The shine has come off Bytes Technology Group in a big way (JSE: BYI)

The company has bigger problems than repairing its reputation after the shocking governance around the ex-CEO’s trades

In February 2024, former Bytes Technology Group CEO Neil Murphy resigned after an astonishing number of undisclosed share trades suddenly came to light. The share price was obliterated in response, with Sam Mudd promoted to CEO shortly after the initial chaos.

The share price bounced back strongly initially, but the unfortunate reality is that the company has much bigger problems than a badly behaved ex-CEO. The UK market hasn’t been great for the past couple of years and Bytes was priced for growth, so a nasty slowdown in performance can only lead to a drop in the share price. With the release of results for the six months to August 2025, the market has been disappointed once more and has shown its displeasure:

The problem seems to primarily lie in the margins. Gross invoiced invoice (GII) might be up 9.1% year-on-year, but revenue is up just 2.5% and gross profit increased by a measly 0.4%. Costs unfortunately didn’t sit still (especially with headcount up 12% year-on-year), so operating profit dropped by 7% and operating margin dipped from 43.4% to 40.2%. By the time you get to HEPS, the decrease is 5.1%.

There clearly aren’t many highlights here. A slightly silver lining is growth in the interim dividend per share of 3.2%, although this isn’t a sustainable trajectory unless earnings improve. The board’s confidence to increase the dividend would’ve come from a 15.1% increase in cash on the balance sheet.

The problem is that Bytes doesn’t really have a moat. They are selling products on behalf of the likes of Microsoft, so a change to how Microsoft incentivises its partners can cause considerable pain. This is why the company is focusing on services vs. software, as it gives them more control over their margins. That strategy is bearing fruit, with software GII up 8.9% and services GII up 15.1%. But what investors really want to see is an uptick in revenue and margins, as that’s what counts.

It’s unlikely that the trajectory will be any prettier in the second half of the year, as they are up against a particularly strong base period.

Combined Motor Holdings gives us the rarest of examples of capital allocation (JSE: CMH)

Not only are they doing huge buybacks, but it’s instead of the dividend

In South Africa, many corporates are obsessed with the idea of paying an annual dividend and ensuring that it increases each year. To be fair, there are lots of mature companies in the US that are no different. As a reward for having an artificially low payout ratio and a dividend that keeps going up, those US companies even form part of a special club: the Dividend Aristocrats.

In truth, the decision to pay a dividend should always be weighed up against other capital allocation decisions. This is dividend theory 101, with the “bird in the hand” argument suggesting that the market pays a premium valuation for companies that show commitment to the dividend.

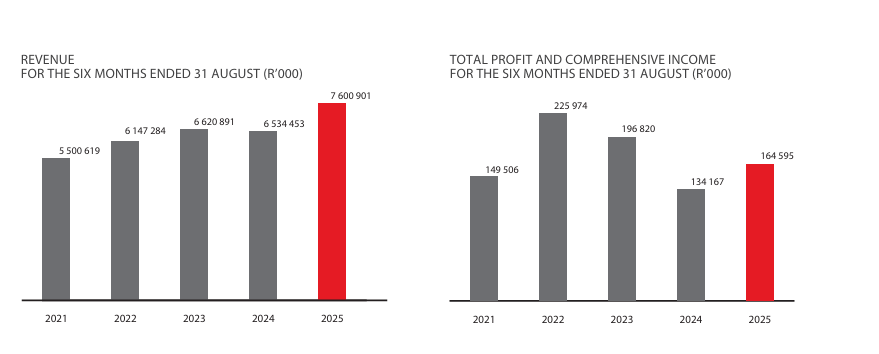

At CMH, we are going to find out if that theory holds in South Africa. Having just released results for the six months to August 2025 that reflect revenue growth of 16.3%, operating profit growth of 14% and HEPS growth of 22.7%, you would expect to see a juicy dividend. Instead, there is no dividend whatsoever! The company has decided to rather invest that cash into share buybacks, with a plan to repurchase up to 15% of the shares currently in issue. They won’t be able to execute a buyback of this size on-market and without shareholder approval, so a circular will no doubt follow in due course.

This approach to buybacks feels sensible, as these charts demonstrate that profitability hasn’t been nearly as smooth as the revenue journey thanks to all the distortions of the pandemic margins and then the significant change to the local market from the influx of Chinese cars:

Due to the cash-hungry nature of the operations from a working capital perspective, the cash generation story is even more volatile. For example, in the latest period, cash generated from operations fell by 14%.

When you’re dealing with this kind of volatility, buybacks give you flexibility that dividends simply don’t.

If we dig into the segments, then we find the usual situation that is such an amazing example of structural differences in margins. The car hire business generates profit before tax of R77 million from external revenue of R389 million, a profit before tax margin of almost 20%. The motor retail business has revenue of R7.1 billion, yet it only manages profit before tax of R104 million – a margin of just 1.5%. Talk about picking up pennies in front of a steamroller!

There is another element to the economics of the motor retail business that we need to consider. Selling cars feeds the financial services segment at CMH, which made profit before tax of R27.6 million from revenue of R74.9 million. That’s a margin of nearly 37%, which makes this the most profitable segment of the group!

CMH has done a commendable job of adapting here, with the management commentary noting that Chinese and Indian cars are nearly 50% of group new car sales. The traditional names at CMH (Nissan / Ford / Volvo) are really struggling. Hybrids are just 3% of the market, way below NAAMSA’s target of 20% this year and 40% by 2030. I have no idea how NAAMSA arrived at that target, but there is no chance of that happening here at the tip of Africa.

The car rental business also isn’t without its challenges, as they operate in a highly competitive environment. One of the ways they generate usage of the vehicles is the insurance replacement market. Now, we know from reading the results of short-term insurers that underwriting profits have been strong recently, which means that claims have been lower. Sure enough, CMH echoes this view in the commentary, noting a decrease in the level of insurance claims.

A juicy jump in AUM at Ninety One (JSE: N91 | JSE: NY1)

The rise in global asset prices has no doubt helped them here

There are literally only two ways in which an asset manager like Ninety One can increase its assets under management (AUM). The first is the “controllable” way, being the attraction of net inflows through marketing strategies and possibly a dedicated distribution network (depending on which asset manager we are looking at). The second is based on exogenous factors to a large extent, with an increase in asset prices over time leading to growth in the funds.

Sure, the company’s investment philosophy (which is controllable) will also have an impact on fund growth, but it doesn’t make as big a difference as the broader macroeconomic environment, especially not once you reach the scale of the likes of Ninety One.

There are a lot of concerns out there around global asset prices, but for now at least Ninety One is riding that wave. AUM as at 30 September 2025 came in at £152.1 billion, well up from £139.7 billion as at June 2025 and 19.4% higher than the AUM a year ago (September 2024).

The announcement doesn’t indicate the extent to which this is driven by asset prices vs. flows.

A nasty downturn at Santova (JSE: SNV)

Much of the strong recent share price performance has now reversed

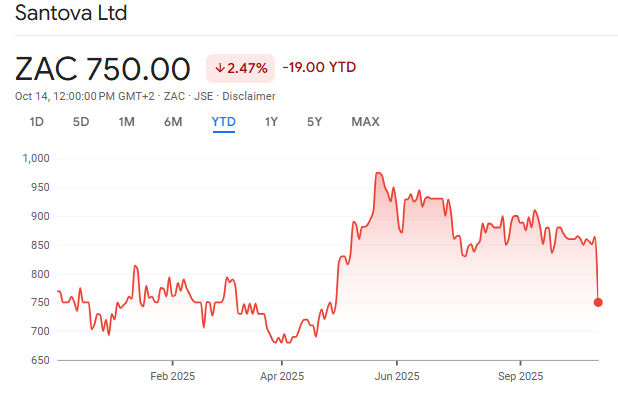

In May this year, the Santova share price went mad in response to the news of an acquisition and subsequent buying of shares by directors and execs. My dad joke of the day is that the share price has now been Santova the edge:

As you can see, the drop came suddenly on the day of release of a trading statement for the six months to August. The company was impacted by lower volumes and freight rates in Africa, Asia-Pacific and North America. The resilient performance in the UK and Europe wasn’t good enough to offset the impact, which is why HEPS is down by between 20.1% and 25.1%.

The global trade environment is volatile to say the least.

Tharisa had a strong finish to the financial year (JSE: THA)

Q4 production numbers were excellent

Mining companies can’t do anything about commodity prices in the market, but they can make sure that their production is strong when those prices are lucrative. Tharisa has played their part in the latest quarter, with PGM production for Q4 up 19.7% vs. Q3. Chrome production increased by 2.9% vs. Q3.

Before you get too excited, I must note that PGM production for the full year was down 4.7% and chrome was down 8.5%. The acceleration in the fourth quarter wasn’t enough to offset the drop in production earlier in the year.

In terms of pricing, the USD price of PGMs increased by 18.6% for the year and 24.1% in Q4 vs. Q3. This jump in price is why the PGM sector has been flying. Chrome prices didn’t behave themselves though, down 11% for the full year and nearly 6% quarter-on-quarter.

The group’s net cash position improved from $43.1 million as at June 2025 to $68.6 million as at September 2025.

Production guidance for FY26 is between 145koz and 165koz for PGMs (vs. 138.3koz in FY25) and 1.50Mt to 1.65Mt for chrome (vs. 1.56Mt in FY25).

Nibbles:

- Director dealings:

- At Growthpoint (JSE: GRT), CEO Norbert Sasse retained shares worth R10.9 million as the non-taxable portion of a share award (meaty enough to deserve a mention – especially at this point in the property cycle). The company secretary of the company sold shares though, to the value of R857k.

- The Chief People Officer of Quilter (JSE: QLT) sold shares worth R4.1 million.

- Here’s some novel wording for you: Super Group (JSE: SPG) announced that the company secretary and a director of a major subsidiary sold shares “in part to settle tax obligations” – in other words, the sale was in excess of the amount needed for tax. I just haven’t seen a company word it that way before. The total value of the trades is R1.77 million.

- AYO Technology (JSE: AYO) released the final timetable for the offer by Sekunjalo Investment Holdings and the delisting of the company. The listing will be suspended from 22nd October and terminated from 28th October.

- PBT Group (JSE: PBG) has obtained shareholder approval to change the name to PBT Holdings.