Altron flags solid growth in earnings (JSE: AEL)

Traders might find the share price chart rather interesting

Altron has been in turnaround mode for a while now, with the share price more than doubling over the past three years. Recent trade has been choppy though. I’m no technical expert, but there’s been quite the double top this year in this share price, a pattern made more obvious by drawing a 5-year chart:

With that kind of volatility, traders may want to take a closer look at the chart. For investors with a longer-term lens, the latest update reflects an expected increase in HEPS from continuing operations of between 16% and 24%. If you look at total group operations instead, the expected move is 12% to 19%. The difference between the two is Altron Nexus, which seems to make a difference of roughly 10 cents per share in the latest period vs. 5 cents per share in the comparable period.

Full details will be released with the interim results on 3 November.

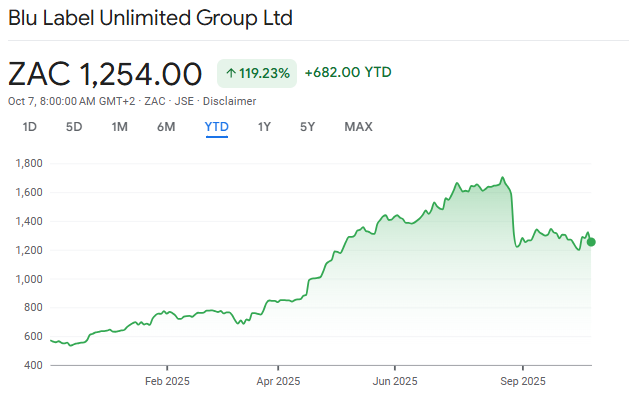

Blu Label gives a summary of Cell C’s financial outlook (JSE: BLU)

Margin expansion is key to the story

Blu Label Unlimited (the new name for Blue Label Telecoms) has released an updated financial outlook for Cell C ahead of the planned listing of that asset.

For net revenue growth, they expect the typical mid-single digits outcome that we see in many companies in South Africa. This feels like an achievable target, as top-line growth above these levels is hard to find in our country.

EBITDA margin is expected to expand thanks to a change in mix and ongoing efficiencies, increasing from the low twenties to the mid twenties in coming years. Targets like these are often deliberately vague. The same direction of travel can be found in the EBIT margin.

Free cash flow is boosted by a decreasing capex requirement, with the capex-light operating model as a key feature of the business. The group has guided for dividend payouts of 30% to 50% of free cash flow. That isn’t quite the cash cow that you might have expected, with Cell C needing to run at a sustainable level of leverage.

These are decent targets, but are by no means earth-shattering or quite as exciting as one might expect to see based on all the bullishness in the market around this name. Having had an incredible run in price this year, the share price recently corrected and is now trying to consolidate:

Gemfields just cannot catch a break (JSE: GML)

Illegal miners are now impacting the Mozambican operations and even the latest auction wasn’t great

Earlier this year, Gemfields was at serious risk of being a corporate failure. They had run the balance sheet too hot for too long, with a vast capital investment programme and dividends to shareholders at a time when the core business was facing almost existential risks. Luckily, major investors were happy to support a rights offer and give the management team another chance to run a more conservative financial strategy.

The problem is that Gemfields still faces significant risks throughout the business, ranging from the realities of operating in difficult African countries through to the impact of fluid supply and demand dynamics in the gemstones market. Both of these issues are on full display in the latest announcement.

Let’s start with the really bad news, which is that the all-important second processing plant at MRM in Mozambique has been significantly impacted by illegal mining activity in the past week. Plant supply infrastructure is being sabotaged and illegally mined rubies are being removed from the area. Although final commissioning of the plant is expected in October, Gemfields has had to defer the November / December ruby auction to January / February next year. This is a very good example of the kind of thing that investors do not want to see.

We now move on to the mixed news, being the latest auction results that achieved revenue of $11 million. Only 62% of the carats on offer were sold at a realised price of $59.43 per carat. The pricing itself doesn’t tell us much unfortunately, as the grade of rubies varies at every auction. It seems as though the smallest and lowest grade material didn’t sell, with Gemfields taking a gamble here on what they actually brought to market. They will “leverage the market feedback received to refine future offerings” – in other words, the gamble didn’t really work.

I was quite surprised that the share price fell by only 6% on the day!

Jubilee Metals is getting closer to being a focused Zambian copper business (JSE: JBL)

The disposal of South African operations is expected to be completed this year

Over at Jubilee Metals, their sights are set on one thing and one thing only: copper in Zambia. To give themselves as much flexibility on the balance sheet as possible, they are selling off the South African chrome and PGM operations. The first tranche of the sale of $15 million has been received and they are busy with remaining conditions for the deal, including Competition Commission approval. They reckon that the deal can be completed by the end of 2026.

It’s important for Jubilee to keep the market informed about the plans for Zambia, where they have three distinct business units.

The Roan Concentrator is a tailings business that purchases and processes run-of-mine material. Production was in line with guidance in the first quarter, with the upcoming rainy season making it more difficult to forecast how production in the next quarter might be affected. They have experience with the seasonality of course, so perhaps their predictions won’t be far off.

The Sable Refinery is currently being expanded to allow for increased production from nearby mines and near-surface assets, with the expansion expected to be completed in the third quarter this year. They need another $5.5 million in capital at Sable, which they expect to fund from existing cash resources and the proceeds from the sale of South African assets. Importantly, the Molefe Mine (previously called Munkoyo) is delivering run-of-mine to Sable, with improving copper grades. They are busy negotiating with potential joint venture partners regarding this business, including for further mine development.

Finally, there’s the Large Waste Project, which is much earlier in its journey. Final designs for the project are expected by the end of the third quarter and they are in talks with a potential funding partner.

As these assets are all located in Zambia, they aren’t entirely independent of each other in terms of future plans. There are various integration opportunities that the company can look at.

The market has been less than thrilled with the timing of the PGM and chrome disposal though, as that sector is rallying like crazy at the moment. While the big PGM names are registering huge positive share price moves, Jubilee is down 18% year-to-date.

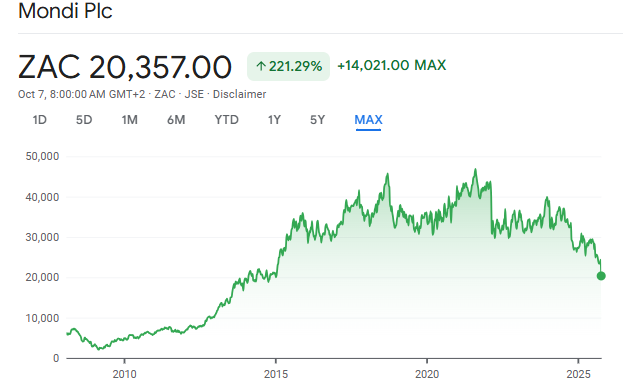

Ugly momentum at Mondi – and not just in the share price (JSE: MNP)

The share price is back where it was 10 years ago

There are certain sectors that I simply don’t invest in. Anything related to paper is one of them, even if there’s a packaging business to try and smooth things out. Cyclical industries scare me on a good day. This chart of Mondi shows you exactly why:

If you have great memories from 2014 that you want to keep alive, then owning Mondi shares will help you think of that year whenever you look at your portfolio. Who needs music and photos when you can just own stocks in the paper industry?

The reason for the 16.5% price drop in response to the latest quarterly update is that Mondi’s numbers are heading firmly in the wrong direction. Underlying EBITDA was €223 million in Q3, down sharply from €274 million in Q2 and €290 million in Q1.

Volumes were impacted by weak demand and paper selling prices declined in the quarter, so that’s a nasty combination. It’s never good when the best thing a company can do is focus on maintenance shuts during a subdued market.

It seems to be getting worse before it gets better, with oversupply in key markets and current selling prices that are even worse than what we just saw in the third quarter!

The only silver lining is that the group has completed its current investment cycle. In other words, they’ve spent a fortune on capital expenditure and they now have to suffer through a poor market for the improved assets. This is exactly why I tend to avoid cyclicals, as the chances of the investment cycle working out beautifully with the market cycle are slim.

This is deep inside the “too hard” bucket for me.

Sirius reports on a seasonally slower period, with ongoing growth in the rent roll (JSE: SRE)

The focus is now on bedding down the recent acquisitions

Sirius Real Estate has released a trading update for the six months to September 2025. Although the rent roll is up 15.2%, around two-thirds of this is thanks to the recent acquisition activity. Sirius has been raising capital and deploying it into assets in Germany and the UK, a strategy that Sirius investors are highly familiar with.

On a like-for-like basis, the rent roll increased by 5.2%. Germany and the UK produced very similar growth rates in this regard. This growth is based on lease escalations and renewal rates, as the asset management focus is on the newly acquired buildings that are excluded from this number.

There are some interesting growth drivers within the group, including in verticals like self storage and defence. The latter is a particularly strong opportunity in Europe, with Sirius appointing a retired Major General and now specialist supply chain consultant to help them optimise the opportunity.

They expect to announce further acquisitions in the next quarter, primarily in Germany. This will add to the almost €300 million in acquisitions across Germany and the UK this year. They have recently raised a significant amount of debt in the form of a revolving credit facility and a bond tap issue, so there’s no shortage of cash available for further deals.

Results for the six months will be released on 17 November.

Tharisa wins against SARS (JSE: THA)

It looks like a significant positive adjustment to earnings is coming

Tharisa has achieved a favourable ruling in the Tax Court against SARS. This relates to mining royalties and the approach that SARS took for the 2015 and 2017 years of assessment, although it has a much bigger impact on the approach that SARS is able to take towards mining companies.

I’m certainly no expert in this space and this is very technical stuff. It sounds like SARS had a difference of opinion to Tharisa regarding the application of an average PGM grade and the incremental cash costs to beneficiate the PGMs to the required standard. This approach effectively assumes a certain income level for a particular grade of mined materials, which is prejudicial to miners with lower-grade ore bodies.

Tharisa previously raised a provision of $56.8 million for this matter and will now recalculate it based on the ruling, with a “materially favourable” impact on earnings per share expected. They will announce more details once the calculation is finalised.

Vunani Fund Managers to merge with Sentio Capital Management (JSE: VUN)

This is why Vunani has been trading under cautionary

Vunani has announced the creation of Vunani Sentio Fund Managers, a merger of businesses that will lead to a combined R60 billion in funds in management. Consolidation of these Black-Owned fund managers makes sense, as scale is key to success in this particular industry.

The deal is structured as an acquisition of Sentio by Vunani. The end result will be that Vunani holds 63% in the merged entity, while current management of Vunani Fund Managers will have 15% and current management of Sentio will have 22%. Notably, Investment Managers Group (part of Momentum JSE: MTM) currently has a 30.05% stake in Sentio and will be exiting the stake entirely, as being diluted to a small stake isn’t part of its strategy.

Vunani Fund Managers is paying for the deal in cash and shares. If I understand the announcement correctly, shares in Vunani Fund Managers will be issued, not new shares in Vunani as the listed company.

The deal isn’t categorisable under JSE rules, so we won’t be getting any further details on it at this stage.

Nibbles:

- Director dealings:

- Discovery (JSE: DSY) directors and prescribed officers received quite the payday, especially Hylton Kallner as the CEO of Discovery Bank. I’m sure that his KPIs had big green ticks next to them after the bank recently turned profitable! He only sold the taxable portion of his shares, but the same can’t be said for all the execs. Other than sales purely to cover tax, over R40 million worth of shares in aggregate were sold by multiple directors and prescribed officers.

- The chair of Mondi (JSE: MNP) bought shares worth over R1 million. He took advantage of a massive negative move in the price in response to results.

- A director of Standard Bank (JSE: SBK) sold shares worth R338k.

- eMedia Holdings (JSE: EMH | JSE: EMN) is getting value investors hot under the collar at the moment, even if the company seems to have paid a meaty price for the offshore investment in a visual effects business. This is balanced by a significant recent share repurchase programme, with 3.44% of N ordinary shares in issue having been repurchased since 30 September 2025. I suspect that the unbundling by Remgro (JSE: REM) led to plenty of shares being offered in the market, with eMedia only too happy to sit on the bid. The average price for the repurchases is around R1.81 per share, with the N shares currently trading at R2.05. Of course, the downside to repurchases of this magnitude is that they hurt liquidity in the stock, something that smaller companies always need to keep in mind.

- In good news for Barloworld (JSE: BAW) shareholders who want to accept the offer from the consortium, the TRP has issued a binding ruling that the final consideration per share must be R120 per share, not the R118.80 that the consortium tried to get through as an adjustment to the price for a recent dividend. The offer is open for acceptance until Wednesday, 15 October.

- MultiChoice (JSE: MCG) announced that Canal+ is up to a 72.46% stake in the company. There are further acceptances in place that will take them to 76.52%.

- Visual International Holdings (JSE: VIS) is raising R2 million (for context, the market cap is only R55 million) through an accelerated bookbuild process. As the capital raise has been timed in such a way that they aren’t in a closed period, it looks likely that directors will participate in the raise. The way it works is that related parties have to buy shares at the price at which the book closes. The question will of course be whether the market is particularly interested in this raise. It would probably help if the company actually had a working website…

- Assura (JSE: AHR) is going through the motions for the cancellation of its listing. The shares are suspended from trading on the JSE and will be delisted on 23 October. In case you missed all the news related to this company this year, Assura was acquired by Primary Health Properties (JSE: PHP), which remains listed on the JSE.

- MTN Zakhele Futhi (JSE: MTNZF) has renewed its cautionary announcement regarding the final unwind of the scheme and the calculation of the residual value. They haven’t given an updated view on the timing of when this might happen.

- With Jan Potgieter deciding not to stand for re-election to the board of Italtile (JSE: ITE), his long journey with the company (including 5 years as CEO) comes to an end. Notably, the ex-CEO of Pepkor (JSE: PPH), Leon Lourens, has been appointed as a non-executive director. No shortage of retail experience there!

- Shareholders in Marshall Monteagle (JSE: MMP) almost unanimously approved the resolutions required to execute the equity capital raising activities of the company.