VWAP. It will be paid with a combination of cash and shares in Capitec (JSE: CPI) and PSG Financial Services (JSE: KST) – two of the best companies on the local market. If this trade was about the money, there is no world in which any profit-motivated party would swap Capitec and PSG Financial Services exposure for Curro. It’s like trading your Ferrari for a Fiat.

Incredibly, the fees related to the transaction add up to less than R2 million. This has to be one of the most efficiently priced schemes I’ve ever seen, with the advisors perhaps recognising the broader rationale and stepping up accordingly.

Bravo, Jannie Mouton and everyone involved.

eMedia Holdings is buying 30% in Pristine World Holdings (JSE: EMH | JSE: EMN)

There’s some clear momentum at the company

Someone seems to have lit a fire under their you-know-whats at eMedia Holdings. This company usually has fewer SENS announcements than reruns of Anaconda on eTV, but that changed recently. The Remgro (JSE: REM) deal injected capital into the business and significantly improved the liquidity of the N shares with a wider shareholder base after the unbundling by Remgro. People are suddenly talking about eMedia!

The positive momentum isn’t going to waste, with the company announcing the acquisition of 30% in Pristine World Holdings, an offshore company that focuses on providing visual effects services to the global film and television markets. Combined with further investment by eMedia in its visual effects studios in Hyde Park, the group will provide clients with the opportunity to use virtual advertising and will enhance its current productions.

The 30% stake will change hands for $6.9 million, or roughly R119 million. That’s certainly not a small deal, especially for a significant minority position rather than a controlling stake. The net asset value (NAV) of Pristine is $22.9 million, so they are paying basically paying the NAV. We only have a net profit number for 9 months rather than 12 months, with no indication of seasonality in the business, so all I can do is annualise the 9-month number to arrive at indicative annual net profit of $2.48 million. This puts the deal on a P/E of roughly 9.2x, which feels like a big number for a non-controlling stake.

It’s possible that earnings are weighted towards the final quarter of the year, but then why don’t they say that in the announcement? And if there isn’t any seasonality, then I struggle to understand the pricing of this deal.

Orion Minerals has increased the capital raise (JSE: ORN)

They seem to be enjoying strong demand from institutional investors

Orion Minerals recently announced an all-important funding deal with Glencore (JSE: GLN). This really kicked the company into a higher gear, with the market believing that things are finally happening.

This is of course an excellent backdrop to capital raising activities, with Orion taking full advantage of the demand in the market. They initially planned to raise around R57 million (the number makes more sense in Aussie dollars than in rands) from “sophisticated and professional investors” – i.e. not a retail raise open to the public. The raise is now up to R89 million thanks to the level of demand for the shares, so that’s rather encouraging.

Prosus is ready to Just Eat (JSE: PRX | JSE: NPN)

It’s time for the European strategy to be demonstrated

Prosus announced that the offer for Just Eat Takeaway.com is unconditional. The deal can now be closed, with 90.13% of the shares in Just Eat Takeaway.com committed to the offer. Remaining shareholders can still accept the Prosus offer until 16 October.

This is going to be the first really big test for Prosus CEO Fabricio Bloisi, as this deal has been conceptualised and executed under his watch. The thesis here is that Prosus can unlock growth in the tepid Western European markets using AI, with the recently announced acquisition of La Centrale in France following a similar theme.

I really like the Just Eat Takeaway.com deal, as it feels like Prosus pounced on this thing at the right time and at a decent price. All eyes are on execution now, particularly with the Prosus share price up 65% year-to-date. This is a chart that I’ve been very happy to own!

Trustco is on the wrong side of the JSE yet again (JSE: TTO)

How does this company expect to cope in the American regulatory environment?

Trustco has found itself in the naughty corner yet again, with the JSE imposing a public censure and a fine of R5 million on the company. The regulator doesn’t take this step lightly, so Trustco really managed to irritate them here.

How did this happen? Well, back in 2022, Trustco subsidiaries entered into a transaction with SBSL Investments that gave that company the option to subscribe for shares in Meya Mining. This was a category 1 transaction, which would require a circular and shareholder approval. According to the JSE, Trustco went ahead with implementing the deal across a couple of tranches anyway.

To make it worse, to date there is still no circular! The jokes about the company’s name truly do write themselves.

I must remind you that Trustco already has a poor relationship with the JSE and has made it very clear that they don’t want to be listed here. The grand plan is to be listed in the US instead. If Trustco treats the US regulators with the same disdain as the South African regulators, then they are going to have a very bad time.

Is R5 million enough for a company’s disregard of the rules for a circular? Personally, I don’t think so. The advisory fees alone would usually come to that number. The fine for non-compliance needs to be a lot higher than the cost of compliance, otherwise there isn’t a strong enough deterrent.

Nibbles:

- Director dealings:

- I take a somewhat asymmetrical view on director share awards. For example, a director of AVI (JSE: AVI) was awarded shares and sold only the taxable portion, but I don’t really see this as a “buy” because the director didn’t need to put additional cash in. But when a director sells an entire award i.e. not just the taxable portion, it’s a proper “sale” in my books because the director would rather have cash than shares. This was the case for a director of an AVI subsidiary, with a sale to the value of R570k. Director dealings are ultimately only useful for their signalling value to investors, so my approach is based on the typical intent behind the various types of transactions. You may of course have a different view on this!

- While on this topic, I should mention that I always ignore partnership matching schemes, in which directors get to buy shares in a subsidised manner (like at British American Tobacco – JSE: BTI). I also ignore situations in which multiple directors simply reinvest their dividends in shares, as we often see at Anglo American (JSE: AGL). Again, it’s all about how strong the signal actually is. These are weak buy signals that are more linked to employment and remuneration than a view on where the share price is currently trading.

- And now we arrive at a director dealing that is actually useful, being the CEO of Santam (JSE: SNT) buying shares worth R317k.

- Buy signals are by far the most useful form of director dealings, but we should never ignore sales, especially of chunky amounts. A prescribed officer of Standard Bank (JSE: SBK) sold shares worth R3.5 million.

- Finally, we get to an off-market purchase that is clearly some kind of negotiated transaction rather than anything else. An associate of the non-executive chairman of Burstone (JSE: BTN), Moss Ngoasheng, has agreed to acquire a whopping R499.99 million worth of shares in an off-market deal. Quite why it is just below R500 million, I really don’t know. The price is R9 per share and the current traded price is R8.05.

- Following recent on-market transactions, Emira Property Fund (JSE: EMI) now holds an 8.7% stake in SA Corporate Real Estate (JSE: SAC).

- If you’re a shareholder in Supermarket Income REIT (JSE: SRI), you’ll be interested in the fact that the fund has declared a dividend for the July to September period of 1.545 pence per share. There’s no scrip dividend alternative, so all shareholders will be receiving the dividend in cash. The exchange rate for South African shareholders will be announced on 20 October.

- Telemasters (JSE: TLM) will pay its dividend of 0.2 cents per share (yes, just 0.2 cents per share) on 24 October. Try not to spend it all at once.

- If you’re keen to catch up on Southern Palladium (JSE: SDL) and the company’s investment thesis, you can check out the presentation they did in Sydney.