Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

MAS looks to simplify the Prime Kapital joint venture (JSE: MSP)

In an interesting potential deal, MAS would become sole owner of the commercial properties and pipeline

MAS has been dealing with a really tough forecast around debt refinancing and the state of play in debt markets for sub-investment grade property funds in Eastern Europe. Credit to the management team: they haven’t stuck their heads in the sand on this one. Instead, they’ve been highly proactive in dealing with the problem, even if it wasn’t a popular decision for the share price.

Now, they are looking to simplify the joint venture structure with Prime Kapital. MAS owns 40% of the joint venture and Prime Kapital owns the rest. The proposal is for the joint venture to acquire Prime Kapital’s commercial development platform and interests in the joint venture, while disposing of the residential assets and residential development pipeline to Prime Kapital.

The net result is that the joint venture would be a wholly-owned subsidiary of MAS, focused on commercial properties and developments. When they say commercial, they mean what South Africans would typically refer to as retail properties i.e. malls. Local funds often say “commercial” in the context of office properties.

If they get this right, MAS believes that credit rating prospects would be improved thanks to having control of high quality assets with limited existing debt.

Pick n Pay declares its rights offer (JSE: PIK)

The market has known for months that this was coming

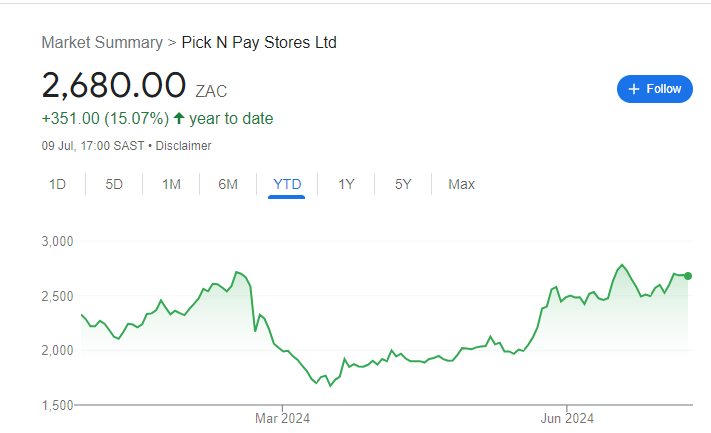

In perhaps the most well-telegraphed rights offer of all time, Pick n Pay has finally pulled the pin on the plan to raise R4 billion in equity to try and save the group. The GNU-phoria in the market and lack of load shedding has given Pick n Pay an unbelievable get-out-of-jail card that I sincerely hope management will have the humility to avoid taking credit for.

This share price rally has been driven by factors largely outside of their control, like the disappearance of load shedding in the second quarter and the recent rally in SA Inc stocks:

Still, all great turnaround stories need a bit of luck at some point, so hopefully Pick n Pay will make the most of this good fortune.

As has been noted previously, the plan is to raise the R4 billion in debt through a full underwritten, renounceable rights offer. This comes after a shocking trading loss of R1.5 billion in the year ended February 2024, along with a spike in the debt ratio from 1.1x EBITDA to an unacceptable 6.3x EBITDA. For reference, most companies operate in a range of 1x to 2x EBITDA.

The underwriters are the banks: Absa, RMB and Standard Bank. They are underwriting the raise equally. The banks don’t particularly want the shares, which is why excess applications are being allowed – a process through which shareholders can apply for additional shares beyond their pro-rata allocation.

Full details will be found in the rights offer circular that is scheduled for release on 22 July.

The ongoing sentiment improvement around South Africa is a gift for Pick n Pay beyond just the rights offer. They will also look to separately list Boxer and raise cash through that process. The valuation of Boxer will no doubt be much higher in the current environment than it would’ve been six months ago.

Zeder announces another farm disposal (JSE: ZED)

The value unlock has momentum

Hot on the heels of the Theewaterskloof Farm disposal announcement in June, Zeder has now announced the disposal of Applethwaite, one of the primary farming production units with Zeder Pome Investments, in which Zeder holds 87.1%.

The disposal price is R190 million plus the value of agricultural inputs on hand and 2025 seasonal costs already incurred. This won’t exceed the threshold for a Category 1 transaction, so they won’t need a circular or shareholder vote.

The purchase price will be settled on the day of transfer of the farm.

There are a couple of layers of separation here, as the farm is currently held within Capespan Agri, a 100% subsidiary of Zeder Pome. For the cash to flow all the way up to Zeder shareholders, both Capespan and Zeder Pome would need to approve the distributions. The board of Zeder itself would then need to declare a dividend. Thankfully, Zeder effectively controls the entire structure, so chances are very good that the cash will flow to the top. Assuming that happens, Zeder has noted an intention to distribute the majority of the cash to shareholders.

I didn’t see any mention in the announcement of the buyers needing to raise funding for the purchase, so there’s a good chance that the deal will go through. They expect conditions precedent to be fulfilled by the end of September 2024.

Little Bites:

- Director dealings:

- Although not a traditional director dealing as this is institutional money linked to director representation on the board, it’s still worth mentioning that Capitalworks Private Equity bought R7.4 million worth of shares in RFG Holdings (JSE: RFG).

- A director of a major subsidiary of Insimbi Industrial (JSE: ISB) sold shares worth R8.9k.

- Ethos Capital (JSE: EPE) announced that exchange control approval has been received for the Brait (JSE: BAT) unbundling. Ethos shareholders will be in the lucky(?) recipients of 0.50857 Brait shares for each share held in Ethos.

- Orion Minerals (JSE: ORN) announced “outstanding” drilling results for the first diamond drill holes at Flat Mine South. The initial bankable feasibility study is nearing completion, with the company also highlighting the potential to expand the mine and extend the mine life thanks to the opportunities presented by the broader Okiep district. The Okiep properties achieved historic production levels of 20,000 to 50,000 tonnes of copper under the previous owners, so the track record is there. This is like a restoration of a classic car!

- Accelerate Property Fund (JSE: APF) has announced a delay to the release of audited financial statements for the year ended March. They are now expected to be released by 15 July.

I was looking at the numbers of shares traded in MUR on the 9th July where the share price was R2.28. There were 4 deals where the volume traded showed 1 share and then a few others where the volume was ridiculously low. Why would this arise? Is a devious broker selling shares for brokerage and not noticeably denting the portfolio numbers of his client? This is not the only share, I think I saw the same for EOH. Have I missed the announcement that they are doing odd lot buy backs?

Hi Penny – genuinely not sure on that! I guess it’s not impossible that it’s a genuine trade going through from e.g. EasyEquities. Even if they are doing odd-lots, it wouldn’t go through like that. Anyone else reading this who can shed light is most welcome to do so!