Famous Brands is up, but on shaky ground (JSE: FBR)

The manufacturing segment saved this result – again

Famous Brands has had an extremely volatile share price in the past year. The company is way off the levels seen during the GNU exuberance, but has recently been moving higher after testing the 52-week low. For those who enjoy a bit of momentum trading, this chart might be interesting:

The business itself is doing better than the chart might otherwise suggest, although a deeper dive into the numbers will reveal where the risks are.

For the six months to August, revenue increased 5.6% and operating profit was up 5.8%. This means that Famous Brands achieved margin expansion despite that modest growth rate. HEPS increased by 8% and the dividend per share was also up 8%. It’s always good to see a higher growth rate in HEPS than in revenue, as it means that the company is using leverage successfully.

On the face of it, this looks like a resilient performance that investors should feel good about, particularly as the results for the year to February 2025 reflected pressure in almost every segment in the business. Have things actually turned around?

Let’s dig deeper to see where the improvement lies. Leading Brands (the typical takeaway outlets that the group is, well, famous for) grew like-for-like sales by 2.6% and system-wide sales by 6.0%, a significant acceleration vs. the previous financial year. Interestingly, only 27.8% of new restaurants were allocated to existing franchise partners, so there are lots of new investors who want to own a franchise. Unfortunately, this didn’t translate into any growth in operating profit, with an almost perfectly flat performance on a year-on-year basis.

Signature Brands remains a struggle. The trend of weak sales and a worsening operating margin continued in this period, with like-for-like sales down 0.6% and the operating loss margin moving from -6.7% to -7.0%. The company-owned PAUL restaurants haven’t even broken even yet. Personally, I think Famous Brands should just stick to selling burgers and pizzas.

In the SADC region, operating profit fell by 11.8% despite revenue growth of 2.7%. The AME region saw revenue fall 5.4%, with the operating loss only slightly better at -R19 million vs. -R22 million in the prior period. For context, the AME loss almost full offsets the operating profit of R24 million in SADC! UK Wimpy is just as bad, with operating profit of only R1 million. Why bother?

The supply chain side of the business has been a stronger recent performer, although I worry about how sustainable this is if the restaurants aren’t doing well. Has this continued?

Sure enough, manufacturing revenue increased 10.4% and operating profit was up 23.6%, with margins up from 9.3% to 10.4%. The logistics business runs at paper-thin margins, with revenue up 7.4% and operating profit down 14.8% as margins dipped to 1.1%. Finally, joining Wimpy UK in the why-bother bucket, we have Famous Brands’ retail business with an operating loss of R12 million from revenue of R171 million.

Customers are seeking better value all the time and Famous Brands operates in a very competitive space. Their group numbers look decent this period, but it’s more of the same in terms of relying on the manufacturing side to drive growth.

My view remains that the group is still too complicated and stretched too thin. Much like a pizza base, if you roll the dough too thin to try and cover too much ground, it breaks.

Quilter’s momentum in net flows continues (JSE: QLT)

They are already way ahead of the prior year – and only nine months in

Quilter is demonstrating the power of distribution. For financial services businesses to really make the big bucks, they need to be able to attract flows rather than just manage them. Quilter is doing an excellent job of that, with the third quarter in a row of net inflows in excess of £2 billion. Amazingly, third quarter flows were up 48% year-on-year and represent 7% of opening assets under management and administration (AuMA)!

This is why the third quarter year-to-date net inflow of £6.7 billion is already so far ahead of the full-year 2024 number of £5.2 billion. These are impressive numbers, with a positive story being told across the High Net Worth and especially Affluent channels.

From a profitability perspective, the business is becoming more productive over time (gross sales per adviser increased 10% year-on-year). This implies enhanced profitability at operational level. They don’t disclose profits for the quarter, but it’s hard not to believe that the full-year numbers will be strong based on these underlying metrics.

Salungano Group’s Keaton Mining has signed a coal supply agreement with Eskom (JSE: SLG)

As a reminder, the shares are still suspended from trading

Salungano Group recently released their financials for the year ended March 2024. No, you aren’t losing your mind – they are indeed very far behind. This is why the shares are currently suspended from trading.

Being suspended from trading isn’t the same as being prevented from doing business. It just means that the shares can’t change hands on the JSE in the normal way.

In the business itself, Salungano’s wholly-owned subsidiary Keaton Mining has signed a coal supply agreement with Eskom for the supply of coal from the Vanggatfontein Colliery. Deliveries will start on 1 November 2025 and run until the contracted quantity (6.5 million tons) has been delivered, which is estimated to take five years and two months.

Above all else, this obviously makes a big difference to the going concern assessment at Keaton Mining.

Vunani achieved revenue growth in every segment (JSE: VUN)

This adds to the positivity around the recently announced Sentio merger

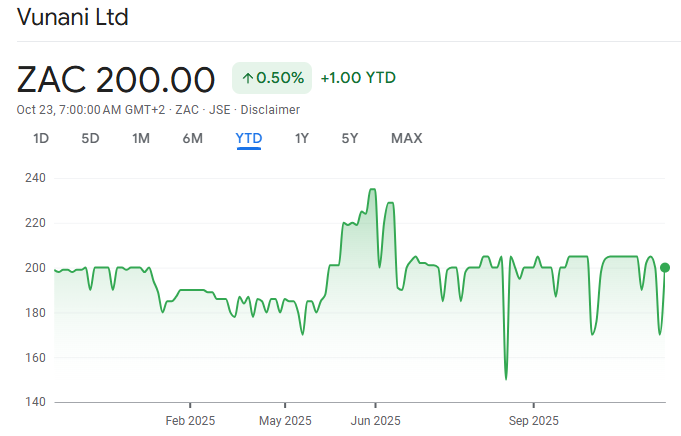

Vunani is having a year to remember. The group has been a tough story in recent years, with the share price still trading roughly 30% lower than three years ago. The stock is stuck in bid-offer spread hell right now, which is why the share price looks like this:

In the underlying business though, there are positive recent updates. Vunani will be merging with Sentio Capital Management to form a combined business with R60 billion in funds under management. Consolidation in that space makes sense, as margins are tight.

Even without the merger, Vunani’s business seems to be improving. The strong performance of the local market is good news for any fund management and securities broking business. Vunnai’s group revenue increased by 8.8% for the six months to August 2025, with each of the underlying segments achieving growth in revenue. The profit performance was a bit choppier, with two of the five segments still in loss-making positions.

By the time we reach HEPS, Vunani’s growth was a delightful 41.8%. They will certainly hope that this momentum can continue.

Nibbles:

- Director dealings:

- Jan Potgieter has sold more shares in Italtile (JSE: ITE), this time to the value of almost R2 million. I guess if he’s no longer going to be a director of the company, he would rather diversify his wealth. Makes sense to me.

- The company secretary of AVI (JSE: AVI) sold an entire share award worth nearly R1.6 million.

- Barloworld (JSE: BAW) announced that the PIC has disposed of all its shares in the company in terms of the offer by the consortium.

- Marshall Monteagle (JSE: MMP) is selling the Nicol Garage property in Durban for R68.5 million. The purchaser is a private company that isn’t a related party. The property consists of a parking garage and multi-tenanted ground floor units with 129 small business tenants. The income at the property is R1.6 million per month. The net asset value is a whopping R132.7 million, so they are selling this way below book. The property made a loss of R9.4 million in the year ended March, which might explain why they are happy to let it go at this price.

- In happy news for the overall functioning of the market, Insimbi Industrial Holdings (JSE: ISB) announced that the erroneous broker trades that we saw last week are being fixed by the broker. The announcement doesn’t clarify exactly how this fix is happening. This includes the CEO’s trades. This affected a number of companies, but I assume that Insimbi being corrected means that all of them are being corrected.

- Hulamin (JSE: HLM) has noted that they are hosting an investor day on Thursday. Keep an eye out for the presentation!

- aReit (JSE: APO) is still trying to get audited financials done. They’ve now submitted financials for the year ended December 2023 to the auditors who previously resigned because they ran out of patience. Those auditors are considering whether they will take aReit on as a client again or not. The financials for the year ended December 2024 are also ready. They would also need to get interims for the six months to June 2025 done before the suspension can be lifted!

- AYO Technology (JSE: AYO) has received the compliance certificate from the TRP for the delisting offer. The delisting will be effecting from 28 October.