If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

AngloGold reports better numbers

Production has increased significantly thanks to Obuasi

AngloGold has had anything but a glittering year, with the share price down nearly 27%.

The good news is that production is up by 20% in the latest quarter, with Obuasi continuing its ramp-up. Total cash costs were up 4% to $966/oz. All-in sustaining costs (AISC) improved by 6% to $1,284/oz.

Adjusted EBITDA increased by 5% to $472 million. Free cash flow is much better, coming in at $169 million vs. $17 million in the comparable quarter last year.

With improvements in production and costs, AngloGold is reporting much better numbers than we saw earlier this year. This is critical when the gold price is going nowhere slowly, which has been a feature of this macroeconomic environment with rising rates.

The adjusted net debt to EBITDA ratio is 0.41x.

AngloGold has reiterated guidance for annual production of between 2.55Moz and 2.80Moz. The majority of production growth is expected to come from Obuasi. Group guidance for cash costs and AISC has also been maintained.

Datatec reports a mixed bag of results in tricky conditions

The special dividend from the sale of Analysys Mason is coming later this year

Datatec has released results for the six months to August.

Including the Analysys Mason business (which has been disposed of), revenue increased by 8.7% and headline earnings per share (HEPS) fell by 25.4%, in both cases measured in dollars.

The sale was finalised in September and unlocked significant value for the group. A special dividend of £135 million is being paid to shareholders in December as a result of this sale.

Looking at the remaining operations, Westcon International grew revenue by 16.1% in dollars and 22.9% in constant currency. EBITDA was up 66.1% or 84.3% on an adjusted basis. Strong results are being driven by demand for network infrastructure, remote access solutions and cyber security.

Logicalis has now been split into two reporting segments: Logicalis International and Logicalis Latin America. The former grew revenue by 5.6% but experienced a drop in EBITDA of 35.6% (or 9.2% on an adjusted basis). The latter saw revenue drop by 21.3% and EBITDA deteriorate to a $1 million loss vs. $18.1 million profit in the comparable period. On an adjusted basis, it was still profitable.

In terms of group outlook, demand continues be strong and there are signs of improvement in global supply chains.

Gold Fields reports a “stable” quarter

All eyes are on two chinchillas (no, really)

For the quarter ended September, Gold Fields’ attributable gold equivalent production fell by 1% year-on-year and 4% quarter-on-quarter. Costs are up: all-in cost increased by 1% year-on-year and all-in sustaining costs increased 4% year-on-year to $1,061/oz. You can immediately see how much lower that is than AngloGold ($1,284/oz as reported further up).

With net debt to EBITDA of 0.4x, the balance sheet is still in a strong financial position.

The Salares Norte project is being impact by the relocation of endangered chinchillas. Yes, you read that correctly. The relocation of these animals has been put on hold, with the team monitoring the two surviving animals that had been relocated. These must be the most valuable little animals in the world, with first production expected to be up to three months delayed.

The circular for the proposed Yamana Gold transaction was distributed on 24 October and the general meeting is expected to be held on 22 November.

Although mining cost inflation has been higher than expected, cost guidance has been unchanged because of the offsetting effect of weaker exchange rates. Production guidance is also on track.

Battered Murray & Roberts gives a business update

With a share price drop of nearly 70% this year, investors are hurting

In case you ever thought that construction is a buy-and-hold industry, here’s a five-year chart of Murray & Roberts:

If someone showed you that chart and didn’t give you any further details, you might be tempted to buy at these levels. To help you decide whether there’s an opportunity here, Murray & Roberts released the business update that was presented at the AGM.

Before we delve into the business platforms, it’s worth noting that the potential disposal of the 50% stake in the Bombela Concession Company is progressing well. The group hopes to realise the present value of the next three year’s dividends through this disposal. The proceeds would be used to reduce debt in South Africa.

Murray & Roberts is structured through three platforms and each one is covered separately.

Mining

A strong price outlook for most major commodities is expected to drive growth in mining investment. This is especially true for commodities required for decarbonisation.

The order book (R22.2 billion) and near-term pipeline (R9.8 billion) is strong and all projects are progressing according to expectations.

Energy, Resources & Infrastructure

This is where things start to get very ugly, with supply chain disruptions causing delays in project milestone payments. This platform is struggling with “acute pressure” on working capital, which isn’t cute at all.

The really bad news is that cost overruns at Traveler in the US and Waitsia in Australia are so severe that profits recognised in previous financial years have to be reversed. This is going to drive a drop in earnings of more than 100% in the six months ended December 2022. In other words, the impact takes the entire group into a loss-making position.

The announcement goes on to talk about “ongoing and urgent cash flow needs” in this platform. The group doesn’t expect to raise new capital, so it’s not clear how that will be addressed.

Power, Industrial & Water

The biggest challenge in this platform is that South Africa’s infrastructure spend is poor. We’ve seen the impact this has had on Eskom and the next issue down the line is water.

The order book is tiny in this platform (just R0.3 billion) and near orders are R1.9 billion. At such a small size, the platform isn’t profitable.

Overall

Other than the indication that near-term earnings will be negative, the group isn’t ready to give more detailed guidance on earnings for the six months to December 2022. A trading statement will be released in due course.

Sibanye gets another smack from the market

A 10.4% drop on Thursday took the year-to-date pain to over 20%

In a quarterly update to September, Sibanye-Stillwater frightened the market. There have been many pressures in the business, reminding us that mining is a tough game.

The biggest issue is in the gold business, where all-in sustaining cost is $2,207/oz (way up from a year ago). This puts the gold operations in a loss-making position. At a time when profits are under pressure in the South African PGM operations as well (thanks to load shedding), this isn’t a great story.

One needs to recognise that these aren’t the usual results, as Sibanye had to build up to normalised gold production after the recent industrial action. When production is much lower, the cost per ounce obviously goes through the roof because of fixed costs.

The US PGM operations are also well down vs. last year, with the impact of the floods still being felt.

One of the few highlights in the recent newsflow is the conclusion of a five-year wage agreement with the representative unions at the Marikana and Rustenburg operations. The PGM operations managed to get this right without labour disruptions, in stark contrast to the disaster in the gold operations.

Although Sibanye is pushing forward with strategies in battery metals, the market is clearly worried about the current operational pressures. With such a significant drop in the price and with the gold results arguably expected to normalise, one wonders if this is oversold.

Truworths grew strongly, but flags a challenging outlook

I hope you took some profits after that incredible rally in August

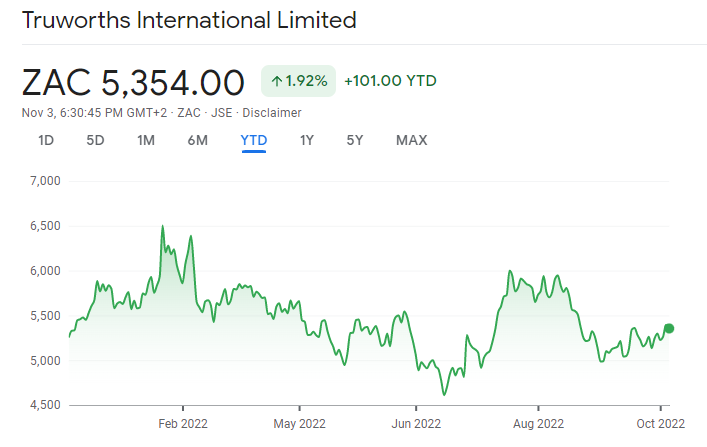

Most South African retailers are candidates for swing trades rather than buy-and-hold strategies. This is because they are cyclical stocks that have good periods and bad periods, with the long-term outlook impacted by challenges in South Africa like slow growth and load shedding.

As an aside, I think some of the best strategies you could’ve implemented this year would’ve been to buy strong support levels and take profit at resistance levels. It’s one of the only ways for individual investors to make money in a bear market without taking significant risk on leveraged positions that you can be closed out of. Easier said than done, obviously.

A feature of this bear market has been face-ripping rallies at any hint of good news. This is a feature of a bear market. As the exuberance calms down, the share price tends to fall away and close the gap, really hurting those who bought into the excitement.

Truworths is a perfect example:

The share price has come back down to earth after the excitement in August. The question is whether the business has done the same.

In a trading update, Truworths highlights comparable group retail sales growth of 13.1% for the first 17 weeks of the new financial year (4 July to 30 October). A 53rd trading week in 2022 means that comparing the first 17 weeks of the financial years gives a funny answer, as they don’t cover the same number of paydays. This is why Truworths releases a comparable number that matches the calendar periods rather than the exact trading weeks. Retail reporting is complicated.

Account sales are growing faster than cash sales (19.2% vs. 7.1%), which is perhaps cause for concern in this consumer environment. Account sales are now 52% of group revenue.

In Truworths Africa (mostly the SA business), retail sales were up 14.2%. If you exclude stores affected by civil unrest, the growth is 10.7%. This is the most useful number to remember. It’s interesting to note the ongoing growth in online sales, up 33% and contributing 3.3% to total retail sales.

Account sales contributed 70% of Truworths Africa’s sales. Key metrics in the credit book (active account holders able to purchase, and overdue balances as a percentage of gross receivables) were unchanged vs. the comparable period.

Merchandise inflation was 12% in Truworths Africa vs. deflation (not a typo) of 3.4% in the comparable period.

In the UK, the Office business grew sales by 10.2% in local currency. Online sales contribution fell from 45% to 41%, in line with the trend we’ve seen at other retailers as shopping habits normalise.

Looking at trading space, Truworths Africa increased by 0.7% in this period and expects to increase by 2% for the full year. Office is rationalising, with space down 3.4% in this period and an expected decrease of 8% for the full year.

The group has noted a challenging outlook, with low economic growth and ongoing load shedding in South Africa.

Little Bites

- Director dealings:

- The CFO of Famous Brands loves doing leveraged trades. The latest example is a long CFD position on the company’s shares with a value of just under R190k.

- A prescribed officer of ADvTECH has sold shares worth R450k.

- Value Capital Partners is taking a different view on ADvTECH, with a major acquisition of shares worth over R67 million (as a reminder, VCP has board representation, hence it comes through as dealings with an associate of directors)

- The company secretary of Aspen has sold shares worth almost R458k

- Glencore’s penalty from the UK Serious Fraud Office investigation has been finalised. The company will pay nearly £281 million. Together with the settlements in the US and Brazil, the payments are not materially different from the $1.5 billion provision recorded in the 2021 financial results.

- There’s a changing of the guard at Curro, with Andries Greyling retiring as CEO with effect from 1 January 2023. He has served in various executive roles over the past 15 years, including as CFO, COO and CEO. The current CFO, Cobus Loubser, has been appointed as interim CEO. For some reason, the company also feels compelled to have a deputy CEO at this point in time, with Mari Lategan (the executive for corporate services and the group company secretary) appointed to that role.

- In an exceptionally odd development, the JSE declined to give a dispensation for the chairman of MiX Telematics to enter into a share trade plan on the US market. In such a plan, shares are sold in a structured way to avoid crashing the share price. The process is managed by a broker and the chairman would’ve had no say on the timing. As this could lead to sales during a closed period, the JSE would’ve needed to grant a dispensation for this to go ahead. With 90% of volume on the NYSE rather than the JSE, it’s quite incredible that the JSE declined the request, leading to the chairman resigning from the board so that the plan can go ahead without breaching JSE rules, as he wants to sell down his stake in order to diversify his wealth. This is a perfectly reasonable thing to do and it’s beyond me how the JSE reconciles this approach with an overall strategy of attracting more international listings.

- enX Group released results for the year ended August. The share price jumped 13.6% in a nod of appreciation, as HEPS from continuing operations increased from 90 cents to 160 cents (a 78% jump). This was achieved through a 21% increase in revenue from continuing operations. The balance sheet is a lot stronger, with net debt to equity improving from 50% to 31%.

- Grindrod Limited has concluded the disposal of Grindrod Bank to African Bank. The effective date was 1 November. This is a major step for both groups, with a particular shout out to African Bank for what has been achieved since the tough years of curatorship.

- Five non-executive directors have resigned from the board of Tongaat Hulett, with the rationale being that the business rescue practitioners are now administering the company. In such a situation, the directors felt that their role is limited. Their risk isn’t limited, so I’m not surprised to see this.

- Libstar held an investor day and made the presentations available online. If you’re interested, you’ll find them here.

- Hammerson has announced that it is exercising the early redemption option in respect of bonds due in 2023 with cash that it has on the balance sheet. The principal amount of the bonds outstanding is €235.5 million.

- The Singapore sovereign wealth fund now holds a stake in Shoprite of over 5%.

- The ARC Fund has sold down some of the stake in Afrimat, now holding 4.718% in the company.

Always great articles on the markets