Diamonds continue collapsing at Anglo American, with all eyes on near-term copper (JSE: AGL)

But copper production in 2025 was at the lower end of guidance

Anglo American has carved its group into two segments called “simplified portfolio” (the stuff they are keeping) and “exiting businesses” (the stuff they are selling).

That makes it sound like the businesses they don’t want are now someone else’s problem, but that’s not the case. At this stage, there are no concrete deals on the table for diamonds or steelmaking coal, with only a sales process running in the background. At least they have a buyer for nickel, with that deal currently going through approval processes.

Average diamond prices were down 7% year-on-year for full year 2025 and 17% for the fourth quarter. This is despite a 35% drop in fourth quarter production, so even a sharp drop in supply hasn’t sent prices the right way. Full year production was down 12%. At this rate, they might have to pay someone to drag De Beers away! Jokes aside, they’ve flagged that an impairment is likely in the full year numbers based on negative EBITDA in 2025. The lab-grown diamond disruption went beyond even my expectations when I first started writing about it.

In steelmaking coal, production fell by 15% in the fourth quarter and 43% for the full year. Thankfully, this drop is largely (but not exclusively) due to disposals of assets that were in the base period and not in this period.

Anglo would like to sweep these businesses under the carpet and move on. As you can see, it’s not quite that easy.

Let’s move on to the stuff they actually want to own.

We know that copper is the big focus, yet production actually fell 14% in the fourth quarter and 10% for the full year. They produced 695 kt in 2025, right near the bottom of the guided range of 690 – 750 kt. Great numbers at Los Bronces were offset by lower grades at Quellaveco and Collahuasi. Unfortunately, copper guidance for 2026 and 2027 has been revised lower. The 2026 revision is no joke – the lower end of the guided range has been dropped by 8%.

In premium iron ore, you can read further down about how well Kumba Iron Ore (JSE: KIO) performed within the Anglo stable. The other asset is Minas-Rio in Brazil, where production dipped by 1% for the full year. Guidance for 2026 is much more encouraging for that asset, revised higher thanks to recent operational performance.

The third and final business they plan to keep is manganese ore. Production jumped by 22% for the quarter and 30% for the year, with production now at normalised levels after a tropical cyclone hit Australia in March 2024.

Despite highlights appearing to be thin on the ground in this update, Anglo’s share price is up 34% in the past year thanks to exuberance around copper.

Losses down and debt up at ArcelorMittal (JSE: ACL)

Is a government bailout the only hope for this company?

ArcelorMittal released results for the year ended December 2025. It’s hard to imagine how much longer this can go on for, as the company has generated R8.4 billion in headline losses over the past two years. They are sitting with net borrowings of R6.5 billion, so we are firmly in “too big to fail” territory here.

Or are we? Will this thing be allowed to collapse? And is the South African government, via the IDC, the only potential saviour?

It’s hard to find positives here unfortunately. Even though the headline loss of R3.4 billion was much better than in 2024, it’s still a huge number. The net borrowings number is R1.3 billion higher than the year before. And perhaps most shockingly, this is despite the “Longs” business being EBITDA neutral in 2025! The group EBITDA loss in 2025 was R1.1 billion instead of almost R3 billion in the prior year.

Now get ready for the worst news of all: the stronger rand makes everything worse for ArcelorMittal. It makes imports cheaper and exports less attractive. This is a company that couldn’t keep it together when the rand was weak, so what do you think happens in 2026 with a stronger rand?

The company has flagged a commitment by the DTIC to address fair trade protections in the first quarter of 2021. The cynic in me can’t help but wonder whether government will give the business a helping hand before or after doing a deal to acquire these assets.

The share price of R1.27 is up 12.5% over 12 months. This is despite a headline loss per share of R3.01. There is only one reason why this is possible: the market is hoping with everything it has that government will swoop in with a deal.

I’ll keep my money far away from that “investment” thesis, thank you very much.

Boxer is certainly a worthy adversary for Shoprite (JSE: BOX)

The periods aren’t directly comparable, but Boxer is looking good

Boxer is by far the best part of the Pick n Pay (JSE: PIK) stable. The grocery chain competes very well for lower-income customers, giving Shoprite (JSE: SHP) something to really think about in the Shoprite and Usave chains. The winners are of course the consumers who get to enjoy a period of price deflation as these grocery stores fight over the most price sensitive customers in the country.

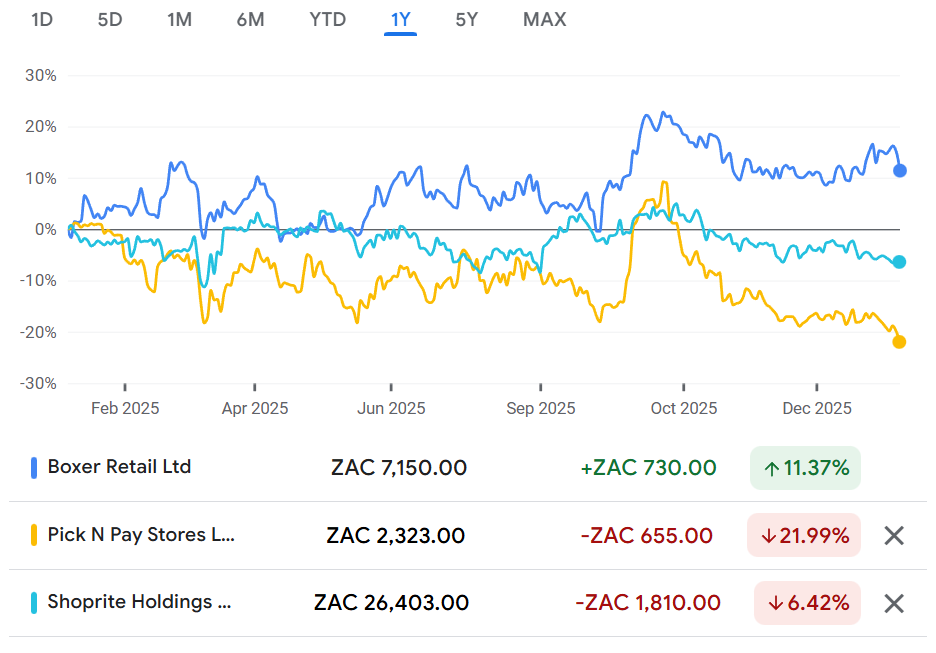

If you look over the past year, Shoprite is a victim of its valuation and a slowdown in growth. Pick n Pay is a victim of… well, a whole lot of things. And Boxer is the one you wanted to own, up 11.4%:

It gets tricky to compare the performance, as Boxer has a different reporting period to Shoprite. Due to factors like two-pot withdrawals at the end of 2024 and the timing of inflationary changes, it’s dangerous to compare the performance of companies over different periods and draw any conclusions.

Starting with just Boxer’s numbers, turnover for the 48 weeks to 1 February 2026 was up 11.9%, with like-for-like growth of 3.9%. For the 22 weeks to 1 February 2026, turnover growth slowed to 9.8% and 2.4% on a like-for-like basis. Interestingly, November was the month that they highlight as being the biggest struggle! Clearly, Black Friday at Boxer isn’t a thing.

For the 48-week period, there was deflation of -1%. For the 26 weeks to 31 August 2025, deflation was -0.7%. The closest comparable period we have at Shoprite is the six months to December 2025, in which deflation at Usave (the closest in spirit to Boxer) was -0.7%.

As you can see in the gap between total growth and like-for-like growth, Boxer is aggressively rolling out stores. They are on track to hit their targets for the 52 weeks to 1 March 2025 (the full financial year). They also believe that they will meet the trading profit growth targets based on an expectation of strong year-on-year numbers in February.

It’s a great business, that’s for sure.

Glencore doesn’t want to be swallowed up by Rio Tinto (JSE: GLN)

Mining mega-mergers remain rare things

The year kicked off with news of Glencore and Rio Tinto circling each other on the dancefloor. As is so often the case in huge mergers like these, one party decided to go home early and leave the other one hanging.

In this case, it was Glencore who decided that they weren’t comfortable with the value being put forward by Rio Tinto. At least Glencore was honest about one of the other issues: Rio Tinto insisting on retaining the Chairman and CEO roles. The mining industry does have a reputation for having bigger-than-average egos in the boardroom!

The official record will show that Glencore feels that the copper assets were being undervalued in the negotiations. I would’ve loved to be a fly on the wall for some of these deal discussions.

Glencore fell over 5% on the day, but the market hasn’t had an opportunity to digest this news yet.

Double-digit dividend growth at Hudaco (JSE: HDC)

The engineering consumables segment is doing all the heavy lifting

Hudaco has released results for the year ended November 2025. Turnover increased 4%, operating profit was up 9%, HEPS grew 16% and the dividend was up 10%. That sounds like a perfect story of leverage, with top-line growth translating into a much better outcome for shareholders by the time you reach the bottom of the income statement.

The segmental story is somewhat less steady.

Consumer-related products suffered a turnover decline of 2%, although they did well to increase operating profit by 0.6% despite this dip. The battery and alternative energy business is almost a lost cause, with Hudaco impairing the goodwill in that business in full. Other businesses like automotive, CADAC and data networking did well.

Engineering consumables brought the growth, with turnover up 10.1% and operating profit increasing by 11.2%. But what is the source of that growth? Acquisitions contributed R58 million in operating profit, so it looks as though the existing businesses only added R12 million in incremental operating profit (total operating profit was R696 million, up by roughly R70 million).

By now, the main thing you should be wondering is whether the stronger rand is a risk. Sure enough, the prospects section does note that it will put selling prices under pressure. They hope that some consumer relief will accompany this.

I wonder if anyone at the SARB reads these things when making interest rate decisions? Because until rates start coming down, I fear that the consumer relief isn’t going to happen.

KAL Group has a new CEO (JSE: KAL)

The group enters this new chapter in excellent shape

At KAL Group’s AGM, they announced that Sean Walsh will be retiring as CEO with effect from 28 February 2026. That’s a rather sudden change, not least of all after a 15-year term! Walsh will be available to the board on a consulting basis in the coming months.

This paves the way for Johann le Roux to take the reins. If that name sounds familiar, it’s because le Roux has just stepped down at Zeder (JSE: ZED) in the wake of the Zaad disposal being announced. I’m sure he’s excited to move into a growth business rather than a value unlock story.

And growth is the word: at the AGM, the company reiterated its 2030 goal of 15% compound annual growth in profit before tax at Agrimark and PEG. They are also targeting a 15% return on equity with a 40% gearing ratio.

These are lofty targets, representing an acceleration from the profit before tax growth of 12.8% in 2025. With considerable exposure to fuel retail and the whims of the fuel price, it’s important to remember that not everything is within their control.

The AGM update included news on trading during the first quarter of 2026. Recurring HEPS increased 13.4% and debt dropped by R385 million year-on-year, with a gearing ratio of 34.3%.

The share price is only up 4.7% in the past year, but that doesn’t tell the full story. It went as low as R36.69 before recovering to the current level of R49.00 (pretty close to the 52-week high of R53.49).

Kumba Iron Ore had a pretty good year in 2025 (JSE: KIO)

Earnings are up and there’s a more positive narrative around Transnet

Kumba Iron Ore released an update for the fourth quarter of 2025, which means we have full year numbers as well. This was accompanied by a trading statement indicating growth in HEPS of between 11% and 23% – a strong outcome. The share price is only up 6% over 12 months though, so the market is taking a cautious approach on this one.

Production in the fourth quarter was up 10% year-on-year. For the full year, they were up 1%. Kolomela was up 7% for the year and Sishen (which is 2.5x larger) was down 1% due to planned maintenance.

Kumba is responsible for getting the stuff out of the ground, but Transnet then needs to rail it to Saldanha. This is historically where things have gone wrong. Despite two derailments, there was a 2% increase in ore railed to the port in Q4!

Once it gets to the port, it then needs to be put on a ship. With high wind speeds and other issues, this is where things went south in Q4. Sales were down 5% year-on-year for the quarter, and up 2% for the full year.

As you can see, it’s not easy running this business. Nonetheless, it was a successful year, with earnings up thanks to better export ore prices, the 2% increase in sales volumes and penalty income from Transnet.

Production guidance for 2026 is unchanged at 31 to 33 Mt, while 2027 and 2028 sit at 35 to 37 Mt.

Lesaka Technologies finally delivers positive net income (JSE: LSK)

They’ve met profitability guidance and reaffirmed full-year guidance

Lesaka Technologies has released results for the second quarter of the year. Before we dig in, I want to remind you that I recorded a podcast in November last year with Executive Chairman Ali Mazanderani. It’s still a really great resource to help you understand the company, so check it out here.

In terms of the latest numbers, net revenue (a non-GAAP measure) was up 12.2% in dollars and 16% in rand. If you work with revenue as reported, it was up 1.4% in dollars and down 3% in rand.

That won’t really blow anyone’s hair back in terms of growth, but we haven’t gotten to the numbers that really count yet.

Operating income jumped by a lovely 265% in rand as the company started to climb the J-curve (or the S-curve, depending on your long-term view here). Curve shapes aside, profits are now starting to climb as the company has reached that inflection point that all successful technology companies must move through.

Most encouragingly, there was positive net income this quarter, a massive positive swing from where they were a year ago. This is a big deal for the company, as this is the first positive net income since Lesaka was put together in 2022. It’s also worth noting that this is the 14th consecutive quarter of meeting guidance.

Based on these numbers, further revenue growth will likely have a great impact on the bottom line. We can therefore move on to look at Lesaka’s three segments.

The largest is Merchant, where net revenue dipped 2% and adjusted EBITDA was down 6%. This is why the group revenue picture isn’t as inspiring as one might hope in this quarter.

The Consumer segment is much smaller on the net revenue line, but almost as big on the adjusted EBITDA line as Merchant. This is especially true after adjusted EBITDA more than doubled (up 106%) based on revenue growth of 38%.

The Enterprise segment is scaling rapidly, with revenue up 58% and adjusted EBITDA swinging from a loss to a solid positive of R24.3 million. For context, that’s still much smaller than Consumer’s EBITDA of R159 million, or Merchant at R170 million.

The guidance for the year ending June 2026 reflects expected growth in adjusted earnings per share of more than 100%. Most importantly, they expect positive net income. This excludes the acquisition of Bank Zero, a critical additional step in this journey.

The Lesaka share price hasn’t really captured the imagination of the market. Will a swing into profitability change that?

MTN is potentially acquiring the remaining 75% in IHS (JSE: MTN)

This seems like a slightly odd allocation of capital

As I wrote about in the Vodacom (JSE: VOD) update earlier this week, the macroeconomic situation in Africa is giving telcos like MTN a golden opportunity to cement their positions on the continent and generate proper cash flows.

It therefore makes sense for the companies to be allocating more capital to Africa. But I’m not so sure that it makes sense for this to take the form of owning the towers that are leased to the telco companies. The trend in the sector has been to separate the towers from the telco operators, as one is essentially a property company and the other is a technology company.

Despite this, MTN has confirmed rumours that they are at an advanced stage of discussions with IHS to acquire the remaining 75% in the company that it doesn’t already own. They are looking at an offer price close to the recently traded price of IHS on the New York Stock Exchange.

The MTN share price closed 5.8% lower on the day. I can’t say that I’m surprised.

Prosus is focused on execution, not M&A (JSE: PRX | JSE: NPN)

The real test of new management has arrived

Whenever there’s an exciting new thing out there (like AI), there’s always a flurry of capital that flows into it. When every dart is thrown at the dartboard, some of them are bound to land in weak positions – and others will fall off altogether. You can only see the outcome once the chaos of the initial throws has subsided.

Prosus is now 32% off its 52-week high. This gets me excited as a long-term investor. At nearly 38 years old, I still have plenty of time for the market to pay me for duration. In other words, riding out volatility in core positions is something I have no difficulties in doing.

Why the drop? Well, unless you haven’t been paying any attention at all to the big tech names globally, there’s been a shaking of the tree in anything related to AI and software. The market is treating almost everything with suspicion. This creates an opportunity for investors to identify the good stuff that gets sold off with the bad.

A letter to shareholders from CEO Fabricio Bloisi is no doubt an effort to remind investors of the long-term story. But he’s also given an important update about the near-term strategy: “I don’t have plans for any major M&A while we focus on this” – and by “this” he means execution on what they already own.

In fact, instead of doing major acquisitions, they will be selling more than $2 billion in assets in this fiscal year and even more the following year. Share repurchases remain a core focus, something that you absolutely want to see when a share price has come off the boil. It’s worth noting that they fund a large part of the buybacks through selling shares in Tencent, where the share price is also under pressure. It would be ideal if the buybacks were funded fully by cash profits in the group.

Speaking of profits, Prosus indicates that they are still on track to do over $7.3 billion in revenue and over $1.1 billion in adjusted EBITDA in FY26. For context, in FY25 they achieved $6.2 billion in revenue and $655 million in adjusted EBITDA.

This is only possible if the major acquisitions are performing well. In Brazil for example, Despegar is up more than 30% year-on-year in local currency and 50% in dollars, with strong sales synergies delivered with other Prosus businesses in the region. At Just Eat Takeaway.com in Europe, new management is in place and initial testing is encouraging, but there’s a very long way to go. At La Centrale, they are giving a positive overall view, but again these are early days and there’s a lot of integration to do with OLX.

On the topic of classifieds, OLX is on track for $450 million in EBITDA. They will be hosting an investor event soon that will be focused on the classifieds opportunity.

iFood, which is Bloisi’s area of deepest expertise, is facing strong competition in Brazil from new entrants who are burning through VC money with unsustainable pricing structures. I remember the exact same thing happened with Bolt Food in South Africa. Today, Bolt is gone and Uber Food is still here. I therefore understand when Prosus talks about how customers return to the best product and service once the subsidies are over, but that doesn’t mean that there won’t be short-term pain.

I remain long here. And if it keeps dropping, I’ll buy more.

A nasty knock to earnings at Sasol (JSE: SOL)

Better fuel volumes can’t offset the weak prices

Everyone’s favourite wild child is back with another day of volatility. Sasol closed 3.8% lower on Thursday, which means that it is flat over 90 days despite swinging wildly between R99 and R127 per share over that period.

The previous update on manufacturing performance was positive, indicating progress made in the South African fuel business. But that’s only half the battle won for any industrial company, with the other half being the selling price of the products. With a 17% decline in the average price of Brent Crude (on a rand per barrel basis) for the six months to December, Sasol’s earnings didn’t stand much chance.

To rub salt in the wound, the average chemicals basket price in dollars fell 3% over the period as well.

Despite the mitigating factors like much better refining margins, a 3% increase in sales volumes and a drop in costs, Sasol still suffered a decline in HEPS of between 29% and 40%. Adjusted EBITDA fell by between 4% and 21%.

I’ve been wondering how it is possible that the Sasol share price is up 35% over the past year despite a stubbornly flat Brent Crude price and a strengthening rand. Now that we know where HEPS has gone, I’m asking myself that question even more.

Results will be released on 23rd February.

Super Group is acquiring 70% in DIG Group (JSE: SPG)

The deal is valued at R447 million

After releasing an interesting update that laid bare the challenges in the UK automotive segment, Super Group announced that they are acquiring 70% in the DIG group of companies. They have the option to acquire the remaining 30% after the 5th anniversary of the effective date, so there’s a pathway to effective control here.

This business will fit into the fleet solutions offering at Super Group, with DIG’s niche being in sectors (like mining and civil engineering) that have strict safety compliance requirements and complicated induction and onboarding protocols. DIG is currently active across 19 mining sites, with exposure to clients in various commodities like coal, chrome and gold.

The fair value has been set at R576 million, with profit after tax for the year ended February 2025 of R191.5 million. I can’t help but wonder why the seller is happy to accept a Price/Earnings multiple of just 3x for this asset!

The purchase price is R448 million settled up-front in cash, with up to R160 million as a deferred profit warranty payment. The put option down the line will be based on the fair value of the business, with a cap in place as well.

The profit warranty is based on a profit after tax of over R200 million per annum in FY26 and FY27. The Price/Earnings multiple applicable to the profit warranty payment is 3.2x.

And no, your mental maths isn’t wrong – the numbers don’t reconcile particularly well in terms of the fair value and the 70% being acquired at this stage.

Despite Super Group trading on a P/E of over 7x, the market reacted negatively to this news of an acquisition at 3x. The share price closed 3.4% lower on the day.

Valterra took advantage of PGM prices in the fourth quarter (JSE: VAL)

They did what they needed to do in terms of production

As I’ve written many times, mining management teams are judged on production performance and capital allocation. This is because they have control over these factors, unlike commodity prices where they are merely passengers on that journey.

In the quarter ended December 2025, Valterra Platinum needed to take advantage of strong PGM prices (the basket price in rand was up 41% year-on-year). Total production increased by 1% and so did refined PGM production on a year-on-year basis. Momentum was good, with refined PGM production up 6% on a quarter-on-quarter basis.

PGM sales volumes were up 4% for the quarter, with some missed sales in Q3 rolling into this quarter.

Still, even if you adjust for the timing distortion of Kroondal, full year PGM sales volumes were down 10% based on refined PGM production falling 13%. Valterra may have had a decent end to the year, but the full year picture isn’t nearly as strong thanks to the flooding at Amandelbult (among other challenges).

Production guidance for 2026 to 2028 is identical across the three years: annual refined PGM production of between 3.0 and 3.4 million ounces. For context, 2025 was 3.4 million ounces. This tells you that earnings growth depends on efficient mining and especially ongoing improvement in PGM prices, rather than an uptick in production.

Nibbles:

- Director dealings:

- Two directors of Calgro M3 (JSE: CGR) exercised options and received a total value of R1.14 million, settled in cash. They seem to have retained the post-tax shares.

- Exxaro (JSE: EXX) successfully refinanced R10 billion in corporate facilities due in April 2026 and added another potential R3 billion of debt on top for good measure. The funding structures range from term loans to recurring credit facilities, with an accordion of R3 billion applicable to all facilities. This is essentially a mechanism that allows for the facilities to be increased without renegotiating all the terms. Financial flexibility is never a bad thing to have.

- There have been numerous announcements about Ninety One (JSE: NY1 | JSE: N91) acquiring stakes in South African listed companies of between 5% and 10%. I am sure that this is because the transaction with Sanlam (JSE: SLM) for the South African active investment management business has closed, so the ex-Sanlam stakes now fall under the Ninety One umbrella.

- I’m confused once again about these weird stakes that Standard Bank (JSE: SBK) is picking up in other banks. One theory is that they are held by Liberty as part of a broader investment strategy. That seemed plausible, but now Nedbank (JSE: NED) has announced that the communication sent by Standard Bank to Nedbank was actually sent in error, and that they do not in fact own more than 5% of the shares. Very, very odd.

- Southern Palladium (JSE: SDL) gave an update on the drill programme for the definitive feasibility study (DFS) at the Bengwenyama Project. The DFS remains on track for completion by the end of August 2026.

- Argent Industrial (JSE: ART) announced that Fred Litschka will be retiring as an executive director after an incredible innings of over 22 years. That’s a well-deserved retirement I think!