Attacq is on track to meet growth guidance (JSE: ATT)

The office properties are still a headache though

Attacq has released a pre-close update dealing with the six months to December 2025. Their full year goal for distributable income per share is growth of 7% to 10% and they believe that they are on track for this.

Encouragingly, the overall occupancy rate has increased from 91.6% to 92.6%. The total reversion is negative 1.8%, with the collaboration hubs (their fancy word for office properties) dragging things lower with negative reversions of 8.6%. The retail properties had positive reversions of 1.3%.

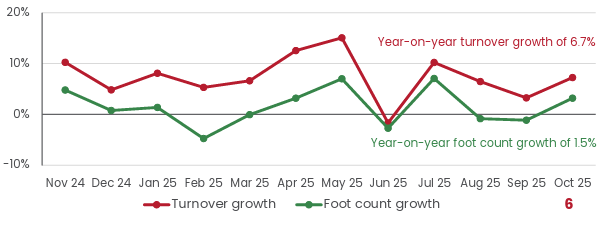

There’s a very interesting slide from the update showing the gap between turnover growth and foot count growth. Although most of this gap is of course explained by inflation and changes in average basket size, there’s no doubt in my mind that an element of online shopping adoption is contributing to the gap:

To keep people coming to the properties (and especially the Waterfall district), there’s an extensive development pipeline. It’s actually quite amazing to just take a step back and consider the sheer extent of development that has taken place around the Mall of Africa.

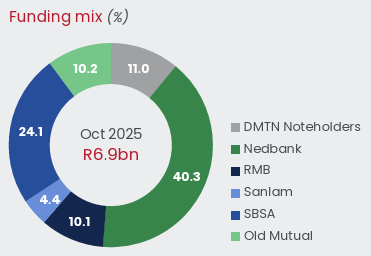

Looking at the balance sheet, the weighted average cost of debt has improved by around 30 basis points since June 2025. The credit rating is in good shape. The company is considering a further issuance under the DMTN programme, which is currently only 11% of the total debt on the balance sheet:

Things look solid overall, with the main caveat being around the ongoing pressure on rental renewal rates in the office sector.

Mantengu flags significant losses (JSE: MTU)

Flooding and winter Eskom tariffs are a reminder of how hard this sector is

I genuinely cringe when Mantengu releases a SENS announcement, mainly because I’m worried about the pending headspace disaster on X from dealing with the CEO and his extremely misinformed opinions on my business. But my brand promise to you as a Ghost Mail reader is to write about every single company on the JSE, regardless of how they behave in response. It would be very unfair for me to write in an unbiased way about negative news from companies that behave like professionals, while giving a free pass to others who behave poorly.

So, here goes:

Mantengu released a trading statement dealing with the six months to August 2025. They have swung from HEPS of 2 cents to a headline loss per share of 28 cents. The share price fell nearly 14% on this news, now trading at R0.50. If you annualise the loss (which you have to be very careful doing, as there are specific events affecting the numbers), then the P/E of the company is worse than -1.

Junior mining results can be really volatile though, so they might swing back to profits in the second half, hence my caution about annualising numbers in this space. Still, it’s clear as day that all is not well in the financial health of this company. When detailed results come out later this week, the balance sheet will need a careful review.

Mantengu’s chrome production was impacted by flooding this year, an issue that has plagued many mining houses around the world. Remember how bad the flooding was for Sibanye-Stillwater (JSE: SSW) in their ironically-named Stillwater business in the US? Unfortunately, mining companies are subject to the whims of Mother Nature herself. This is why mining is seen as risky, as companies typically have only a handful of operating facilities that carry concentration risk in terms of natural forces.

From September 2024 to February 2025, average monthly chrome production was 13,520 tonnes per month. From March 2025 to August 2025, they only exceeded that number in two months. The average for this period is 11,505 tonnes per month, or a drop of 15% vs. the preceding six months. In addition to the flooding problems from March to May, they also had drilling and blasting issues in August that have since been sorted out.

We now arrive at the silicon carbide segment, the Sublime Technologies business that Mantengu acquired for almost nothing. This is the acquisition that created the very large “bargain purchase gain” in the financials – the converse of “goodwill” under accounting rules.

Production of silicon carbide looked fine in March and April before dropping sharply in May. The company took the decision to shut production in June and perform maintenance over the winter period when Eskom tariffs are much higher. We’ve seen similar strategies in the winter months at Merafe (JSE: MRF), where they are having a really hard time in the ferrochrome sector.

This is objectively an ugly set of numbers that would typically send management teams on a PR offensive to convince the market that there’s more value here than one might think based on these losses. Let’s see what the management outlook statements say when full results are released.

Nedbank to pay R600 million to Transnet (JSE: NED)

This is going to sting for shareholders

Nedbank and Transnet have been fighting over interest rate swap transactions that go back to 2015 / 2016 as part of the broader state capture debacles. The bank maintains its innocence, but that doesn’t mean that drawn out proceedings are worth going through. Aside from them being very expensive, it also impacts the opportunity to do more work with Transnet.

Without admission of any liability, Nedbank has agreed to pay R600 million to Transnet to make this problem go away. The initial lawsuit was for around R2.8 billion, a truly bonkers number that would’ve implied that it was surely the most profitable (and corrupt) deal in the bank’s history. R600 million is also a fat number, but at least it brings closure. The broader problem here is that the legal process incentivises the use of gigantic claims in the hope of using anchoring bias to achieve a lucrative settlement.

Nedbank also noted that financial performance is in line with expectations for the 10 months to October, provided you exclude this settlement of course. To give more context to this number, headline earnings for the six months to June was R8.4 billion.

Pepkor has released a great set of numbers (JSE: PPH)

And they are starting a bank to take advantage of their distribution power

Pepkor released results for the year ended September. They’ve showed the market what is possible in the apparel space when you are resonating with customers and offering a mix of value-added services that get the job done.

Revenue increased by 12%, gross profit margin was up 150 basis points to 39.8% and operating profit jumped by 13.2%. That’s a fantastic set of numbers, with the cherry on top being that HEPS from continuing operations was up by 14.8% as reported, or 23.4% on a normalised basis.

As for the dividend though, the increase was only 9.2%. HEPS from total operations was only up by 8.4%, so that might give us a clue.

If we dig into the underlying business, we find group merchandise sales growth of 8.8% for the year, along with like-for-like sales of 6.5%. Southern Africa (which excludes PEP Africa and Avenida) grew like-for-like sales by 7.4%. If you exclude Southern Africa (i.e. only PEP Africa and Avenida), like-for-like sales were up 8.9% in constant currency, but down 3.1% in rand terms because our currency has had a strong year.

Avenida has had a fairly iffy start in the Pepkor stable, although there’s recently been some improvement. Like-for-like sales increased by 1.8% for the period, with a solid acceleration in the fourth quarter of 8.8%.

Within the retail segments, PEP was the leader with like-for-like sales of 9.3% and total sales growth of 10.8% thanks to a growing footprint. Ackermans grew like-for-like sales by 7.1%, a similar performance to total sales growth of 7.2%. The Speciality division was good for like-for-like growth of 3.0% and overall sales of 8.3%.

The overlay of the fintech segment is really important, with revenue up by 31.1%. Gross profit margin increased by 840 basis points to 56.4%. Operating profit jumped by 52.3% in this exciting growth engine to R2.2 billion.

Although there is much focus on the credit interoperability strategy at Pepkor, credit sales are only 16% of total sales. The rest is in cool, hard cash. Still, that’s enough of an opportunity here for credit sales to be the underpin of the fintech segment, with the Flash business as another really important contributor. Insurance is also a winner.

Here’s a stat that is always amazing to read: Pepkor sells 8 out of 10 new prepaid cellphones in South Africa. Mindboggling stuff.

The group has significant expansion plans, with acquisitions across home and adultwear categories. Here’s a particularly interesting nugget: the company is looking to establish a banking presence in South Africa, taking advantage of the massive distribution footprint across the country. The Prudential Authority gave them a Section 13(1) approval in November, so this banking push is very real.

The group is in really strong shape. It’s worth remembering that the start of the financial year was boosted by two-pot withdrawals, with that distortion now creating a very demanding base for the new financial year. For the 7 weeks to 15 November, group sales were up 5.3%. The prior period saw 14.6% growth in those weeks, so the two-year stack is still excellent.

Sea Harvest’s focus on hake has paid off (JSE: SHG)

HEPS has more than tripled!

Here’s a fascinating trading statement, particularly after we saw such tough numbers from sector peer Oceana (JSE: OCE) the other day. Within those Oceana numbers, the hake business was the highlight and global fish oil prices dragged them down. Over at Sea Harvest, the hake business is the focus area and hence they’ve had a great time in the year ending December 2025.

Yes, we are still over a month away from the end of this period, yet the company feels confident enough to issue a trading statement highlighting a huge move in HEPS of at least 200%. This means that HEPS will more than triple!

Better catch rates and pricing in the hake business were accompanied by efficiency gains. The positive outcome of this combination is clear to see. And as a reminder, a trading statement going out this early means that the guidance is probably conservative. In other words, profits may be even better than this guidance would suggest.

Much higher profits at Stefanutti Stocks, but still work to do on the balance sheet (JSE: SSK)

The company also recently announced a settlement with Eskom

Stefanutti Stocks has been on a wild ride. Get this: the share price is up 1,420% over 5 years! That is absolutely insane. I should also point out that despite these gains, the share price is only back to where it was in 2017. It also happens to be more than 80% down vs. the pre-FIFA World Cup construction bubble.

Some stocks are like old dogs that snore gently in the corner of the kitchen and wag their tails when the treat cupboard gets opened. Others are bucking broncos that attract only the brave.

The recent share price run at the company has been the result of restructuring activities designed to save the balance sheet. Current liabilities exceed current assets by R1.2 billion, so the company is on a knife’s edge. The share price performance is a function of progress made in areas like the Kusile Power Project claim against Eskom, leading to a settlement of R580 million that must be paid to Stefanutti Stocks by 12 December. This will take some of the heat off, but not all of it.

There are also disposals in process for the businesses in Mozambique and Mauritius. This will be a further boost to the balance sheet, but won’t fully solve the problem.

The performance from continuing operations is thus relevant, with revenue from continuing operations up 1% and operating profit up 22%. Profit from continuing operations has jumped by 53%. Combined with a much stronger order book, this has allowed the company to keep the banks at bay while the important corporate actions are concluded.

Has the market finally woken up on Zeda? (JSE: ZZD)

Or will this be a short-lived uplift?

Mobility company Zeda released results for the year ended September 2025. The share price closed 11% higher on the day, taking the year-to-date increase to 6% after a long and frustrating sideways period. Buying so-called “cheap” shares on the JSE is an exercise in patience. I don’t usually dabble in value stocks on the JSE and I made an exception for Zeda, but it really is taking forever to rerate higher.

Although HEPS may be up by 15.7%, the truth of it is that the underlying story isn’t very exciting. Revenue increased by only 1.7%. EBITDA was flat, while operating profit increased by 10.8%. I would far rather see the growth in earnings before depreciation, not after it!

The depreciation is an even bigger sticking point than you might think. Because of pressure on used car prices in the market, Zeda decided to keep vehicles in their fleet for longer. In other words, they extended the useful lives of rental vehicles. This hurt revenue from sales of vehicles, but it boosted margins. It’s just clearly not sustainable, as people renting cars are expecting to climb into vehicles in excellent condition, not something that looks ready to become an UberX.

The good news is that there’s a dividend that pays you to wait around. This is a core part of my investment thesis in this company. The dividend for the year of 181 cents is a yield of 15.3% on my in-price of R11.84. That makes me feel a lot better about the overall position! Even on the current price of R13.75, that’s a trailing yield of 13%.

Return on Equity (ROE) may have dipped from 23.1% to 21.9%, but that’s still a solid number that is well in excess of their cost of capital. There’s no shortage of debt to help boost ROE, with a net debt to EBITDA ratio of 1.5x (up from 1.4x in the prior period).

I suspect that it won’t be long until the rental fleet has a large contingent of Chinese cars. I also worry that there might be some painful financial results during that transition. For this reason, I’m not sure that the market will rerate the multiples when much of the current growth came from changes to depreciation, but at least there’s a fat dividend for those with patience.

Nibbles:

- Director dealings:

- A trust related to an independent non-executive director of Blu Label (JSE: BLU) bought shares worth nearly R2 million.

- The CEO of Sirius Real Estate (JSE: SRE) bought shares worth R1.08 million.

- A director of a major subsidiary of Sasol (JSE: SOL) sold shares worth R215k.

- A director of Visual International (JSE: VIS) sold shares worth R40k.

- Copper 360 (JSE: CPR) has financial woes that have been well documented, so it’s not a huge surprise that losses have gotten much worse. As we so often see in the risky junior mining space, the company just hasn’t lived up to expectations. A reset is in process at the company, with a significant restructuring of the balance sheet and the raising of fresh equity capital. The market is very unforgiving, so this feels like the last roll of the dice for them in terms of public markets. They simply have to make it work.

- The final steps in the MTN Zakhele Futhi (JSE: MTNZF) dance are upon us. A scheme of arrangement will be used to execute the final payment to shareholders of 15 cents per share. It’s important to remember that this comes after a return of capital of R20.00 and a dividend of R4.20 per share. This is why the net asset value per share is now so low. It was a great outcome in the end for shareholders, particularly compared to where it was trading last year.

- RH Bophelo (JSE: RHB) has very little liquidity in its stock, so the results for the six months to August just get a passing mention down here. Net asset value per share grew by 4%, an important metric for what is essentially an investment holding company. There was unfortunately an 18% decrease in investment income due to delayed dividend income. That impact is much more severe when you consider the components of investment income. Of the R44 million in this period, a whopping R41 million was thanks to fair value moves and only R3.3 million was in the form of interest income. There was no dividend income. In the prior period, interest income was R4.4 million and dividend income was R9.4 million. Thankfully, cash on the balance sheet has only decreased from R32.3 million to R29.5 million.

- Ascendis Health (JSE: ASC) reminded the market that the offer closing date is Friday, 28 November. There is a maximum acceptances condition to the offer, so it’s not clear yet whether it will go through. For this reason, the cautionary announcement has been renewed.

- Ethos Capital Partners (JSE: EPE) released the final details for their planned unbundling of the Brait Exchangeable Bonds (JSE: BIHLEB). The total value of the bonds being unbundled is R175.5 million. The unbundling ratio is 0.00086 Brait bonds for each A ordinary share in Ethos Capital.

Thanks for the great work, Ghost. Just wondering why no comment on Octodec results released yesterday, unless I’ve somehow missed it.

cheers

dave

Gosh. No, it appears that it was ME who missed it! Will sort that out. Thank you. Guess that was bound to happen at some point!