AngloGold reaches for the passport (JSE: ANG)

With no South African assets anymore, this primary listing is headed for New York

Before you panic, AngloGold is not getting rid of its JSE and A2X listing. Even the listing in Ghana survives! The point is that the primary listing is moving to the New York Stock Exchange (NYSE), which means that the US regulations become the primary regulatory environment.

Get ready for quarterly results from the company!

It’s fascinating to note that the American Depository Receipt (ADR) programme in the US already accounts for two-thirds of daily liquidity in the stock, despite US investors holding only 35% of the share register. The pools of capital in the US are deeper than anything we can imagine in South Africa and AngloGold isn’t blind to that fact.

Of course, what the company is really hoping to achieve is a higher valuation multiple in line with international peers. That’s a nice way of saying that the company is trying to shed the South African image, which isn’t doing the multiple any favours even though there are no remaining assets here.

And in case you’re wondering, there’s also a change to domicile on the cards. The new listed structure will have its holding company in the UK, but “key corporate functions” will still be provided from Johannesburg.

The cost of this transaction is huge, with the announcement noting an expected cost of 5% of the market cap because of taxes payable in South Africa. That’s a nice payday for the fiscus, but AngloGold will then be out of the tax net forever.

The company also announced an update for the quarter ended March, with cash costs per ounce up 16% to $1,204/oz due to inflationary pressures. All-in sustaining cost (AISC) was up 15% to $1,619/oz. EBITDA fell from $438 million in Q1 2022 to $320 million in Q1 2023, a drop of 27%.

Guidance ranges for 2023 have been confirmed.

Ascendis puts Surgical Innovations into business rescue (JSE: ASC)

Legacy tax and creditor issues have been compounded by a new SARS assessment

When Ascendis Health released its interim results for the six months to December 2022, shareholders were advised of the dispute between Surgical Innovations and SARS regarding VAT for 2018 – 2020, with a total provision of R67 million raised in those results.

The company engaged with SARS on this amount but to no avail, with SARS requiring almost immediate repayment. Along with another legacy creditor, this has put the directors in a position where they needed to voluntarily commence business rescue proceedings.

The intention is for the business to continue while the disputes with SARS and the other non-operational creditor are resolved. The board of Surgical Innovations believes that there is a “high likelihood” that the company will exit this process as a solvent and commercially viable operations.

The announcement came out shortly before the close and the price moved 4.8% lower, but I wouldn’t see this as true price discovery on this matter as the bid-offer spread tends to be wide on small caps like this.

Eastern Platinum’s Q1 report is out (JSE: EPS)

The company is focused on the Zandfontein underground restart plan

In the first quarter of 2023, Eastern Platinum grew revenue by 26.7% year-on-year. The key driver was an increase in chrome sales on the open market, offset to some extent by pressure on PGM prices.

Mine operating income increased by 53.8% to $5.2 million. Net income attributable to equity holders was $1.3 million vs. $3.0 million in the comparable period, with forex losses as the major reason for the drop.

The balance sheet is where the attention needs to be, with a working capital deficit (current assets less current liabilities) of $35.2 million and short-term cash resources of only $3.8 million.

Lewis updates the market on its share buybacks (JSE: LEW)

These buybacks are core to the investment thesis

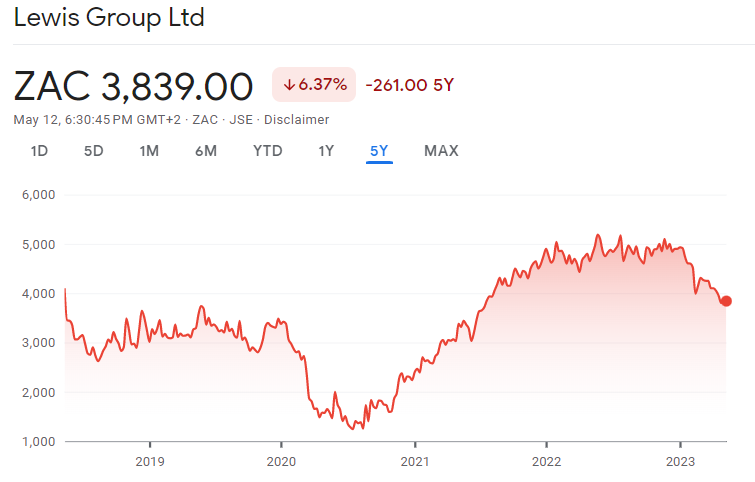

I wouldn’t usually give share buybacks this much airtime, but at Lewis the situation is a little different. The furniture industry in South Africa isn’t exactly a bastion of hope at the best of times, yet Lewis has managed to generate decent returns at times for shareholders because of the clever use of buybacks. Having said that, the share price has rolled over recently:

What you aren’t seeing on this chart is the all-important dividend yield that makes the total return look far better than the chart suggests. The key learning from Lewis isn’t related to cash dividends, but rather the use of share buybacks when a share is trading at a modest multiple.

This strategy has continued, with shareholders giving authority back in October 2022 for the company to repurchase up to 10% of shares in issue. Lewis has announced that 3% has been repurchased, leaving 7% to go.

The price volatility comes through here, with repurchases executed at prices between R38.00 and R50.00 per share. The average price is R47.23 per share and R83.7 million worth of cash has been invested in these buybacks,

With the current price at R38.39 and seemingly dropping, the company needs to get on the accelerator pedal with the remaining buybacks.

Richemont closes off its best-ever year (JSE: CFR)

The direct-to-consumer business now contributes nearly 75% of group sales

€20 billion is a big number. Although Richemont’s sales came in slightly short of that level, a 19% increase vs. the prior year was enough to make FY23 Richemont’s strongest ever year based on revenue. Operating profit also reached an all-time high of just over €5 billion and operating margin expanded from 22.4% to 25.2%.

Profit for the year from continuing operations was €3.9 billion, up 60% for the year. If you look a level lower on the income statement though, you’ll see some ugly numbers. The loss from discontinued operations was a huge non-charge of €3.4 billion on the transfer of YNAP net assets to being classified as held-for-sale. Non-cash or otherwise, the reality is that Richemont didn’t have a good time with this online initiative.

Still, the direct-to-consumer business has been a strategy that has paid dividends in other ways for Richemont. Sales in directly-operated stores contributed 68% of group sales. When combined with online sales, that number is close to three quarters of group sales.

If you look at the underlying business units, the Jewellery Maisons (like Cartier) increased sales by 16% at constant rates and achieved a 35% operating margin. A substantial 83% of revenue is generated through direct-to-consumer sales. Total sales in this segment were €13.4 billion.

The Specialist Watchmakers achieved 56% of sales through direct channels. Revenue grew by 8% at constant exchange rates and operating margin of 19% was achieved. This segment contributed €3.9 billion in revenue.

The Fashion & Accessories segment is the smallest with a revenue contribution of €2.7 billion, up 19% vs. the prior year. This business unit is profitable but not by much vs. the rest of the group, with an operating margin of around 3.5%.

There still isn’t much of an Asia Pacific growth story in these numbers, with sales up by 6%. The rebound in China etc. only came through in the final quarter of the year. This should be a significant driver of sales growth in the new financial year.

If you’re interested in the luxury sector, our report and podcast on LVMH (the global giant that is surprisingly different from Richemont) is fresh out the oven in Magic Markets Premium. Together with my partner Mohammed Nalla, we put out a report every week on a global stock and a subscription only costs R99/month. You can subscribe here>>>

Little Bites:

- Director dealings:

- Guess what? Des de Beer has bought more shares in Lighthouse Properties (JSE: LTE), this time worth R4.49 million.

- The Chief Growth Officer of British American Tobacco (JSE: BTI) has bought shares worth £21.8k (note the currency).

- Nedbank (JSE: NED) has repurchased 3.1% of its shares (based on the number in issue at the last AGM) at a total investment of R3.36 billion. The average price paid per share is R212.91 and the current share price is around R209.

- While we are on buybacks, this is a reminder that Glencore (JSE: GLN) and South32 (JSE: S32) are both busy with share buyback programmes and are making daily announcements on the progress.

- I’m not sure how they got this wrong, but Octodec (JSE: OCT) had to release a correction to its trading statement. The guidance for distributable income per share for the six months to February was given as between 81 and 99 cents per share. It should’ve been between 85 and 89 cents per share, which is thankfully within the originally disclosed range rather than outside of it. The percentage changes in the first trading statement are correct.

- Impala Platinum (JSE: IMP) has acquired a further 0.48% in Royal Bafokeng Platinum (JSE: RBP), taking the total stake to 45.68%.

- I’m never quite sure how much we can read into updates like these, but Vodacom (JSE: VOD) has constituted a standing investment committee. Such committee meetings were previously convened on an ad-hoc basis. This suggests that Vodacom is putting increased focus on how capital is allocated, which certainly makes sense to me.

Love receiving your daily email. Thank you. Des de Beer buying all these Lighthouse shares – is he simply confident in the future of Lighthouse, or is there something more sinister at play?

Hi John – no I think he’s just building the stake. They do scrip dividends as well and he takes full advantage to build his stake even further. I would fully expect the scrip dividends to continue.