AngloGold’s corporate restructure costs $60 million (JSE: ANG)

Yes, that is well over R1 billion to restructure the group!

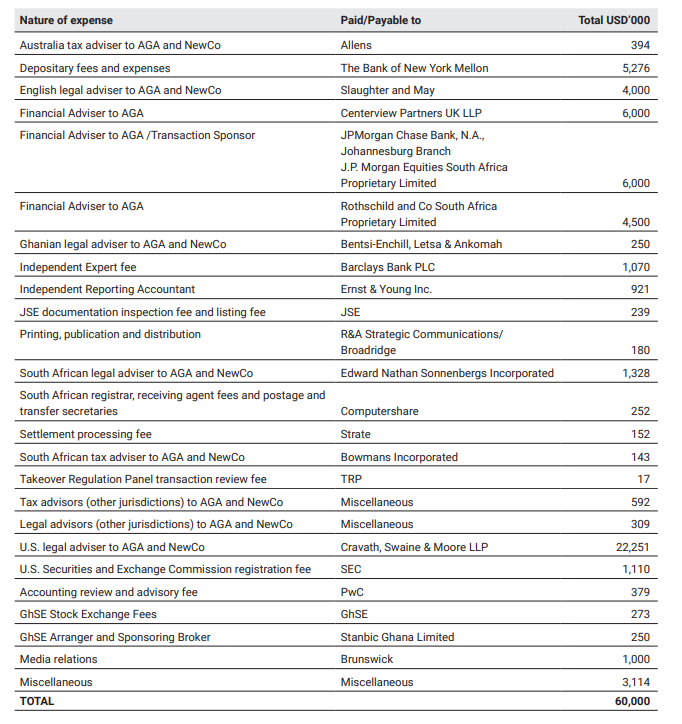

AngloGold Ashanti has a market cap of R160 billion. This makes it a meaty group that corporate advisors saw coming from a mile away, with costs of the intended restructure coming in at a truly spectacular $60 million. Here’s how that money gets spent:

This table comes from the pre-listing statement that has been released as the next major step in the corporate reorganisation. When all is said and done, AngloGold will have its primary listing on the NYSE and inward listings on the JSE and A2X, as well as a secondary listing on the Ghana Stock Exchange.

This entire gedoente is to convince the market that AngloGold is an international gold group rather than a South African company, which should hopefully drive a higher valuation multiple over time. It also gets the company a lot closer to North American investors, which isn’t a bad thing as that is the deepest pool of capital on the planet.

Choppies is still looking at Kamoso Group (JSE: CHP)

The cautionary announcement has been renewed once more

Botswana retail group Choppies has been figuring out a potential acquisition of the Kamoso Group for several months now, with the first cautionary announcement having been released in January 2023. The intended deal is an acquisition of a 76% controlling stake in the FMCG (fast-moving consumer goods) business.

Choppies has already received conditional approval from the Botswana Competition and Consumer Authority, even though there’s a long way to go in finalising the terms of any deal.

Eastern Platinum is being dragged to court (JSE: EPS)

The company is fighting with ABT Toda over a construction agreement

Eastern Platinum announced that its South African subsidiary, Barplats, is being taken to the High Court by ABT Toda, which is the intended nominee of Advanced Beneficiation Technologies (ABT) to hold its interest in a joint venture between Barplats and ABT.

That joint venture clearly hasn’t gone the way the parties intended. Barplats and ABT are in an arbitration process to deal with a dispute over the development and construction of a modular plant to process PGMs at the Crocodile River Mine. Various milestones needed to be met and weren’t, but that hasn’t stopped an escalation of this matter by ABT.

Shouting by Nedbank shareholders, but no substance (JSE: NED)

A strange habit has developed in the market around voting on remuneration policies

These days, you just aren’t a good corporate citizen unless you vote against remuneration policies at corporates. It almost doesn’t matter whether the policy is fair or not, as some players in the market just can’t bring themselves to vote in favour at any company.

Embarrassingly for those 25.24% of Nedbank shareholders at the AGM who voted against the remuneration policy, not a single one sent through questions or comments to Nedbank to engage on elements of the report. Not one.

If this isn’t the greatest example of the classic “Karen” complaining on Facebook about something ridiculous that can’t be backed up, then I don’t know what is.

Telkom’s board says no to Afrifund / Axian / the PIC (JSE: TKG)

The board thinks that the current Telkom strategy will create more value for shareholders

When a potential suitor comes to the table, the board needs to consider whether it will take the deal to shareholders. If they don’t, then there’s a chance that it goes hostile in the form of an offer directly to shareholders. This seldom happens because the deal risk (and costs) go through the roof.

The Afrifund consortium (consisting of ex-CEO Sipho Maseko, international partner Axian Telecoms and most recently the PIC) will now need to decide whether to sweeten the existing offer to the Telkom board or take it directly to shareholders. This is because the board has decided that the proposal isn’t in the best interests of shareholders, with the current Telkom strategy believed to be generating a better outcome for shareholders.

Here’s a chart of how the current strategy is performing:

Little Bites:

- Director dealings:

- A director of Dipula Income Fund (JSE: DIB) has bought shares worth R664k.

- A director of Adcorp (JSE: ADR) bought shares worth R384k.

- An associate of a director of Acsion (JSE: ACS) has bought shares worth R292k.

- I usually ignore independent director appointments in Ghost Bites as they don’t really tell you much about the company. Occasionally, something catches my eye. The Foschini Group (JSE: TFG) has made two major appointments, with Jan Potgieter (ex-CEO of Italtile) and Nkululeko Sowazi (co-founder of Tiso Investment Holdings) both joining the board as independent non-executive directors.