Congratulations to my Ghost Wrap partners Mazars on their appointment as the auditors of African Media Entertainment!

African Rainbow Minerals tracks the cycle lower (JSE: ARI)

It’s the standard playbook of lower commodity prices and logistical challenges

For the year ended June 2023, headline earnings at African Rainbow Minerals fell by between 18% and 27%. The story is in line with what we’ve seen across most of the sector, with commodity prices under pressure and poor infrastructure putting pressure on sales volumes.

The weaker rand did help a bit at least, though obviously not enough to stop earnings from dropping. Full results are due on 4 September.

Blue Label continues to confuse everyone (JSE: BLU)

Market apathy is a serious problem when something is too complicated

After the three millionth attempt to save Cell C and turn it into something profitable (this time by Blue Label), the group’s numbers are so confusing that most people just don’t bother. This is despite some trusted voices on Twitter / X shouting Blue Label from the rooftops and hoping that someone will listen.

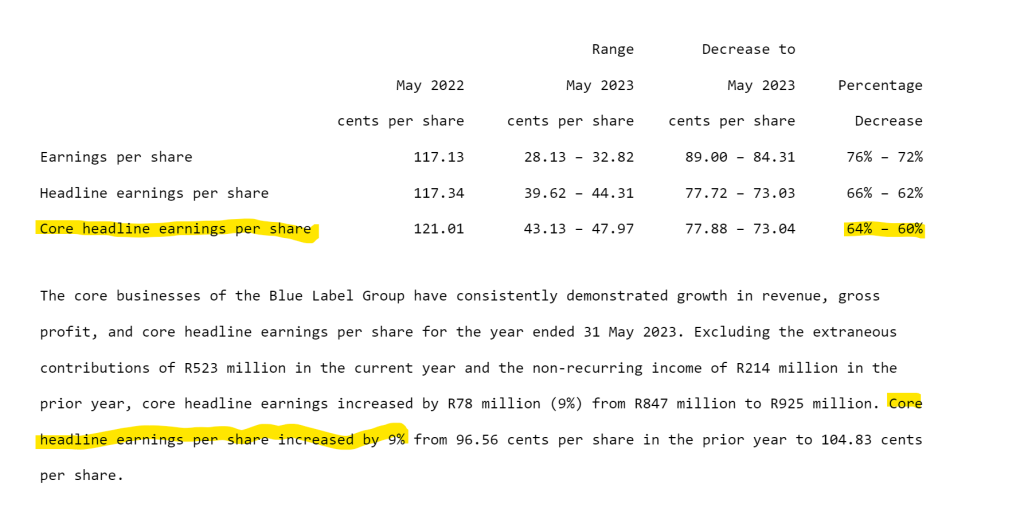

With HEPS for the year ended May down by between 62% and 66%, the announcement doesn’t get off to a great start. Core HEPS is hardly any better unfortunately.

What would help matters greatly is if the announcement actually made any sense whatsoever. Just take a look at this:

So on an adjusted, adjusted, very-adjusted, please-look-away-from-this-section basis, it’s possibly gone up. But I’m not sure. Nobody is.

There’s momentum at Momentum Metropolitan (JSE: MTM)

For the most part, operating conditions have been more favourable this year

The year ended June 2023 has been a much happier one for Momentum Metropolitan. One of the wins (for all of us) is that the impact of Covid on that period was limited vs. the comparable period. Insurance businesses also enjoyed better investment returns (other than in venture capital portfolios) and a favourable shift in the yield curve.

Aside from pressure on venture capital valuations, this happy story was dampened to some extent by lapses in the life business and underwriting losses in short-term insurance.

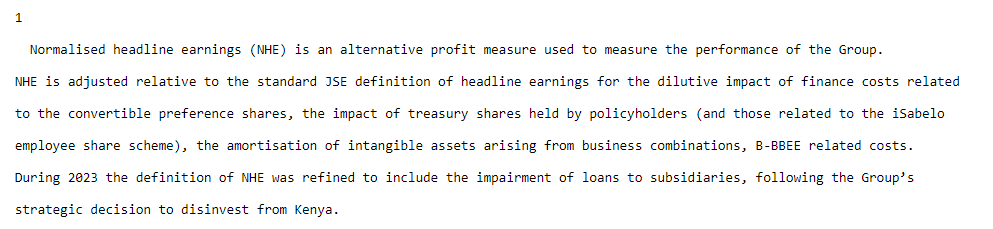

Of course, there are other complexities that will come to light when detailed results are released on 13 September. In the meantime, a trading statement has guided growth in normalised HEPS of between 15% and 22%.

HEPS as reported is only up by between 2% and 7%, so pay close attention to the normalisation adjustments in deciding whether you are willing to accept management’s view.

To show you how complicated this can get, here’s a screenshot from the announcement showing how they think about normalised HEPS:

South32: the latest victim of the mining cycle (JSE: S32)

Another day, another mining house where the dividend has come back down to earth

If nothing else this year, investors have hopefully learnt the difference between trailing dividend yield and forward dividend yield. In the mining sector, trailing yields (the last dividend vs. the current price) don’t tell you much. Forward yields (the forecast next dividend vs. the current price) are the real story, which is why the share prices drop as commodity prices drop in anticipation of dividends falling.

This is why mining share prices don’t usually react on the day of results based on those results. Instead, they react based on the day’s commodity price movements. The exception is where there’s a significant surprise in the results, like a production result that differs from guidance.

Production hasn’t been a problem at South32, with three production records this year. This goes a long way towards blunting the impact of a drop in commodity prices.

If you look at profit after tax, you’ll see a negative number for the year ended June 2023. This is because of a $1.3bn impairment related to the Taylor deposit at the Hermosa project. Even if we ignore this, underlying EBITDA fell by 47% and margin dropped from 47.1% to 29.4%. As I have been consistently pointing out in the recent mining results, that is still a decent margin. It’s simply the year-on-year story that looks poor.

An area of concern for me is the deterioration in return on invested capital (ROIC) from 33% to just 10%. The group has been investing for growth and there is generally a lagging effect in mining, where today’s spend typically drives profits that will only be realised in the future. This is something to keep an eye on.

Last year, South32 paid an ordinary dividend of 22.7 US cents per share and a special dividend of 3.0 US cents per share. The total dividend this year is only 8.1 US cents, so that’s a 64% drop in the ordinary dividend. By their very nature, special dividends are not used for year-on-year comparative purposes.

Over five years, South32 is trailing competitors like Glencore and Anglo American. If Anglo hadn’t gifted Thungela to its shareholders at a ridiculously low price, the below chart would look different and Anglo would look better.

Workforce: profitable, but only just (JSE: WKF)

The company invested for growth that simply didn’t come

Although revenue for the six months to June increased by 7% and gross profit inched slightly higher, Workforce Holdings had invested in capacity and the demand didn’t come through. This crushed earnings, with EBITDA more than halving to R32.8m and the Staffing and Outsourcing segment bearing the brunt of the pain.

Even cash conversion on EBITDA wasn’t great, with cash from operations of R22.5m (down from R64.6m in the comparable period).

It gets worse by the time we reach HEPS, which collapsed from 14.6 cents to 1.7 cents. After a revolting first half of the year, the company expects the second half to be better.

A very interesting comment in the earnings is that the recruitment business is under pressure because uncertain macroeconomic conditions reduce the likelihood of high-quality candidates leaving their jobs and changing roles. I had never considered this, but it makes sense.

Little Bites:

- Director dealings:

- Des de Beer has bought another R12.7m worth of shares in Lighthouse Properties (JSE: LTE)

- The CFO of Standard Bank (JSE: SBK) sold shares worth R12.6m and a prescribed officer sold shares worth just over R2m.

- Argent Industrial (JSE: ART) directors and their associates continue to head for the exit, with the latest round of sales being a total of nearly R1.9m.

- An associate of a director of Mantengu Mining (JSE: MTU) sold shares worth R36k.

- I’m not sure what the back-story is, but an associate of two directors of aReit (JSE: APO) had to return 9,600,000 shares in terms of a court order. I’m not sure who they were returned to and the value isn’t specified. At the current traded price, these are worth R33.6m.

- WG Wearne (JSE: WEA) is suspended from trading and as a market cap of just R8.3m based on the last time it traded. For those who are stuck in this thing, you may be interested to know that there’s a new CFO as an internal appointment.