Anglo American is ready to sell everything it still has in Valterra Platinum (JSE: AGL | JSE: VAL)

Given Anglo’s previous market timing, this is probably bullish for PGMs

Anglo American doesn’t have an amazing reputation for timing the market, I’ve gotta tell you. Or perhaps they do, but for timing it in the wrong direction! You may recall Thungela (JSE: TGA), which Anglo unbundled in 2021. Thankfully, Anglo shareholders got the benefit of the subsequent rally (well, those who didn’t run away from the asset while wildly waving the ESG flag), but Anglo as a corporate did not. Given all the challenges they’ve had since then, I bet they would’ve preferred to keep some Thungela shares and sell them down over time!

Obviously, hindsight is perfect. But it will be interesting to see whether a similar mistake is being made with Valterra Platinum, as Anglo has decided to sell the remaining 19.9% stake in the company after the rest was unbundled to shareholders as part of the demerger of what was then called Anglo American Platinum.

This decision comes pretty soon after the separate listing of Valterra, so Anglo American is either (1) bearish on PGMs from these levels onwards or (2) badly in need of the capital. Or a bit of both, of course. Naturally, the corporate narrative includes all kinds of lovely comments about Valterra and the PGM sector, yet Anglo is selling anyway.

Selling off a stake of that size is only possible through an accelerated bookbuild, which means that bookrunners will phone up institutions and gauge their interest in taking up stock. There are no fewer than five local and international banks involved, so it will be a case of calling all pockets here.

Aspen’s share price is still sliding (JSE: APN)

The release of results did nothing to shift the momentum

Aspen had an awful year. There’s really no other way to put it. For the year ended June 2025, revenue fell by 3% as reported and HEPS tanked by 42%. If you prefer to look at normalised HEPS, that’s down by 29%. The dividend per share is down 41%, so perhaps that’s a good guide on whether to consider reported or normalised HEPS.

There were a number of issues, all of which were simply too much for the otherwise good performance of Commercial Pharmaceuticals to offset. The most frightening issue is the contractual dispute dealing with mRNA products, leading to normalised EBITDA in the Manufacturing business dropping by 62%. To add insult to considerable injury, there were negative impacts like changes to tax legislation.

Despite a great operating cash conversion rate, net debt was R1.2 billion higher than at the halfway mark this year, coming in at R31.2 billion. Together with weak EBITDA, this puts the leverage ratio on an uncomfortably high 3.2x.

Heading into 2026, Aspen is telling a positive story around its strategy for diabetes and weight loss management, including on the GLP-1 front. On a currency neutral basis, the company expects double-digit growth in normalised headline earnings. Remember, this is coming off an incredibly depressed base, hence why the market isn’t excited by this story.

Where is the bottom here?

Cashbuild just has to keep grinding away (JSE: CSB)

Progress is slow, but steady

Cashbuild is forced to play life on hard mode, with the South African economy giving them almost no breathing room. Every sale is a slog, with stubbornly high interest rates and very little economic growth. Under the circumstances, I think it’s pretty good that revenue was up 5% on a 52-week adjusted basis (the prior period had an extra week). Expenses were also up 5% on that basis if we exclude prior period impairments.

Thanks to other moves on the income statement, HEPS increased by 10% for the year. Double-digit growth in this environment is a decent outcome.

In the first 7 weeks of the new financial year, sales are up 6%. That’s an extra 100 basis points of growth that will be most welcomed. I hope expense growth is being kept at levels below that.

With a 27% increase in the final dividend per share, management seems to be more confident. They are still telling a story of a tough market though and an overall approach of caution.

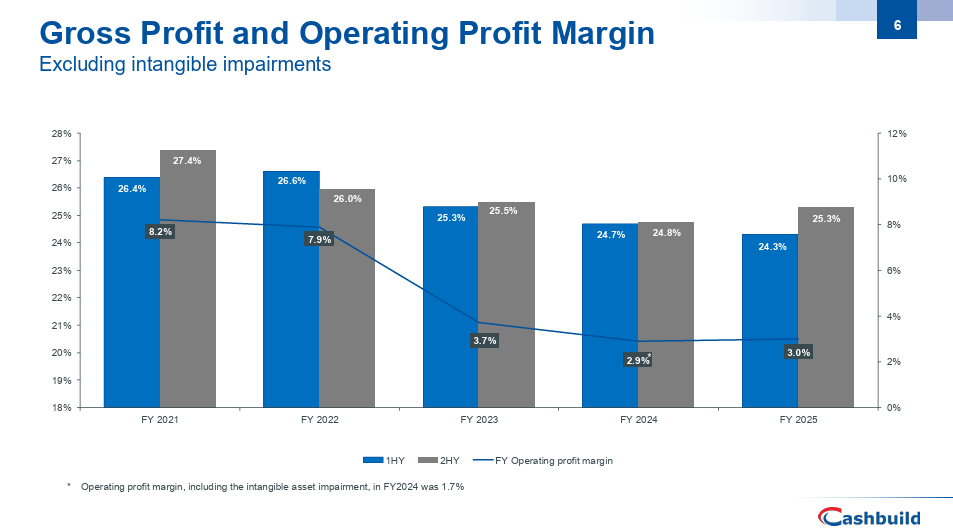

I loved this slide from the investor presentation, as it shows how incredibly lucrative it was when everybody was investing heavily in their homes during softer lockdowns and in a period of very low interest rates:

It looks to me like things have started to turn higher here, but patience will be needed.

Discovery shows strong growth – and the first profitable six-month period for Discovery Bank (JSE: DSY)

This is why the share price has had an excellent 12 months

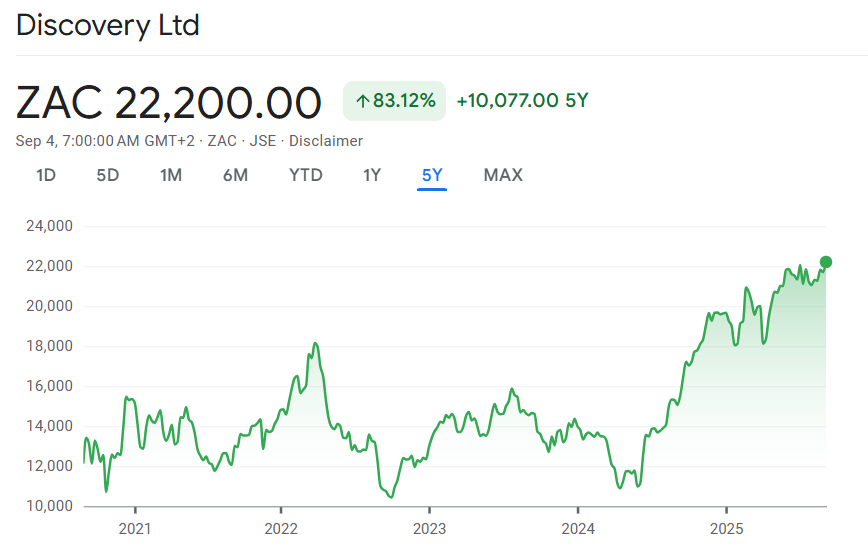

The Discovery share price had a number of false starts in the past five years, with decent rallies and then ugly examples of return-to-sender on the chart. But in the past year, the share price has broken higher in what looks like a sustainable way:

The reasons for this can be found in the trading statement dealing with the year ended June 2025, in which normalised headline earnings is expected to increase by between 27% and 32%. That’s juicy!

Most importantly, the growth is being seen across practically every business unit. The mature businesses (Discovery Health and arguably Vitality Network) managed single-digit growth, while other areas like Discovery Insure had a spectacular year in which profits more than tripled. It really has been an exceptional year for the short-term insurance industry.

But here’s perhaps the most interesting news of all: Discovery Bank reduced its loss for the year by between 82% and 87%, which means it is nearly break-even. In the second half of the year, it generated a profit. It’s therefore very likely that Discovery Bank will be profitable in the coming financial year. The question now is how long it takes for the J-curve to work its magic and what the eventual return will be on the immense capital allocated to that project.

Woolworths dragged down under by the Aussie business (JSE: WHL)

But Woolworths Food is taking the fight to Checkers

Woolworths just released results for the 52 weeks ended 29 June 2025. The prior period was a 53-week period, so the adjustment for that week is important.

On an adjusted basis, turnover and concession sales increased by 6.1%. Alas, that’s where the good news ends at group level, with HEPS down by 23.9%. The dividend is 29% lower. Return on Capital Employed fell from 18.7% to 16.4%.

The problem? Quite simply, Australia. Country Road Group is now picking up where David Jones left off, with sales down 6.8% on a comparable store basis and gross margin dropping by 390 basis points. Adjusted EBITDA fell by 41.1% and they were actually loss-making at adjusted EBIT level. Things look pretty dire there.

Thankfully, the South African business is doing its best to offset the thunder down under. Woolworths South Africa grew turnover and concession sales by 9.4% and adjusted EBITDA by 6.8%, with promising second half momentum as well. But where did they really make their money?

Digging deeper, Woolworths Food grew turnover and concession sales by 11.0%, with an impressive 7.7% on a comparable store basis. We do need to adjust for Absolute Pets though. Here’s something interesting: excluding Absolute Pets, sales growth in the second half was 10.6%. Shoprite (JSE: SHP) experienced quite a slowdown in its Supermarkets RSA business in the second half. Is this because Woolworths is successfully fighting back against Checkers?

To add to the good news in Woolworths Food, gross profit margin was up 20 basis points. It seems as though they are clawing back lost ground there, one packet of organic nuts at a time.

Fashion, Beauty and Home (FBH) isn’t doing as well as Food. Turnover and concession sales were up 5.1% on a comparable store basis, with improved momentum in the second half as we’ve observed elsewhere in the group. The really encouraging story is Beauty, which grew sales by a delightful 14.7%. An interesting fact is that Beauty is margin dilutive in FBH, mainly because they had a strong proportion of full-price sales in the clothing business. This led to a decline in gross margin of 120 basis points to 47.3%. This doesn’t mean that Beauty isn’t profitable, it just means that it wouldn’t be great long-term if the F and H in FBH fell over and B was the only thing that worked.

Net trading space in FBH decreased by 2.3% and online sales were up 22.8%. I’ll say it again: digital is top-of-mind in the retail space. Businesses that are ignoring omnichannel are going to find themselves in serious trouble.

Unfortunately, full year adjusted EBITDA was down 0.4% in FBH and adjusted EBIT declined by 9.1%. Things were much better in the second half, with slightly positive adjusted EBIT growth.

Due to the significant problems in Australia, the Woolworths share price is down 14% over 12 months.

Nibbles:

- Director dealings:

- An associate of a director of a major subsidiary of eMedia Holdings (JSE: EMH | JSE: EMN) bought N shares worth R48k and ordinary shares worth R36k.

- A director of a major subsidiary of PBT Group (JSE: PBG) bought shares worth R4.4k.

- Marshall Monteagle (JSE: MMP) is one of the more obscure names on the JSE, so I’m only giving the latest news a mention down here. The company is pursuing a rights offer to raise up to $10.7 million. There’s quite a discount on this rights offer, with a price of R21.35 vs. the closing price on the shares of R29.50. When a rights offer is deeply discounted, it’s because the company really wants shareholders to follow their rights. Sometimes you see rights offers with a strategic underwriter who actually wants to get a big stake, in which case the rights offer is priced at a modest discount as they don’t want shareholders to follow their rights. The Marshall Monteagle rights offer is not underwritten, hence the discounted pricing strategy. They are also allowing excess applications, another good example of a strategy to help ensure a successful raise from existing shareholders. The market cap is just over R1 billion, so this is a meaty rights offer of nearly 20% of the market cap.

- Southern Palladium (JSE: SDL) has commenced the drill programme at the Bengwenyama PGM project, with four drill rigs on site and more coming in October. This is part of the next phase of work towards the Definitive Feasibility Study (DFS), the next milestone after the recently completed Pre-Feasibility Study.

- Spear REIT (JSE: SEA) announced that the acquisition of Maynard Mall in Wynberg has been given unconditional approval by the Competition Commission. This is an important milestone for the deal. There is still a condition precedent in the agreement that needs to be met, with registration of transfer of the property expected to be in January 2026.

- Putprop (JSE: PPR) is experiencing a complete change to top management, with both the CEO and CFO retiring. The new CEO is Darryl Mayers, with previous experience as joint CEO of Investec Property Fund. He joins the group on 1 November 2025. The new CFO is Alicia Nolte, an internal promotion that shows some succession planning coming through.

- If you would like to refresh your memory on the current strategy at Orion Minerals (JSE: ORN) or just get to know the company better, then you can check out the presentation from the African Downunder Conference.

- Conduit Capital (JSE: CND) continues to navigate a difficult legal situation around Constantia Insurance Company Limited (CICL), a former subsidiary. The joint liquidators of CICL are going after an alleged loan of R37.4 million between the company and CICL. Conduit will defend the litigation. They say that it isn’t material at this stage, which I find surprising given how broken Conduit Capital is overall. Even if there’s a remote chance of success for this litigation, it feels like everything is material to them at the moment.

- Trustco (JSE: TTO) has renewed the cautionary around the planned delisting from the JSE, Namibian Stock Exchange and OTC market in the US. This is all part of the broader plan to go to the Nasdaq. The JSE isn’t 100% happy with the experience of the appointed independent expert, with Trustco engaging with the JSE accordingly. There are also approvals needed regarding the audit.