Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Important correction: last week, I noted that the odd-lot offer by Quilter (JSE: QLT) was an opportunity to potentially make some “beer money” on the arbitrage. As a reader thankfully reminded me, you actually needed to be on the share register months ago to qualify. In other words, this arbitrage is not available. The structure is very different to a standard odd-lot offer. My apologies for this oversight. This is also a good time to remind you that the ultimate responsibility for research and any decisions always rests with you. I do my very best to avoid any errors, but even ghosts are only human.

Copper up, diamonds down at Anglo American (JSE: AGL)

The company released its production report for the quarter ended September

It never really makes sense to me why a diversified company like Anglo American gives a view on total production vs. the prior period. The underlying commodities are so different that you have little choice but to dig into the details.

The good news story is firmly in copper, with production up 42% thanks to the contribution of Quellaveco. Things are less enjoyable in PGMs (down 2%), nickel (down 7%), and iron ore (down 4%). Manganese ore headed in the right direction, up 4%.

We then get to the major negatives. Steelmaking coal production fell 21% and diamonds dropped by 23%, with the latter due to planned reductions (particularly in South Africa) as Venetia transitions to underground operations.

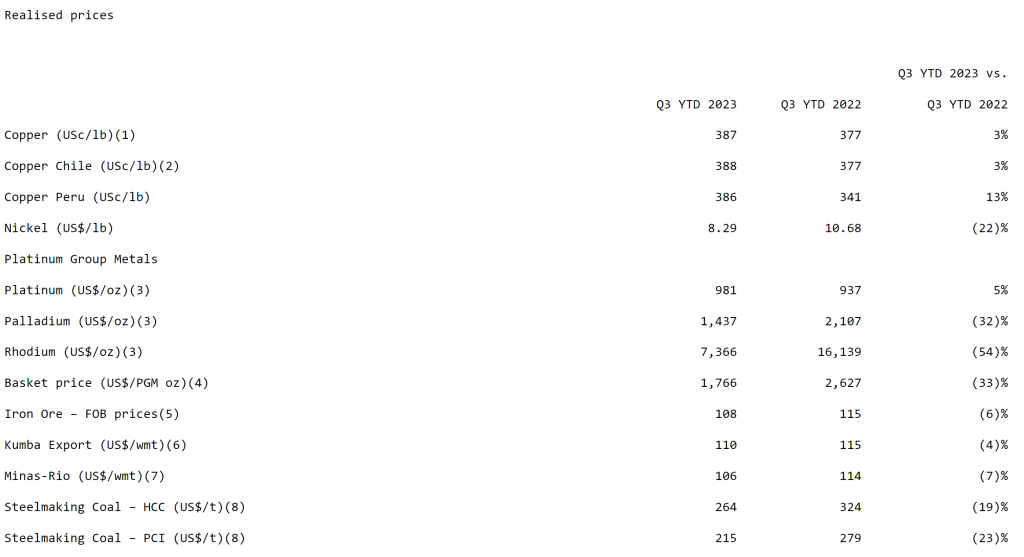

Rather than hitting you with selected numbers in terms of commodity prices, I’ll give you the entire table so you can see just how many commodities have dropped in price:

In terms of production guidance, copper has been reduced for the full year. Guidance across other commodities has been retained.

Anglo American Platinum really is up against it (JSE: AMP)

Production is under pressure and the rand basket price of PGMs just keeps dropping

For the third quarter ending September 2023, total PGM production dropped by 2% at Anglo American Platinum. Refined PGM production fell 9%, thanks to the combined impact of a “multi-municipal water stoppage” in Rustenburg and lower metal in concentrate production.

PGM sales were up 2% as the company was able to rely on refined stock to prop up sales at a time when production went the wrong way.

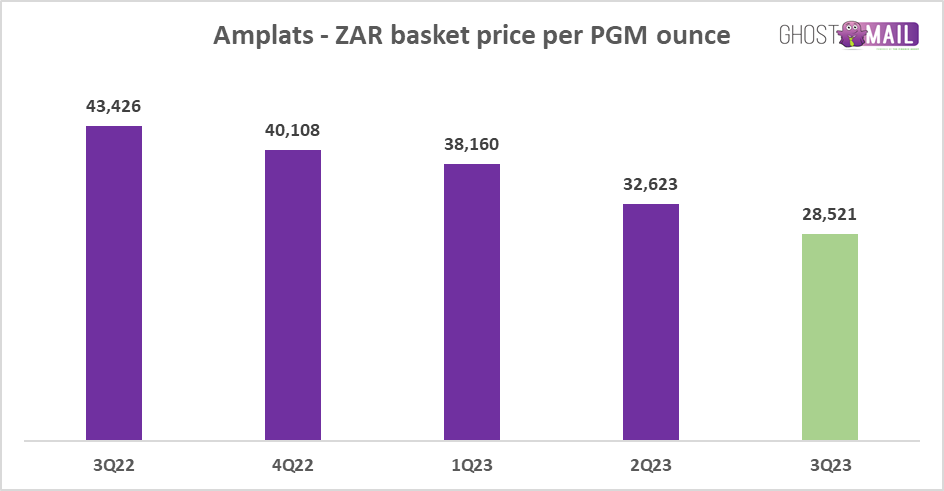

Speaking of going the wrong way, here’s the PGM basket price for the past year or so:

Note that this chart is already in ZAR, so it would’ve looked worse in USD.

And of course, adding insult to injury, a drop in production tends to mean an increase in unit costs, especially during inflationary times. Despite the PGM production guidance for full year 2023 being unchanged, unit cost per PGM ounce is expected to be at the upper range of R16,800 to R17,800 per ounce produced.

It’s not hard to see why the share price is down 57% this year.

Earnings fall at Famous Brands, yet the dividend is higher (JSE: FBR)

I would prefer to see a reduction in debt rather than a higher dividend

As though we don’t already have enough problems in South Africa, Famous Brands notes that we had a poor potato harvest in the country this year. Look, I can put up with a lot of things in life and most of what this country throws at me, but I won’t cope with not having any chips.

For now at least, there are still chips. Revenue increased by 10% for Famous Brands in the six months to August, so I’m clearly not the only fan of chips in this world.

Unfortunately for Famous Brands shareholders, that’s where the good news stops. With pressure on food input costs, massively higher insurance premiums (thanks to levels of civil unrest in this country) and support to franchisees through load shedding, operating margin fell from 11% to 9.4% and group HEPS dropped by 7%.

The trend of consumers trading down in search of value continues, with the “Signature Brands” (the fancier restaurants) reporting evening trade that hasn’t recovered to pre-pandemic levels. Families still want to get out the house, but affordability remains a challenge.

I worry about the dividend going up by 6% at a time when HEPS has fallen by 7%. With R1.25 billion in debt on the balance sheet, I can’t help but wonder whether that cash would be better utilised in reducing debt.

Strategically, the company has noted Cote d’Ivoire, Egypt and the Democratic Republic of Congo as potential growth areas for Debonairs and Steers.

I continue to prefer Spur in this sector for its relative simplicity and quality of strategic execution.

Transnet continues to hurt Kumba (JSE: KIO)

This time, the port seems to be worse than the rail situation

You don’t have to read very far into a Kumba announcement to find the word “Transnet” – the Achilles’ heel of South African resources.

For the quarter ended September, Kumba’s production was 2% lower quarter-on-quarter. The good news is that it was 4% up year-on-year, thanks to improvements in rail performance and a reduction in cable theft.

Before you get too excited, equipment failures and adverse weather conditions at the Saldanha Bay Port impacted ship loading, with sales down by 12% year-on-year and 6% quarter-on-quarter. There’s never a dull moment with Transnet.

The silver lining is that levels of finished stock at Saldanha Bay Port improved, so hopefully this benefit will be felt in the next period. Full year sales guidance for 2023 has been retained.

In term of iron ore pricing, the year-to-date average FOB export iron price was $112/dmt, which is down from $117/dmt in the comparable nine-month period.

Oasis Crescent: having no debt works well in this environment (JSE: OAS)

Shariah compliant funds aren’t exposed to rising interest rates as debt is not permissible

At a time when most REITs are finding it difficult to grow distributable earnings because of the high cost of debt, Oasis Crescent is enjoying the combination of high inflation and zero debt on the balance sheet. This has driven the distribution higher by 12.7% for the six months to September.

In the announcement, the fund reminds the market that unit holders have enjoyed a return of 10.3% per annum since inception vs. SA inflation of 5.9% per annum.

Welcome, Primary Health Properties (JSE: PMP)

The secondary listing is complete and we also have a trading update

The thesis behind Primary Health Properties (PMP) is centred around a basic concept: dependable rental income in a real currency. It’s as simple as that. This isn’t terribly different to the logic that people use when investing in global dividend stalwart British American Tobacco.

I think we can all agree that a healthcare group sits at the other end of the spectrum to a tobacco company on the public benefit scale, no matter how many ESG consultants and colours of the rainbow British American Tobacco uses on its website. There’s an ESG tick-box exercise and then there’s common sense.

The good news is that PMP is managing to increase its rent in a time of inflation. That sounds incredibly obvious, but “negative reversions” have been a feature of South African REITs over the past year or two.

To give you an idea of the PMP strategy, a recent acquisition is a community care facility in Ireland, presumably to help them with the pain of another quarter final exit in a Rugby World Cup. This property is fully let to the public health service on a 25-year lease with five-yearly inflation indexed rent reviews.

Before you assume that nothing can possibly go wrong with this story, don’t forget that debt costs have been increasing sharply in developed markets. The loan to value ratio at 30 September 2023 was 45.8%, up from 45.6% just three months prior. 97% of the group’s debt is fixed or hedged at a weighted average cost of 3.3%. Debt is never fixed for an indefinite term, so any further research here should be around when the debt expires and what the likely refinance rate might be.

Let’s hope we actually see some liquidity in this thing on the local market. The very last thing that anyone wants to see is a dud listing with a disappointing outcome for this international company.

RMB Holdings receives the base loan repayment from Atterbury (JSE: RMH)

The issuance of shares to settle the rest of the loan is expected soon as well

Back in August, RMB Holdings announced to the market that Atterbury Property Holdings has entered into an agreement with the company regarding the repayment of the R487 million loan.

In accordance with that agreement, Atterbury has repaid the base loan (R162 million plus interest) in cash. The remaining debt (R325 million) is repayable through the issue of shares based on the underlying net asset value of Atterbury. That calculation is being finalised, with shares expected to be issued on 1 November 2023.

Santova reminds us that what goes up… (JSE: SNV)

…probably comes down in a cyclical industry, regardless of how good the strategy is

If you followed markets during the pandemic, you’ll remember that shipping costs went to extreme highs as supply chains suffered from delays at ports and ships that got mysteriously stuck in important canals. Santova points out that the Drewry World Container Index (a common indicator for shipping rates per container) dropped from a high of $9,700 in January 2022 to $1,400 in September 2023. Current rates are even lower than pre-pandemic levels.

Although you might be tempted to think that this means heightened demand for shipping due to it being cheaper, the problem is that the price is a function of demand rather than a driver of demand. In other words, the price has fallen so sharply because demand has fallen as well.

Despite a significant decrease in gross billings as shipping rates have fallen, Santova managed to increase its billings margin in the six months to August. This was enough to drive a 3.3% increase in revenue.

The problem is everything below the revenue line, as operating margin has deteriorated from 45.7% to 33.0%. Santova highlights that this is above the industry average, but the trend still hurts for investors.

This is why HEPS is down by 22.9%, with share buybacks softening the blow of the decrease in operating profit.

I’ve always had my worries about cash flow generation in this business model, so I must point out that cash generated from operations for this period was only R25.3 million vs. R119.5 million in the comparable period.

And in case you’re out there thinking that the global strategy of Santova is propping things up, you would be interested to know that the South African business is showing defensive characteristics and only the UK moved solidly in the right direction, with a major drop in profits in Asia Pacific and Europe. The group is early in its US journey, showing a modest loss there.

Overall, the share price is flat on a 12-month view. Here’s how severe the rollercoaster has been along the way:

Spear’s dividend is up thanks to a higher payout ratio (JSE: SEA)

Even the best local property funds are finding things difficult at the moment

Spear REIT is focused on the Western Cape. Unless you’ve been living under a rock, you’ll know that this is the province where exciting things are happening. Even against that backdrop though, it’s not easy to navigate this environment.

For the six months to August, distributable income per share has decreased by 1.19% to 40.77 cents per share. The distribution per share is up by 3.21% to 38.33 cents, which is a 94% payout ratio vs. 90% in the prior year. The reason that the distribution per share has grown is because the payout ratio has been increased.

If we look at key metrics, there are some good signs. Reversions on new leases were positive 3.57% and the value of the portfolio increased by 5.85%. It’s less encouraging that revenue fell 0.41% and operating expenses increased by 0.31%. The better news is that on a like-for-like basis, operating margin expanded.

Another source of pressure is debt on the balance sheet. The loan-to-value has increased from 36.30% to 39.58% over the past six months and interest cover has dropped to 2.36 times. Debt levels are fine overall, but the increase in leverage has put the brakes on earnings growth. With the average cost of funding up by 93 basis points and 67% of the debt being variable in nature, investors will watch this carefully.

As a final comment, international business process outsourcing firms are establishing a larger presence in Cape Town, as it is obviously a great city for attracting talent and the South African timezone and availability of local skills make us an appealing location for outsourcing. This is proving to be very helpful for office vacancies.

Little Bites:

- Director dealings:

- A director of FirstRand (JSE: FSR) purchased shares worth R2.73 million.

- A director of NEPI Rockcastle (JSE: NRP) bought shares in the company worth R181k.

- RECM & Calibre (JSE: RAC) released a trading statement for the six months ended September. The metric used is net asset value per share, which is expected to be between 30% and 32% lower. This is a range of R12.00 to R12.40 per share. The current share price is R9.50.

- Liberty Two Degrees (JSE: L2D) has confirmed the clean-out dividend that will be paid to shareholders before the company is taken private, coming in at 8.42 cents per share.

- Clientele Limited (JSE: CLI) has renewed the cautionary announcement relating to negotiations for a potential acquisition in the insurance sector. This has been going on for some time now, with shareholders none the wiser as to the potential transaction.

- ISA Holdings (JSE: ISA) has tightened up the range for its earnings, releasing a further trading statement that reflects HEPS growth of between 18% and 38% for the six months ended August 2023.

- Hyprop (JSE: HYP) wants to retain equity in every way possible, which is why the company makes use of dividend reinvestment programmes. To entice shareholders to reinvest dividends, the reinvestment price is at a discount to the market price. Given the deal to acquire Table Bay Mall, it’s especially important to Hyprop to retain R500 million in equity capital through this programme. The reinvestment price has been set at R24 per share, which is a discount of 12.3% to the clean price 15-day VWAP. The clean price takes into account that the current share price has an embedded cash dividend.

- Sirius Real Estate (JSE: SRE) announced that Fitch has maintained its investment grade credit rating with a stable outlook. Notably, Fitch liked the way that Sirius has transferred some of its best practices from Germany to the UK.

- Zeder (JSE: ZED) noted that the SARB approval for the special dividend of 10 cents per share hasn’t been received yet.

- Salungano Group (JSE: SLG) released a very angry SENS announcement regarding inaccuracies in an IOL article. It’s a sensitive matter, as wholly-owned subsidiary Wescoal Mining is currently in a voluntary business rescue process. The article alleges that the group has been unable to pay its debts, which the company refutes.

- Conduit Capital (JSE: CND) is still trying to sell CRIH and CLL, with the fulfilment date for conditions to be met postponed once again. This has been going on since June. The new date is 30 November.

- Chrometco (JSE: CMO) is suspended from trading. During a suspension, the rules still apply though. This is why the company has renewed a cautionary announcement regarding circumstances relating to a material subsidiary. It’s hard to use caution when you can’t trade the shares!