Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

BHP takes a knock in metallurgical coal (JSE: BHG)

Production of other commodities is in line with guidance at the halfway mark of the year

If you know anything about mining, you’ll know that it is fraught with production risks and things that can go wrong. Production updates are big news, as the mining house can control production but cannot control commodity prices. In many cases, management is measured based on production rather than anything else.

BHP is halfway through its financial year and is showing a strong first half in copper, iron ore and energy coal. It hasn’t been a good half for metallurgical coal due to a combination of planned maintenance and low starting inventory values. Full year guidance for BMA (the metallurgical coal) asset has been decreased, which means expected unit costs of production also go up. To achieve an appealing cost per unit, production needs to be running at high levels. This is true for any commodity.

Another headache for BHP is a sharp fall in nickel prices, leading to tricky production decisions. They refer to the problem as being a number of structural changes in the nickel industry and a cyclical low in realised pricing. Average realised prices for nickel are down 24% year-on-year for the first six months of the year.

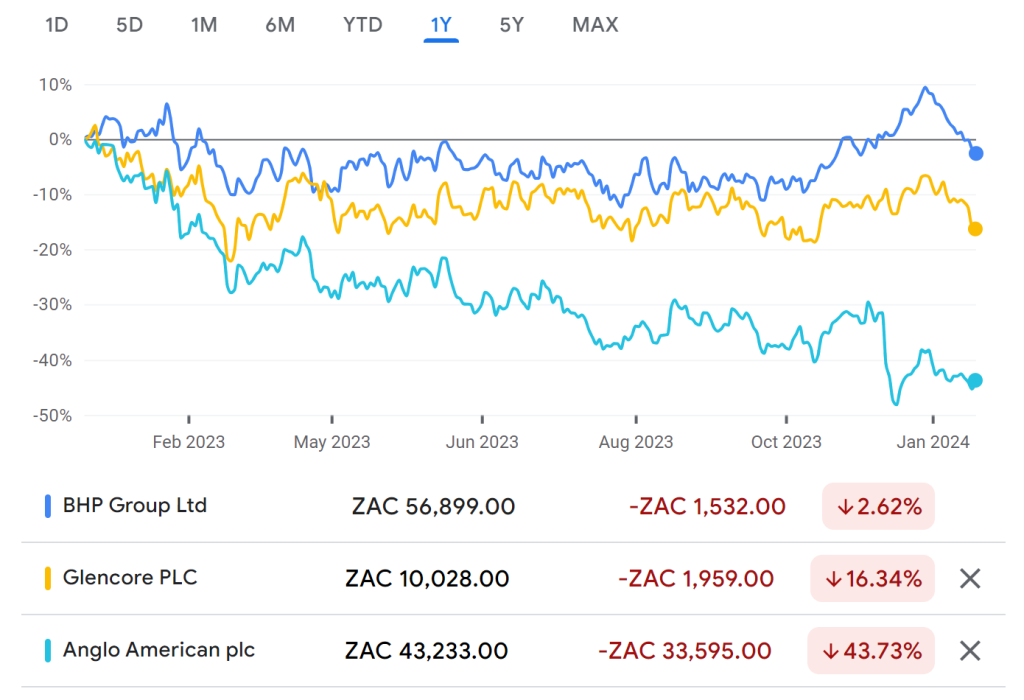

Comparing the BHP share price to other mining giants like Glencore and Anglo American reveals that even when buying the large “diversified” groups, you still need to understand the underlying exposures:

Kore Potash: still awaiting PowerChina’s EPC proposal (JSE: KP2)

In the meantime, the CEO and CFO have both left the company

Doing business in a place like Republic of Congo is no joke. Not only does it take forever to get a proposal to build a mining operation because of all the complexities involved, but there are also notoriously difficult government departments to manage.

You can imagine how delicate the position is when the SENS announcement talks about having a “moral guarantee” from the government to keep supporting the project despite milestones not having been met, as well as the importance of a ceremony that was held at the site and attended by dignitaries.

Moving on from politics, Kore Potash has had its own management challenges. The CEO resigned in October 2023 and the acting CFO in December 2023. The current chairman has assumed the role of CEO and a “non-board CFO” has been appointed as well. The company is trying to save on costs and is avoiding making commitments to new people until the financing proposal for the project has been received from the Summit Consortium.

That funding proposal isn’t going to happen until the Engineering, Procurement and Construction (EPC) proposal is received from PowerChina. These contracts are exceptionally complicated and need to manage the risks for both parties. When you read of major construction companies losing a fortune or even going bankrupt, it’s usually because a specific contract went really badly. This is why PowerChina is investing heavily in getting the contract proposal right, including having boots on the ground for months now to properly assess everything from the design of the facility itself through to service corridors

PowerChina has confirmed that it has received all required information and that internal reports are being finalised. It’s do-or-die for Kore Potash, as I can’t see the project or the company surviving if this contract isn’t finalised and the financing proposal isn’t obtained shortly thereafter.

Motus confirms a substantial drop in HEPS (JSE: MTH)

The market seemed to fully expect this, with the share price in the green for the day

The car business is cyclical. Sales are impacted by all kinds of factors, ranging from interest rates through to inflation. The aftermath of the pandemic was a great time to sell cars because of supply shortages, forcing consumers to really pay up for new vehicles. Of course, distortions like that eventually experience a correction.

This correction has come to Motus, with the market seemingly expecting it based on the share price actually closing higher for the day despite HEPS for the six months to December 2023 falling by between 20% and 30%.

Interesting strategic nuggets include the company acknowledging oversupply of vehicles from the manufacturers, leading to discounts on new vehicles and a negative impact on margins. This is a complete turnaround from the post-pandemic supply shortages.

Despite this, the announcement notes double-digit revenue growth and stable operating profit for the six months to December 2023, so that doesn’t really make sense in the context of the commentary on pricing. The drop in earnings is mostly being attributed to higher financing costs because of working capital tied up on showroom floors and vehicles in the car rental business. Acquisitions made by Motus have also driven debt higher.

They are looking to reduce the rental fleet and unlock working capital savings. This should come through in the second half of the financial year as this is a seasonal business.

Unexpected riches at Richemont (JSE: CFR)

The market got this one totally wrong based on other luxury brands

Richemont is a gigantic company. To see a group this size put a 10% gain on the share price in one day is extraordinary. The sales update completely blew the market away, along with anyone who might have had a short position. Such a position would’ve been pretty logical based on what we’ve seen from other luxury brands like Burberry.

Of course, if the markets were easy, you wouldn’t even be bothering to read this.

For the three months ended December 2023, Richemont managed to grow sales by 8% at constant exchange rates and 4% at reported rates (being euros). The important news is that the company achieved growth across almost all regions, including the Americas where luxury has had a wobbly.

Asia Pacific grew 13% in constant currency. China, Hong Kong and Macau were good for a combined 25% growth. Europe fell by 3% with an overall reduction in tourist spending. The Americas grew by 8%, with Richemont believing that part of this is domestic purchasing by Americans rather than spending abroad (with Europe suffering as a result). It was Japan that really shone though, growing 18% in this quarter despite a whopping 43% growth in the prior year. Middle East & Africa grew 10%, with the UAE and Saudi Arabia as strong contributors.

I’m not surprised that online retail was down 5% in constant currency. It’s a very small component of the group, thankfully. I suspect it will stay that way as I don’t understand why people would buy a timepiece that costs the same as a family car (and sometimes a family home) online! The retail channel grew 11% and the wholesale and royalty channel was up 4%.

As a final comment on online, YOOX NET-A-PORTER (recognised as a discontinued operation) saw sales drop by 11% on a constant currency basis. Richemont notes a “continuing challenging environment” for pure online businesses in this space.

Looking at product categories, the Jewellery Maisons did particularly well with an increase of 12%. Specialist Watchmakers managed 3% and the Other segment dropped 1%. The Jewellery Maisons business contributes over 70% of sales revenue, so the segment that needed to perform is the one that did perform.

If we consider the nine months to December 2023 as a year-to-date view, sales increased 11% at constant rates and by 5% at actual rates.

All eyes will be on LVMH later this month. Where Richemont is genuine luxury (with a number of watchmaking brands that I can’t even pronounce), LVMH is exposed to mass affluent businesses like Sephora cosmetics stores and Hennessy Cognac. I could be way off the mark here, but I don’t think this positive surprise from Richemont is a guarantee that LVMH is going to deliver good numbers.

Little Bites:

- Director dealings:

- The company secretary of Trematon Capital Investments (JSE: TMT) sold shares worth R277k.

- The matchy-matchy buying at Invicta (JSE: IVT) continues, with the CEO Steven Joffe and Dr. Christo Wiese each buying shares worth R202k in the company.

- The chairman has bought shares in Life Healthcare (JSE: LHC) worth R185k.

- An executive director of Santova (JSE: SNV) has bought shares worth R56.5k.

- An associate of the CEO of Mantengu Mining (JSE: MTU) has bought shares worth R35k.

- There’s a new executive management structure at PPC (JSE: PPC), including two major hires of internationally experienced executives. Although much progress has been made in turning the group around, it shows how much still needs to be done that there’s space for a Chief Strategy Officer and Chief Revenue Officer.

- Sappi (JSE: SAP) is making some changes to its balance sheet by issuing a notice of early redemption for 5.25% convertible bonds issued by Sappi Southern Africa. Holders of bonds who do not want them to be redeemed would need to convert them into equity instead. The value of the bonds outstanding is well in excess of R1.1 billion.

- If Kibo Energy (JSE: KBO) had a dollar for every time that the company releases a SENS announcement, by now the share price would be higher than one cent a share. The latest announcement relates to an extraordinary general meeting to amend rights related to shares. If you’re a shareholder in this thing, go check it out.

- Steve Phiri served as CEO of Merafe (JSE: MRF) and then as a non-executive director some years ago. He has also been the CEO of Royal Bafokeng Platinum. Phiri has now joined the board of Merafe once more as a non-executive director.

- In the unlikely event that you are a shareholder in Cafca Limited (JSE: CAC), one of the most illiquid stocks on the JSE, you may be interested in their financial results. The short-form announcement gives no details at all, which might explain why nobody ever trades in this thing.

- Dan Marokane is stepping down from his role as interim CEO of Tongaat Hulett (JSE: TON) to take the reins at Eskom, perhaps the hardest job in the country. He will work with the team until the end of February to assist with the handover to current CFO Rob Aitken who will move into the CEO role.

- Chrometco (JSE: CMO) has renewed the cautionary announcement linked to “circumstances relating to a material subsidary of the company” – it’s suspended from trading anyway, with caution or otherwise.