Fairvest’s B shares are doing very nicely (JSE: FTA | JSE: FTB)

The B shares are the “risk” shares that do well in the good times

Fairvest offers a dual-share class structure. Their A shares are designed for more income-focused, risk-averse investors. The dividend on the A shares increases each year by the lower of 5% or the most recent CPI number. The B shares then get the residual, which means great growth in the good years and possibly even no growth (or worse) in rough years.

Thankfully, things are good at the moment. The distribution per B share is up 8.8% for the six months to March 2025, driven by strong underlying metrics like 5.1% growth in like-for-like net property income. Another useful factor has been the lower finance charges, with the loan-to-value ratio dropping from 32.6% to 31.8%.

One of the significant changes in recent months was an increase in the stake in Dipula Properties from 5% as at September 2024 to 26.3% as at March 2025.

Fairvest’s portfolio includes 127 properties across retail, office and industrial. By revenue, the split is 69.8% retail, 18.4% office and 11.8% industrial. Within this, they need to try and find the best growth drivers, as evidenced by the deal announced this week that will see Fairvest acquire a portfolio of township-adjacent / busy commuter route retail properties from Collins Property Group.

The Collins acquisition isn’t in these interim numbers. Neither is the recent capital raise by Fairvest that saw the issue of new Fairvest B shares to raise R400 million, with those funds being put towards various opportunities, including of course the Collins deal.

Fairvest has guided growth of between 8% and 10% for the 2025 financial year. This implies strong momentum into the second half of the year.

Fortress is running in line with guidance (JSE: FFB)

Earnings are growing by mid-single digits

Fortress Real Estate has delivered a pre-close update for the year ending June 2025. With a combination of a strong logistics and retail portfolio, along with a sizable stake in NEPI Rockcastle, the fund has done a great job of navigating life-after-REIT, despite all the worries that they had about what the reaction to the loss of REIT status would be.

As is so important for property funds, they are “recycling capital” i.e. selling properties at appealing prices, having achieved sales of R1.44 billion at a premium to book value of 3.0%. The market treats this as an indication that the book value is grounded in reality.

The retail portfolio has achieved like-for-like tenant turnover growth of 4%. Retail vacancies are just 0.9%, which is the same as the vacancy rate in the SA logistics portfolio. The same can’t be said for the Central and Eastern European logistics portfolio, which saw vacancies increase from 1.4% to 2.5%. The local industrial and Inofort portfolio saw vacancies increase from 9.8% to 10.0%. As for the office portfolio, which is non-core and less than 1.5% of total assets, vacancies are still very high at 24.7% (but better than they were at 25.5%).

The company is enjoying strong support from the debt market, with R820 million raised under the DMTN programme in May 2025. The cost of funding reduced by 21 basis points on the three-year and 24 basis points on the five-year note, with the tighter funding margins reflecting improved sentiment in the market. The group also took advantage of early refinancing with Nedbank at a favourable rate.

Total distributable earnings guidance for FY25 has been maintained. On a per-share basis, this means an expected 160.26 cents per share for FY25 (up 5.7%), with guidance given for FY26 of between 169.88 and 172.27 cents per share (up 6.0% – 7.5%).

Solid numbers at Mr Price (JSE: MRP)

Their caps may be red, but their numbers are very green

Mr Price has released results for the 52 weeks to 29 March. It’s a story of revenue growth (7.9% at group level) and higher margins, with gross margin up 80 basis points to 40.5% and operating margin up 20 basis points to 14.2%. Diluted HEPS therefore achieved double-digit growth of 10.1%.

The second half was stronger than the first, with HEPS growth of 12.1%. This sets them up well for the new financial year, with the market no doubt appreciating the underlying momentum.

It’s pretty interesting that group in-store sales were up 7.8% and online sales were up 7.9%, reflecting no obvious consumer preference between the two. Although Mr Price puts this forward as an indication of a successful omni-channel strategy, I’m not sure I agree with that take. Most retail businesses are seeing online growth that is well ahead of in-store growth, as it is coming off a much lower base, so is Mr Price really competing effectively here? The group is delivering strong numbers overall, but I would keep an eye on this.

They certainly aren’t shy to open new stores, so the online strategy is perhaps less important right now anyway. Weighted average trading space increased by 4.3% and they indicate that new stores are achieving returns “well in excess” of the group’s weighted average cost of capital (WACC).

Another interesting insight is that Mr Price’s credit approval rate has increased based on a better credit environment. If we consider this statement in the context of what we’ve seen at the likes of Lewis, it does make sense. This helped drive revenue growth in the financial services segment of 5.7%.

In terms of margins, the uptick in gross profit margin was thanks to lower markdowns and a better inventory strategy overall, with margins on the up in both merchandise and telecoms. This increase was very important in the end, as total expenses increased by 10% and operating margins would’ve been under pressure if not for the higher gross margin. Much of the expense growth was related to the enlarged store footprint.

Another note on margins is that the telecoms segment is at a much lower gross margin than merchandise, coming in at 20% vs. 41.3%. This is relevant because this segment also had the highest sales growth (13.2% vs. 7.9% in Apparel and 6.4% in Home), creating a potential drag on margins over time due to the changing mix.

I must also point out that gross inventory was up 10.6%, which is ahead of sales growth. This isn’t uncommon when there’s a store expansion strategy in process, but it’s worth watching to make sure they don’t end up overstocked.

Within Apparel, Power Fashion is the fastest growing division. In Home, it’s no surprise at all that Yuppiechef managed another double-digit growth period with gains in gross margin as well. Sheet Street was the surprising highlight though, with the highest sales growth recovery in the second half vs. the first half.

Mr Price is clearly on the hunt for more acquisitions, with a statement in the outlook section that their “focused research is going to identify the next growth vehicle that will support the achievement of the long-term vision” – a strong statement to advisors to bring them suitable assets. And with strong cash generation in this period and evidence that previous acquisitions have worked, I suspect that shareholders will be happy to see further deals.

PK Investments makes a better attempt to woo MAS shareholders (JSE: MSP)

At this point, there’s still nothing binding on the table

I must say, it’s not super clear to me why PK Investments didn’t wait for Hyprop to go first here. Hyprop has now raised R808 million and is sitting with that cash drag on its balance sheet, which means that they need to get on with it and make some kind of cash-and-shares offer for MAS. Instead of waiting to see what that offer looks like, PK Investments has gone ahead and given Hyprop more information to work with.

Anyway, having initially put in a non-indicative bid that was somewhere between laughable and just plain sad, PK Investments has gone off and sharpened the ol’ pencil. The revised indicative bid no longer envisages a delisting of MAS. They have also increased the cash consideration from EUR1.10 per share to EUR1.40 per share, with the maximum cash amount up from EUR80 million to EUR110 million.

But alas, the structure still includes the strange redeemable preference shares. So now, assuming I’m understanding this correctly, shareholders who accept this deal from PK Investments would still be swapping MAS listed exposure for what will almost certainly be a less liquid instrument, without MAS even enjoying the benefits of being delisted.

On the plus side, the EUR1.40 value per share works out to around R28.40 per share, which is well above where MAS is currently trading. Even though it’s still such an unappealing structure, it now makes any potential takeout offer by Hyprop even more expensive to implement.

There are a lot of pieces on this chessboard at the moment.

Spear REIT raised R749 million in fresh equity (JSE: SEA)

They’ve now used up their authority from shareholders to issue shares

It’s pretty common for companies to get a resolution in place each year that gives them authority from shareholders to issue up to 5% of shares for cash. This allows the company to raise money during the year without running to shareholders each time. Shareholders aren’t quick to grant this power, so it’s a sign of success when a company gets this authority in place.

Spear REIT has been doing a fabulous job of growing its portfolio and allocating capital, so investors are happy to grant that authority. The company has made full use of it, raising fresh equity at a premium of 1.06% to the 30-day VWAP. Pricing like this is why shareholders really don’t mind.

The raise itself is a combination of shares issued for cash under the general authority, as well as a vendor consideration placement. They will use the proceeds to settle debt and fund further solar and other growth opportunities. With a loan-to-value ratio of 18% to 20% after this raise, there’s plenty of headroom here for deals.

A better second half at The Foschini Group, but growth excl. White Stuff is weak (JSE: TFG)

Online is the bright spot: Bash is profitable two years ahead of expectations

The Foschini Group has released results for the year ended March. With operations across three major regions, the performance does tend to vary significantly by geography. This year was no different.

Performance can also sometimes vary from the first half to the second half, with the 2025 financial year as a perfect example of this.

And as a further nuance, there was a major acquisition during the period that really boosted sales. Group sales growth was 3.6% for the full-year, but it would’ve been just 0.3% without the acquisition.

Before we dig into the regions, it’s important to note that HEPS was up just 4.6%, yet the final dividend per share came in 15% higher.

We begin with TFG Africa, where full-year growth was just 3.7% (or less than half the Mr Price growth rate). They had a very poor first half of the year, with sales down 0.1%. The growth in the second half of 7.0% helped them get into the green. Notably, online platform Bash reached profitability two years ahead of expectations, which is excellent. Online sales growth was 43.5% and now contributes 5.8% to total TFG Africa sales.

With a 69.7% contribution to group sales, it’s so important that TFG Africa does well. Sales only tell part of the story, with gross margin being key to profitability. After plenty of clearance activity in the prior year, gross margin achieved a 150 basis points uptick to 42.6%. This drove gross profit growth of 7.6% vs. the prior year.

Another trend worth noting is the increase in acceptance rates for new accounts. As at Mr Price, we’ve seen South African retailers opening the taps on credit sales.

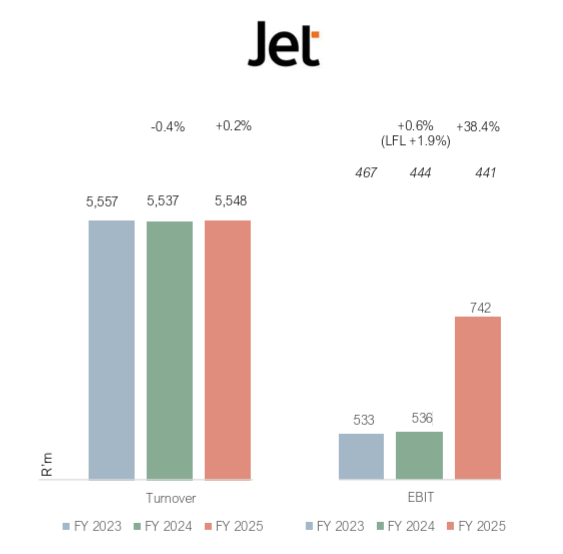

As a final comment on TFG Africa, the value offerings (like Jet) saw a jump in profit of 38% despite turnover growth of just 1%. It’s great to see that they are getting that acquisition to work for them. Check out this chart of turnover and EBIT (a measure of profitability) as a great example of turning water into wine:

Moving on to TFG London, I’m afraid that I don’t have good news. The acquisition of White Stuff in October 2024 massively flattered the numbers, with comparable sales being down 9.5% in TFG London (in ZAR) or 8.6% in local currency. You can’t fix a business by buying more revenue, so investors will definitely want to see an improvement in the group excluding White Stuff. If you include White Stuff, then sales were up 15.3% for TFG London.

In TFG Australia, sales for the year fell by 6%. After the investment in White Stuff in TFG London and now the dip in TFG Australia, the two offshore operations have nearly identical contributions to group sales at around 15.2% each. Sales in Australia were down 2.6% in local currency, with gross margin falling by 80 basis points. They managed to mitigate some of that impact through operating cost control.

The first eight weeks of the new financial year reflect growth in TFG Africa’s sales of 9.9%. The UK business is still in trouble, down 1.7% excluding White Stuff. Australia is even worse, down 3.4% in local currency.

As a general comment, I worry about the lack of commentary around balance sheet metrics in the results. You have to dig into the analyst presentation rather than the SENS announcement to find anything useful. With return on capital employed of 14.5%, down from 14.6% in the prior year, that might be why. That isn’t a strong enough return in my books, with a further challenge being that stock turn dipped from 2.4x to 2.3x as inventory moved 17.5% higher excluding White Stuff.

And yet, despite what certainly seems to be healthier momentum at Mr Price at the moment, The Foschini Group has been the better performer over five years:

And even more surprisingly, over 12 months as well:

Nibbles:

- Director dealings:

- A senior executive of Sirius Real Estate (JSE: SRE) sold shares worth nearly R7 million.

- There’s yet more buying at Santova (JSE: SNV), with a director of a subsidiary buying shares worth R229k.

- A director of NEPI Rockcastle (JSE: NRP) bought shares worth R138k.

- Assura (JSE: AHR) has confirmed that it is still busy with the due diligence on Primary Health Properties (JSE: PHP). This comes after Primary Health Properties improved its bid to the point where Assura had to take it seriously, resulting in the meeting to vote on the cash bid from KKR and Stonepeak being adjourned. In the meantime, the KKR and Stonepeak bidco (the entity making the offer) has gotten a few regulatory clearances out of the way.

- Delta Property Fund (JSE: DLT) is in the process of disposing of the property known as 88 Field Street in Durban. This is a category 1 deal, so they need to get a circular out. The JSE has granted an extension for the circular to be issued by no later than 31 July 2025.

- At least one layer of uncertainty around Telemasters Holdings (JSE: TLM) has been removed, with the company no longer considering an acquisition. The cautionary related to a potential acquisition of shares by a B-BBEE investor is alive and well, with the recent update being that the party has secured funding and that documents are being negotiated.

- The CFO of Coronation (JSE: CML), Mary-Anne Musekiwa, has tendered her resignation in order to pursue an international opportunity. The resignation is effective 30 November 2025. The process to appoint a new CFO will begin soon.

- If you are a Powerfleet (JSE: PWR) shareholder, then you may want to check out the amendment to the severance agreement with the CEO. It relates to the bonus that would be payable to the CEO in the event that employment is terminated.